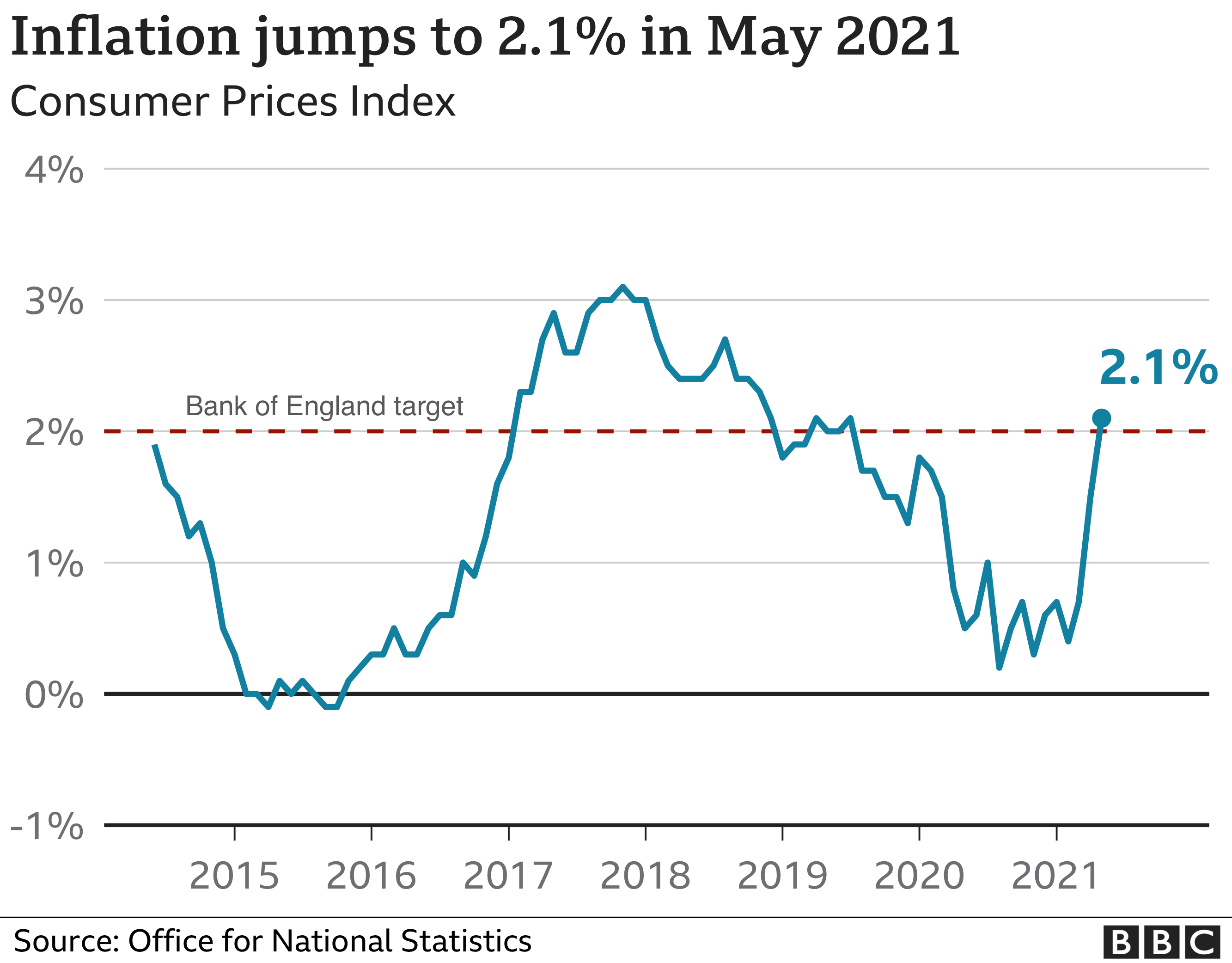

UK inflation jumped to 2.1% in the year to May, as the opening up of the economy from lockdown sparked a rise in consumer spending.

The Consumer Prices Index measure of inflation rate rose from 1.5% in April, according to the Office for National Statistics, driven by the rising cost of fuel and clothing.

Inflation is now at its highest since before the pandemic.

That is likely to fuel a debate about whether interest rates should go up.

May's reading was above most economists' forecasts of an increase of about 1.8%, and means inflation is now above the Bank of England's 2% target.

ONS chief economist Grant Fitzner said: "The rate of inflation rose again in May and is now above 2% for the first time since the summer of 2019.

"This month's rise was led by fuel prices, which fell this time last year but have jumped this year, thanks to rising crude prices. Clothing prices also added upward pressure as the amount of discounting fell in May."

The ONS said motor fuels saw a 17.9% price surge over the past year, representing the highest increase for more than four years.

Clothing prices also increased by 2.3%, the biggest rise since 2018, as retailers significantly reduced their discounting a month after welcoming customers back into stores.

The rise in inflation was partly offset by a negative impact from cheaper food and drink prices. Bread, cereals and meat prices all dipped after seeing significant rises a year earlier.

'Rushing back'

Karen Ward, a chief market strategist at JP Morgan Asset Management, said the May figure was a "big upside surprise".

She told the BBC's Today programme the increase in inflation was due to consumers rushing back to the shops after coronavirus restrictions eased.

She said: "They have got all these savings they accumulated last year when they weren't allowed out but supply is really struggling to keep pace, and so what we are seeing therefore is pops of prices in various aspects of the consumer basket."

She said if inflation pressure was sustained into next year, "we could see interest rate hikes". UK rates, however, remain at historic lows.

Last week, the Bank of England's chief economist, Andy Haldane, said a rise in inflation above the central bank's target must be only temporary, and that long-term levels of high inflation need to be "avoided at all costs".

Inflation is not only on the rise in the UK, with US consumer prices hitting 5% in May, the highest in almost 13 years.

Jack Leslie, an economist at the Resolution Foundation think tank, said the speeding up of price growth from 0.3% last November to 2.1% in May represented the fastest six-month rise since sterling collapsed after the 2008-09 financial crisis.

"But UK inflationary pressures are different - and nowhere as near as large - as those causing fierce debate in the US," he said.

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU3NDkwMTAx0gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTc0OTAxMDEuYW1w?oc=5

2021-06-16 06:54:05Z

52781672225232

Tidak ada komentar:

Posting Komentar