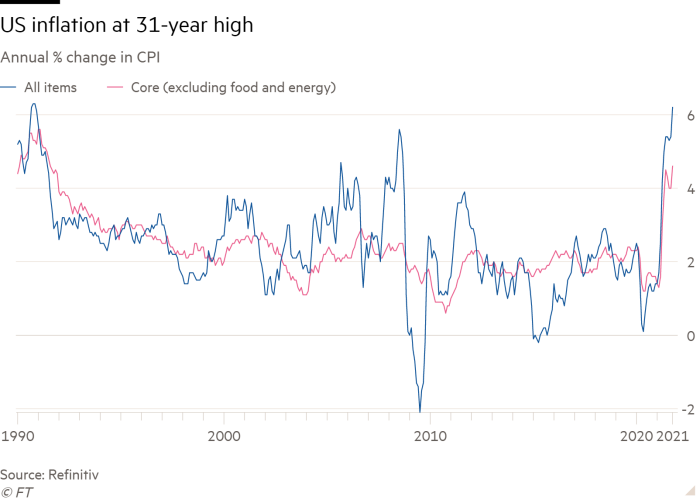

US consumer prices jumped in October at the fastest pace in three decades as inflationary pressures spread further throughout the economy, putting the Biden administration on the defensive and increasing prospects that the Federal Reserve will raise interest rates next year.

The consumer price index published by the Bureau of Labor Statistics on Wednesday rose 6.2 per cent in October from a year ago — the fastest annual pace since 1990 and a sharp increase from September’s levels of 5.4 per cent.

Month-over-month price gains accelerated, with a jump of 0.9 per cent amid what the BLS described as a “broad based” increase across a number of sectors. Between August and September, prices had risen 0.4 per cent.

Driving the surge was an uptick in costs for energy along with shelter, food, used cars and trucks and new vehicles. The energy index rose 4.8 per cent from September, while the gasoline index increased 6.1 per cent. On an annual basis, these sectors are up 30 per cent and 50 per cent, respectively.

US President Joe Biden on Wednesday singled out rising energy costs as a primary driver of inflation and said it was a “top priority” to reverse the continuing trend.

“I have directed my National Economic Council to pursue means to try to further reduce these costs, and have asked the Federal Trade Commission to strike back at any market manipulation or price gouging” in the energy sector, he said in a statement.

He also implored Congress to pass his $1.75tn spending bill, saying “17 Nobel Prize winners in economics have said that my plan will ‘ease inflationary pressures’” — although some Republicans have countered that such a huge injection of spending will make inflation worse.

Joe Manchin, the Democratic senator from West Virginia who has been at the centre of congressional negotiations over the bill, also weighed in, warning that the threat posed by extremely elevated inflation was “getting worse”.

“From the grocery store to the gas pump, Americans know the inflation tax is real and DC can no longer ignore the economic pain Americans feel every day,” he wrote on Twitter.

In addition to higher energy prices, food prices jumped 0.9 per cent over the month, with a 1 per cent rise in “food at home” costs.

Stripping out volatile items such as food and energy, prices rose 0.6 per cent for the month, well above the previous reading of 0.2 per cent. On an annual basis, those costs increased 4.6 per cent, the highest level since 1991. In September, it stood at 4 per cent.

Short-dated US government bond yields, which are most sensitive to changes in monetary policy, surged following the report, as expectations rose that the central bank may lift interest rates multiple times next year.

The two-year Treasury traded roughly 0.08 percentage points higher at 0.51 per cent, while yields on the benchmark 10-year bond climbed 0.06 percentage points to trade around 1.51 per cent.

The data reinforce the view that inflationary pressures are proving more persistent than expected — a growing risk the Fed acknowledged last week when it announced plans to begin scaling back its $120bn-a-month asset purchase programme this month.

Senior Fed officials — including chair Jay Powell and Richard Clarida, the vice-chair — contend that the current imbalances will eventually recede as global supply chains and labour markets adjust, meaning inflation will ultimately prove “transitory” and fade over time. But Wednesday’s data challenged that view, economists said.

“Transitory is dead and buried,” said Eric Winograd, senior economist for fixed income at AllianceBernstein. “There is a good chance we will see core CPI close to 6 per cent over the next few months.”

A “striking” surge in services-related expenses affirmed that the Fed is likely to raise interest rates next year, according to Winograd. He expects an adjustment soon after the central bank’s asset purchases end as planned in June, with another increase likely later in the year.

Save for a dip in airfares and the prices for alcoholic beverages in October, costs are rising again for many of the sectors most sensitive to the economic reopening, although the pace is more moderate than earlier in the year.

Prices for used cars, which had driven the bulk of the inflation surge this spring, picked up again after two months of declines. They rose 2.5 per cent from September and are up 26.4 per cent for the year.

Hotel expenses also increased 1.5 per cent after several months of lower prices, bringing the annual rise to almost 26 per cent.

October’s data confirmed prices were picking up across a broader number of sectors, including medical care, household furnishings and recreation. Transportation services rose 0.4 per cent after two months of decreases.

Rents and other shelter-related costs, which represent about a third of CPI, kept advancing steadily. Owner’s equivalent rent — a measure of what homeowners believe their properties would rent for — rose 0.4 per cent between September and October, or 3.1 per cent on the year.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzVhNWE3ZTVmLTQyMDctNGRlMS05NDMyLTAwMmY5NmRlNjdiYtIBAA?oc=5

2021-11-10 18:43:13Z

CAIiEDn45xC-66FxAfYTd_EgODEqFwgEKg8IACoHCAow-4fWBzD4z0gwwtp6

Tidak ada komentar:

Posting Komentar