- FTSE 100 closes 95 points lower

- Wall Street to open in the green

- Government names 139 companies failing to pay minimum wage

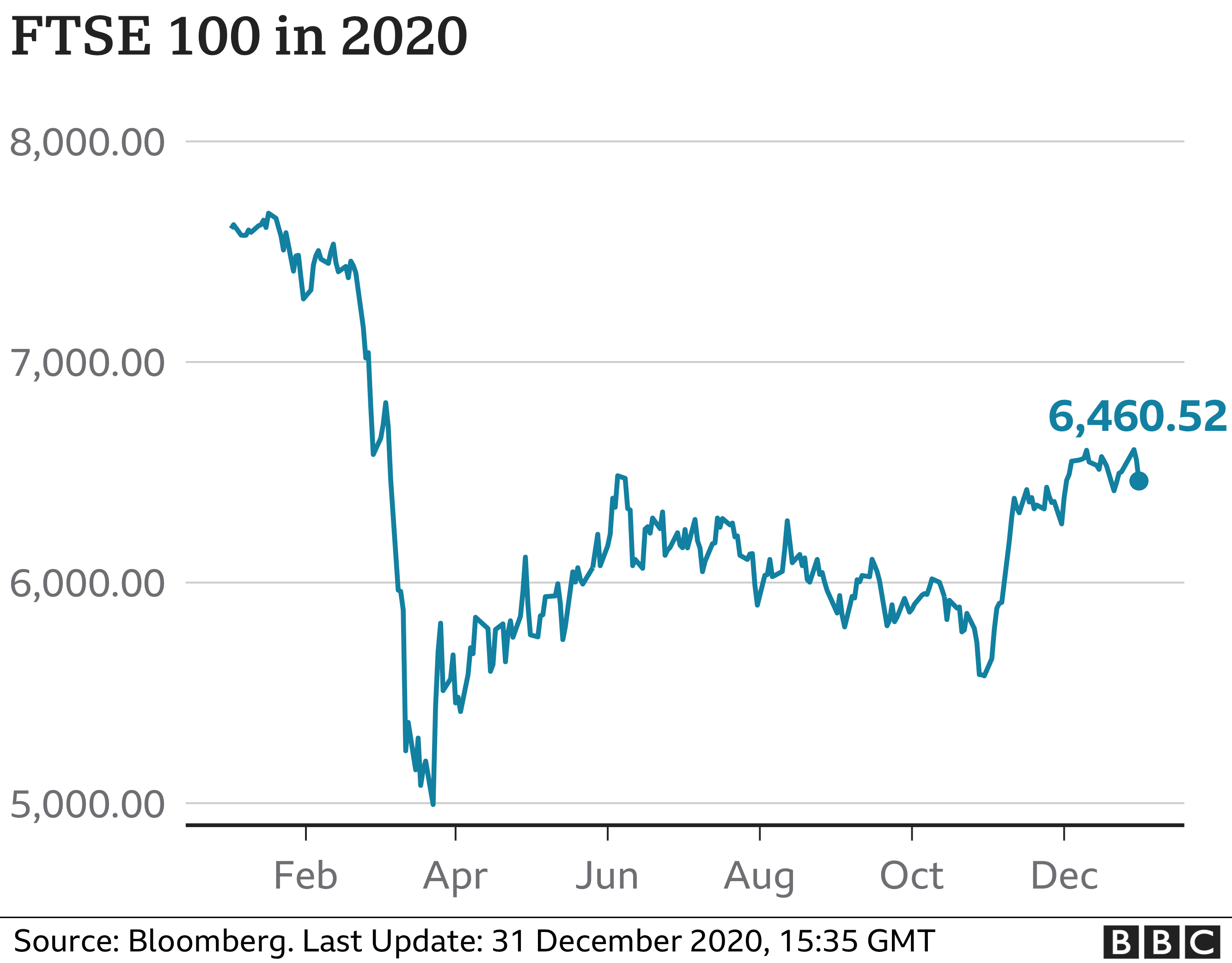

12.55pm: Bad year for FTSE 100

The Footsie has closed the last session of the year 95 points lower at 6,460, a level last seen in July 2016, and 15% below January figures.

The value and cyclical nature of the UK markets has caused significant underperformance compared with their US counterparts, especially after the Dow reached record highs, while the FTSE 100 had its worst annual performance since 2008.

Travel and housing are the hardest hit on New Year’s Eve as it is unclear how Brexit will hit the UK economy.

The borders are expected to see some chaos, but experts are still puzzled regarding how the services sector – which accounts for 80% of the UK economy – will react, considering how little attention it received in Brexit negotiations.

“Despite ongoing upheaval and suffering, the swift actions taken on a governmental and central bank level have helped avoid what could have been a year filled with bankruptcies and economic collapse,” said Josh Mahony at IG.

“Instead, UK businesses are looking towards Spring as a target to blossom once again. The current April deadline to end the furlough scheme coincides with Matt Hancock's prediction that the UK could be out of this crisis by spring, with the vaccine roll-out boosted by the news that the inoculation effort begins next week.”

“While short-term fears over the covid restrictions and Brexit implications will understandably ensure volatility over the months to come, the prospect of a reopening effort in the second quarter should provide the basis for a much better 2021 for UK stocks.”

12.00pm: Green open for Wall Street

FTSE 100 trimmed more losses but was still deep in the red, down 49 points to 6,504.

Conversely, US indices are expected to open higher, with futures indicating the Dow Jones, the S&P 500 and the Nasdaq to add a handful of points to start the last trading day of the year.

COVID-19 is expected to dominate the news after California was the second state to record a case of the new, more infectious strain initially discovered in the UK.

In company news, ExxonMobil () said it expects to write down US$18-20bn of assets amid the sector crisis, although higher oil, gas and chemicals prices are expected to lift fourth quarter earnings.

10.55am: Tesco, Pizza Hut and Superdrug named for failing to pay minimum wage

The Footsie trimmed its losses in late morning but was still 89 points underwater at 6,465.

(), Pizza Hut and Superdrug were among the employers “named and shamed” for not paying minimum wage to their staff.

The government identified 139 firms that failed to pay £6.7mln to over 95,000 workers following investigations between 2016 and 2018.

The offending companies range in size from small businesses to large multinationals who employ thousands of people across the UK, according to an official press release.

“Paying the minimum wage is not optional, it is the law. It is never acceptable for any employer to short-change their workers, but it is especially disappointing to see huge household names who absolutely should know better on this list,” said business minister Paul Scully.

“This should serve as a wake-up call to named employers and a reminder to everyone of the importance of paying workers what they are legally entitled to.”

Tesco failed to pay £5mln to 78,199 workers, Pizza Hut £845,936 to 10,980 workers and Superdrug £15,228 to 2,222 workers.

The supermarket chain dipped 1% to 233.3p on Thursday morning.

9.55am: -Calais route may see less chaos over next few days

The Footsie held its losses in mid-morning and dropped 109 points to 6,445.

Meanwhile, sterling clawed back its early morning losses and rose 0.25% to US$1.3658.

The route between and Calais is expected to see less chaos in the next few days, after thousands of lorries were stranded in Kent last week due to travel restrictions.

"I'm confident that it will work well on 1 January," John Keefe, director at Channel Tunnel operator Getlink, told the BBC.

"Things will start slowly. 1 January will be a quiet Bank Holiday after New Year's Eve. I don't think traffic will build up until late in the first or second week of January."

"This initial quiet period will allow everyone to prepare."

However, the government said some disruption should be factored in as hauliers will need extra paperwork from 11pm on Thursday.

Officials warned those without the correct documentation will have to be stopped at the border.

9am: Subdued start for FTSE 100

The FTSE 100 is set to end 2020 in the doldrums, as the blue-chip benchmark opened New Year’s Eve trading over 1% lower.

After the early exchanges, the FTSE was down 106 points or 1.6% at 6,449.

Unsurprisingly the two main factors for traders are Brexit and COVID-19.

After four and a half years of negotiations, noise and conjecture the Brexit ball will drop tonight, at 23:00pm (GMT), an hour before London waves goodbye to 2020.

Old acquaintances with the European Union won’t be entirely forgotten as the Brexit transition period ends, and, the relationship with the continent moves under the zero-tariff ‘deal’ struck last minute on Christmas Eve – and backed by MPs yesterday.

The deal smooths the switchover, relative to a no-deal scenario, but the shift away from the EU remains significant.

“UK politicians overwhelmingly backed the Brexit deal struck on December 24 during a vote yesterday, stamping its divorce from the EU into law,” said Joshua Warner, market analyst at City Index.

“Although the deal has tried to minimise disruption, Brexit will bring about huge changes that businesses will have to adapt to. The UK is leaving the Single Market and Customs Union, and many sectors – such as financial services – remain largely uncovered by the new deal.”

Elsewhere, on the COVID front, the UK yesterday boosted its arsenal against the virus with the approval of the -Oxford university vaccine. This second approved vaccine is said to be cheaper and easier to produced than the -BioNTech vaccine which began a UK roll out campaign in mid-December.

At the same time, COVID case numbers continue to rise – Wednesday’s stats showed just over 50,000 new cases and 981 deaths – and Tier 4 lockdown was expanded to cover a further 20mln people.

A total of 44mln Britons, around 78% of the population, will now be in Tier 4 whilst the other 12mln (22%) are in Tier 3. No part of the UK is in Tier 2.

Over in the US, Wall Street marked positive on Wednesday.

The Dow Jones ended at 30,409, up 73 points or 0.24%, whilst the S&P 500 edged to a 0.13% gain for the session, closing at 3,732. Similarly, the Nasdaq notched a 0.15% gain to end the day at 12,870.

In Asia, Hong Kong’s Hang Seng was up 84 points or 0.31% at 27,231 on Thursday and the Shanghai Composite climbed 1.72% to 3,473.

The Tokyo Stock Exchange is closed for a market holiday, to re-open on January 4.

Around the markets

The pound: US$1.3668, up 0.32%

Gold: US$1,893 per ounce, down 0.05%

Silver: US$26.48 per ounce, down 0.51%

Brent crude: US$51.39 per barrel, down 0.46%

WTI crude: US$48.20 per barrel, down 0.4%

Bitcoin: US$28,989, up 4.29%

Let's block ads! (Why?)

https://news.google.com/__i/rss/rd/articles/CBMilgFodHRwczovL3d3dy5wcm9hY3RpdmVpbnZlc3RvcnMuY28udWsvY29tcGFuaWVzL25ld3MvOTM3NTE0L2Z0c2UtMTAwLWNsb3Nlcy10aGUteWVhci0xNS1iZWxvdy1qYW51YXJ5LWxldmVscy11bmRlci1wYW5kZW1pYy1icmV4aXQtcHJlc3N1cmUtOTM3NTE0Lmh0bWzSAT5odHRwczovL3d3dy5wcm9hY3RpdmVpbnZlc3RvcnMuY28udWsvY29tcGFuaWVzL2FtcC9uZXdzLzkzNzUxNA?oc=5

2020-12-31 12:55:00Z

52781277811547