Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

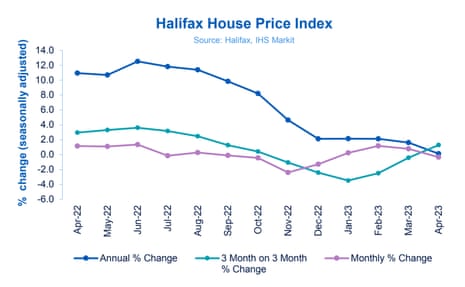

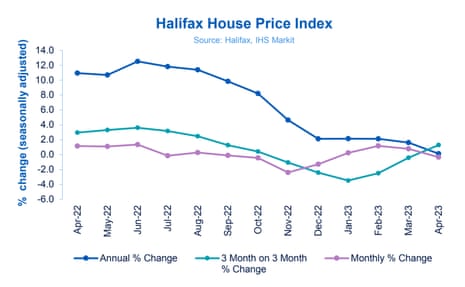

Annual house price inflation in the UK has slowed to its lowest in a decade, as the market stabilises after last autumn’s turmoil.

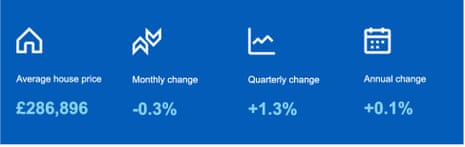

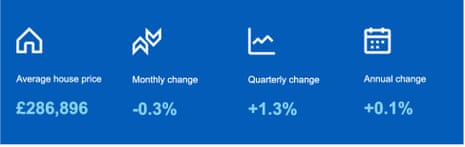

Lender Halifax has just reported that prices in April were 0.1% higher than a year ago – a slowdown on the 1.6% annual house price growth recorded in March.

That’s the weakest increase since December 2012, as this chart shows:

On a monthly basis, the average house price decreased by 0.3% in April, wiping out a little of the 0.8% rise reported in March.

This knocked the price of the average property down to £286,896, from £287,891 in March.

Average prices are still around £28,000 higher than two years ago, but are around £7,000 below their peak set last summer – before rising mortgage costs and the turmoil caused by the mini-budget.

House price movements over recent months have largely mirrored the short-term volatility seen in borrowing costs, says Kim Kinnaird, director of Halifax Mortgages, who explains:

The sharp fall in prices we saw at the end of last year after September’s ‘mini-budget’ preceded something of a rebound in the first quarter of this year as economic conditions improved.

The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months. Mortgage rates are now stabilising, and though they remain well above the average of recent years, this gives important certainty to would-be buyers.

While the housing market as a whole remains subdued, the number of properties for sale is also slowly increasing, as sellers adapt to market conditions.

Last week, rival lender Nationwide reported that the average house price rose by 0.5% in April after seven months of declines.

Halifax’s data comes two days before the Bank of England is expected to raise UK interest rates for the 12th time in a row, to 4.5%, as it battles inflation.

Higher interest payments are already hitting households, with an estimated 700,000 UK households missed or defaulted on a rent or mortgage payment last month, data from Which? shows.

Overall, an estimated 2 million households missed or defaulted on at least one mortgage, rent, loan, credit card or bill payment in April, according to the latest Which? monthly consumer insight tracker, based on an online poll of about 2,000 people.

More here.

The agenda

7am BST: Halifax house price index for April

11am BST: NFIB index of US small business optimism

3pm BST: IBD/TIPP index of US economic optimism

Filters BETA

A new 100% mortgage, aimed at potential buyers who can’t save for a deposit, is being launched today – the first since the 2008 financial crisis.

Skipton Building Society’s new “track record” mortgage is available for first-time buyers across Britain. Tenants aged 21 and over may be able to take out mortgages at between 95% to 100% of the value of the property they want to buy.

In return, they will need to demonstrate a strong track record of paying their rent, with evidence of a minimum of 12 months of rental history.

It is aimed those “trapped in rental cycles” and who do not have access to “the bank of mum and dad,” as my colleague Rupert Jones reported yesterday:

Some brokers have welcomed the move, saying it could help Generation Rent onto the housing ladder.

But there also concerns that the product could be risky, given the role of such 100% mortgage fuelling the housing market in the run-up to the 2008 financial crisis.

Without a deposit, borrowers would be pushed into negative equity quickly if prices kept falling.

As Graham Cox, founder at SelfEmployedMortgageHub.com, put it:

I’m amazed the Prudential Regulation Authority has given Skipton the go-ahead to launch this product.

“It’s like we’ve learnt nothing from the Global Financial Crisis in 2008. I understand the logic of trying to help those who are rent-trapped, and unable to save for a deposit, but to me, it’s addressing the symptom rather than the cause, which is that house prices are too high.

A surprise tumble in imports into China has fuelled concerns over the health of the global economy.

Chinese imports fell by 7.9% year-on-year in April, new government data released today shows, indicating its economic recovery stumbled last month.

That follows a 1.4% drop in the year to March, and economists had expected imports to be flat in April, year on year.

China’s exports rose by 8.5% year-on-year, benefitting from a low base in April 2022 when pandemic restrictions were hitting production.

Analysts at ING warns that the deterioration of the global economy could weigh further on China’s economy as the year progresses.

On a monthly basis, exports fell 6.4% and imports fell 9.7% in April, points out Iris Pang, ING’s chief economist for Greater China, adding:

It seems increasingly clear that the global economic slowdown is weighing on China’s exports.

Today’s data also shows that China’s exports to Russia soared by 153.1% in April, while imports from Russia grew by over 8%.

This has hit the mood in the financial markets today, with Brent crude oil down 0.6% at $76.56 per barrel.

In London, the FTSE 100 index has dipped by 24 points, or 0.3%, to 7753 point.

Sainsbury’s has cut the price of some of its lines of bread and butter following a drop in commodity prices, bringing some relief to struggling households.

The UK’s second-biggest supermarket chain has lowered the price of its own-brand 250g salted and unsalted butter by 5% to £1.89.

It is also cutting the price of its 800g Soft White Medium, Wholemeal Medium, Wholemeal Thick and Toastie White loaves of bread by 11% to 75p.

The grocer said it was able to lower some prices due to commodity prices for wheat and butter beginning to fall.

Rhian Bartlett, food commercial director at Sainsbury’s, said:

“We have been battling hard to beat inflation and whenever we are paying less for the products we buy from our suppliers, we will pass those savings on to customers.

“As we see the commodity prices starting to fall for wheat and butter, we’re able to lower our prices on two of the products people buy most often, bread and butter.

“We are committed to offering our customers the best value possible so they can be confident that they are getting a great deal on their everyday essentials when they shop with us.”

The UN’s Food Price Index shows that wholesale global dairy prices have dropped by 15% over the last 12 months, while cereal prices are almost 20% lower than a year ago (when the Ukraine invasion drove up agriculture prices).

Shoppers, though, have faced soaring food inflation. The latest UK inflation report showed that butter prices were up 22.7% in the year to March, with bread up 18.9%.

International tourism is well on its way to returning to pre-pandemic levels, according to the UN World Tourism Organization.

UNWTO reports that an estimated 235 million tourists travelled internationally in the first three months, twice as many as in the same period of 2022.

Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023, it adds.

Insurer Direct Line said its earnings outlook remains “challenging” due to the soaring cost of claims – despite ramping up prices across its motor and home policies.

The group said it was seeing a further impact of the rising cost of motor repairs due to inflation, which is expected to put pressure on earnings this year, PA Media reports.

In response, it said it was hiking car cover prices, which pushed up average motor renewal premiums by nearly a fifth – 19% – year-on-year in the first quarter.

This led to a 2.5% fall in policies in the quarter, but premium price rises helped the motor division’s gross written premium lift 3.3% to £358.7 million.

The firm also said it was seeing “significant price increases” across the home insurance market, with its gross written home premium up by 2.1%.

The slowdown in the UK housing market has hit Marshalls, the gardens, driveways and roofing products company.

Marshalls reported this morning that like-for-like sales have fallen by 14% so far this year, with trading weaker than anticipated.

The company, which sells garden paving and walls, paths and driveways, and owns roofing firm Marley, says this falls reflects the uncertain macro-economic climate, a reduction in new house building and continued weakness in repair, maintainance and investment by home owners.

Marshalls tells shareholders:

In the first quarter of the year, National House Building Council new housing starts were 27 per cent lower than 2022, which had an impact on the performance of all the Group’s reporting segments.

Marshalls now expects to miss its previous financial expectations for this year, citing the slowdown in the housing market.

It says:

The Board’s expectations for 2023 were set with reference to the Construction Products Association’s (‘CPA’) Winter forecast that was published in January 2023. The CPA reduced its 2023 construction output forecast earlier this month.

This was principally driven by a six-percentage point deterioration in new build housing to a year-on-year contraction of 17 per cent. The CPA cited reduced demand in the wake of the mini budget, the consequential sharp rise in mortgage rates and the end of Help to Buy as contributing factors for the downgrade.

Shares in Marshalls have dropped 15%, the biggest faller on the FTSE 250 index.

One of the UK’s most prominent business leaders, the Tesco chair John Allan, faces claims of inappropriate and unprofessional behaviour from four women, the Guardian can reveal.

Allan allegedly touched the bottom of a senior member of Tesco staff in June 2022, at the company’s annual general meeting (AGM). It is also claimed that he touched the bottom of a member of staff at business lobbying group, the Confederation of British Industry (CBI), at its annual dinner in May 2019, when he was the organisation’s president.

Sources allege that Allan, 74, made inappropriate remarks on those occasions as well as separate, similar comments to two other female members of CBI staff in November 2019 and in 2021 respectively. Some of the women said they were offended by the alleged actions and considered his behaviour to be sexual harassment.

Allan has denied all but one of the allegations – making a comment about a CBI staffer’s appearance that she found to be offensive in 2019. A spokesperson for Allan said the other claims are “simply untrue”.

A spokesperson for Tesco said: “John Allan’s conduct has never been the subject of a complaint during his tenure as chair of Tesco.” The company urged anyone with concerns or information to contact a confidential phone line.

Here’s the full story, by my colleague Anna Isaac:

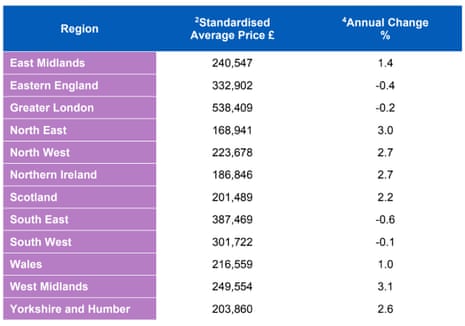

While the overall UK housing market remains sluggish there are pockets of outperformance, points out Victoria Scholar, head of investment at interactive investor.

New-build prices and first-time buyers are remaining resilient, partly because of soaring rental costs.

Geographically, the West Midlands enjoyed the strongest annual growth of 3.1% while the South-East has seen property prices suffer.

Rising rates from the Bank of England and the cost-of-living crisis are squeezing individuals and families and are weighing on the UK property market, she adds:

Many potential buyers are holding off amid hopes that property prices will cool and mortgage rates will ease later this year as inflation starts to finally starts to come down.

The housing market is still reeling from the fallout from the mini-budget fiscal fiasco last year, which sent mortgage rates soaring and many mortgage products temporarily pulled from the market altogether. While the macroeconomic backdrop remains challenging, last year’s most dire forecasts have been wound back with the UK now expected to narrowly stave off a recession this year.

But with Brexit, inflation above 10%, recent political turmoil, and a sluggish economy, the UK property market is not considered the investment it once was by the international community.”

The Bank of England could be forced to raise interest rates to 5% this summer, Goldman Sachs has warned this week, as Britain struggles to bring down the highest rates of inflation among the G7 group of advanced economies.

Threadneedle Street is widely expected to increase the cost of borrowing for households and businesses on Thursday for a 12th time in succession, with financial markets anticipating a quarter-point rise to 4.5%.

However, the US investment bank warned that households and businesses could face further increases in the cost of borrowing as the central bank struggles to bring down the highest rates of inflation in 40 years to more sustainable levels.

The slowdown in annual house price growth to just 0.1% in April shows that the cost-of-living and mortgage worries are weighing on demand, says Jeremy Leaf, north London estate agent.

He adds:

‘However, there is no doubt that we are much busier than we were a few months ago and the underlying feeling is that we are over the worst and will continue on a relatively even keel despite some ups and downs along the way.’

Tom Bill, head of UK residential research at Knight Frank, says the UK housing market is “regaining its footing after being knocked sideways” by last September’s mini-Budget.

The big picture, Bill says, is that annual growth is broadly flat and transactions clearly hit their low-point in January.

It should be a steady year, with the impact of a recovering economy kept in check by mortgage rates that are notably higher than 18 months ago. It will also be the most predictable year for the housing market since 2018.

As the political temperature rises and a 2024 general election moves onto the radar, switched-on buyers and sellers are acting while the backdrop remains relatively uneventful.”

A newly built house would have cost you 3.5% more than a year ago in April, Halifax reports, much larger than the 0.1% rise in overall prices across the market.

Prices of ‘existing properties’ fell by 0.6% over the last 12 months.

The first-time buyer market is also proving to be “more resilient”, with average property prices up +0.7% over the last year, compared to a fall of -0.1% for home movers.

Halifax says:

One factor behind this difference may be that with rents continuing to rise sharply, it’s becoming increasingly cost effective to purchase a home, despite the challenge of raising a deposit and higher mortgage borrowing costs.

Halifax Mortgages director Kim Kinnaird also predicts that higher borrowing costs will weigh on prices this year.

Kinnaird says:

“Alongside a market-wide uptick in mortgage approvals, these latest figures may indicate a more steady environment. However, cost of living concerns remain real for many households, which will likely continue weigh on sentiment and activity.

Combined with the impact of higher interest rates gradually feeding through to those re-mortgaging their current fixed-rate deals, we should expect some further downward pressure on house prices over course of this year.”

House prices in the south of England are under the greatest pressure at the moment, Halifax’s report shows.

The four regions of southern England have seen average house prices fall over the last year, with the South East registering the largest dip, of -0.6%, pulling average house prices down to £387,469.

Halifax says:

Typically, it’s these regions (including Greater London, Eastern England and the South West) where buyers face the most expensive average property prices, and therefore the biggest impact of higher borrowing costs.

In London, which has the costliest homes of anywhere in the country at an average of £538,409, annual house price growth slowed to -0.2%.

But other regions saw growth, led by the West Midlands which had the strongest annual growth of +3.1%

Northern Ireland (+2.7%, £186,846), Scotland (+2.2%, £201,489) and Wales (+1.0%, £216,559) have also seen average property prices increase year-on-year.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Annual house price inflation in the UK has slowed to its lowest in a decade, as the market stabilises after last autumn’s turmoil.

Lender Halifax has just reported that prices in April were 0.1% higher than a year ago – a slowdown on the 1.6% annual house price growth recorded in March.

That’s the weakest increase since December 2012, as this chart shows:

On a monthly basis, the average house price decreased by 0.3% in April, wiping out a little of the 0.8% rise reported in March.

This knocked the price of the average property down to £286,896, from £287,891 in March.

Average prices are still around £28,000 higher than two years ago, but are around £7,000 below their peak set last summer – before rising mortgage costs and the turmoil caused by the mini-budget.

House price movements over recent months have largely mirrored the short-term volatility seen in borrowing costs, says Kim Kinnaird, director of Halifax Mortgages, who explains:

The sharp fall in prices we saw at the end of last year after September’s ‘mini-budget’ preceded something of a rebound in the first quarter of this year as economic conditions improved.

The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months. Mortgage rates are now stabilising, and though they remain well above the average of recent years, this gives important certainty to would-be buyers.

While the housing market as a whole remains subdued, the number of properties for sale is also slowly increasing, as sellers adapt to market conditions.

Last week, rival lender Nationwide reported that the average house price rose by 0.5% in April after seven months of declines.

Halifax’s data comes two days before the Bank of England is expected to raise UK interest rates for the 12th time in a row, to 4.5%, as it battles inflation.

Higher interest payments are already hitting households, with an estimated 700,000 UK households missed or defaulted on a rent or mortgage payment last month, data from Which? shows.

Overall, an estimated 2 million households missed or defaulted on at least one mortgage, rent, loan, credit card or bill payment in April, according to the latest Which? monthly consumer insight tracker, based on an online poll of about 2,000 people.

More here.

The agenda

7am BST: Halifax house price index for April

11am BST: NFIB index of US small business optimism

3pm BST: IBD/TIPP index of US economic optimism

https://news.google.com/rss/articles/CBMieWh0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvbWF5LzA5L3VrLWhvdXNlLXByaWNlcy1pbnRlcmVzdC1yYXRlcy1oYWxpZmF4LWNvc3Qtb2YtbGl2aW5nLWJ1c2luZXNzLWxpdmXSAXlodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21heS8wOS91ay1ob3VzZS1wcmljZXMtaW50ZXJlc3QtcmF0ZXMtaGFsaWZheC1jb3N0LW9mLWxpdmluZy1idXNpbmVzcy1saXZl?oc=5

2023-05-09 06:37:00Z

1969830955

Tidak ada komentar:

Posting Komentar