The UK has fared better.

Business output growth edged up to a six-month high in December, led by a faster recovery in the service economy while factories continued to cut back production, according to the latest flash estimate from the S&P Global / CIPS purchasing managers’ index (PMI) survey. It said:

UK private sector output expanded for the second month running in December, which continued a modest recovery from the downturn seen during the three months to October. Higher levels of business activity were supported by a renewed improvement in order books, alongside efforts to work through post-pandemic backlogs.

The main index rose to 51.7 in December, from 50.7 in November, the highest since June and pointing to a faster expansion.

Flash UK PMI Composite Output Index at 51.7 (Nov: 50.7). 6-month high

Flash UK Services PMI Business Activity Index at 52.7 (Nov: 50.9). 6-month high

Flash UK Manufacturing Output Index at 45.9 (Nov: 49.2). 2-month low

Flash UK Manufacturing PMI at 46.4 (Nov: 47.2). 2-month low

Independent economist Julian Jessop tweeted:

Filters BETA

Dave Ramsden, deputy governor for markets and banking at the Bank of England, has been talking about the banking system in a speech to the Deloitte Academy.

The UK banking system is well capitalised and has high levels of liquidity. Those are key elements in maintaining financial stability. But the overall risk environment remains challenging. That doesn’t mean I think a failure is imminent; the next real resolution weekend doesn’t start here. But as and when we are faced with another resolution we must be humble and recognise it is impossible to predict how it will unfold in real time.

No matter how much preparation is done, a resolution is always going to be complex to carry out and is almost certainly going to be messy to execute. In 2023 we have seen the successful application of key elements of the resolution toolkit including stabilisation and write-down powers, without using public funds.

But given our experience this year we must continue to invest in our toolkit and in places enhance it to ensure we have the optionality we need so that the regime remains credible. In that way we can ensure that progress on overcoming too big to fail continues for the largest banks. While ensuring that smaller banks don’t become a new source of systemic risk.

This year has been a reminder that we may need to use our powers at any time. In future we may not even have an actual weekend to deliver the resolution. To safeguard feasibility we and the firms we supervise need to maintain a high degree of operational readiness and continue to ensure resolvability as a foundation of financial stability.

He was referring to the banking collapses in the US such as Silicon Valley Bank, and the near-failure of Credit Suisse, which had to be rescued by its bigger Swiss rival USB.

Here’s our full story on Halifax’s house price predictions:

UK house will fall by up to 4% next year as high interest rates continue to affect mortgage affordability and sales completions, according to Halifax.

Britain’s biggest mortgage lender said the price of an average UK property will fall by between 2% and 4% but it expects a part recovery in the market as interest and mortgage rates ease next year.

“Overall, with the combination of cost of living pressures and interest rate levels that are still much higher than even two years ago, we will likely see continued mild downward pressure on house prices,” said Kim Kinnaird, the director of Halifax Mortgages.

An independent review has found “no evidence” that NatWest Group has been closing customer accounts due to their political views, but the lender has been urged to put in place more formal rules when it decides to end relationships for non-financial reasons, including when they do not align with its “purpose.”

The review, by the law firm Travers Smith, also said the bank may have breached rules by not explaining why those customer accounts were being closed.

The law firm found previously that NatWest’s decision to close Nigel Farage’s accounts at its private bank Coutts earlier this year was lawful, but there were “serious failings” in its treatment of the former Ukip leader.

Lawyers hired by NatWest determined that Coutts had a “contractual right” to shut Farage’s accounts, and had done so because the bank was losing money by keeping him as a client.

While Coutts also considered that there was a reputational risk of keeping Farage as a customer, it had not discriminated against him, despite raising concerns that his views on issues including migration, race, gender or Brexit did not align with its own, the law firm said.

Business growth in December was fuelled by a pick-up in the service sector. Firms talked of tentative signs of a revival in customer demand, especially for technology and financial services. However, cost of living pressures on household budgets remain, as well as subdued conditions in the construction sector.

Manufacturing production declined for the tenth month running, and at a faster pace than in November.

Rhys Herbert, senior economist at Lloyds Bank, said:

Another rise in output in December is in line with the more optimistic outlook as we approach 2024. Recent industry data has shown an uptick in business confidence, including our latest Business Barometer, which showed services sector confidence at a two-year high, and that optimism among manufacturing firms is the highest it’s been for five months.

While these positive signs are good news for businesses when it comes to future activity, we’re continuing to see business caution around the current economic climate given the delicate balancing act the Bank of England will have to consider with its interest rate decision-making next year.

Chris Williamson, chief business economist at S&P Global Markit Intelligence, tweeted:

The UK has fared better.

Business output growth edged up to a six-month high in December, led by a faster recovery in the service economy while factories continued to cut back production, according to the latest flash estimate from the S&P Global / CIPS purchasing managers’ index (PMI) survey. It said:

UK private sector output expanded for the second month running in December, which continued a modest recovery from the downturn seen during the three months to October. Higher levels of business activity were supported by a renewed improvement in order books, alongside efforts to work through post-pandemic backlogs.

The main index rose to 51.7 in December, from 50.7 in November, the highest since June and pointing to a faster expansion.

Flash UK PMI Composite Output Index at 51.7 (Nov: 50.7). 6-month high

Flash UK Services PMI Business Activity Index at 52.7 (Nov: 50.9). 6-month high

Flash UK Manufacturing Output Index at 45.9 (Nov: 49.2). 2-month low

Flash UK Manufacturing PMI at 46.4 (Nov: 47.2). 2-month low

Independent economist Julian Jessop tweeted:

Ricardo Amaro, lead economist at Oxford Economics, said:

Today’s flash PMI results poured a bit of cold water into the mix of recent survey results, which had so far been pointing to a turning point in high-frequency data. Indeed, the eurozone headline index partly reversed last month’s gain to stand at 47 in December, signalling another solid contraction in activity.

Overall, the aggregate PMI results for Q4 are pointing to a contraction in GDP. However, we note that the Q4 average level is broadly unchanged from Q3, when the PMIs proved to be overly pessimistic. Thus, while acknowledging the downside risk, we stick to our forecast that the eurozone economy remained stagnated in Q4. But big picture, today’s results pointed to weak momentum heading into 2024, confirming that the recovery we expect to develop through the year will start from a low base.

The ‘flash’ PMI survey suggests the eurozone is heading for recession, economists say.

Chris Williamson, chief business economist at S&P Global Markit Intelligence, tweeted:

Nationwide building society has put out its predictions for next year, saying that a rebound in house prices is unlikely. It said they could show a low single-digit decline or remain broadly flat in 2024.

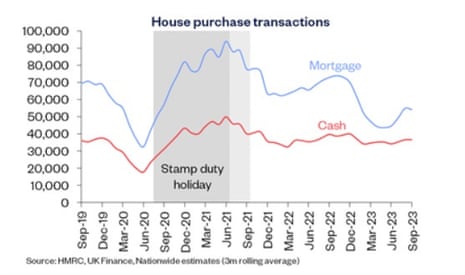

The housing market was weak throughout this year, with the total number of transactions running at 15% below pre-pandemic levels over the past six months.

Robert Gardner, Nationwide’s chief economist, said:

Even though house prices are modestly lower and incomes have been rising strongly, at least in cash terms, this hasn’t been enough to offset the impact of higher mortgage rates, which are still more than three times the record lows prevailing in 2021 in the wake of the pandemic.

As a result, housing affordability is still stretched. A borrower earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 38% of take home pay – well above the long run average of 30%.

At the same time, deposit requirements remain prohibitively high for many of those wanting to buy – a 20% deposit on a typical first-time buyer home equates to over 105% of average annual gross income – down from the all-time high of 116% recorded in 2022, but still close to the pre-financial crisis level of 108%.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said:

Once again, the figures paint a disheartening picture as the eurozone economy fails to display any distinct signs of recovery. On the contrary, it has contracted for six straight months. The likelihood of the eurozone being in a recession since the third quarter remains notably high.

The service sector maintains a relatively more stable position compared to the manufacturing sector, contracting at a much slower rate. This is likely attributed to the concurrent reduction in consumer price inflation, coupled with an above-average surge in wages. These factors contribute to bolstering the purchasing power of private households, a crucial element for the more consumer-driven service sector.

However, despite these elements, there are no indications of the service sector breaking free from its unsatisfactory trajectory. Quite the opposite, new business is diminishing at an accelerated pace, as is the backlog of work. Employment has teetered between marginal increases and decreases over the past five months, essentially holding steady.

He is forecasting only modest economic growth in the eurozone, of 0.8% for 2024, following 0.5% growth this year.

Business activity in the eurozone worsened in December, falling at a steeper rate and closing off a fourth quarter which has seen output fall at its fastest rate for 11 years, barring only the early 2020 pandemic months.

The flash PMI reading shows the manufacturing and services sectors recorded further downturns, with both reporting steep falls in inflows of new business. Jobs were cut for a second month running.

Input cost inflation cooled but selling price inflation picked up and remained high by historical standards.

HCOB Flash Eurozone Composite PMI Output Index at 47.0 (November: 47.6). 2-month low

HCOB Flash Eurozone Services PMI Business Activity Index at 48.1 (November: 48.7). 2-month low

HCOB Flash Eurozone Manufacturing PMI Output Index at 44.1 (November: 44.6). 2-month low

HCOB Flash Eurozone Manufacturing PMI at 44.2 (November: 44.2). Unchanged rate of decline

https://news.google.com/rss/articles/CBMilAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL2RlYy8xNS91ay1jb25zdW1lci1jb25maWRlbmNlLXJpc2VzLWNoaW5hLWVjb25vbXktc2hha3ktZ3JvdW5kLWZsYXNoLXBtaS1yYXRlLWN1dC1ob3Blcy1idXNpbmVzcy1saXZl0gGUAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvZGVjLzE1L3VrLWNvbnN1bWVyLWNvbmZpZGVuY2UtcmlzZXMtY2hpbmEtZWNvbm9teS1zaGFreS1ncm91bmQtZmxhc2gtcG1pLXJhdGUtY3V0LWhvcGVzLWJ1c2luZXNzLWxpdmU?oc=5

2023-12-15 07:48:00Z

CBMilAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL2RlYy8xNS91ay1jb25zdW1lci1jb25maWRlbmNlLXJpc2VzLWNoaW5hLWVjb25vbXktc2hha3ktZ3JvdW5kLWZsYXNoLXBtaS1yYXRlLWN1dC1ob3Blcy1idXNpbmVzcy1saXZl0gGUAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvZGVjLzE1L3VrLWNvbnN1bWVyLWNvbmZpZGVuY2UtcmlzZXMtY2hpbmEtZWNvbm9teS1zaGFreS1ncm91bmQtZmxhc2gtcG1pLXJhdGUtY3V0LWhvcGVzLWJ1c2luZXNzLWxpdmU

Tidak ada komentar:

Posting Komentar