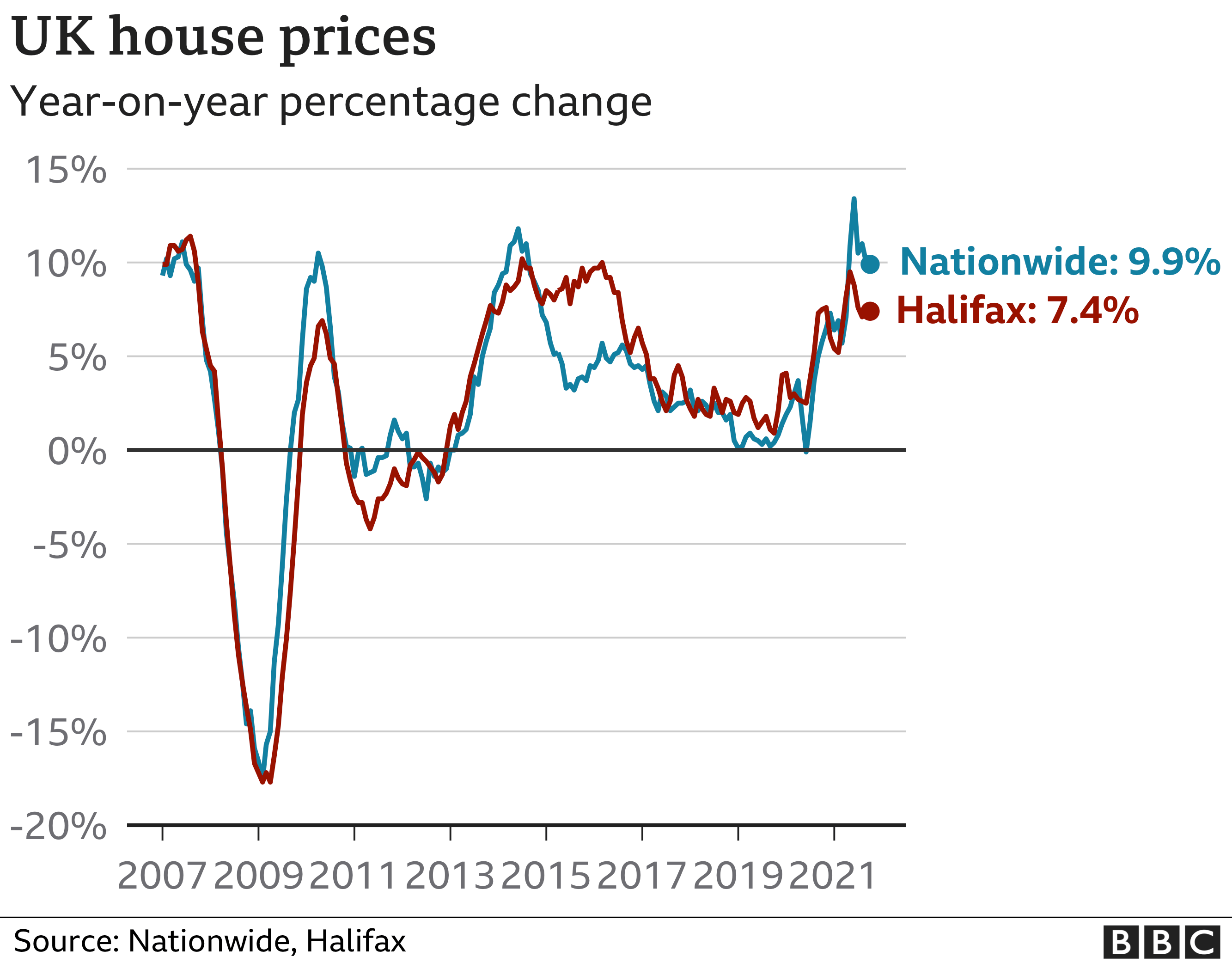

A typical UK home costs more than £250,000 for the first time after prices rose by 9.9% in the last year, according to the Nationwide.

The building society said the average house price was £250,311 in October, up 0.7% on the previous month.

It said this was an increase of £30,728 since the start of the pandemic. Covid has coincided with intense demand from buyers unmatched by supply.

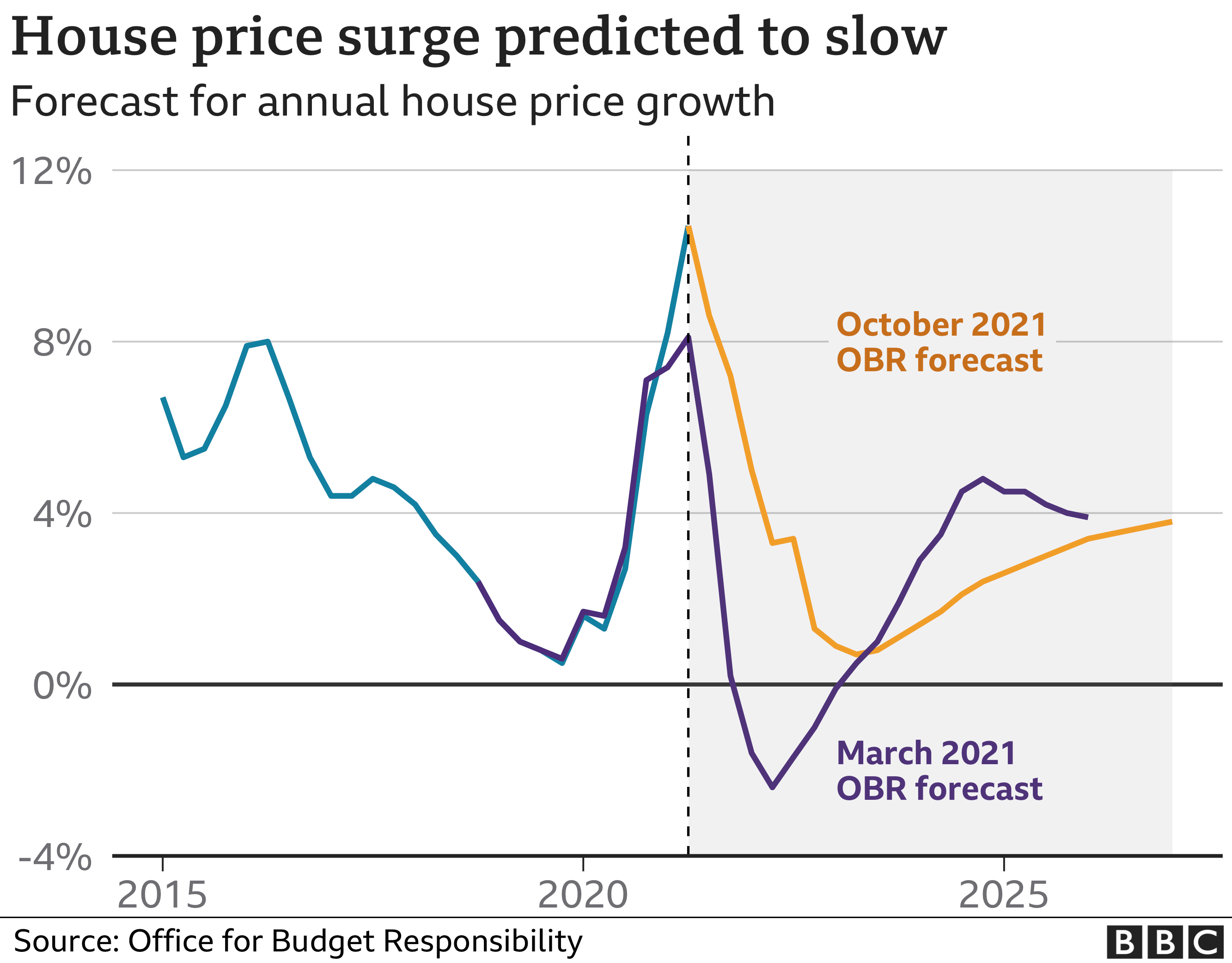

Official forecasters say the pace of house price rises will slow.

"The dynamics of the housing market may be about to shift slowly once again, but make no mistake, the boom still isn't over," said Nicky Stevenson, managing director at estate agent Fine & Country.

Demand during pandemic

UK house prices have risen sharply over the last 18 months owing to changing preferences of buyers, who are now looking for more indoor and outside space, but those properties have not been plentiful on the market.

That has led to intense competition among potential buyers in some areas, particularly in rural and coastal spots.

The market also been buoyed by tax incentives, with ministers introducing stamp duty holidays, as well as cheap borrowing costs.

Those tax breaks are now over, and there is widespread speculation that mortgage rates will rise from the ultra-low levels of recent times.

"We expect house prices to continue to beat expectations in the near term before a gradual rise in mortgage rates applies the brakes in the second half of 2022," said Andrew Wishart, property economist at Capital Economics.

The outcome of Thursday's Bank of England interest rate decision will be one factor affecting house prices in the months ahead.

"The outlook remains extremely uncertain," said Nationwide chief economist Robert Gardner.

"If the labour market remains resilient, conditions may stay fairly buoyant in the coming months - especially as the market continues to have momentum and there is scope for ongoing shifts in housing preferences."

The government's official, independent forecaster - the Office for Budget Responsibility - said that house prices would continue to rise in the coming years, albeit at a slower rate.

It means potential first-time buyers are facing another period of difficulty if they wish to buy a home, especially if the cost of borrowing rises.

The OBR has now predicted that house prices will go up by 8.6% this year, compared with a year earlier. The annual rise would then slow to 3.2% in 2022, before decelerating further to 0.9% in 2023, it said.

This would be followed by rises of 1.9% in 2024, 2.9% in 2025, and 3.5% in 2026, although longer-term forecasts and more difficult to make accurately.

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU5MTQ3NzE40gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTkxNDc3MTguYW1w?oc=5

2021-11-03 10:17:10Z

CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU5MTQ3NzE40gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTkxNDc3MTguYW1w

Tidak ada komentar:

Posting Komentar