Jeremy Hunt has announced that the International Monetary Fund had made a ‘big upgrade’ to the UK’s growth forecasts, following its annual healthcheck.

Hunt says:

“Today’s IMF report shows a big upgrade to the UK’s growth forecast and credits our action to restore stability and tame inflation.

“It praises our childcare reforms, the Windsor Framework and business investment incentives. If we stick to the plan, the IMF confirm our long-term growth prospects are stronger than in Germany, France and Italy – but the job is not done yet.”

The Fund is due to release its assessment of the UK economy at 11.15am, when we’ll her from Hunt and IMF chief Kristalina Georgieva.

But the news is already out – with multiple reports that the IMF is no longer expecting the UK to fall into recession this year.

Instead of shrinking by 0.3%, as the IMF forecast in April, the UK economy is now forecast to grow by 0.4% during 2023.

The Fund said the improved outlook reflected the unexpected resilience of demand, helped in part by faster than usual pay growth, the fall in soaring energy costs, improved business confidence and the normalisation of global supply chains.

“Declining energy prices and widening economic slack are expected to substantially reduce inflation to around 5 percent y/y by end-2023, and below the 2 percent target by mid-2025,” the IMF said.

The IMF forecast economic growth of 1% in 2024 and 2% in 2025 and 2026 before settling back to a long-run rate of around 1.5%.

Filters BETA

It’s official: The International Monetary Fund no longer expects Britain’s economy will fall into a recession this year.

After its annual healthcheck on the UK, the IMF has upgraded its forecasts. It now expects UK GDP will rise by 0.4% this year, rather than shrink by 0.3% as it had expected back in April.

Today the IMF cites the UK’s unexpectedly resilience of demand, helped by faster than usual pay grpwth, and the drop in energy costs.

The recovery in global supply chains, helped by China’s reopening from pandemic restrictions, has also helped.

But, the IMF also warns that UK inflation remains subbornly high, due to the Ukraine war, and that monetary policy (set by the Bank of England should remain tight to keep inflation expectations well-anchored.

Silvana Tenreyro, an independent member of the Bank of England’s Monetary Policy Committee, then explains to MPs that the BoE would have had to raise interest rates months before the Ukraine war, to protect the economy from the inflation shock.

She outlines a scenario in which the Bank could have raised interest rates to 8% in July 2021 (when they were a record low of 0.1%), even though inflation was then on target at 2%.

Had this happened, UK unemployment would have been three percentage points higher she explains, but it would have only had a relatively small impact on inflation.

The models show that inflation would have peaked at 9%, not 11%, and also led to a “massive undershoot” in inflation in future, professor Tenreyro explains.

John Baron MP doesn’t accept that the UK’s inflation surge can simply be blamed on ‘black swan events’ such as the Ukraine war.

In February, the month of Russia’s invasion, inflation hit 6.2% and Bank Rate was only 0.5%, Baron points out, as evidence that the BoE was moving too slowly.

Andrew Bailey says that the inflation from global supply chain shocks did prove to be transient, as central bankers had expected. The problem was that the Ukraine war drove up food and energy costs.

Bailey also reminds MPs on the Treasury Committee that the BoE expected the labour market to weaken at the end of 2021 when the furlough scheme, pushing up unemployment and easing inflationary pressure.

Bailey says:

We hold our hand up and say that’s a judgement we had to make, and it didn’t turn out right.

But almost every other forecaster took the same view, he insists.

The Bank of England’s failure to keep inflation close to its 2% target is a “woeful neglect of duty”, says Conservative MP John Baron, causing pain to households and businesse.

Q: Why should the public have confidence in your ability to get it right going forward, and what will you do differently?

Governor Andrew Bailey says there are lessons to learn, and that the Bank has “a lot to learn” to learn about how to operate monetary policy in the face of very big, unprecedented shocks.

I think there are big lessons about how we operate policy in that world, and in a world of very substantial uncertainty.

Bailey points out that the Bank makes policy in realtime, and doesn’t have the benefit of hindsight.

We have to get inflation back down to target, he reiterates. That’s why the Bank raised interest rates again this month, even though its models suggest inflation will fall sharply this year.

A scuffle has broken out at the Shell annual meeting amid continued protests (see earlier post).

It was the 45-minute mark before its chair Andrew Mackenzie, formally opened the meeting, but still there were protests. Security staff rushed to the front of the meeting to shield the board as a scuffle broke out.

“We want the debate”, said Shell chair Andrew Mackenzie, as security removed dozens of people.

Mackenzie said:

“Clearly this is a coordinated attempt to disrupt this meeting.”

Shell’s “intelligence” had warned of “these kind of threats to our shareholder meeting and others”, he said.

Bank of England chief economist Huw Pill explains to the Treasury Committee that the Bank is trying to understand why its models failed to predict the rise in UK inflation.

Pill says the Bank’s model’s use data from the last 30 years, so it is now trying to incorporate recent changes in consumer behaviour.

Pill tells MPs:

We see these models have led to some of the errors you are describing.

We recognise that our forecast for inflation have been too low, and we’re trying to understand why we have made those errors, interpret those errors in terms of behaviour, and make an assessment if that behaviour will continue or not.

Treasury committee chair Harriett Baldwin asks why the Bank doesn’t think data from the 1970s, when the UK last experienced an inflation shock, would be useful…..

Pill replies that we can learn lessons from the past. But the UK didn’t have an inflation target in the 1970s, or an independent central bank, so the monetary policy regime is different.

Baldwin says this “slightly makes me dispair”, reminding her of bankers and traders who claimed things were different ahead of the 2007-08 financial crisis.

Q: Have you made the same errors of bankers and traders running into the financial crash?

Pill defends the Bank’s models, saying it has introduced a “skew” to the risks around its baseline forecasts which recognises the possibility that inflation could be higher, or more persistent, than data from the last 30 years would justify.

Over in parliament, the Treasury committee are quizzing the Bank of England about interest rates, and inflation.

They’re hearing from:

Andrew Bailey, Governor, Bank of England

Huw Pill, Chief Economist, Bank of England

Dr Catherine Mann, External Member, Monetary Policy Committee

Professor Silvana Tenreyro, External Member, Monetary Policy Committee

Committee chair Harriett Baldwin MP starts by asking if inflation today is higher than expected in February.

Andrew Bailey says that yes, inflation is higher than the Bank had expected. The BoE had expected a gradual decline in inflation.

Although inflation has dropped below its peak of 11%, it was about 0.8 percentage points higher than expected.

A large annual base effect will come out tomorrow (when we get April’s inflation data).

Q: 0.8 percentage points is quite a miss, given your target is to keep inflation at 2%

Bailey says he stands by the view that inflation has “turned the corner” [it dropped to 10.1% in March, having hit 11.1% last October].

He says we have seen some benefits of falling energy prices. but food prices and some goods (such as footwear) have been higher than expected.

Q: So what’s gone wrong, with your models or the network of agents? Something has gone really wrong.

Bailey says the Bank’s agents were told by companies in February that food inflation had peaked, but clearly it hasn’t.

He says weather events have pushed up some food prices, such as cold weather in Morocco.

Secondly, Bailey says the rise in energy prices has not fallen evenly on firms, as it depends when they renewed their energy bills.

Also, food producers have bought forward their buying of key commodities, due to shortages fears. One farmer told him last week that they had bought more fertiliser than normal, locking in a higher price.

That could have been identifiable, Bailey admits, although the weather events weren’t.

Chief economist Huw Pill says it is very difficult to forecast, at very high frequency, some of the shocks that have hit the UK economy.

Inflation today is unacceptably high, Pill says, due to the shock which the economy has faced.

Harriett Baldwin MP isn’t convinced that the impact on inflation wasn’t predictable – a year ago, she says, the governor was warning of ‘apocalyptic’ food price rises from the Ukraine war.

Shell’s annual meeting has descended into chaos within the first seconds of opening, with a crowd of protestors accusing it of “earning billions from climate collapse”.

Climate protests have become a regular feature of annual meetings, with campaigns focused particularly on banks such as HSBC and Barclays that lend to fossil fuel projects as well as oil companies.

Shell’s executives, sitting at London’s ExCel conference centre, were clearly braced for disruption. As soon as the meeting opened one protestor stood up shouting his protests.

He said: Do you like David Attenborough, the most popular man in this country? He said it is crazy that banks and pension funds are investing in fossil fuels.

Andrew Mackenzie, Shell’s chair and the former chief executive of mining company BHP, asked the protestor to sit down.

The protestor responded:

“I can go on all day, and will.”

Mackenzie repeatedly asked him to sit down, and then - perhaps somewhat ill-advisedly - said the company wanted to hear from others.

That appeared to be a cue for the chorus. First the crowd started singing: “Go to hell, Shell”, to the tune of Hit the Road Jack by Ray Charles.

Here’s a clip of the singing:

That was followed by a chant of “shut down Shell”, and “we hate Jackdaw” - a reference to its North Sea oil field. “We have heard you loud and clear,” Mackenzie said. 20 minutes in, there are still protestors being escorted from the room.

The IMF’s managing director, Kristalina Georgieva, says she had an ‘excellent meeting’ with Jeremy Hunt today, during the Fund’s visit to assess the UK economy.

Georgieva says the UK authorities have taken “decisive actions to promote macroeconomic and financial stability and are focused on the fight against inflation and on reforms to boost productivity, labor supply, and investment”.

Jeremy Hunt has announced that the International Monetary Fund had made a ‘big upgrade’ to the UK’s growth forecasts, following its annual healthcheck.

Hunt says:

“Today’s IMF report shows a big upgrade to the UK’s growth forecast and credits our action to restore stability and tame inflation.

“It praises our childcare reforms, the Windsor Framework and business investment incentives. If we stick to the plan, the IMF confirm our long-term growth prospects are stronger than in Germany, France and Italy – but the job is not done yet.”

The Fund is due to release its assessment of the UK economy at 11.15am, when we’ll her from Hunt and IMF chief Kristalina Georgieva.

But the news is already out – with multiple reports that the IMF is no longer expecting the UK to fall into recession this year.

Instead of shrinking by 0.3%, as the IMF forecast in April, the UK economy is now forecast to grow by 0.4% during 2023.

The Fund said the improved outlook reflected the unexpected resilience of demand, helped in part by faster than usual pay growth, the fall in soaring energy costs, improved business confidence and the normalisation of global supply chains.

“Declining energy prices and widening economic slack are expected to substantially reduce inflation to around 5 percent y/y by end-2023, and below the 2 percent target by mid-2025,” the IMF said.

The IMF forecast economic growth of 1% in 2024 and 2% in 2025 and 2026 before settling back to a long-run rate of around 1.5%.

Growth across UK companies is slowing this month, while firms are continuing to hike prices, according to the latest survey of purchasing managers.

UK economic growth remained centred on the service sector in May, data provider S&P Global reports, with travel, leisure and hospitality businesses benefiting from resilient consumer demand.

But production levels at manufacturing firms fell at the fastest pace in four months.

This pulled the S&P Global / CIPS flash UK composite output index down to 53.9 in May, from a 12-month high of 54.9 in April. Any reading over 50 shows growth.

Firms reported a fractional easing in input price inflation, thanks to a drop in energy bills and raw material costs for factories. But strong wage inflation pushed up costs for services firms.

The prices charged by private sector companies increased at an historically steep pace in May, although the rate of inflation was the second-lowest since August 2021.

This could spur the Bank of England into continuing to raise interest rates to squash inflation.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said the UK is seeing a tale of two economies, as manufacturing and services diverge:

“The UK economy enjoyed another month of strong growth in May, with the expansion continuing to be driven by surging post-pandemic demand in the service sector, notably from consumers and for financial services, with hospitality activities buoyed further by the Coronation. The surveys are consistent with GDP rising 0.4% in the second quarter after a 0.1% rise in the first quarter.

“However, this growth spurt is driving renewed inflationary pressures, as service providers struggle to meet demand and hence not only offer higher wages to attract staff but also find themselves able to charge more for their services.

It’s a different story in manufacturing, where spending is being diverted away from goods to services, and many companies are also winding down their inventories, exacerbating the downturn in demand and driving both output and prices lower.

The government pulled in more money from inheritance tax last month.

New data from HMRC show that inheritance tax receipts rose to £600m in April, which is £100m higher than a year ago.

Alex Davies, CEO and Founder of Wealth Club said:

“The 2023/24 tax year is looking likely to be yet another record-breaking year for inheritance tax. It really is a cash cow for HMRC.

Currently, people can pass on up to £325,000 of their estate without them having to pay any IHT. Anything above £325,000 could be subject to up to 40% inheritance tax. The nil-rate band has stayed at the same level since April 2009, although asset prices (such as houses) have risen since.

Dean Moore, Managing Director and Head of Wealth Planning at RBC Wealth Management, says the freeze on inheritance tax thresholds is pushing up IHT receipts.

The burden of IHT on families is reaching unprecedented levels, with a projected record payment of £6.7 billion in the financial year 2022/23. This amount is more than double the £2.9 billion paid in 2011/12, and it is expected to further increase to £7.8 billion within the next five years.

“The significant rise in IHT is primarily driven by sustained increases in property prices and the long-term freeze of the IHT threshold which is unchanged at £325,000 since 2009. Meanwhile, average house prices in London have increased from £245,000 to £532,000 over the same period. (Source: Land registry).

“The current state of IHT places a substantial financial strain on the loved ones left behind after a person’s passing. In response, individuals are increasingly resorting to measures such as gifting, investing, donating, and insuring their money to minimise or avoid this tax.

“Failing to promptly and effectively address the issue of IHT can lead to families facing overwhelming administrative and financial burdens during a time of already profound emotional stress. By adopting a proactive and incremental approach to IHT, the process can be made significantly easier, alleviating the strain on those who are grieving the loss of a loved one.”

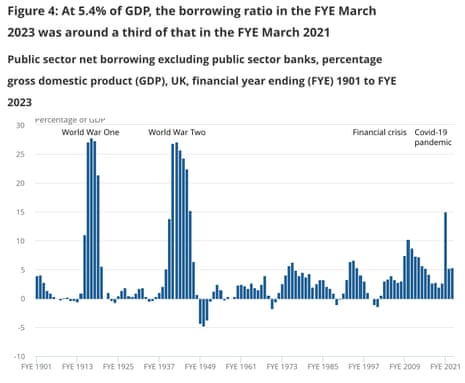

Here’s a handy chart from today’s April public finances, showing UK public sector borrowing as a proportion of GDP.

As you can see, the Covid-19 pandemic pushed up borrowing in the 2020-21 financial year to 15%, the highest for 75 years.

https://news.google.com/rss/articles/CBMilAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21heS8yMy9pbmZsYXRpb24tdWstYnVkZ2V0LWRlZmljaXQtYXByaWwtam9obi1hbGxhbi1iYXJyYXR0LWJhbmstb2YtZW5nbGFuZC1pbWYtZWNvbm9teS1idXNpbmVzcy1saXZl0gGUAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvbWF5LzIzL2luZmxhdGlvbi11ay1idWRnZXQtZGVmaWNpdC1hcHJpbC1qb2huLWFsbGFuLWJhcnJhdHQtYmFuay1vZi1lbmdsYW5kLWltZi1lY29ub215LWJ1c2luZXNzLWxpdmU?oc=5

2023-05-23 10:03:53Z

2056937853

Tidak ada komentar:

Posting Komentar