The City regulator needs a change of culture and more agility to prevent a repeat of the London Capital and Finance (LCF) saga, MPs have said.

About 11,625 people invested a total of £237m with LCF before it collapsed into administration.

A judge-led review criticised the Financial Conduct Authority (FCA) for its failures in the case.

Now the Treasury Committee of MPs has said the FCA needs to get on the front foot to protect consumers.

The committee has made a string of recommendations, primarily to encourage a quicker change of culture at the regulator, and speedier compensation for those who lost money.

Mini-bond claims

Many people who put money in to LCF were first-time investors, including inheritance recipients, small business owners or newly retired.

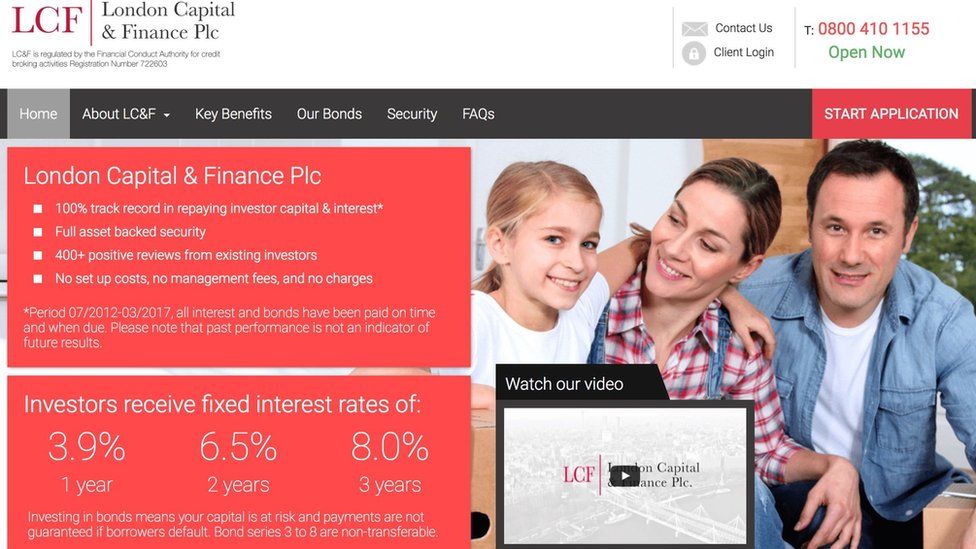

They believed they were putting their money into safe, secure fixed-rate ISAs, approved by the FCA.

In fact, LCF was approved, but the products - which were high-risk mini-bonds - were not.

LCF offered returns of around 8% on three-year mini-bonds.

The FCA ordered LCF to withdraw its marketing and, following further investigation, then froze LCF's assets leading the company to collapse into administration in January 2019.

Former Court of Appeal judge, Dame Elizabeth Gloster's review of the saga found that the FCA failed to "effectively supervise and regulate" LCF before its collapse.

At the time, the regulator was run by Andrew Bailey, who is now the governor of the Bank of England.

He has apologised to those who lost life savings.

The Treasury Committee said that the regulation of mini-bonds and compensation for victims should take place as soon as possible.

Many investors lost all their investment, but may now receive one-off compensation.

Grant Walker told the BBC's Today programme he had invested his entire life-savings of £300,000 in LCF and may now have to go back to work to earn back the money for a future pension.

"This is just a life-changing event," he said. "This affected my whole future because that money, I'd saved up [and] worked hard to have a safe financial future - now I'm not sure what's going to happen.

"I just feel so let down by the government, primarily. It has just been an uphill struggle, a battle. I go to bed every night thinking: 'Why? Why has this been allowed to happen?'."

Mel Stride, who chairs the Treasury Committee, said: "The collapse of LCF is one of the largest conduct regulatory failures in decades."

His committee has suggested that the FCA needed set a clear date for completing changes that would move the culture on so the FCA is a more proactive and agile regulator.

It also said there was evidence of an over-reliance on collective responsibility, which made it hard to see who was accountable for the FCA's actions.

An FCA spokeswoman said: "We are profoundly sorry for the mistakes we have made over LCF and are committed to implementing the recommendations of The Gloster Report which are progressing at pace.

"The FCA has embarked on a wide ranging transformation programme to build a data-led regulator able to make fast and effective decisions."

'Sorry situation'

Last year, it emerged that Mr Bailey, who was chief executive of the FCA between 2016 and 2020, had sought to have his name removed from Dame Elizabeth's report into LCF's collapse. This prompted an angry response from Mr Bailey who said there had been a "fundamental misunderstanding" on the issue.

Mr Stride told the BBC that "there's no doubt that he did seek to have his name removed".

He said Mr Bailey was "concerned at that point that what Dame Elizabeth was suggesting was that he was personally culpable for some of the failings at the FCA rather than responsible for areas where there were failings that occurred and there is an important distinction there".

He said: "I think where the committee finally ended up on that - because it ultimately became a question of whether Andrew Bailey's evidence was misleading the committee or not - was that Andrew Bailey did not mislead the committee."

However, he said: "This is a very sorry situation and I think a lot of people have not come out of this looking very good."

'This was my son's money'

Among those who lost money invested in LCF was Amanda Cunningham, who had put decades worth of savings into the scheme - for her son's future.

"He [her son] suffers with autism, I don't even know if he'll be able to hold down a job. That money was there to give him the life he should have," she told Radio 4's Money Box.

"I can't afford to keep him forever and if anything happens to me that money was there for his future".

"It [the FCA] should have protected us," she said. "The whole system is at fault, and wrong."

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU3NTgyMjYy0gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNTc1ODIyNjIuYW1w?oc=5

2021-06-24 07:24:56Z

52781688310048

Tidak ada komentar:

Posting Komentar