European stock markets were mixed on Wednesday, while Wall Street advanced, as the pound continued its rally and the US economy grew faster than expected.

In London, the FTSE 100 (^FTSE) closed 0.4% lower on the day, held back by a stronger pound, which hit a three-month high against the dollar during the session.

Meanwhile the CAC (^FCHI) gained 0.4% in Paris and the Frankfurt DAX (^GDAXI) surged 1.1%, touching a four-month high after data showed consumer prices in the state of North Rhine-Westphalia fell 0.3% month-on-month in November and to 3% year-on-year.

German inflation was less than expected in November, boosting hopes that the European Central Bank (ECB) will start cutting interest rates soon.

The consumer price index for Europe’s largest economy came in at 2.3%, lower than the 2.5% predicted by analysts. Overall eurozone inflation numbers will be published on Thursday.

Across the pond, the S&P 500 (^GSPC) climbed 0.3%, and the tech-heavy Nasdaq (^IXIC) was also 0.3% higher. The Dow Jones (^DJI) advanced 0.1% by the time of the European close.

It came as the US economy grew by 5.2% in the three months to September, better than estimates of 4.9%.

Consumer spending also grew during the period, albeit at a slower than forecast pace of 3.6%

Sterling (GBPUSD=X) was more than 0.2% higher against the US dollar at $1.2715 on Wednesday morning while it was was more than 0.1% up against the euro (GBPEUR=X) at 1.1562, at the time of writing.

The currency has gained 4.7% verses the global reserve currency over the last month as investors have increased bets that the US Federal Reserve will begin cutting interest rates soon.

Pressure on the dollar has continued to rise after a Fed official said monetary policy is well positioned to slow the US economy and get inflation back to target.

The comments from Fed governor Christopher Waller fuelled expectations that interest rate hikes are over. He went on to say that if disinflation starts to become a concern, then rates could be cut in response.

Read more: UK mortgage take up rises as interest rates hit pause

He told a conference: "I am encouraged by what we have learned in the past few weeks — something appears to be giving, and it’s the pace of the economy.

”Economic data from October are consistent with the kind of moderating demand and easing price pressure that will help move inflation back to 2%"

Sterling stood at its highest level since August at $1.27 on Wednesday morning, with demand also reflecting more warnings from Bank of England policymakers that UK interest rates need to stay higher for some time in order to tame inflation.

Meanwhile, global bonds are rising at their fastest pace since the 2008 financial crisis, according to new analysis, as traders bet that interest rate cuts are looming.

Markets close and recap

Well that's all that we have time for today, thanks for following along. As a quick reminder, here's a breakdown of the top stories from today...

UK mortgage approvals rise for first time since June

Households up borrowing at fastest rate in five years

London Metal Exchange wins court case

UK urged to reform triple lock

US economy grows faster than expected

Halfords slumps 20% after weak sales warning

Berkshire Hathaway slides as Charlie Munger dies

Saudi Arabia buys 10% of London Heathrow airport

Have a great evening!

Telegraph sale potential national security threat

A number of Conservative MPs have written to the deputy prime minister urging him to use national security powers to review the potential sale of the Daily Telegraph.

Ministers are being asked to intervene after RedBird IMI, an investment fund owned by Sheikh Mansour bin Zayed Al Nahyan, vice-president of the United Arab Emirates (UAE), reached a deal to purchase the broadsheet newspaper and The Spectator magazine.

In a letter co-ordinated by Neil O’Brien, who was a health minister until the reshuffle a fortnight ago, the 18 MPs said they believed that the proposed transaction “presents a very real potential national security threat”.

he backbenchers said ministers should not be “railroaded into clearing” the change of ownership and should instead “pause the deal” to review its impact on Britain’s security and press freedom.

They urged Oliver Dowden, Prime Minister Rishi Sunak’s deputy, to conduct a review of the transaction linked to Sheik Mansour, who owns Manchester City football club, by using powers under the National Security and Investment Act (NSI).

CMA to investigate baby formula market

Photograph: Eric Gay/AP The competition watchdog has launched an investigation into the baby formula market after it discovered manufacturers were raising prices by 25%.

The probe showed that increases had taken place over two years and that companies had managed to increase profit margins during the cost of living crisis.

Danone and Nestlé accounted for 85% of sales.

The Competition and Markets Authority (CMA) said it was concerned there was too little choice in the market, with a very limited number of own-label products, and that very few parents were switching to cheaper alternatives where available.

If families did shop around, they could make savings of more than £500 in the first year of a child’s life, it found.

Sarah Cardell, the chief executive of the CMA, said:

Food price inflation has put huge strain on household budgets, so it is vital competition issues aren’t adding to the problem. While in most cases the leading brands have raised prices more than their own cost increases, own-label products are generally providing cheaper alternatives.

Wall Street to open higher as US economy grows faster than expected

S&P 500 futures (ES=F) are up 0.5%, Dow futures (YM=F) have gained 0.2%, and Nasdaq futures (NQ=F) are 0.8% higher an hour before the opening bell in New York.

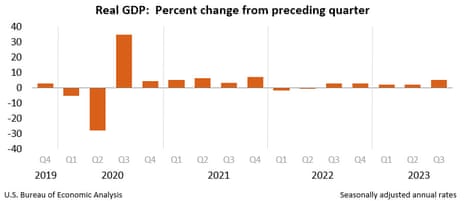

It comes as the US economy grew faster than expected in the third quarter of 2023.

Real gross domestic product (GDP) increased at an annual rate of 5.2% in the period, according to revised data by the US Bureau of Economic Analysis.

Economists had expected an upward revision from the first estimate of 4.9%, but it was faster than the 5% annualised growth predicted in a poll of economists.

The US economy grew at the fastest rate since 2021 in the third quarter of 2023. How to protect yourself from scams this Christmas

It’s officially scams season. For the next month, with Christmas shopping in full swing, criminals will ramp up their efforts to cash in on shoppers looking for deals.

And when the festive frenzy dies down in the new year, they can still exploit our vulnerabilities as we rush for the tax return deadline.

The festive shopping season is particularly fruitful for scammers, because we’re in the perfect frame of mind to fall for a scam.

We’re busy and distracted, we’re desperate to buy the perfect gifts and we’re often spending with several online retailers at a time, so we can lose track.

OECD triple-lock commentary

Lindsay James, investment strategist at Quilter Investors, said.

While the peak of the rate hiking cycle appears to have been reached, the effects are lagging in nature and thus 2024 is going to see economic growth slowdown even further than it has already, and cause developed nations to feel the effects of the weakening environment.

In better news, they now believe that a soft landing is the most likely outcome across the developed economies, with recession avoided – although were at pains to emphasise this was far from a certainty.

The OECD isn’t expecting any rate cuts until late 2024 and for some economies not until 2025. As a result, stimulating economic growth is going to be very challenging, and thus investors need to adapt and look for quality businesses and more tactical opportunities that can still thrive in uncertain times.

“The OECD also gives some options to help loosen the restrictive fiscal backdrop, and although supportive of the measures in the Autumn Statement, it clearly does not think these go far enough. The state pension triple lock is specifically called out as one way to ease the pressure on government spending – reforming it instead to a double lock of average inflation and wage increases.

There is a growing problem with the state pension and in its current state can be financially unpredictable and at worst unsustainable in the long run. It’s unfortunate but not unsurprising that this government has not opted to make long term decisions about reforming how the state pension is uprated, particularly given the economic benefits that could be realised with such a change.

UK urged to reform triple lock

The OECD’s latest Economic Outlook is out.

My colleague Pedro Gonçalves writes...

Jeremy Hunt should scrap the pensions triple lock to pay for net zero policies, the Organisation for Economic Cooperation and Development (OECD) has said.

The Paris-based economic body said the UK should reform the pensions triple lock to improve public finances.

"Reforming the costly triple lock uprating of state pensions would help, by indexing pensions to an average of CPI [consumer price index of inflation] and wage inflation, and by providing direct transfers to poor pensioners to mitigate poverty risks," the OECD said.

The triple lock means that the state pension must rise every April by whichever is highest out of average earnings, inflation or 2.5%. Next year, it is going up by 8.5%, from £10,600 to £11,502.

The Institute for Fiscal Studies (IFS) said the triple lock added an extra £11bn a year to public spending.

The OECD said that the UK government should do more to shore up the public finances.

London Metal Exchange wins court case

Traders in the Ring at the London Metal Exchange, in the City of London, in 2021 after open-outcry trading returned for the first time since March 2020, when the Ring was temporarily closed due to the COVID-19 pandemic. The London Metal Exchange has won its court case in a £450m lawsuit over its controversial decision to halt a runaway short squeeze in the nickel market last year.

The LME was brought into the spotlight last March after it suspended the nickel market and retroactively cancelled $12 billion of trades.

Elliott Management and Jane Street were seeking damages of $472m (£372m) but their challenges were dismissed in a ruling today.

Elliott said it was “naturally disappointed by the court’s decision and concerned about the precedents that it establishes for market participants in the UK”, They intend to appeal the decision.

UK households up their borrowing at fastest rate in five years

UK households increased their borrowing at the fastest rate in five years in October, according to Bank of England data on Wednesday.

The annual growth rate for all consumer credit hit 8.1% in October, the highest since October 2018 as the cost of living crisis continues to bite.

Paul Dales, chief UK economist at Capital Economics, a consultancy, said:

Some of this might be because the cost of living crisis has forced some households to borrow to fund necessary spending.

But he added that the fact that borrowing was continue to rise “suggests that higher interest rates are yet to significantly crimp unsecured borrowing”.

Saudi Arabia buys 10% of London Heathrow airport

Saudi Arabia’s Public Investment Fund has bought a 10% stake in Heathrow airport for £1bn.

It comes as infrastructure group Ferrovial has sold a quarter of the business.

Ferrovial late on Tuesday said it had agreed the sale of a 25% of London Heathrow, which it has owned for 17 years, for £2.4bn.

The Saudi PIF will take 10%, while European private equity group Ardian will snap up 15%.

Watch: What are SPACs?

Download the Yahoo Finance app, available for Apple and Android.

https://news.google.com/rss/articles/CBMiYGh0dHBzOi8vdWsuZmluYW5jZS55YWhvby5jb20vbmV3cy9saXZlLWZ0c2UtMTAwLWV1cm9wZWFuLXN0b2Nrcy1wb3VuZC13YWxsLXN0cmVldC0xMDE3MjA5MzUuaHRtbNIBAA?oc=5

2023-11-29 16:35:20Z

2643990993

Tidak ada komentar:

Posting Komentar