Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK’s house price recovery “continued in November”, according to the Nationwide Building Society, as falling mortgage rates help to warm up demand.

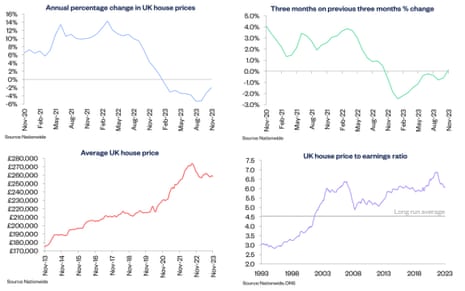

After a bumpy year for the housing market, Nationwide has just reported that UK house prices rose 0.2% month-on-month in November, on a seasonally-adjusted basis. That’s the third monthly rise in a row – surprising City economists who expected a 0.4% monthly fall.

On an annual basis, prices were 2% lower than a year ago – a weak result, but the strongest reading since February.

According to Nationwide, the average price of a house sold in November was £258,557, which (you may note) is actually slightly lower than October’s £259,423 – but that’s before seasonal adjustments.

This data only covers lenders who take out a mortgage, rather than cash buyers, but it’s still a good test of the housing market.

The housing market is benefitting from the drop in UK inflation, which is leading to expectations that UK interest rates will be lower than previously feared. Several mortgage lenders have cut their rates in recent weeks.

Robert Gardner, Nationwide’s chief economist, says:

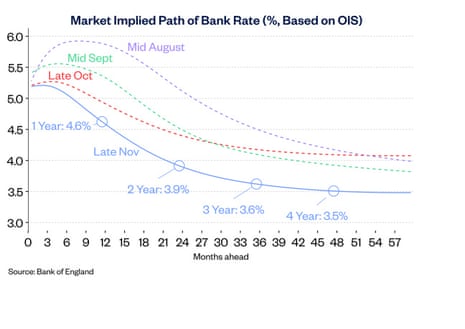

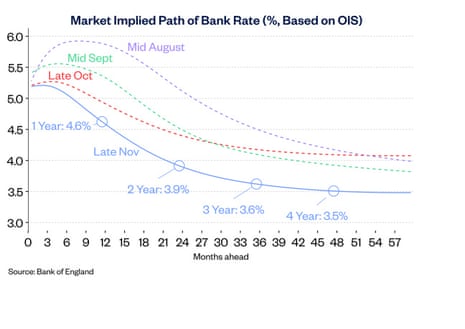

“There has been a significant change in market expectations for the future path of Bank Rate in recent months which, if sustained, could provide much needed support for housing market activity.

“In mid-August, investors had expected the Bank of England to raise rates to a peak of around 6% and lower them only modestly (to c.4%) over the next five years. By the end of November, this had shifted to a view that rates have now peaked (at 5.25%) and that they will be lowered to around 3.5% in the years ahead.

But even so, the housing market has clearly cooled this year. Data yesterday showed that the number of home sales in October was 21% lower than the same month last year.

Also coming up today

Rail passengers are being warned to expect days of disruption as train drivers in the Aslef union start an overtime ban and a series of rolling strikes halting services across Britain, in a long-running dispute over pay.

Drivers will be taking industrial action at train operating companies contracted to the Department for Transport, striking for 24 hours at each one on different dates between Saturday 2 December and Friday 8 December.

The strikes will stop most or all trains at the affected operators in England and also hit some cross-border services to Scotland and Wales.

We also get a healthcheck on UK and eurozone factories this morning.

And later today, global investors will hear from America’s top central banker, Jerome Powell, and hope to hear hints as to when the US Federal Reserve might start cutting interest rates.

The agenda

8am GMT: Switzerland’s Q3 GDP report

9am GMT: Eurozone manufacturing PMI report for November

9.30am GMT: UK manufacturing PMI report for November

3pm GMT: US manufacturing PMI report for November

4pm GMT: Federal Reserve Chair Jerome Powell participates in a fireside chat at Spelman College, US

Filters BETA

Economist forecasters at the EY ITEM Club reckon that a “serious correction” in UK house prices is now an increasingly remote prospect.

Following Nationwide’s latest house price index, released this morning, they say:

Nationwide’s measure of house prices in November delivered a third successive month-on-month increase. The rise of 0.2% was modest, but prices are proving resilient in the face of an increase in mortgage rates and a sluggish economy. The EY ITEM Club thinks the odds of a serious correction in prices are increasingly remote.

Average rates on new mortgages are at a 15-year high and activity in the housing market, as measured by mortgage lending and approvals, is weak. And the Monetary Policy Committee’s (MPC) ‘high for longer’ message on interest rates means markets have reined back expectations of how much borrowing costs will be cut next year.

But the MPC’s decision to pause rate rises in its last few meetings has contributed to a decline in quoted mortgage rates. The EY ITEM Club thinks inflation will recede quicker than the committee expects, opening up the prospect of rate cuts late next spring. Households’ finances remain in good shape and a rebound in mortgage approvals in the latest data suggests the housing market’s weakest point may have passed.

None of this suggests a rebound in house prices anytime soon. But a period of drift, rather than serious decline, looks in prospect, easing at least one previously expected headwind to the economy.

Bloomberg points out that Britain’s housing market has defied forecasts for a sharp correction this year.

One reason is that prices have been buoyed by a lack of properties available for purchase.

Bloomberg’s Lucy White adds:

The average value is now about 5.6% below where it peaked in August 2022, roughly half the 10% drop expected for this year.

Strength in the housing market is another sign of life in the UK economy, which the Bank of England expects to stagnate through much of the next year. In an effort to tame inflation, the central bank has lifted interest rates from near zero at the end of 2021 to 5.25%, the most since 2008.

The UK’s strong employment levels is supporting the housing market, reports Jeremy Leaf, north London estate agent.

Leaf says:

These figures confirm what we’ve seen in our offices – the market is still baring its teeth. Despite a 15-year high in base rate and continuing inflation, buyers are showing there is little chance of a correction, although sales are taking longer and prices are softening. Strong employment is also supporting activity.

‘We don’t expect to see much change in the months ahead but a gradual improvement as optimism always seems to become more apparent at the beginning of the year.’

The Bank of England’s decision to leave interest rates on hold at 5.25% in both September and again in November has lifted confidence in the housing market, argues Alex Lyle, director of Richmond estate agency Antony Roberts.

Lyle says:

“At this time of year, competition is more muted so there are opportunities for buyers who are brave enough not to sit on the fence.

‘Two consecutive holds in base rate has brought some confidence back to the market, helping buyers plan for the future with a little more certainty.

‘Stock levels are lower, as expected at this time of year, but those properties which are coming to the market are at the right price and at less ambitious levels than in the past.”

The UK housing market could see a spring bounce next spring, unless a general election is called in the first half of 2024, predicts Tom Bill, head of UK residential research at Knight Frank

Bill says:

“If we are not at the bottom of the current slowdown in the UK housing market, we must be close. Price indices are potentially more volatile due to low transaction numbers but sentiment has improved in recent weeks as the worst of the economic data moves behind us. Inflation is below 5%, the best five-year fixed-rate mortgage has fallen to less than 4.5% this week and speculation is focussed on the timing of the next rate cut not the size of the next rise.

After a flat autumn, the UK housing market should see a spring bounce in 2024 provided a general election is not called in the first half of next year.”

Here’s a chart from Nationwide, showing the state of the housing market:

Tentative optimism that borrowing costs are “on the turn” are bringing some buyers out ahead of the new year, reports property agent Emma Fildes of Brick Weaver, nudging prices a little higher.

Nationwide also warns that the housing market prices are unlikely to rebound rapidly anytime soon.

Chief economist Robert Gardner says:

“While mortgage rates are unlikely to return to the lows prevailing in the aftermath of the pandemic, modestly lower borrowing costs, together with solid rates of income growth and weak/negative house price growth, should help underpin a modest rise in activity in the quarters ahead.

“Nevertheless, a rapid rebound still appears unlikely. Cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, but consumer confidence remains weak, and surveyors continue to report subdued levels of new buyer enquiries.

“Moreover, while markets are projecting that the next Bank Rate move will be down, there are still upward risks to interest rates. Inflation is declining, but measures of domestic price pressures remain far too high.

“Policymakers have cautioned that it is too early to be talking about interest rate cuts. Indeed, three of the nine members of the Bank of England’s Monetary Policy Committee voted to increase Bank Rate at its meeting in early November, though the remaining six preferred to hold at 5.25% for the time being.”

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK’s house price recovery “continued in November”, according to the Nationwide Building Society, as falling mortgage rates help to warm up demand.

After a bumpy year for the housing market, Nationwide has just reported that UK house prices rose 0.2% month-on-month in November, on a seasonally-adjusted basis. That’s the third monthly rise in a row – surprising City economists who expected a 0.4% monthly fall.

On an annual basis, prices were 2% lower than a year ago – a weak result, but the strongest reading since February.

According to Nationwide, the average price of a house sold in November was £258,557, which (you may note) is actually slightly lower than October’s £259,423 – but that’s before seasonal adjustments.

This data only covers lenders who take out a mortgage, rather than cash buyers, but it’s still a good test of the housing market.

The housing market is benefitting from the drop in UK inflation, which is leading to expectations that UK interest rates will be lower than previously feared. Several mortgage lenders have cut their rates in recent weeks.

Robert Gardner, Nationwide’s chief economist, says:

“There has been a significant change in market expectations for the future path of Bank Rate in recent months which, if sustained, could provide much needed support for housing market activity.

“In mid-August, investors had expected the Bank of England to raise rates to a peak of around 6% and lower them only modestly (to c.4%) over the next five years. By the end of November, this had shifted to a view that rates have now peaked (at 5.25%) and that they will be lowered to around 3.5% in the years ahead.

But even so, the housing market has clearly cooled this year. Data yesterday showed that the number of home sales in October was 21% lower than the same month last year.

Also coming up today

Rail passengers are being warned to expect days of disruption as train drivers in the Aslef union start an overtime ban and a series of rolling strikes halting services across Britain, in a long-running dispute over pay.

Drivers will be taking industrial action at train operating companies contracted to the Department for Transport, striking for 24 hours at each one on different dates between Saturday 2 December and Friday 8 December.

The strikes will stop most or all trains at the affected operators in England and also hit some cross-border services to Scotland and Wales.

We also get a healthcheck on UK and eurozone factories this morning.

And later today, global investors will hear from America’s top central banker, Jerome Powell, and hope to hear hints as to when the US Federal Reserve might start cutting interest rates.

The agenda

8am GMT: Switzerland’s Q3 GDP report

9am GMT: Eurozone manufacturing PMI report for November

9.30am GMT: UK manufacturing PMI report for November

3pm GMT: US manufacturing PMI report for November

4pm GMT: Federal Reserve Chair Jerome Powell participates in a fireside chat at Spelman College, US

https://news.google.com/rss/articles/CBMie2h0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvZGVjLzAxL3Vrcy1ob3VzZS1wcmljZXMtaW50ZXJlc3QtcmF0ZXMtbmF0aW9ud2lkZS11ay1mYWN0b3JpZXMtYnVzaW5lc3MtbGl2ZdIBe2h0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvZGVjLzAxL3Vrcy1ob3VzZS1wcmljZXMtaW50ZXJlc3QtcmF0ZXMtbmF0aW9ud2lkZS11ay1mYWN0b3JpZXMtYnVzaW5lc3MtbGl2ZQ?oc=5

2023-12-01 07:24:33Z

2632987539

Tidak ada komentar:

Posting Komentar