Consumers are being warned they may be targeted by scammers as the government's energy price guarantee comes into effect.

Messages asking for people to provide personal or financial details to receive support should be treated as fraudulent activity, as no applications are required, the business secretary has said.

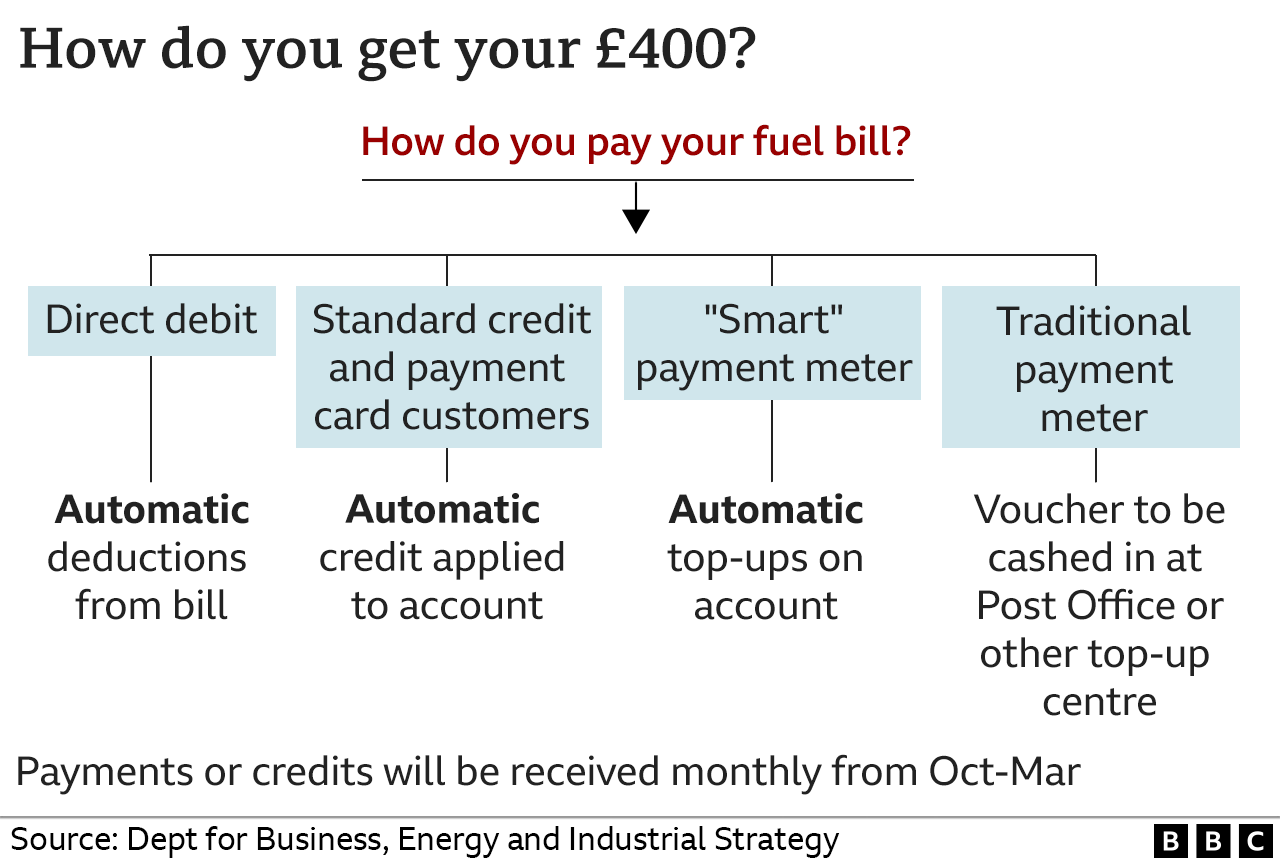

The £400 Energy Bill Support Scheme will be applied automatically to bills each month between October and next March.

And the Energy Price Guarantee, which will limit the amount households pay per unit of gas and electricity, comes into effect from today.

In a statement, Jacob Rees-Mogg said: "Unprecedented government support is beginning this weekend, protecting families and businesses across the country from what was going to be an 80% increase in energy bills this winter.

"I also urge people today to stay alert to scams. This support will reach people automatically and there is no need to apply."

Earlier this month, Action Fraud - the UK's national reporting centre for fraud and cybercrime - said nearly 1,600 reports had been made to the National Fraud Intelligence Bureau (NFIB) about scam emails purporting to be about energy rebates from regulator, Ofgem.

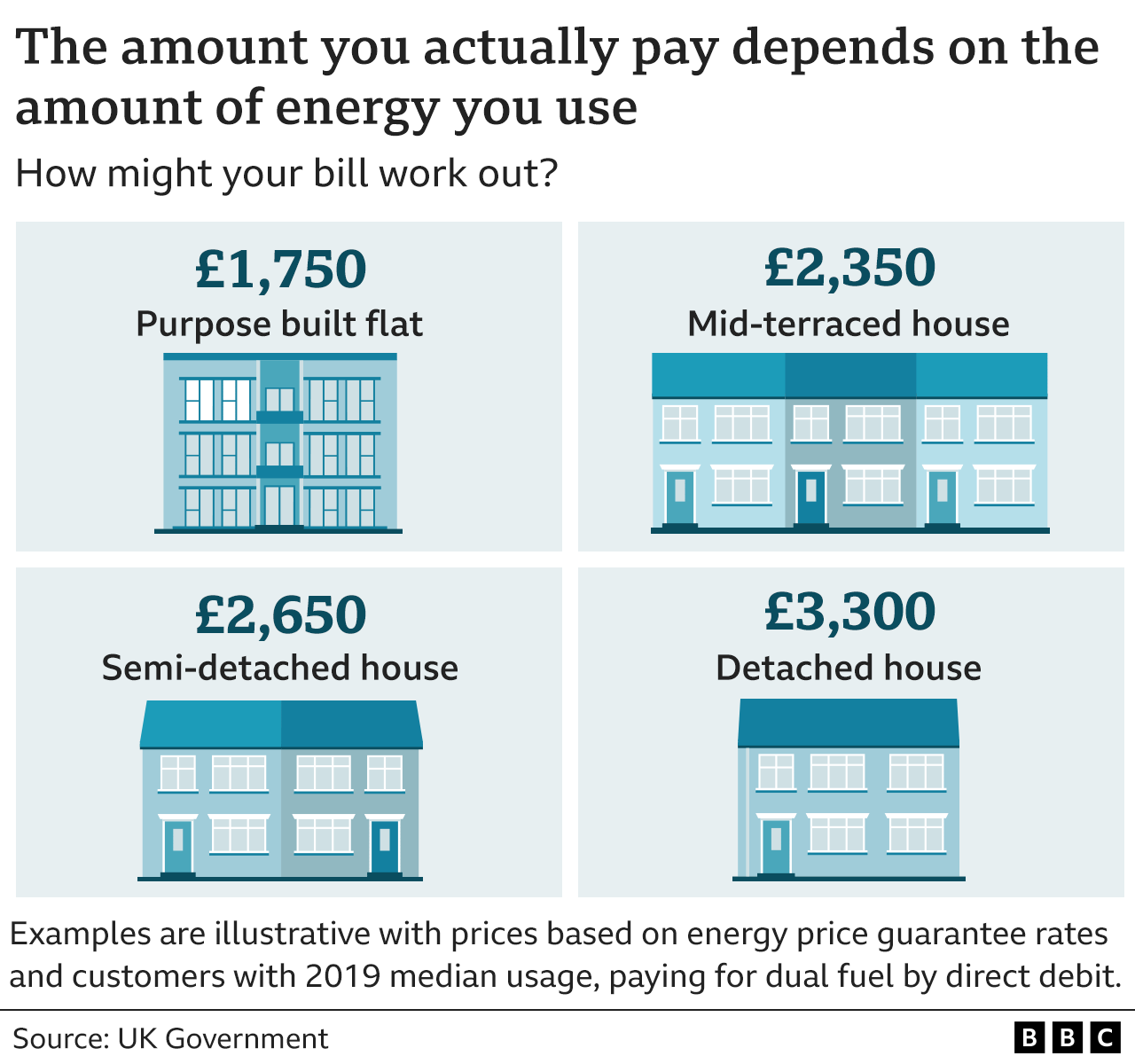

Ministers say the Energy Price Guarantee should mean a typical household will pay about £2,500 per year, starting this month for the next two years - protecting them against what could have been, on average, an additional £1,000 a year on their energy bills.

The government has confirmed households in Northern Ireland will also receive the same support through the Energy Price Guarantee from November, with support for October bills backdated.

People who live in areas not served by the gas grid or who use alternative fuels such as heating oil will still receive a £100 support payment.

For the £400 Energy Bill Support Scheme, customers on pre-payment meters will receive a credit or vouchers direct from their electricity supplier.

Households have been urged to take a photograph of their meter reading and do what they can to cut their energy use as prices spike.

But after a massive surge in people submitting readings caused problems at many suppliers, Ofgem stressed that people did not need to all submit their readings by today.

"If you're planning to submit your meter reading by October 1, you can submit it a reasonable time after," the regulator said.

Read more:

Energy bills are going up - here's what you need to know

Spiralling energy bill burden will send UK into catastrophic territory

Even those who've done the right thing won't escape impact of rise in energy bills

Support for businesses, charities and public sector organisations will also come into effect from today through the Energy Bill Relief Scheme.

The scheme will operate for six months and could be extended subject to a review.

Click to subscribe to the Sky News Daily wherever you get your podcasts

Ministers say the discounts it will provide on the price per unit of gas and electricity will result in payments of wholesale energy costs below half of what had been feared.

As the energy price cap comes into force, Prime Minister Liz Truss said: "Livelihoods and businesses were at stake. The government's energy support limits the price they pay for gas and electricity, shields them from massive bill increases, and is expected to curb inflation too.

"The cost of not acting would have been enormous."

https://news.google.com/__i/rss/rd/articles/CBMieGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L21pbmlzdGVyLWlzc3Vlcy1mcmF1ZC13YXJuaW5nLWFzLWdvdmVybm1lbnQtZW5lcmd5LXN1cHBvcnQtcGFja2FnZS1jb21lcy1pbnRvLWVmZmVjdC0xMjcwODUxNtIBfGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L2FtcC9taW5pc3Rlci1pc3N1ZXMtZnJhdWQtd2FybmluZy1hcy1nb3Zlcm5tZW50LWVuZXJneS1zdXBwb3J0LXBhY2thZ2UtY29tZXMtaW50by1lZmZlY3QtMTI3MDg1MTY?oc=5

2022-09-30 21:40:45Z

1570664554