The news flow about THG, the company formerly known as The Hut Group, was breathless.

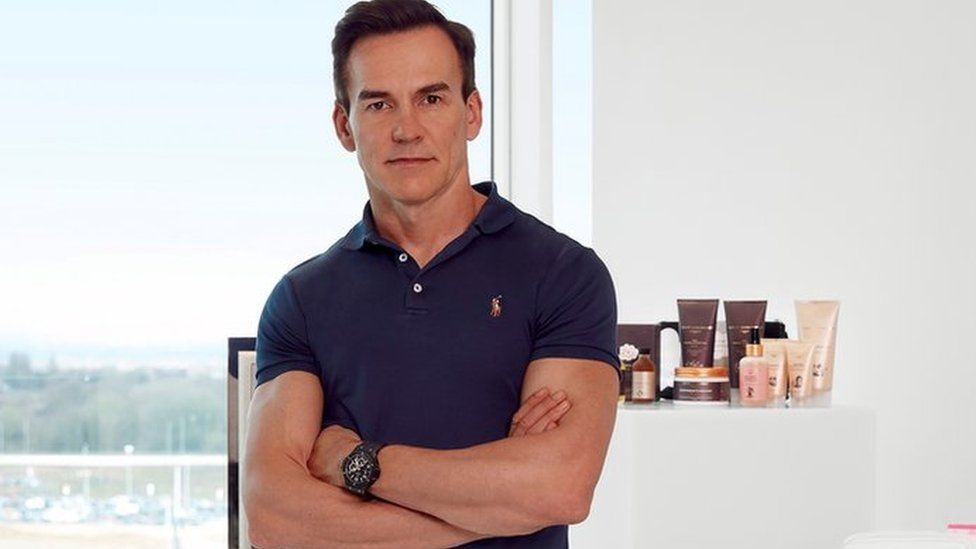

The rag-to-riches story of billionaire boss Matthew Moulding, the pictures on Instagram of his muscled torso stripped to his waist, the dealmaking, the creator of a tech business the UK could be proud of, the generous bonus scheme: it seemed unending.

When Mr Moulding listed his fast-growing health and beauty firm - which includes a potentially highly lucrative software arm - on the London stock market last year, the hyperactive media went into overdrive about a big business success and a big personality.

Much was made of the company's extensive portfolio of brands, including ESPA, Perricone MD and Illamasqua, as well as online beauty retailer Lookfantastic.

Now the bubble has burst, although in truth, it was probably more of a slow deflation over several months.

Billions of pounds have been wiped off THG's value after a series of challenges over its structure, its corporate governance and a deal with Japanese investor Softbank to buy a stake in its technology business Ingenuity.

But with Mr Moulding now hinting he may take the company private again, a little over a year since it floated, the saga is clearly not over yet.

Veto powers

Despite THG being a public company, owned by its shareholders, Mr Moulding had until recently a "golden share" that gave him rare powers to veto a takeover of the business.

The founder, who has a 22% stake in THG, is also chairman and chief executive, a move which puts the firm at odds with City guidance on corporate governance, which recommends the roles should be separated.

THG also pays Mr Moulding about £19m a year after he took control of some of the company's properties around the time of the float, which he now leases back to the business.

Mr Moulding and his wife Jodie also have a £100m personal loan from Barclays, which had been secured against THG shares.

However, the company now says the couple are no longer using THG shares as collateral for the loan, which is apparently still active.

Unease over this corporate governance structure had been developing for some time.

At a meeting last month, Mr Moulding updated shareholders on trading and, specifically, its Ingenuity technology division.

It's still unclear exactly what went on, but investors didn't like what they heard. Actually, there are reports they didn't hear very much, because the update contained little that was material to the business.

Shareholders wanted change in the way THG was run. Many investors voted with their wallets, selling THG shares and triggering a 35% tumble. At one point, THG's value sank almost £2bn.

Following that, THG announced changes to Mr Moulding's powers and a review of its corporate governance.

The City appeared to have won. It seemed a rare defeat for the 49-year-old billionaire - but he is clearly hoping to fight back.

Born in Lancashire on the poor side of the tracks, the young Mr Moulding's prospects were not promising. His father repaired driveways and sold goods procured from house clearances at a market.

Matthew was expelled from college for truancy. He was, though, persuaded to finish his education and eventually went to university, going on to qualify as a chartered accountant.

He cut his entrepreneurial teeth working for John Caudwell, the Phones4U billionaire and another non-conformist businessman. When Mr Caudwell sold the business, Mr Moulding used some of the money he got from the sale to set out on his own.

Mr Moulding has said that he got the inspiration for setting up his own firm by buying his first CD online back in 2003.

He said it was "fundamentally so much cheaper" than picking one up in a shop that he decided to take up that business model himself.

He was in his early 30s when he launched THG with co-founder John Gallemore, who remains chief financial officer.

Beauty bet

With an initial investment of £50,000, Mr Moulding began by selling CDs from the Channel Islands to avoid VAT, making use of a then-prevalent tax loophole which has since been closed.

Since then, the firm has gone through various changes, moving away from its roots when the rise of music streaming started to undermine the CD market.

Using the infrastructure he had already created, he hit on switching to health and beauty products, since they were not perishable or delicate and had high profit margins.

The company grew rapidly by snapping up skincare and lifestyle brands, while also operating online platforms for other companies, including Honda and Nestlé.

Mr Moulding has certainly made a lot of money for himself, but the stock market flotation also reportedly made 74 employees millionaires. And since the flotation, he has also given bucketloads of cash to charities.

His latest possible change of direction, unusually, was signposted in an interview with men's magazine GQ - not usually a must-read for financial analysts.

But maybe it's that kind of star quality that he is counting on to see him through as he prepares for his next set of challenges.

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU4OTUxNzM50gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTg5NTE3MzkuYW1w?oc=5

2021-11-08 23:57:47Z

CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU4OTUxNzM50gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTg5NTE3MzkuYW1w

Tidak ada komentar:

Posting Komentar