The Times are reporting that Jeremy Hunt is “poised” to extend the government’s £2,500 energy price guarantee for a further three months, rather than lift it to £3,000 as planned.

The move, which is expected by energy companies, is an effort to limit increases in people’s bills until the summer, and would protect households from a 20% hike in bills.

A three-month extension would take us to July, when analysts expect Ofgem’s price cap to drop to around £2,100 per year (for a typical household), well below the government’s current guarantee.

The Times’s Steven Swinford says:

The energy price guarantee limits gas and electricity tariffs so that the typical household bill is no more than £2,500 a year. That ceiling was due to rise to £3,000 a year from April.

The Times has been told that Hunt will retain the guarantee for three more months until wholesale prices have fallen so far that it becomes unnecessary.

The government has told energy companies to prepare for the £2,500 energy price guarantee to remain in place. It will cost the government about £3 billion.

A Treasury spokesman said no decision had been made. However, a Whitehall source confirmed that the guarantee was now expected to remain at £2,500.

Filters BETA

Warm This Winter, a coalition of 50 leading UK charities demanding immediate government action to lower energy bills now, are organising a Mass Lobby to demand help with energy bills.

They warn that bills will be three times higher than two years ago if Jeremy Hunt doesn’t abandong his plan to lift the energy price guarantee to £3,000 per year for a typical household.

UK Chancellor of the Exchequer Jeremy Hunt has asked energy companies to prepare for the curent energy price guarantee of £2,500 per year to be extended for another three months, Bloomberg’s Joe Mayes reports.

Citing “a person familiar with the matter”, Mayes points out that the move follows pressure from charities and consumer groups:

The Treasury did not immediately respond to a request for comment.

The EPG was due to rise to £3,000 on April 1, and Hunt previously resisted calls to change course. He said in February that such a move would be too expensive for the Treasury. However, he’s since come under strong pressure from consumer groups and charities since to act, amid warnings of more people being pushed into fuel poverty.

Hunt is due to deliver his spring budget on March 15, and economists expect he’ll have an extra £10 billion to work with thanks to better-than-expected tax receipts and lower whiolesale energy prices. However, Treasury officials caution that the fiscal picture is still difficult and Hunt has limited room for manoeuvre.

Raising the EPG to £3,000 would have saved the government about £2.5 billion, according to consultancy Cornwall Insight.

Ireland’s domestic economy has fallen into a technical recession, new official statistics show.

Modified Domestic Demand (MDD), a broad measure of underlying domestic activity in the Republic of Ireland that covers personal, government and investment spending, fell by 1.3% in October-December.

That follows a 1.1% drop in the third quarter of the year – meaning two consecutive quarters of contraction, the technical definition of a recession.

MDD is used to strip out the impact of multinational companies based in Ireland, and ‘aircraft-related globalisation effects’, which can bolster gross domestic product statistics.

According to the Central Statistics Office, Ireland’s GDP rose by 0.3% in the final quarter of last year, a sharp downgrade on the 3.5% growth initially recorded.

For 2022 as a whole, Ireland’s GDP increased by 12.0%, the narrower Gross National Product (GNP) measure grew by 6.7%, while MDD increased by 8.2% last year.

The CSO’s assistant director general with responsibility for Economic Statistics, Jennifer Banim, says:

“The impacts of the conflict in Ukraine, the rise in inflation, and the continued unwinding of the COVID-19-related restrictions varied across the sectors of the economy in 2022 and today’s results show the overall annual impact and the underlying quarterly variations.

Extending the current subsidies on household energy bills until the summer would cost a lot less than forecast last year.

Barret Kupelian, senior economist at PwC, says wholesale energy prices are continuing to fall (they’re already down by two-thirds since in September).

So with Ofgem’s price cap dropping from £4,279 per year in January to £3,280 in April, for a typical user, the cost of the subsidy will fall.

In PwC’s predictions for the budget on 15 March, Kupelian says:

We can expect the Chancellor to continue to provide support to households through delaying the increase in the Energy Price Guarantee.

Wholesale energy prices are continuing on a downward trajectory and therefore the policy is likely to cost considerably less than forecast, and has been a substantial bulwark against inflationary pressures in the wider economy.”

PwC also predict Hunt will try to address the UK’s labour shortages in the budget:

We can expect some measures, such as health MOT programmes, to specifically support those who can return to work and also potentially targeted welfare measures to convert part-time workers into full-time workers.

Britain’s energy suppliers are expecting the government to U-turn on a planned cut to energy support for households – but have been told by officials to prepare two sets of bills for next month, my colleague Alex Lawson explains.

Chancellor Jeremy Hunt is under pressure to extend the energy price guarantee, a government policy which aims to limit annual household bills to £2,500 until the end of March.

Hunt, who is due to deliver the budget on 15 March, had been planning to make the guarantee less generous from April, raising it to £3,000. One-off support of £400 is also due to end in April.

Although, as flagged at 10.16am, Hunt is now said to be poised to extend the government’s £2,500 energy price guarantee until July.

Energy suppliers have been contacted by government officials with two sets of rates for units of gas and electricity – depending on whether Hunt decides to extend the support, Alex explains.

The Times are reporting that Jeremy Hunt is “poised” to extend the government’s £2,500 energy price guarantee for a further three months, rather than lift it to £3,000 as planned.

The move, which is expected by energy companies, is an effort to limit increases in people’s bills until the summer, and would protect households from a 20% hike in bills.

A three-month extension would take us to July, when analysts expect Ofgem’s price cap to drop to around £2,100 per year (for a typical household), well below the government’s current guarantee.

The Times’s Steven Swinford says:

The energy price guarantee limits gas and electricity tariffs so that the typical household bill is no more than £2,500 a year. That ceiling was due to rise to £3,000 a year from April.

The Times has been told that Hunt will retain the guarantee for three more months until wholesale prices have fallen so far that it becomes unnecessary.

The government has told energy companies to prepare for the £2,500 energy price guarantee to remain in place. It will cost the government about £3 billion.

A Treasury spokesman said no decision had been made. However, a Whitehall source confirmed that the guarantee was now expected to remain at £2,500.

The UK’s service sector returns to growth in February as business activity expanded at fastest pace since June 2022, a survey of purchasing managers has found.

Services firms reported that business activity and incoming new work both rose last month, for the first time since August 2022, as fears of an imminent recession fade.

Signs of a turnaround in client confidence, helped by reduced political uncertainty and hopes that inflationary pressures would continue to ease in the months ahead lifted the sector, according to the S&P Global / CIPS UK Services PMI.

The Services PMI, which measures activity in the sector, jumped to 53.5 in February, up from 48.7 in January and above the 50-point mark that shows stagnation.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“UK service providers moved back into expansion mode in February as fading recession fears and improving business confidence resulted in the strongest rise in new orders since May 2022.

However, elevated borrowing costs and stretched household finances remained constraints on growth.

There was “clear evidence” that input price inflation has peaked, with the latest increase in average cost burdens the weakest since June 2021, Moore explains, adding:

Service sector firms commented on lower fuel bills and transportation costs, alongside a gradual easing of broader inflationary pressures due to falling wholesale gas prices. However, many businesses also noted historically strong wage inflation and sharply rising food costs, especially those operating in the hotels and restaurants sector.

However, firms only cut the charges of their own services marginally.

The Economic Affairs Committee of the House of Lords has launched an inquiry into how the Bank of England’s operational independence was functioning.

The committee plan to examine the BoE’s Role and remit, its governance and culture, and the level of accountability for its actions.

They explain that that 2023 marks the 25th anniversary of the Bank of England Act 1998, which gave the UK’s central bank its independence and reformed its structure, responsibilities and functions.

But, the committee say they won’t review specific policy decisions.

The commitee is making a public call for written evidence, to be submitted by midday on 13 April 2023. You can learn more, and submit your views here. Short submissions are preferred.

Bank independence came under strutiny last summer during the race to succeed Boris Johnson as prime minister. Liz Truss said she wanted to change the Bank of England’s mandate so it did a better job dealing with inflation.

The BoE’s mandate is to set monetary policy (interest rates) to achieve the Government’s target of keeping inflation at 2% in the medium term.

The committee membership includes former BoE governor Mervyn King, now Lord King of Lothbury, who should have some good insights into how Bank independence works.

Nearly 50 offshore workers on several of BP’s North Sea installations have backed strike action in pursuit of a pay increase and overtime changes, British union Unite said on Friday.

The strike involves crew working on BP’s Andrew, Clair, Clair Ridge, ETAP, Glen Lyon and Mungo installations in the North Sea, with “a series of 24 and 48-hour stoppages”, Unite said (via Reuters)

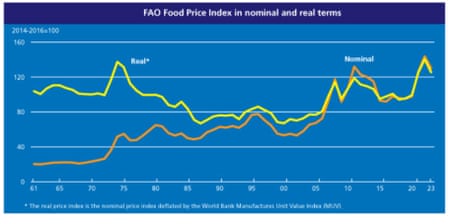

Global food prices continued to fall last month, a development that could bring relief to strugging households around the world.

The United Nations food agency’s world price index, which tracks the price of major food commodities, fell in February for a 11th consecutive month.

The Food and Agriculture Organization’s (FAO) price index averaged 129.8 points last month, down from 130.6 for January, the agency said on Friday. This is the lowest reading since September 2021.

The index is now down by almost 19% from a record high of 159.3 points hit last March following Russia’s invasion of Ukraine.

The FAO say that the “marginal decline” in the food index was due to significant drops in the price indices of vegetable oils and dairy, together with fractionally lower cereals and meat indices. Sugar price rose steeply, though.

UK grocery prices have surged by 17% over the last year, market research group Kantar reported this week, a record for food inflation as supermarkets lift prices sharply.

Fears that Europe’s companies are exploiting high inflation to increase their profit margins have prompted a warning from the European Central Bank that it is closely monitoring potential price gouging of consumers.

Money Saving Expert Martin Lewis believes there’s an 85% chance that the government will bow to pressure and maintain its current support for energy bills from April.

Lewis, who has been urging Jeremy Hunt not to lift energy bills by 20% next month, tells the Today programme that “I wouldn’t say it’s a done deal”.

But, he’s increasingly confident that the chancellor will execute a u-turn, as some energy firms now expect (see opening post for details).

Lewis has been saying all week that there was a greater than 50% chance of success in his campaign to freeze the Energy Price Guarantee at £2,500 per year for a typical household for another three months, from April until July.

(Ofgem’s price cap is expected to fall below the EPG in July, meaning household bills would drop to an estimated £2,100 per year).

Around 110 major charities now back this call, including Which?, Citizens Advice, Alzheimer’s Society and the Samaritans, and also trade body Energy UK.

Lewis fears raising energy bills in April will hurt people’s mental health, and damage consumer confidence --- which is bad for businesses -- and also push up inflation.

Lewis tells Radio 4’s Today Programme:

It’s a bit of a no-brainer. It’s been a tough slog to get it through.

Lewis explains that yesterday was the deadline for energy suppliers to tell prepayment meter providers what the new energy rates will be in April.

What I have heard, is that some of the firms have kept it at the current rates.

The point is that it’s easier for energy companies to keep the rates at the £2,500 per year level and then lift it to £3,000 (if Hunt doesn’t u-turn), than to hike and then try to backpay to customers, Lewis explains.

Lewis has heard that energy firms have not been told that the rate is staying. But, they have been told “there is an attempt to keep the rate at £2,500”, and explains:

We are not at the smoking gun stage that this is definitely happening, but I would say we are at 85% likelihood that the price won’t be going up.

Earlier this week, energy Secretary Grant Shapps said he was “very sympathetic” to calls to protect households from the increase.

Nearly half (49%) of people have put off vehicle repairs due to rising living costs, a survey has found.

More than a third (39%) are concerned their car will break down due to neglect while 56% are concerned about how they would be able to afford any repairs, the research by Censuswide among more than 2,100 people whose household owns a vehicle found.

More than half (54%) of motorists also said they had started trying to use their vehicle less to save money, according to the survey in February for Nationwide Building Society’s FlexPlus account.

James Broome, head of current accounts at Nationwide Building Society, said: “

Keeping on top of car maintenance is a key step to avoiding the nasty surprise of a large one-off expense.

“Also, having a reliable breakdown cover in place will mean that you won’t be left stranded.”

(via PA Media).

Elsewhere in the cost of living crisis, the cost of both petrol and diesel fell for the fourth consecutive month in February at the UK pumps.

Diesel drivers continue to be overcharged, though, motorist body the RAC argues.

Last month, the average price of a litre of unleaded fell by a penny to 147.72p, while diesel dropped 3.19p to 167.19p.

This means it now costs £81.25 to fill a 55-litre family petrol car £81.25, compared with over £100 back in June, or £91.95 for diesel.

Diesel drivers are paying “a needlessly high price” every time they fill up, the RAC says, though:

Despite there being just a 6p difference between the wholesale prices of both diesel and petrol throughout all of February, diesel pump prices are currently a colossal 20p more than petrol.

This means anyone filling a diesel car is, the RAC calculates, paying around £7 more per tank than they should be if diesel was being sold at a fairer price of around 155p a litre.

Sales of new diesel cars have been dropping steadily in recent years, since the Volkswagen emissions scandal, while drivers in London have abandoned diesel cars six times faster than those in the rest of the UK since plans to expand the capital’s clean air zone were announced.

In the City, hopes that British chip technology firm Arm Ltd could list on the London stock market in 2023 have been dashed.

Arm’s owners, Japanese conglomerate SoftBank Group, have said they will pursue a US-only listing this year, ending speculation about a primary or a secondary listing in the UK.

Arm isn’t completely ruling out an eventual London listing, saying it intended to consider a subsequent IPO there in due course.

But, Arm Chief Executive Officer Rene Haas said in a statement that:

“After engagement with the British Government and the Financial Conduct Authority over several months, SoftBank and Arm have determined that pursuing a U.S.-only listing of Arm in 2023 is the best path forward for the company and its stakeholders,”

Arm used to be listed in London, before accepting a £24.3bn offer from Softbank in July 2016 (when the slump in the pound after the Brexit vote made it cheaper to buy a UK company).

Cambridge-based ARM designs the chips that power most of the world’s smartphones.

The decision to float in New York is a blow to the UK government’s efforts to boost the City of London, and to attract more high-tech firms to list here.

Victoria Scholar, head of investment at interactive investor, explains:

“Softbank-owned Arm said it is aiming for a US IPO this year, as expectations fade that the British chipmaker could be heading for a London-listing. This is a blow to the UK government and the City of London post Brexit as Arm pins its hopes on New York, where some of the world’s biggest tech companies have floated including Apple and Tesla.

While the FTSE 100 enjoyed relative resilience last year partly because of its lack of technology giants, allowing it to avoid the ‘tech-wreck’, this has also long been a criticism of the UK blue chip index which has struggled to attract key behemoths in the sector. There have also been some high profile disasters in UK tech with Deliveroo’s IPO flop and THG’s share price slide.

Arm’s abandonment of London is another kick in the teeth for the Square Mile’s attractiveness among international investors as a go-to destination for technology giants.”

Jeremy Hunt can afford to extend the current energy bill support beyond April, according to Simon French, chief economist at UK investment bank Panmure Gordon.

French points out that last September, when the energy price guarantee was announced, the wholesale gas price was about three times the level it is today.

UK wholesale gas is trading around 120p per therm today, and was 360p/therm in early September.

That means that the amount the Treasury will give to energy companies to cap prices for households and businesses is ‘considerably lower’ than expected in this financial year, and into the next financial year (from April), French told the Today Programme, adding:

Do I expect them to reallocate some of that money to keep the energy price guarantee at its current £2500 level for households? Yes I do.

It’s clear the energy industry expects government support to continue beyond April, says the BBC’s Simon Jack.

He cautions, though, that it isn’t a 100% done deal.

But with one company preparing their bills on the expectation that support will be maintained, and others waiting for a decision to be announced, it appears that the pressure from campaigners such as Martin Lewis has had an effect.

Jack tells the Today programme:

If companies are getting hints that this is going to happen, to the extent they are actually changing their processes and updating their bills in a different way, it’s a pretty clear indication that the intense pressure has actually had an effect and the government is preparing to bow to that pressure.

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

Hopes are growing that the UK government may reverse plans to lift the cost of energy for households in April.

The BBC reports this morning that some energy firms are preparing to amend bills in expectation that the government will keep support at or near current levels.

Currently, the Energy Price Guarantee limits the cost of gas and electricity to levels where a typical household bill is £2,500 per year. That limit is set to rise to £3,000 in April, and there have been many calls for ministers to change course and maintain current subsidies.

According to the BBC’s Simon Jack, those calls may be heeded. He writes:

At the moment, the government is limiting the typical household bill to £2,500 a year, plus a £400 winter discount, which will also end from April.

From 1 April the help is scheduled to be scaled back, which will push bills up.

Fuel poverty campaigners have said the number of households struggling to afford bills could rise from 6.7 million to 8.4 million as a result of the April rise.

However, industry sources told the BBC that some energy companies have already started amending future bills to reflect that energy help will continue at or very near to current levels beyond 1 April.

Earlier this week, a Downing Street spokesperson indicated the plan to raise EPG to £3,000 per year was being re-examined, saying: “All I would say on this is it’s something we are just keeping under review.”

Money saving expert Martin Lewis predicted earlier this week that Jeremy Hunt could maintain current support, saying there was a ‘better than 50/50 chance’ energy bills will not rise in April.

Ofgem, the energy regulator, cut its energy price cap to £3,280, reducing the maximum that a supplier can charge by almost £1,000 per year.

That means that the cost to the government of freezing bills is much lower than over the winter, as wholesale energy costs have dropped sharply since their peaks last year.

If Hunt doesn’t u-turn, and freeze the EPG at its current level, the cost of living crisis will intensify for millions of households.

Citizens Advice predicted this week that unless the government changes course on planned reductions to the level of support for households under the Energy Price Guarantee, the number of people unable to afford their bills will double, from one in 10 to one in five.

The agenda

7am GMT: German trade balance for January

9am GMT: Eurozone service sector PMI report for February

9.30am GMT: UK service sector PMI report for February

10am GMT: Eurozone purchasing prices index (PPI) for January

3pm GMT: US service sector PMI report for February

4pm GMT: Andrew Hauser, Bank of England executive director for markets, gives speech on the LDI pension scheme crisis (text released at 11am)

https://news.google.com/rss/articles/CBMimgFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21hci8wMy9lbmVyZ3ktZmlybXMtdWstZ292ZXJubWVudC1zdXBwb3J0LXByaWNlLWd1YXJhbnRlZS1lcGctZWNvbm9teS1zZXJ2aWNlcy1jb3N0LW9mLWxpdmluZy1idXNpbmVzcy1saXZl0gGaAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvbWFyLzAzL2VuZXJneS1maXJtcy11ay1nb3Zlcm5tZW50LXN1cHBvcnQtcHJpY2UtZ3VhcmFudGVlLWVwZy1lY29ub215LXNlcnZpY2VzLWNvc3Qtb2YtbGl2aW5nLWJ1c2luZXNzLWxpdmU?oc=5

2023-03-03 12:44:48Z

1816377370

Tidak ada komentar:

Posting Komentar