© Reuters. FILE PHOTO: The logo of the Organization of the Petroleum Exporting Countries (OPEC) is seen inside their headquarters in Vienna

© Reuters. FILE PHOTO: The logo of the Organization of the Petroleum Exporting Countries (OPEC) is seen inside their headquarters in Vienna

By Rania El Gamal and Ahmad Ghaddar

VIENNA (Reuters) - OPEC and its allies look set to extend oil supply cuts next week at least until the end of 2019 as Iraq joined top producers Saudi Arabia and Russia on Sunday in endorsing a policy aimed at propping up the price of crude amid a weakening global economy.

Iran is the only major OPEC nation yet to have spoken publicly about a need to extend production cuts. Tehran has in the past objected to policies put forward by arch-rival Saudi Arabia, saying Riyadh was too close to Washington.

The United States is not a member of OPEC, nor is it participating in the supply pact. Washington has demanded Riyadh pump more oil to compensate for lower exports from Iran after slapping fresh sanctions on Tehran over its nuclear program.

OPEC and its allies led by Russia have been reducing oil output since 2017 to prevent prices from sliding amid soaring production from the United States, which has become the world's top producer this year ahead of Russia and Saudi Arabia.

Fears about weaker global demand as a result of a U.S.-China trade spat have added to the challenges faced by the 14-nation Organization of the Petroleum Exporting Countries in recent months.

Russian President Vladimir Putin said on Saturday he had agreed with Saudi Arabia to extend existing output cuts of 1.2 million barrels per day, or 1.2% of global demand, by six to nine months - until December 2019 or March 2020.

Saudi Energy Minister Khalid al-Falih said the deal would most likely be extended by nine months and no deeper reductions were needed.

"It’s a rollover and it’s happening,” Falih, whose country is the de facto leader of OPEC, told reporters.

Warren Patterson, head of commodities strategy at Dutch bank ING, said OPEC had more to lose by not extending the deal.

"It comes down largely to fiscal breakeven oil prices - the Saudis have a breakeven price of around $85 per barrel, and so they will be concerned about potentially a widening gap between this level and where the market trades," he said.

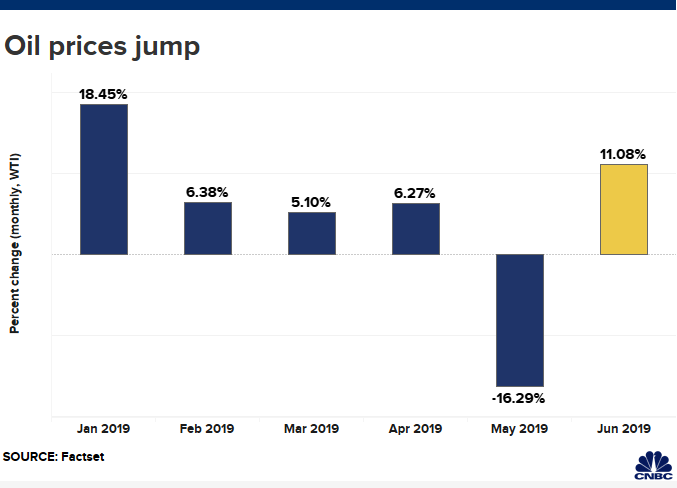

Benchmark has climbed more than 25% since the start of 2019 to $65 per barrel. But prices could stall as a slowing global economy squeezes demand and U.S. oil floods the market, a Reuters poll of analysts found.

WORSENING GEOPOLITICAL RISK

The output-cutting pact expires on Sunday. OPEC meets in Vienna on Monday followed by talks with Russia and other allies, a grouping known as OPEC+, on Tuesday.

Iraqi Oil Minister Thamer Ghadhban said on Sunday he expected the deal to be extended by six to nine months.

"Iraq’s position is positive, deals with the reality of the challenges of the oil market and supports all (efforts) related to balancing oil supply and demand,” Ghadhban said.

Iraq has overtaken Iran as OPEC's second-largest oil producer and its exports have been rising due to investments by Western majors.

Iran's exports, in contrast, have plummeted to 0.3 million barrels per day in June from as much as 2.5 million bpd in April 2018 due to Washington's fresh sanctions.

The sanctions are putting Iran under unprecedented pressure. Even in 2012, when the European Union joined U.S. sanctions on Tehran, the country's exports stood at around 1 million bpd. Oil represents the lion's share of Iran's budget revenues.

Washington has said it wants to change what it calls a “corrupt” regime in Tehran. Iran has denounced the sanctions as illegal and says the White House is run by “mentally retarded” people.

Iranian Oil Minister Bijan Zanganeh has not spoken in recent days about the OPEC meeting. He is due in Vienna on Monday.

"Worsening tensions between the U.S. and Iran add potential for oil price volatility that could be tricky for OPEC members to manage," said Ann-Louise Hittle, vice president, macro oils, at consultancy Wood Mackenzie.

"Geopolitical risk means the supply outlook is tightening, offsetting the moderate weakening in oil demand growth thus far this year,” she added.

https://www.investing.com/news/commodities-news/opec-set-for-oil-cut-extension-if-iran-endorses-pact-1911632

2019-06-30 16:40:00Z

52780323608077