Great Britain’s energy price cap has fallen to £2,074 a year, but the average household will still pay almost double the rate for their gas and electricity than before costs started to soar, our energy correspondent Jillian Ambrose reports.

Around 27m households can expect a modest drop in energy bills this summer after the regulator Ofgem lowered the cap on the typical annual dual-fuel tariff to reflect a steep drop in global energy prices over recent months.

From July, when the change takes effect, households will see their average gas and electricity bill fall from the £2,500 a year level set by the government’s energy price guarantee.

But households who struggled to pay their bills over the winter will feel little relief, because government top-ups worth £400 between October to March have come to an end.

The average energy bill will remain almost double the level seen in October 2021 – when Russia began restricting supplies of gas to Europe in a move that sent wholesale prices soaring. Before the energy crisis, the typical household paid £1,271 a year for gas and electricity.

Households could still face dual-fuel bills above £2,074 if they use more than the typical amount of energy because Ofgem’s cap limits the rate energy suppliers can charge for each unit of gas and electricity – not the total bill.

More here:

Filters BETA

Pressure is mounting for a “social tariff” for gas and electricity to be introduced to protect the most financially vulnerable.

Such a social tariff would help lower-income households with their energy bills, which will still be around double their pre-Ukraine war levels even once the Ofgem price cap drops in July to £2,074 per year for a typical household.

The Money Advice Trust, the charity that runs National Debtline and Business Debtline, backs a social tariff.

Joanna Elson CBE, chief executive at the Money Advice Trust, warns that the damage from unaffordable energy bills is already done, adding:

Energy is still significantly more expensive than when this crisis started, and more support is going to be needed.

“We need permanent solutions to this problem – including a social tariff for low income households, and a wider Essentials Guarantee to ensure Universal Credit always covers essential costs.

“It’s also vital that people can access the advice they need. I would urge anyone who is worried about their energy bills to seek free, independent debt advice from a service like National Debtline. Our expert advisers are there to help and talk you through your options.”

Emily Fry, economist at the Resolution Foundation, says there is a strong case for social tariff:

“Expected energy costs for a typical household this year are now on course to be around £2,100 – still up by almost 80 per cent on what families were used to pre-crisis.

“A return to the level of bills households paid pre-crisis isn’t arriving anytime soon. The case for developing more sustainable support with energy bills, such a social tariff for vulnerable households, therefore remains strong.”

Simon Virley CB, vice chair and head of energy and natural resources at KPMG in the UK, says energy suppliers still need greater clarity about the future direction of government policy for the energy market.

Virley adds:

Serious thought needs to be given to how best deliver sustainable competition in the long-term, whilst protecting those that need it from higher prices.

If that is a move to a social tariff for energy, on what basis would the eligible group be defined, and is there an ongoing role for the price cap in this scenario?”

Sana Yusuf, warm homes campaigner at Friends of the Earth, has warned that struggling households will still struggle to stay warm this winter, even once the price cap falls in July.

Yusuf says:

“Make no mistake, this announcement will make little difference to the millions of people who struggled to stay warm in cold, damp homes this winter. Most government energy bills support has already ended, and people will still be paying double what they were before the energy crisis.

“With the rate of food price inflation now outstripping energy, things will only get tougher for the hardest hit communities that have already suffered so much in the last year. What’s more, analysts say that average energy prices will not fall below pre-pandemic levels until at least the end of the decade. Amid all this, energy firms are still posting record-breaking profits.

“The injustice is breath-taking. People shouldn’t have to wait ten years before they can afford to pay for life’s basics. The government must not waste another summer that could be spent rolling out a street-by-street insulation programme. Not only will this bring down bills quickly and help to protect people from the cold, it’s vital to cut the emissions our homes produce if we’re to meet our climate goals.”

Back on the Ofgem price cap announement, energy security secretary Grant Shapps says today’s reduction in bills is a ‘major milestone’ in the drive to halve inflation.

Shapps says:

“It’s positive households across the country will see their energy bills fall by around £430 on average from July, marking a major milestone in our determined efforts to halve inflation.

“We’ve spent billions to protect families when prices rose over the winter covering nearly half a typical household’s energy bill – and we’re now seeing costs fall even further with wholesale energy prices down by over two thirds since their peak as we’ve neutralised Putin’s blackmail.

“I’m relentlessly focused on reducing our reliance on foreign fossil fuels and powering-up Britain from Britain to deliver cheaper, cleaner and more secure energy.”

UK government borrowing costs have climbed to the highest level since the aftermath of the mini-budget last year, after inflation failed to fall as much as hoped in April.

The yield, or interest rate, on two-year UK government bonds has jumped to 4.44% this morning, up from 4.35% last night.

That’s the highest since last October, when the markets were spooked by the chaos caused by Liz Truss and Kwasi Kwarteng’s package of unfunded tax cuts.

Benchmark 10-year and 30-year UK government bond prices have also fallen further in value, pushing up their yields.

The selloff comes as the City is gripped by anxiety that Britain’s inflation problem will force interest rates even higher, after the Consumer Prices Index fell by less than expected in April.

CPI dropped to 8.7% last month, higher than the 8.2% that was expected, while core inflation hit a 30-year high.

This is expected to prompt the Bank of England to keep raising interest rates, from 4.5% at present, up towards 5.5% by the end of this year.

Bond yields are also being pushed up by concerns that the US could default in June, if a debt ceiling deal can’t be agreed in time.

In the City, the UK’s blue-chip shares index has hit its lowest level in eight weeks.

The FTSE 100 lost almost 50 points to as low as 7577 points this morning, down another 0.6% after tumbling by 135 points on Wednesday.

DIY chain Kingfisher are the top faller, down 5%, with retailer Frasers Group (-3%) and luxury group Burberry (-1.8%) also in the top fallers.

Germany’s DAX and France’s CAC are both in the red too, down around 0.5%, with Germany’s fall into recession not helping the mood.

Worries over the US debt ceiling are mounting, after ratings agency Fitch put the United States’ credit on watch for a possible downgrade last night.

Fitch’s threat to remove the US’s gold-plated AAA rating came as talks over the country’s debt limit go down to the wire.

The US Treasury has warned that Congress must agree to raise the debt ceiling by 1 June or the US will run out of cash to pay its bills, resulting in a default that would cause widespread disruption in financial markets.

Last night, top Republican Kevin McCarthy warned that more time may be needed to reach a budget deal with President Joe Biden, as the two sides blamed each other for the deadlock:

Victoria Scholar, head of investment at interactive investor, says,

Rating agency Fitch has placed the US AAA rating on negative watch, citing concerns about the looming US debt ceiling deadline.

In 2011, S&P cut the US rating to AA-plus, which triggered a major market sell-off. The Democrats and Republicans have yet to find common ground and reach a deal, with hopes that the stalemate will finally end in the days ahead so that a catastrophic US default can be averted.

However time is ticking, prompting a bout of market nervousness as the deadline draws closer.”

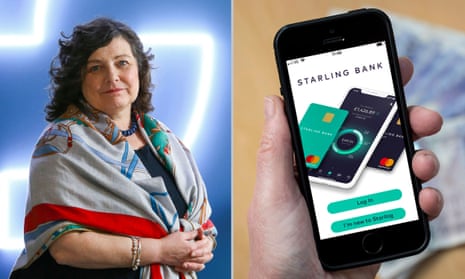

UK challenger bank Starling has announced its chief executive is stepping down next month.

Anne Boden, who founded Starling Bank nine years ago, is to step aside as CEO on 30 June. She’ll be replaced by the bank’s chief operating officer, John Mountain.

Starling has also reported that revenues more than doubled in the last financial year, to 31 March, from £216m to £453m, while pre-tax profits jumped six-fold to £195m from £32m.

Starling now has 3.6m customers.

Anne Boden says today:

“When I started Starling in 2014, I was told no one ever starts a bank, nobody wins market share and you’ll never make a profit. Today’s results prove them wrong.

“We’ve succeeded in disrupting an entire industry. I’m immensely proud of these results, which are a testament to how far we have come as a team and how fast we’ve moved as a business.

“I have spent nearly a decade here as both the founder and CEO, a dual role which is unique in UK banking. It’s been all-consuming and I’ve loved every minute of it.

The head of energy regulator Ofgem has defended a decision to consider increasing the amount of profit companies can make on people’s bills.

Jonathan Brearley argued that firms need to have “more money in the bank” to build resilience over price shocks.

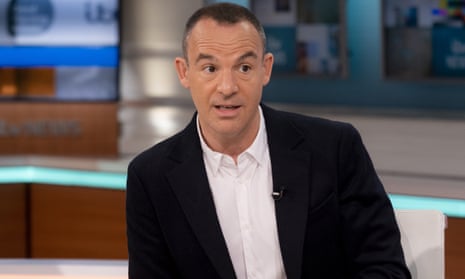

Taking questions on ITV’s Good Morning Britain from money expert Martin Lewis, who said consumers would be “staggered” by the measure, Brearley argued that energy firms needed to be financially resilient after the flurry of failures in 2021.

Brearley told GMB:

“So you’ll remember everything we went through in the end of 2021 and that put around £80 on people’s bills when 30 companies failed.

What we’re saying to every company is: you need to have good risk management and you need to have money in the bank so you can last through the sorts of price shocks we’ve seen over the last two years.

“Now they need to get that money from somewhere, so we’re putting in roughly an increase of about £10 a year to make sure companies are financially resilient.”

Here’s a clip of the interview:

Martin Lewis, of MoneySavingExpert.com, has also warned that energy bills are likely to “bounce back a bit” this coming winter.

He told the Today Programme:

“For every £100 you pay on energy now you’ll likely be paying £80 to £85 on energy from July. So that is a real manifest drop in energy bills.

“The truth is that’s probably it. From October it might go down a little bit more but then we expect it to bounce back a bit in January.

And if those are true, the reality is next winter, the winter coming, people will be paying roughly what they did last winter because rates are cheaper but they’re not getting the £66-67 a month support [from the government].

“So things will get slightly better and they’ll certainly stop getting worse, but by no means are we getting anything close to what we used to have. People will still be paying double what they used to pay before the energy crisis hit.”

Q: Will companies start offer deals below the price cap again?

Lewis expects to see “existing customer offers”, where you will get a bespoke offer from your firm, rather than going to a price-comparison website to get a better deal.

He explains that regulations mean companies don’t need to publish the details of their offers, so it’s hard to get a clear picture of exactly what’s available.

Weak private and public consumption dragged the German economy into recession last winter, says Carsten Brzeski, global head of macro at ING.

Brzeski explains:

It’s not the worst-case scenario of a severe recession but a drop of almost 1% from last summer. The warm winter weather, a rebound in industrial activity, helped by the Chinese reopening and an easing of supply chain frictions, were not enough to get the economy out of the recessionary danger zone. Private consumption continued to suffer from still-high retail energy prices.

Looking beyond the first quarter, the optimism at the start of the year seems to have given way to more of a sense of reality. A drop in purchasing power, thinned-out industrial order books as well as the impact of the most aggressive monetary policy tightening in decades, and the expected slowdown of the US economy all argue in favour of weak economic activity.

On top of these cyclical factors, the ongoing war in Ukraine, demographic change and the current energy transition will structurally weigh on the German economy in the coming years.

Javier Blas says Germany’s fall into recession shows the impact of Europe’s energy crisis – the country scrambled to cut gas use after the Ukraine war began.

Claus Vistesen, chief euro zone economist at Pantheon Macroeconomics, told clients:

“Germany did fall into recession at the end of last year, after all, as the shock in energy prices weighed on consumers’ spending,”

He added that it is unlikely that the German GDP will continue to fall in the coming quarters, “but we see no strong recovery either.”

Europe’s largest economy has fallen into recession, as the economic disruption caused by Russia’s invasion of Ukraine hit growth.

New data released this morning shows that Germany’s economy has shrunk over the last two quarters – the technical definion of a recession.

German GDP shrank by 0.3% in the January-March quarter, revised figures show, rather than stagnating as first estimated.

That follows a 0.5% contraction in October-December.

Ruth Brand, president of the Federal Statistical Office, says:

“After GDP growth entered negative territory at the end of 2022, the German economy has now recorded two consecutive negative quarters.”

Statistics body Destatis reports that household spending fell.

It says:

The reluctance of households to buy was apparent in a variety of areas: households spent less on food and beverages, clothing and footwear, and on furnishings in the first quarter of 2023 than in the previous quarter.

There was also a fall in government expenditure, while investment was up and construction output also rose.

Earlier this week, the IMF ditched its prediction that the UK would fall into recession this year.

Martin Lewis, founder of MoneySavingExpert, has welcomed the news that the Ofgem price cap will drop in July.

He says:

From 1 July, energy bills will no longer be subsidised by the state, as Ofgem is thankfully dropping the Price Cap below the Government’s Energy Price Guarantee for the first time since it was introduced. Bills will drop by an average 17%, meaning for every £100/mth people pay today, they will typically be paying £83/mth from July.

“This will be a relief for many, yet most will still be paying more for their energy than during the winter. This is because, apart from for those with high use, the drop in the rates doesn’t make up for the £66 per month state support people got until April – and most are on monthly direct debit, which means they pay the same in summer as winter.Overall, this still leaves people paying double or more what they did before the energy crisis hit in October 2021.

Lewis argues that the government could provide targeted support to help struggling families in the coming winter:

“The fact the state is paying far less than planned to support people’s bills means there is some wriggle room here for targeted support for another hard winter coming for those who are just above the benefits threshold. Though I’m not holding out much hope that it’ll happen.

“The moral hazard of high standing charges continues too. The reduction is all off the unit rate. It will still cost roughly £300/yr just for the facility of having gas and electricity.This perversely means the less you use, the less you save. I and many others have pushed Ofgem on this, to little avail, though it is launching a consultation on operating costs which impact this and may help a bit in the future.”

National Energy Action have calculated that there will still be 6.6 million households in fuel povert once the price of energy falls in July, under the new price cap, down from around 7.5m.

The charity points out that energy bills are still approximately almost double the level of October 2021.

And crucially, bills from July will be comparable to last winter as the Government has withdrawn support worth £400 to each household.

National Energy Action’s chief executive Adam Scorer says:

“Coming out of winter, most people will welcome any respite from record high prices, but it still leaves prices more than two-thirds higher than the start of the energy crisis and two million more households trapped in fuel poverty.

More than two and half million low income and vulnerable households are no longer receiving any government support for unaffordable bills. For them, the energy crisis is far from over.”

NEA also provide advice and support for those struggling – click here for more details.

Great Britain’s energy price cap has fallen to £2,074 a year, but the average household will still pay almost double the rate for their gas and electricity than before costs started to soar, our energy correspondent Jillian Ambrose reports.

Around 27m households can expect a modest drop in energy bills this summer after the regulator Ofgem lowered the cap on the typical annual dual-fuel tariff to reflect a steep drop in global energy prices over recent months.

From July, when the change takes effect, households will see their average gas and electricity bill fall from the £2,500 a year level set by the government’s energy price guarantee.

But households who struggled to pay their bills over the winter will feel little relief, because government top-ups worth £400 between October to March have come to an end.

The average energy bill will remain almost double the level seen in October 2021 – when Russia began restricting supplies of gas to Europe in a move that sent wholesale prices soaring. Before the energy crisis, the typical household paid £1,271 a year for gas and electricity.

Households could still face dual-fuel bills above £2,074 if they use more than the typical amount of energy because Ofgem’s cap limits the rate energy suppliers can charge for each unit of gas and electricity – not the total bill.

More here:

Q: Yesterday, energy firm SSE reported its profits have almost doubled in the last year (to an adjusted pre-tax profit of £2.18bn). Does that suggest the market might be rigged?

Ofgem CEO Jonathan Brearley points out that SSE don’t have a domestic retail business in the UK, so they don’t have the business that we’re regulating through the price cap.

He says there has been huge turbulence in the market with the cost of commodities internationally going up dramatically.

That came as Russia started withdrawing their gas from the market, and the whole of Europe making plans to move away from Russian gas.

That means the market is tighter and that does mean that prices are higher.

Brearley adds that the situation is starting to stabilise, and repeats that he hopes to see “competitive fixed price deals reenter the market”.

He concludes:

We have faced the biggest energy shock in our history. But things are improving.

https://news.google.com/rss/articles/CBMif2h0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvbWF5LzI1L2VuZXJneS1iaWxscy1vZmdlbS1wcmljZS1jYXAtZ2FzLWVsZWN0cmljaXR5LWNvc3Qtb2YtbGl2aW5nLWJ1c2luZXNzLWxpdmXSAX9odHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21heS8yNS9lbmVyZ3ktYmlsbHMtb2ZnZW0tcHJpY2UtY2FwLWdhcy1lbGVjdHJpY2l0eS1jb3N0LW9mLWxpdmluZy1idXNpbmVzcy1saXZl?oc=5

2023-05-25 08:15:00Z

2043475375

Tidak ada komentar:

Posting Komentar