Sainsbury’s is planning to close two Argos distribution centres, putting up to 1,400 jobs at risk, and will ditch the catalogue shop’s Milton Keynes head office and three remaining Habitat showrooms to cut costs.

The retailer said it expected to close the warehouses in Basildon, Essex and Heywood, Greater Manchester, by 2026 leaving three non-food warehouses that will serve both Sainsbury’s and Argos.

The changes are part of a £90m rejig of the Sainsbury’s group’s distribution network, which will also involve investment in additional automation at a warehouse in Daventry, in Northamptonshire.

Sainsbury’s said the changes would create a “simpler, more modern network to significantly improve availability, reduce stock and enable faster customer deliveries”.

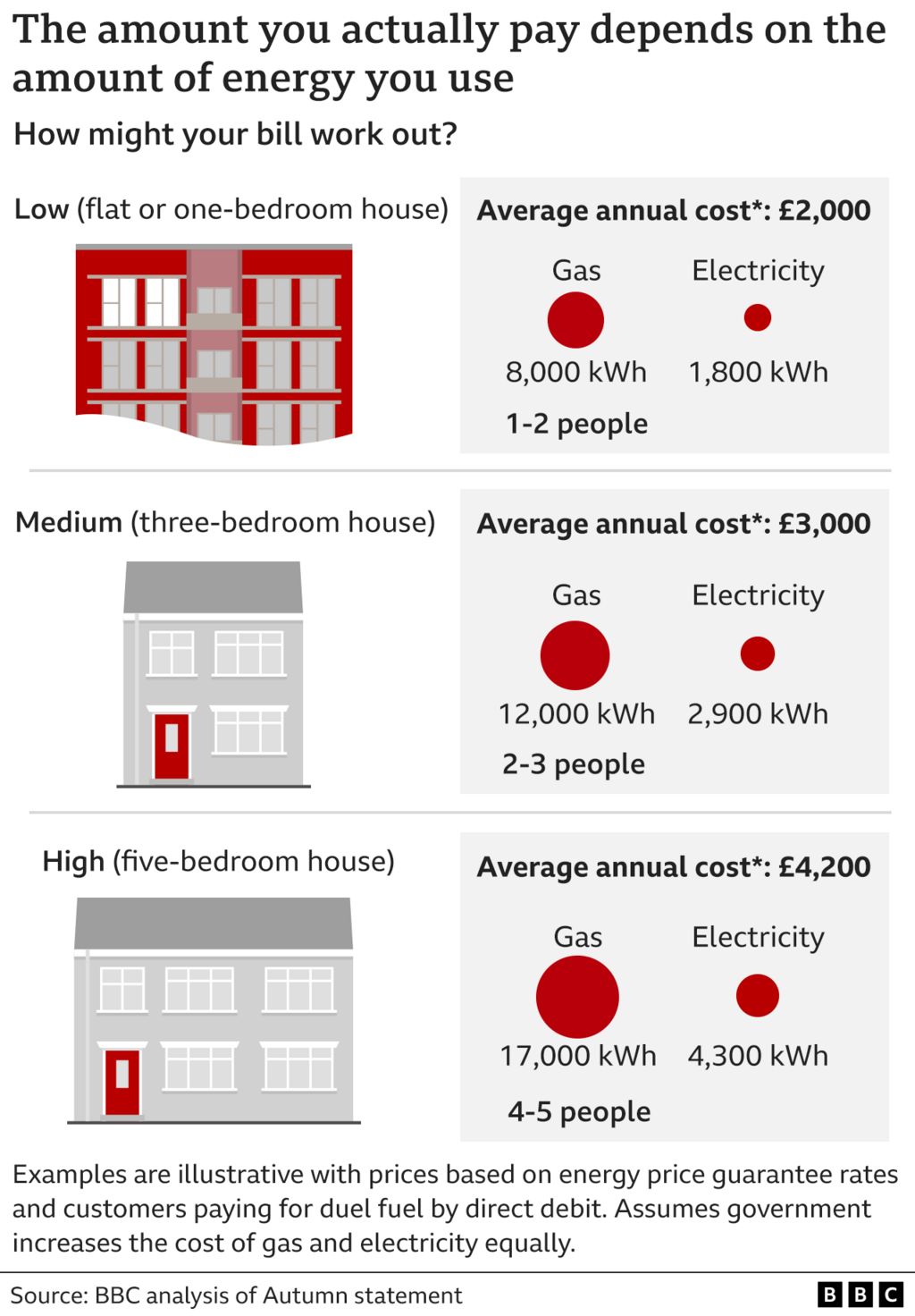

The retailer’s cuts come as traditional supermarkets hunt for ways to trim costs to invest in keeping prices competitive amid soaring food price inflation, higher energy bills and labour costs.

On Tuesday, Marks & Spencer said it was spending £60m on raising minimum pay for store staff by almost 7% to £10.90 an hour, well above the legal minimum. Sainsbury’s and some other grocers now pay a minimum of £11 an hour.

Sainsbury’s has pledged to deliver £1.3bn of cost savings in the three years to September 2024 – such as closing cafes, fresh food counters and high street Argos stores – as it spends £550m on keeping down prices by March this year. It bought Argos in 2016.

The latest market share figures out this week showed both German-owned discounters Lidl and Aldi growing by more than 25%, while Sainsbury’s sales rose by 6.2% in the three months to 19 February – on a par with its close rivals Tesco and Asda.

No jobs are at risk from the closure of Argos’s Milton Keynes head office, where Sainsbury’s said just 11% of desk space was regularly used. Staff working there are expected to move to one of Sainsbury’s other offices.

after newsletter promotion

Simon Roberts, the chief executive of Sainsbury’s, said: “As with any major change to our business, we have not taken the difficult decision to start this consultation lightly. As part of our plan to create a simpler business, we previously set out our intention to integrate our Argos and Sainsbury’s logistics networks.

“Over the last few years, we’ve been working hard to transform this network as we make our business simpler, more efficient and more effective for customers. This also allows us to reduce costs, so we can invest where it will make the most impact for our customers.”

https://news.google.com/rss/articles/CBMic2h0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy8yMDIzL2ZlYi8yOC9zYWluc2J1cnlzLXRvLWNsb3NlLXR3by1hcmdvcy1kaXN0cmlidXRpb24tc2l0ZXMtcmlza2luZy0xNDAwLWpvYnPSAXNodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvMjAyMy9mZWIvMjgvc2FpbnNidXJ5cy10by1jbG9zZS10d28tYXJnb3MtZGlzdHJpYnV0aW9uLXNpdGVzLXJpc2tpbmctMTQwMC1qb2Jz?oc=5

2023-02-28 18:51:00Z

1799259444

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VCI42OJ2R5KMDCKDGQVSG2Q5FQ.jpg)