The Bank of England needs to keep interest rates high enough for long enough to “see the job through” on cutting inflation, its chief economist has said.

Huw Pill said he was focused on a “lasting return to target” for UK inflation, which was at 6.8% in July, well above the Bank’s 2% target.

The Bank’s monetary policy committee (MPC) has raised interest rates for 14 times in a row, and has another meeting on 21 September. It is expected to raise rates further.

Speaking at a research conference in Cape Town organised by the South African Reserve Bank, Pill said (via Reuters):

The key element is that we on the MPC need to see the job through and ensure a lasting and sustainable return of inflation to the 2% target.

At present, the emphasis is still on ensuring that we are - in the words of the MPC’s last statement - sufficiently restrictive for sufficiently long to ensure that we have that lasting return to target.

Filters BETA

Wise shares, listed in London, are down by 1.8% after the sanctions announcement. They had fallen as far as 4% when the initial announcement came out.

You can see the share price move in the below chart. A big drop, followed by a sigh of relief in visual form as investors realised there was no monetary penalty:

Fintech firm Wise has broken UK laws on sanctions on Russia by allowing a person under sanctions to withdraw cash, the Treasury has said.

Wise escaped a fine because it was only a £250 withdrawal, and the company reported the breach itself.

The “nature and circumstances of this breach were assessed as moderately severe”, the Treasury’s Office for Financial Sanctions Implementation (OFSI) said in a report. The appropriate penalty was therefore “disclosure” – consider them punished.

The withdrawal was from a business account held with Wise, but was on a card issued in the designated person’s name on 30 June, one day after sanctions were imposed on 29 June.

There were 12 people newly designated for sanctions on 29 June 2022, according to the UK’s sanctions list, among them Russian oligarchs and leaders of the Wagner mercenary group. The person who withdrew the money was not named.

Wise matched the name on a sanctions database, but its policy was not to shut down access to debit cards immediately because of a lot of “false positives”, the Treasury report said. Someone checked the sanctions a day after the withdrawal was made, and it took another three days for the debit card to be blocked.

OFSI said:

Despite the low breach value, OFSI considered that Wise’s systems and controls, specifically its policy surrounding debit card payments, were inappropriate. This factor made the case moderately severe overall and enabled funds to be made available to a company owned or controlled by the designated person.

A Wise spokesperson said:

At Wise, we take the responsibility of complying with all sanctions laws very seriously. We took immediate steps to suspend our services to Russia as soon as sanctions were enacted in response to its invasion of Ukraine.

On June 29, 2022, an individual was added to the list of sanction-designated persons under UK regulations. We promptly followed sanctions screening procedures and suspended an account suspected to belong to a business owned by that individual. This meant that the account-holder could no longer send or receive any funds via this account. During our review of this account, however, we learned that a business debit card associated with the account was used to make a £250 ATM withdrawal on the same day.

We voluntarily reported this ATM withdrawal to OFSI, undertook an immediate review of our processes and implemented the necessary internal system changes to prevent this type of transaction going forward.

We take this matter very seriously. We remain committed to ensuring that our day-to-day operations are in compliance with all relevant regulatory requirements, and to working openly and collaboratively with our regulators.

*This post has been updated to add Wise’s comment.

Bank of England chief economist Huw Pill used some intriguing topographical metaphors in his speech on the UK economy and the path of interest rates.

Bloomberg’s Lucy White reports that Pill said he wanted a “Table Mountain” approach to interest rates – rather than a Matterhorn.

The speech was in Cape Town, which is overlooked by Table Mountain. A flat top would suggest interest rates will remain at current levels for a long while, rather than dropping steeply like the famous spike of the Matterhorn on the Swiss-Italian border.

(And a thumbs up from the business live blog for visually interesting metaphors in central bank speeches.)

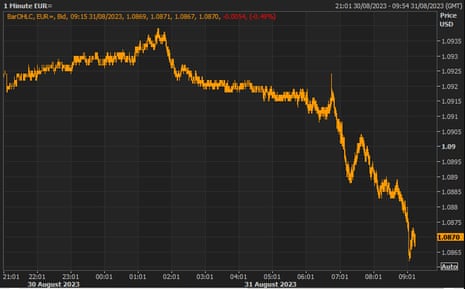

The euro has edged further against the US dollar today after eurozone inflation data beat expectations.

The single currency is trading at $1.087, down 0.5% against the dollar. It peaked above $1.093 earlier this morning.

Eurozone unemployment stayed stable at 6.4%, so it is the inflation data that will be the focus for economists.

Food, alcohol and tobacco was the main driver of inflationary pressure, Eurostat said.

Energy prices have fallen markedly – although that follows a lot of increases caused by Russia’s war in Ukraine. Eurostat said:

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (9.8%, compared with 10.8% in July), followed by services (5.5%, compared with 5.6% in July), non-energy industrial goods (4.8%, compared with 5.0% in July) and energy (-3.3%, compared with -6.1% in

July).

Eurozone inflation has come in higher than expected, adding to pressure on the European Central Bank to push ahead with another rate hike at its September meeting.

Inflation across the euro area is expected to come in at 5.3% in August, the same as July, statistics office Eurostat said.

Economists had expected inflation to fall to 5.1%, according to a poll by Reuters.

The UK’s energy regulator is to ban a controversial practice by electricity generators in which they made tens of millions of pounds a day for helping to balance the grid.

Energy companies were accused of manipulating the market, by saying they were going to switch off their generators just at the moment they were most needed. Under the UK’s grid balancing system, they were then offered inflated prices to turn them back on.

Regulator Ofgem said it would ban the practice from 26 October, in time for this winter’s heating season. Generators could face “stiff penalties for breach of licence conditions, including being subject to provisional and final orders and fines of up to 10% of their regulated turnover”, Ofgem said.

Eleanor Warburton, Ofgem’s acting director for energy systems management and security, said:

This new licence conditions shows Ofgem will not tolerate electricity generators attempting to take advantage of the balancing mechanism system to make excessive profits through inflexible generation.

We believe the new licence condition strikes the right balance between protecting consumers and ensuring they pay a fair price for their energy while also enabling a competitive electricity market that provides fair returns for generators.

We’ll be monitoring the effectiveness of it to ensure it’s doing what it was designed to do.

Ofgem had said it was considering changes to the regime in March.

The scale of the profits made from the balancing regime was enormous. Balancing costs – paid ultimately by the taxpayer – tripled in the winter of 2021/22, to over £1.5bn between November 2021 and February 2022, compared to average annual winter balancing costs of just under £500m for between 2017 and 2020, Ofgem said.

The Bank of England’s Huw Pill also cautioned that there was a risk that the central bank raises borrowing costs too high. He said:

Now that policy is in restrictive territory, there is the possibility of doing too much and inflicting unnecessary damage on employment and growth.

But he also said there was no room for complacency, Reuters reported. Some indicators of underlying inflation pressures have developed less benignly recently than the headline rate of inflation.

Headline UK inflation has fallen from 11.1% in October – a 40-year high – to 6.8% in July.

The Bank of England needs to keep interest rates high enough for long enough to “see the job through” on cutting inflation, its chief economist has said.

Huw Pill said he was focused on a “lasting return to target” for UK inflation, which was at 6.8% in July, well above the Bank’s 2% target.

The Bank’s monetary policy committee (MPC) has raised interest rates for 14 times in a row, and has another meeting on 21 September. It is expected to raise rates further.

Speaking at a research conference in Cape Town organised by the South African Reserve Bank, Pill said (via Reuters):

The key element is that we on the MPC need to see the job through and ensure a lasting and sustainable return of inflation to the 2% target.

At present, the emphasis is still on ensuring that we are - in the words of the MPC’s last statement - sufficiently restrictive for sufficiently long to ensure that we have that lasting return to target.

Germany’s unemployment rate has risen slightly, as expected, to 5.7%.

That’s up from 5.6% in July, according Germany’s federal statistics office.

Shares in Swiss bank UBS have jumped by 7% after it said it was hoping to make $10bn (£7.9bn) in cost cuts after absorbing rival Credit Suisse’s domestic bank operations.

Taking over those operations – rather than selling them off or floating it separately – could be politically difficult because of likely job losses in Switzerland.

Nevertheless, investors appear to like what they see in UBS’s first results since the takeover. Its share price is now higher than at any time since the financial crisis in October 2008.

Credit Suisse was sunk not by its domestic operations, but rather by a series of huge errors by its corporate and investment bank. UBS stepped in to rescue it at the behest of the Swiss government after it became clear Credit Suisse would not make its way out of a crisis.

Sergio Ermotti, UBS’s chief executive, said:

Our analysis clearly shows that full integration is the best outcome for UBS, our stakeholders and the Swiss economy. Clients will continue to receive the premium level of service they expect, benefiting from enhanced offerings, expert capabilities and global reach.

And Credit Suisse will continue to sponsor “civic, sporting and cultural activities in Switzerland at least until the end of 2025”.

Are we heading for a Eurozone inflation surprise in a few hours? French inflation has come in higher than analysts’ expectations.

French consumer prices rose by 5.7% in August compared to a year earlier, up from 5.1% in July, according to data harmonised with the rest of the EU published by Insee, France’s statistics office.

That was higher than the 5.4% expected by economists polled by Reuters.

Insee said:

This increase in inflation is due to a rebound in energy prices. The prices of food slowed down (for the fifth consecutive month), as did, to a lesser extent, those of manufactured goods and services.

The FTSE 100 has dipped at the opening bell.

The UK’s blue-chip index is down 0.1%, with mining company Glencore the biggest faller, down 5%.

Glencore is the subject of a story by the Financial Times saying that 200 funds, including some managed by Fidelity, Vanguard, Legal & General, HSBC, Abrdn and Invesco, are taking action on allegations they “suffered loss” as a result of “untrue statements” by commodities company.

The FT reported:

Dozens of the world’s biggest asset managers have accused the trading house Glencore of lying in past share prospectuses to cover up corrupt activities, escalating a far-reaching action in London’s High Court that could have significant ramifications for the natural resources industry.

Glencore has not yet filed its defence in the case, and declined to comment to the FT.

Good morning, and welcome to our live coverage of business, economics and financial markets.

UK car production rose year-on-year for the sixth consecutive month in July, as the global chip shortage eased and the numbers of electric cars and hybrids rose.

Production from UK factories rose by 31.6% in July compared to last year, according to new data from the Society of Motor Manufacturers and Traders (SMMT). Output remains 29% below 2019, before the coronavirus pandemic (although that includes the effect of Honda’s closure of a plant in Swindon).

More than eight-in-10 cars made in the UK were shipped overseas. The top destination market, as ever, was the EU, followed by the US, China, Japan and Australia.

Almost two in every five cars were electric, or were hybrids combining batteries with petrol or diesel engines. Electrified volumes rose 73.9% to 30,180. So far this year 200,000 of the UK’s 527,000 cars have been electrified in some way (although the SMMT does not break down how many are pure electric in its announcement).

Mike Hawes, SMMT chief executive, said:

Six months of growth shows that British car production is recovering and, with electrified models increasingly driving volumes, the future is more positive. Recent investment announcements have undoubtedly bolstered the sector but global competition remains tough.

If we are to attract further investment and produce the next generation of zero emission models and technologies, we need a coherent strategy that builds on our strengths and supports all aspects of advanced automotive manufacturing.

Today’s big focus in financial markets will be on inflation data, with key measures ahead from the eurozone and the US today.

Both the European Central Bank and the US Federal Reserve will be watching the data closely for signs that inflationary pressures are easing. They must decide whether to raise interest rates further to make sure inflation stays lower, or whether they have now done enough.

Jim Reid and other analysts at Deutsche Bank, an investment bank, said:

Resilient inflation numbers from Germany and Spain [yesterday] added to speculation that the ECB might deliver a 10th consecutive rate hike next month.

Not everyone is convinced that would be a good idea:

The agenda

8:55am BST: Germany unemployment (August; previous: 5.6%; consensus: 5.7%)

10am BST: Eurozone inflation (August; prev.: 5.3%; cons.: 5.1%)

10am BST: Eurozone unemployment (July; prev.: 6.4%; cons.: 6.4%)

1pm BST: India GDP year-on-year growth rate (first quarter; prev.: 6.1%; cons.: 7.7%)

1:30pm BST: US personal consumption expenditure price index (July; prev.: 3%; cons.: 3.3%)

https://news.google.com/rss/articles/CBMiqAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL2F1Zy8zMS9lbGVjdHJpYy1jYXJzLXVrLWZhY3Rvcmllcy1tYW51ZmFjdHVyaW5nLWV1cm96b25lLWluZmxhdGlvbi11cy1lY2ItYmFuay1vZi1lbmdsYW5kLWZ0c2UtMTAwLXN0ZXJsaW5nLWJ1c2luZXNzLWxpdmXSAagBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyMy9hdWcvMzEvZWxlY3RyaWMtY2Fycy11ay1mYWN0b3JpZXMtbWFudWZhY3R1cmluZy1ldXJvem9uZS1pbmZsYXRpb24tdXMtZWNiLWJhbmstb2YtZW5nbGFuZC1mdHNlLTEwMC1zdGVybGluZy1idXNpbmVzcy1saXZl?oc=5

2023-08-31 09:06:33Z

2379358646