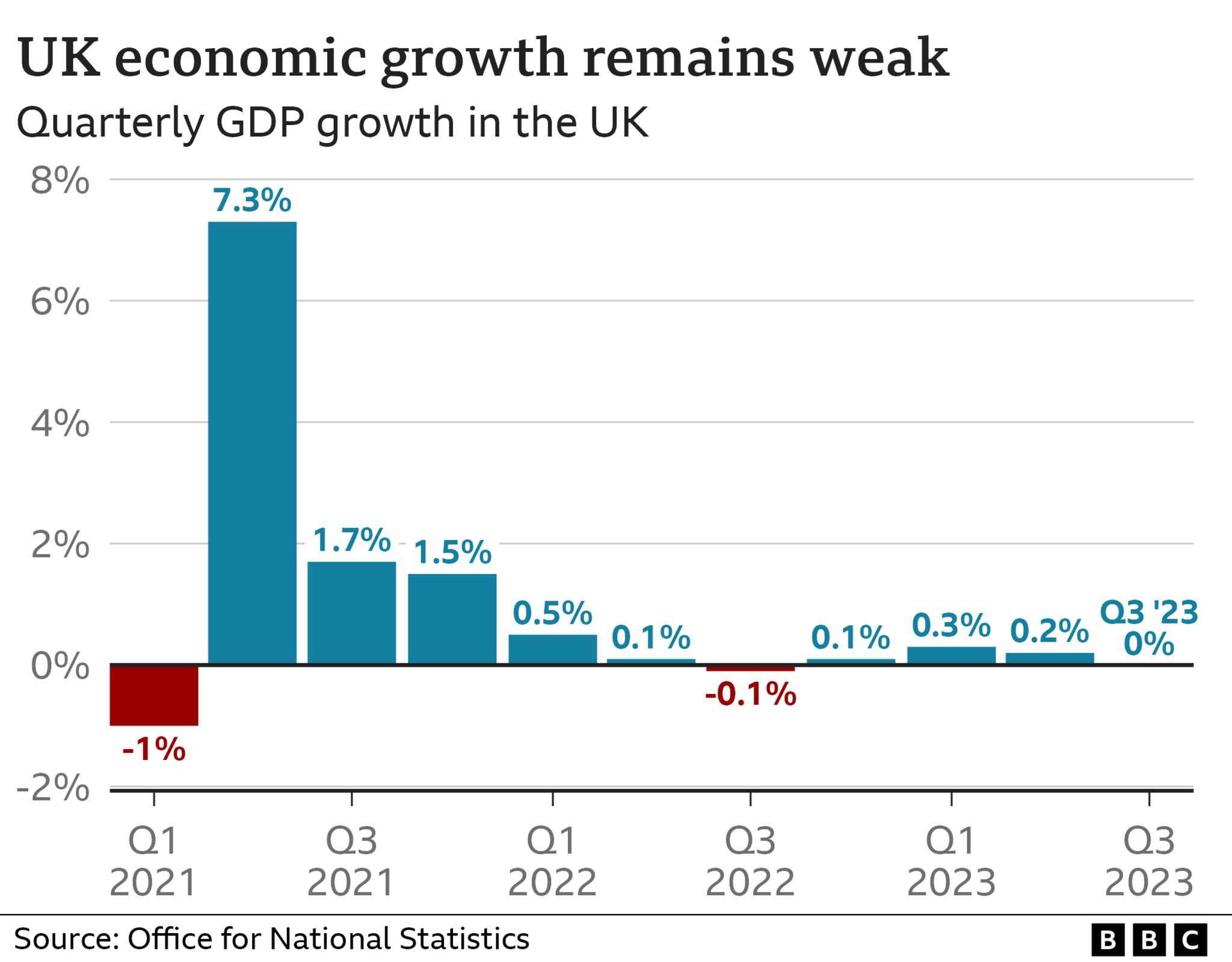

The UK economy failed to grow between July and September, figures show, after a succession of interest rate rises.

The performance was slightly better than expected, as many analysts had expected it to shrink.

But forecasters suggest that the economy is set to be stagnant for several months yet.

Last week, the Bank of England said the UK economy was likely to see zero growth until 2025, although it is expected to avoid a recession.

Up until September, the Bank of England had raised interest rates 14 times in a row to try to tame soaring price rises.

However, while raising rates can reduce inflation - the pace at which prices rise - it also affects economic growth by making it more expensive for consumers and businesses to borrow money.

Interest rates are at a 15-year high of 5.25%, and are expected to remain high for some time. Bank governor Andrew Bailey said last week it was "much too early" to be considering rate cuts.

Paul Dales, the chief UK economist at Capital Economics, said the latest growth data suggested "the drag from higher interest rates is growing".

However, he added that he did not think the Bank would be able to start cutting interest rates until late next year.

The Office for National Statistics (ONS) said that the latest growth figures showed a subdued picture across all sectors of the economy.

The services sector saw a small decline over the three-month period, while manufacturing and the construction sector recorded marginal growth.

Reacting to the latest figures, Chancellor Jeremy Hunt said: "High inflation is the single greatest barrier to economic growth. The best way to sustainably grow our economy right now is stick to our plan and knock inflation on its head."

Although the rate rises from the Bank are flattening growth, the government may feel a small amount of relief that the risk of a formal technical recession - defined as two consecutive three-month periods of the economy shrinking - has been lowered.

But Prime Minister Rishi Sunak's vow to "grow the economy" is very much in the balance. Even between July and September, there was a tiny contraction in the economy, though it rounded down to 0.0%.

The growth forecast for the final three months of the year is between 0% and 0.1%, in line with other major European countries, which are also weighed down by rising rates.

The Bank of England may feel that it has started to engineer a softish landing from last year's excessive inflation.

The government too will point to next week's likely significant fall in the headline rate of inflation, when the figure is forecast to slow from 6.7% to around 4.8% for October.

It may declare victory on that target on Wednesday, even as its growth target is now under question.

This may change the backdrop to the Autumn Statement later this month and, if it continues, for the general election too as it challenges the clear desire of Downing Street to paint a "turnaround" picture.

As the inflation problem eases, the growth problem could become more prominent.

Gross Domestic Product (GDP) figures show the health of the UK economy. It is a measure - or an attempt to measure - all the activity of companies, governments and individuals in a country.

If the figure is increasing, it means the economy is growing and people are doing more work and getting a little bit richer, on average.

But if GDP is falling, then the economy is shrinking which can be bad news for businesses.

The zero growth in the July-to-September period follows 0.2% expansion in the previous three months.

The ONS data also showed that the economy grew by 0.2% in September alone compared with the previous month.

That was stronger than expected, and was helped by growth in film production and from professional services such as accountants and engineers.

Darren Morgan, head of economic statistics at the ONS, told the BBC's Today programme that while the latest data showed a "very flat picture" overall, there were some signs of improvement.

"For example, more than half of businesses were not considering raising their prices in November 2023 - that's the highest proportion of businesses to tell us this since we first introduced that question in April 2022," he said.

https://news.google.com/rss/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTY3MzcwMzE10gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjczNzAzMTUuYW1w?oc=5

2023-11-10 08:36:04Z

2601970752

Tidak ada komentar:

Posting Komentar