Just in time for Christmas, Ripple, the banker-bro Silicon Valley cryptocurrency start-up, says it is about to be slapped with a lawsuit from the US Securities and Exchange Commission.

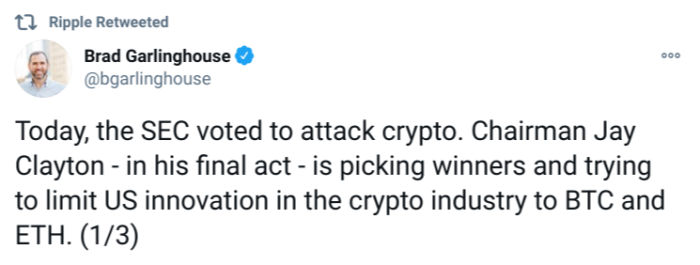

In the early hours of Tuesday morning UK-time, the company’s CEO Brad Garlinghouse tweeted the following:

The case seemingly hangs on whether the early distribution of pre-mined XRP -- the cryptocurrency created by Ripple -- constituted a securities offering, and whether XRP “stock” should have been registered accordingly. This, say XRP critics, can be argued because unlike other cryptocurrencies, XRP’s supply and distribution was centrally controlled in its early days and even now efforts taken to separate control are merely cosmetic in nature.

Garlinghouse linked to a Fortune article, in which he is quoted as saying:

It’s not just Grinch-worthy, it’s shocking . . . It’s an attack on the entire crypto industry and American innovation.

It was also noted in the article that the decision by Ripple (which the news outlet calls one of most important companies in the crypto industry) to announce that it is being sued is an unusual one.

This is partially true. Usually, companies under investigation -- even if they note they have been served a Wells Notice -- shy away from offering any insight into such matters until the SEC itself is prepared to announce an action. This is mostly out of fear of getting themselves into even more trouble with regulators.

In 2019, however, Elon Musk turned provocation of the SEC into an art form.

His dealings with the SEC since then -- which have regularly seen him taunt the regulator on Twitter -- have opened the door to a new norm being established in terms of acceptable communications between authorities and executives with large social media followings.

In trying to get ahead of the regulatory-action news curve, Garlinghouse appears to be running with that norm, or at the very least flagging he too is prepared to throw down the gauntlet to the SEC in a similar fashion. This he has done not only by revealing that the lawsuit will name him and co-founder Chris Larsen as defendants but also by publishing Ripple’s own take on matters to his legion of 279k followers. (Though how many of those followers are flesh-and-blood people is harder to determine.)

And the company is making some very interesting arguments in its bid to control the narrative . . .

Chief among them is that XRP has always been a digital asset with “a fully functional ecosystem and a real use case as a bridge currency that does not rely on Ripple’s efforts for its functionality or price”.

Garlinghouse, however, is channelling another familiar argument too:

In its official Wells submission (the response to the Wells notice) Ripple specifically notes:

Innovation in the cryptocurrency industry will be fully ceded to China. The Bitcoin and Ethereum blockchains are highly susceptible to Chinese control because both are subject to simple majority rule, whereas the XRPL prevents comparable centralization

It is a fascinatingly paradoxical point if you really think about it. The argument suggests only XRP can defend us from China because it alone has the power to defy centralising free-market forces (since presumably it is already controlled and centralised by someone else?).

The above reminds us of the time that those other famous do-gooders, Facebook, kept on trying to say that their planned “Libra” coin was actually all about fighting China and extending “America’s financial leadership as well as our democratic values and oversight around the world”. (Incidentally, “Libra” is no longer and something called “Diem” is due to be launched next year instead. Remember when we dedicated a whole series to arguing that Libra wasn’t going to work out? Yeah. Read Alphaville. 😎)

Silicon Valley invoking the CHAYNA threat while simultaneously replicating Chinese centralisation practices is pretty funny in our parish.

At pixel time, XRP was down more than 6 per cent on the day, having been down as much as 19 per cent earlier. Its “market cap” now stands at $22.5bn, according to Coinmarketcap.com. Though the website also notes XRP’s “circulating supply” (which we presume also includes coins that have been mined but not publicly released) stands at $45.4bn. Who actually knows how “market cap” is calculated in this space? It is after all a bit of a nonsense metric.

Fortune reported that Judith Burns, a spokesperson for the SEC, declined to confirm whether there would indeed be a lawsuit.

Related links:

Who’s been editing the Ripple Wikipedia page? - FT Alphaville

The art of redefining success, MoneyGram and Ripple edition (Updated) - FT Alphaville

With $16bn in cryptocurrency, Ripple attempts a reset - FT

The Ripple effect - FT

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzJkMjMxN2FiLTJmZTgtNGRiNi04ZjNlLTMwYWNmZWEyNWMyONIBP2h0dHBzOi8vYW1wLmZ0LmNvbS9jb250ZW50LzJkMjMxN2FiLTJmZTgtNGRiNi04ZjNlLTMwYWNmZWEyNWMyOA?oc=5

2020-12-22 15:00:00Z

52781258434171

Tidak ada komentar:

Posting Komentar