Wage growth has slowed and the UK jobs market is showing signs of stalling, according to latest official figures.

Pay growth, excluding bonuses, eased to 7.3% in the three months to October while the number of vacancies dropped.

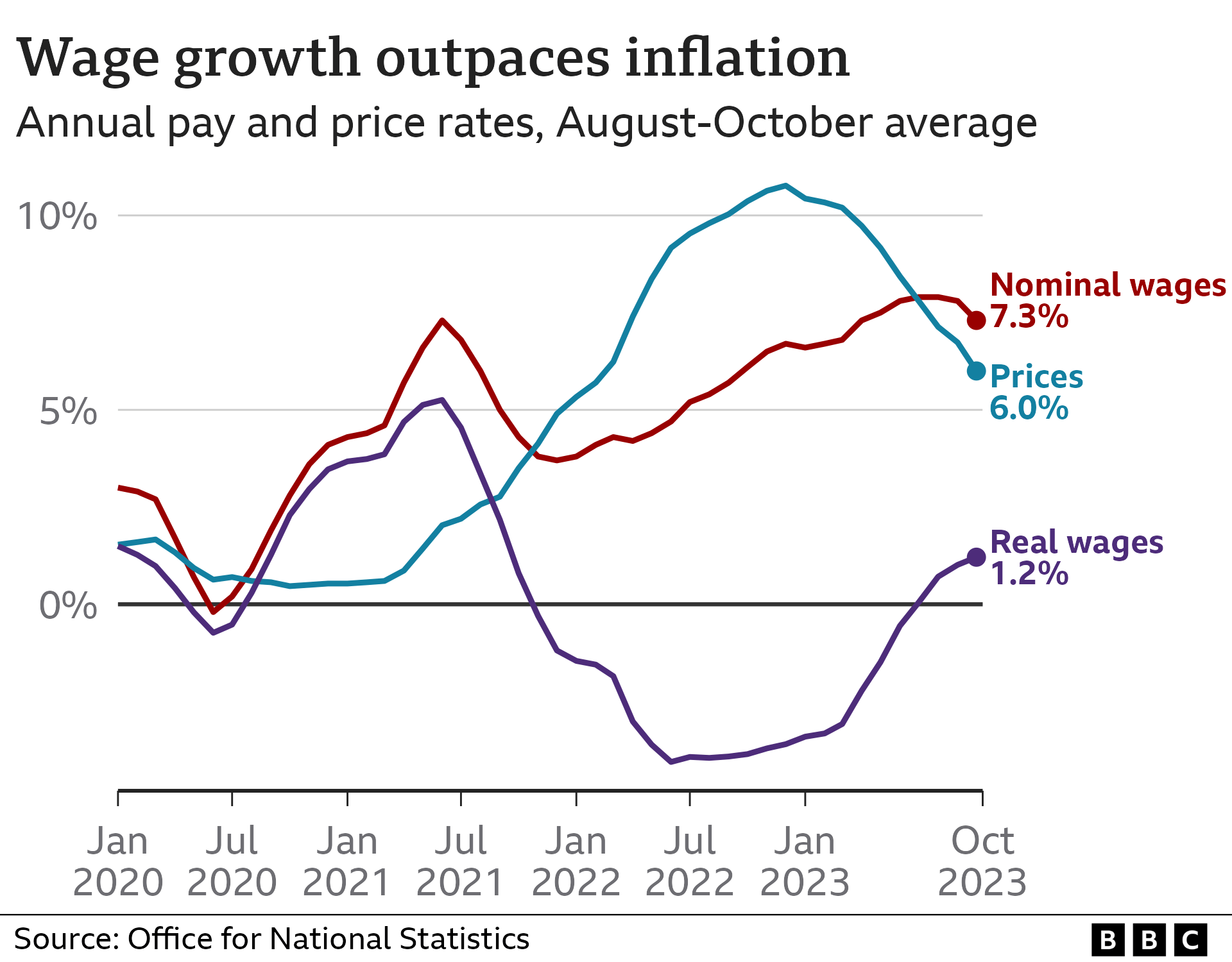

But while earnings are not rising as quickly as before, they are still outpacing inflation - which measures the rate at which prices are going up.

This suggests that the Bank of England is less likely to cut interest rates anytime soon.

The number of people on payrolls eased while UK job vacancies also continued to fall, this time by 45,000 between September and November.

"This is now the longest period of decline on record, longer than in the immediate aftermath of the 2008 downturn," said Darren Morgan, director of economic statistics at the Office for National Statistics, which published the figures.

It is the 17th month in a row that the number has fallen.

However, overall vacancies totalled 949,000, which Mr Morgan said "remains well above pre-pandemic levels".

Inflation has been falling following a long run of interest rate rises by the Bank of England. This has prompted financial markets and some economists to suggest the Bank may soon start cutting interest rates from the current level of 5.25%.

But while inflation has eased to 4.6%, it remains more than double the Bank's target of 2%. In addition, regular pay grew faster than inflation in the three months to October.

Last month, the Bank of England's governor Andrew Bailey said it was "much too early to be thinking about rate cuts".

The Bank is widely expected to hold interest rates for a third time in a row when it announces its latest decision on Thursday.

Yael Selfin, chief economist at accountancy firm KPMG in the UK, said: "While momentum has weakened, the labour market is still tight.

"The Bank of England will remain alert as continued tightness could cause a setback in its battle against inflation, particularly if strong wage growth contributes to persistence in domestic inflation."

Higher interest rates make it more expensive for people and businesses to borrow money.

At the same time, it can make saving money more attractive - if banks choose to pass on the higher savings rates to their customers in the same way that some lenders have passed on higher mortgage rates.

The theory is if people and firms spend or invest less and save more, demand falls and price rises ease. But it can also mean that the economy struggles to grow.

The latest data from the ONS showed that the UK's unemployment rate remained at 4.2%.

But the Bank of England is among those predicting that, amid higher borrowing costs, unemployment is set to top 5% in the next couple of years, possibly signalling the loss of hundreds of thousands of jobs.

It is against this challenging backdrop that the government's "back to work" plans are unfolding. They are aimed at getting more people into work, and not just those on the unemployment count.

Unlike in other rich nations, the UK has hundreds of thousands more classed as "inactive" - neither seeking nor available for work - than prior to the Covid pandemic. But finding employment is a tricky prospect if there are fewer jobs available.

But there is a silver lining for those already in work. As those higher interest rates batter down the pace at which prices are rising, wages are outpacing inflation at their fastest rate for more than two years.

That means household budgets stretch further, but also underlines economists' expectation that, as the Bank of England has warned, interest rates aren't about to fall soon.

Related Topics

https://news.google.com/rss/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTY3NjgwMjY30gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjc2ODAyNjcuYW1w?oc=5

2023-12-12 08:58:05Z

CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTY3NjgwMjY30gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjc2ODAyNjcuYW1w

Tidak ada komentar:

Posting Komentar