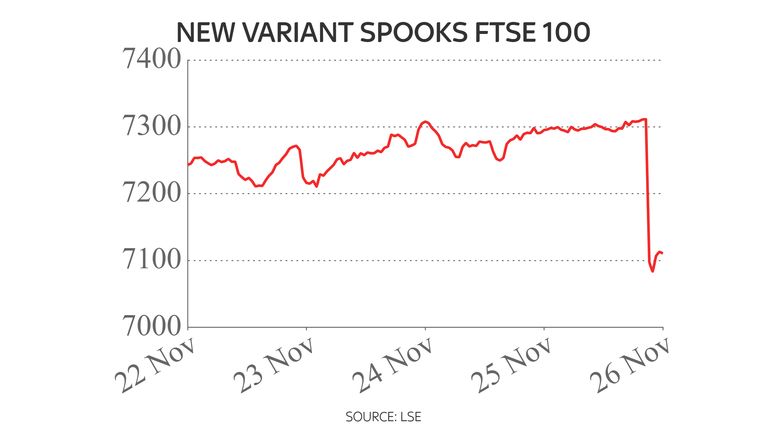

The FTSE 100 has fallen by 3.64% in its biggest one-day sell-off, in percentage terms, since June 2020.

The 266-point slump wiped £72bn off the value of the UK's leading stock index, reflecting fears that a new coronavirus variant could wreak further havoc on international business and travel.

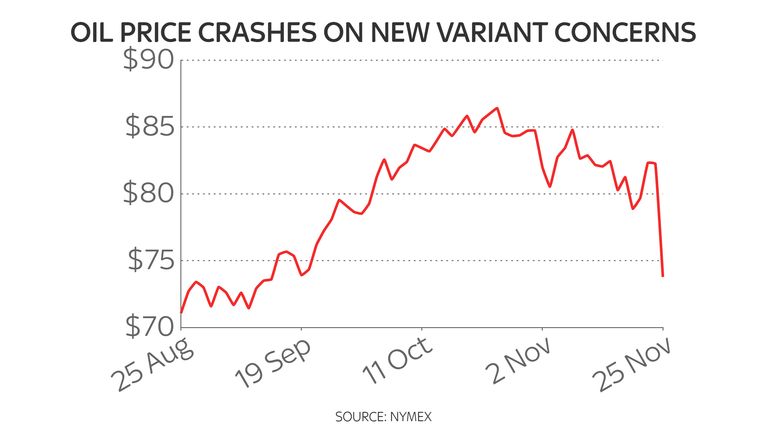

Oil was one of the worst hit assets, with the European benchmark Brent crude crashing by more than 10% after suffering its sharpest one-day drop since April 2020.

Meanwhile, US stock indexes also opened down, with the Dow Jones Industrial Average falling as much as 1,000 points, or nearly 2.5%, in early trading. The S&P 500 fell by 2.05%, with travel and banking stocks hit hardest.

Shares in major airlines plummeted in London with IAG, the owner of British Airways, falling more than 21% in early trading before closing 14.6% down, while EasyJet plunged 12%. The UK government said it would add six countries, including South Africa, to the red list, with flights being temporarily banned.

A number of other European countries, including Italy and Germany, had also banned travellers from the southern African countries by Friday afternoon.

Engine maker Rolls-Royce, engineering company Melrose, and oil giants BP and Shell were also among big fallers.

Prior to European markets opening, Asian indexes had suffered their sharpest drop in two months after the detection of a possibly vaccine-resistant coronavirus variant.

The variant, designated as B.1.1.529 and first identified in Botswana, has a "very unusual constellation" of mutations that could help it dodge vaccine immunity and natural antibodies, scientists have said. On Friday morning, Israeli health authorities said they had detected their first case of the new variant.

Amid the hit to stocks, the pound also took a hammering, with sterling dropping below $1.33 for the first time this year as investors lost their appetite for risk.

The new variant has also prompted investors to scale back their expectations for a Bank of England (BoE) interest rate rise in December, adding to downward pressure on the pound.

European markets were all hit hard in afternoon trading, with Germany's DAX down 4.15%, and France's CAC 40 down 4.75%.

Increasingly treated as a safe haven for investors during turbulent times, digital currencies such as bitcoin and ethereum also fell more than 7% and 10% respectively.

Gold, a traditional investment for nervous traders, was in heavy demand, as was the Swiss franc and US Treasuries, according to analysts at BayernLB.

There are worries that the variant, which UK health officials said was the most significant found to date, could lead to a new wave of infections and travel restrictions, stifling economic growth.

https://news.google.com/__i/rss/rd/articles/CBMiVWh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L2Z0c2UtMTAwLWZhbGxzLXNoYXJwbHktb24tbmV3LXZpcnVzLXZhcmlhbnQtZmVhcnMtMTI0NzkwNjnSAVlodHRwczovL25ld3Muc2t5LmNvbS9zdG9yeS9hbXAvZnRzZS0xMDAtZmFsbHMtc2hhcnBseS1vbi1uZXctdmlydXMtdmFyaWFudC1mZWFycy0xMjQ3OTA2OQ?oc=5

2021-11-26 17:12:00Z

1185084651

Tidak ada komentar:

Posting Komentar