Good morning.

The collapse of Silicon Valley Bank is gripping the financial markets, as global bank shares slide despite reassurances from President Joe Biden on Monday.

There have been fresh losses in Asia-Pacific stock markets today, as bank stocks continues to fall.

Japan’s Topix Banks index is on track for its worst day since March 2020, early in the pandemic, currently down 7.4%. Mitsubishi UFJ Financial Group is down 8.66%, with Mizuho Financial Group losing 7.1%

This has pulled Japan’s Topix index down by 2.7%.

Elsewhere, Hong Kong’s Hang Seng index has dropped by 2.35%.

South Korea’s KOSPI index has lost 2.4%, with its Hana Financial Group down almost 4%. Australia’s S&P/ASX is down 1.4%.

Stephen Innes, managing partner at SPI Asset Management, says:

The collapse of Silicon Valley Bank on Friday has brought on the highest volatile market conditions of 2023 so far.

Shares in a number of America’s regional banks closed sharply lower on Monday night, hours after president Joe Biden tried to reassure depositors and investors, saying:

Americans can rest assured that our banking system is safe.

Your deposits are safe.

On Sunday night, the Federal Reserve and Treasury boosted lenders’ access to quick cash, and guaranteed deposits at Signature Bank (which was closed down on Sunday night) and Silicon Valley Bank.

But other regional banks still came under pressure, with San Francisco-based First Republic losing 62% and Arizona-headquartered Western Alliance Bank off 47%.

On Monday, there were heavy falls on European stock markets, with the UK’s FTSE 100 index sheddding 200 points, or 2.58%, to end at 7548 points, the lowest since the start of January.

Markets are expected to open calmer today, though….

Silicon Valley Bank’s collapse last week was the largest bank failure in over a decade.

It came after SVB made a $1.8bn loss on a sale of securities, due to the drop in prices of government bond and mortgage-backed securities as interest rates have risen. That left it struggling to meet withdrawal requests from customers.

Expectations of further sharp rises in borrowing costs are being reassessed too, with central banks likely to be warier of breaking another part of the financial system.

Yesterday was “a wild session on Wall Street as the failure of Silicon Valley Bank revealed the unintended consequence of the Fed’s tightening cycle”, says IG analyst Tony Sycamore:

As noted in recent months and in wider financial circles, the Fed has historically continued tightening until something breaks.

While the Fed’s move to backstop uninsured deposits will likely prevent further banking runs, a potential banking crisis threat trumps high inflation any day of the week.

Reflecting this, the rates market experienced the most significant 2-day fall in U.S. treasury yields since the 1987 crash (yields are now at 4% from 5.08% last week). After being 70% priced for a 50bp rate hike last week, there is now just 12bps priced for next week’s FOMC meeting.

The agenda

7am GMT: UK unemployment report

8am GMT: European finance ministers hold an ECOFIN conference

10.15am GMT: MPs hold hearing on “Prepayment meters: warrants and forced installations”

12.30pm: US CPI inflation report for February

Filters BETA

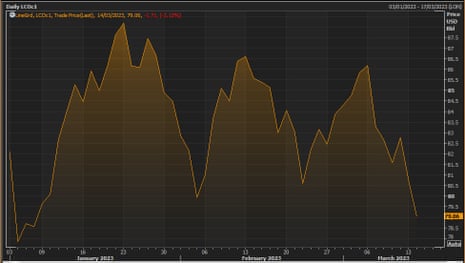

Oil prices have dropped again today, as the fallout from the collapse of Silicon Valley Bank rattles markets.

With fears of a fresh financial crisis high, Brent crude has dropped by 2% to $79 per barrel, close to its lowest level this year.

Oil also weakened yesterday, as the failure of SVB over the weekend stirred fears of a potential recession.

The turmoil that has erupted in the financial system has triggered widespread risk aversion, says Craig Erlam, senior market analyst at OANDA.

If we see markets settle down, that could prevent a break of the lows but oil traders, like those elsewhere, will remain nervous about the prospect of further turbulence.

Suddenly, a break below the lows looks a much greater risk which may keep pressure on in the short term.

Rating agency Moody’s has placed six US lenders, including First Republic Bank, at risk of a downgrade, following the collapse of Silicon Valley Bank.

First Republic, Western Alliance Bancorp, Intrust Financial Corp., UMB Financial Corp., Zions Bancorp. and Comerica are all on review for a downgrade.

It’s the latest sign of concern over the health of regional financial firms – whose shares all fell sharply on Monday.

Moody’s pointed to concerns over the lenders’ reliance on uninsured deposit funding and unrealized losses in their asset portfolios.

In a statement, Moody’s cited the “material” amount of deposits above the Federal Deposit Insurance Corporation threshold of $250,000, saying:

“The review for downgrade reflects the extremely volatile funding conditions for some US banks exposed to the risk of uninsured deposit outflows.”

Moody’s also downgraded Signature Bank and withdrew its credit rating. That’s not a surprise, though given the lender was shut down over the weekend…

In the energy sector, British Gas owner Centrica plans to extend the lives of two nuclear power stations by two years, as part of efforts to strengthen the UK’s energy security.

Heysham 1 on the north-west coast of England near Lancaster and the Hartlepool power station in County Durham are now expected to close in March 2026.

These extensions are expected to add 6TWh (terawatt hour) to Centrica’s electricity generation volumes between 2024 and 2026. This is equivalent to around 70% of Centrica’s total electricity generated from nuclear power last year.

Chris O’Shea, Centrica’s chief executive, said:

“I’m delighted we’ve been able to work with EDF to strengthen the UK’s energy security by extending the life of these critical power stations.

“This continues our action to bolster security of supply in our core markets which includes reopening the Rough gas storage facility in the UK, sanctioning new gas-fired electricity generation capacity in Ireland, and securing increased volumes of gas and renewable power for our customers. We will continue to focus on supporting energy security in our core markets during these uncertain times.”

The news comes after a similar announcement from EDF last week.

Certain aspects of the Silicon Valley Bank situation were unique, UBS Wealth Management point out this morning:

It had the highest ratio of securities to total assets of any US bank; a far higher-than-average proportion of its depositors were corporate clients in the technology sector; and its uninsured deposit mix was one of the highest in the industry.

That made it especially vulnerable both to deposit outflows and to mark-to-market losses when it attempted to meet those outflows.

However, to some extent, the fundamental challenge faced by Silicon Valley Bank is also faced by other US banks, UBS say.

Mark Haefele, chief investment officer at UBS Global Wealth Management, explains:

“From here, in order to minimize the risk of deposit outflows, many smaller banks may be forced to further increase deposit rates.

As demonstrated by equity market performance on Monday, this is not good for any bank’s profitability, though those banks with higher capital ratios, smaller pools of securities relative to total assets, strong brands, and diversified funding sources should be better able to weather the current market dynamics.”

Investors are also on edge today because we get the latest US inflation report at 12.30pm UK time.

The annual Consumer Prices Index is expected to drop to 6% in February, down from 6.4% in January.

But core inflation is only expected to dip slightly, to 5.5% from 5.6%.

In normal times, high inflation would spur the Federal Reserve to keep raising interest rates to squeeze out price pressures.

But having seen Silivon Valley Bank blow up, having been caught out by the rapid rise in borrowing costs which hit the value of its bonds, the Fed may be more reluctant to tighten policy further.

But if inflationary pressures remain hot, the Fed will still feel pressure to act….

The Bank of Japan says Japanese financial institutions have sufficient capital buffers to absorb losses caused by various external factors, including risks caused by the collapse of Silicon Valley Bank.

A BOJ official told reporters in Tokyo:

“Japanese financial institutions’ direct exposure to Silicon Valley Bank is small, and thus the impact is likely limited,”

The BoJ released an annual report that looks at the strength of Japan’s financial institutions.

It found that they have continued to channel funds to borrowers smoothly, despite stress factors such as supply constraints and rising overseas interest rates.

But, the report also pointed to challenges facing regional banks, such as analysing the impact of heightened market volatility on their portfolios….

“Some regional financial institutions have suffered a substantial increase in valuation losses” and failed to adequately assess their risk tolerance against profits, it said.

The collapse of Silicon Valley Bank is not expected to affect the euro zone’s banks, Greek central bank chief Yannis Stournaras has said.

Stournaras, a member of the ECB’s Governing Council, told Kathimerini newspaper:

“We don’t see SVB (Silicon Valley Bank) having an impact on the euro zone’s banks or the Greek ones.”

What a difference a decade makes. 10 years ago, Stournaras was Greece’s finance minister, when the eurozone debt crisis threatened to push Greece into bankrupcy. Today, Greece is hoping to secure an investment-grade credit rating.

Large US banks are being inundated with requests from customers trying to transfer funds from smaller lenders, the Financial Times is reporting.

JPMorgan Chase, Citigroup and Bank of America are among the large financial institutions are trying to accommodate customers wanting to move deposits quickly from Silicon Valley Bank and other regional lenders.

They are taking extra steps to speed up the normal sign-up or “onboarding” process, according to several people familiar with the matter.

The failure of SVB has caused what executives say is the biggest movement of deposits in more than a decade.

Wealthier customers, who have more than the $250,000 maximum guaranteed by federal insurance, are among those looking to move balances into larger banks (although all deposits at SVB and Signature Bank are guaranteed by the package announced on Sunday night).

One senior banker, referring to Chicago’s busy aviation hub, said:

“The calls have been coming in today like airplanes stacked on a snowy day at O’Hare airport.”

The European banks index has dipped in early trading, down 0.3%.

That indicates some calm in Europe this morning, after banking stocks posted their biggest losses in a year on Monday.

London’s stock market is open, and bank shares are continuing to drop – although not as sharply as yesterday.

HSBC are down 1.8%, and Standard Chartered has lost 1.6%.

The blue-chip FTSE 100 index has dipped by 0.3%, or 20 points, to 7528 points, the lowest since 3 January, on top of Monday’s 200-point tumble.

Energy stocks are also weaker, as the oil price comes under pressure.

Victoria Scholar, head of investment at interactive investorsays:

“European markets have opened mixed with the FTSE 100 underperforming. Land Securities, British Land and Rightmove are among the outperformers on the UK index amid hopes of a dovish tilt from the Bank of England.

Most European banks continue to face selling pressure with HSBC and Standard Chartered near the bottom of the FTSE 100. Credit Suisse is leading the declines across European financials after the Swiss lender said it found ‘material weakness’ in its internal financial reporting controls, adding to its woes.

Markets in Asia fell sharply overnight with the Nikkei, the Kospi and the Hang Seng down more than 2% each. In Japan its biggest banks suffered steep losses with the TOPIX Banks index down by more than 7% as President Biden’s address failed to soothe investors.

Elsewhere in banking this morning, Credit Suisse’s bonds are falling after it released its delayed annual report.

The annual report, delayed from last week, showed that Credit Suisse has identified “material weaknesses” in its internal controls over financial reporting and said it had not yet stemmed customer outflows.

It says:

“As of December 31, 2022, the Group’s internal control over financial reporting was not effective, and for the same reasons, management has reassessed and has reached the same conclusion regarding December 31, 2021.”

Credit Suisse said customer “outflows stabilized to much lower levels but had not yet reversed as of the date of this report”

Some Credit Suisse bond prices have hit record lows; yesterday, the cost of insuring its debt hit record highs.

More investors are expecting America’s central bank to start cutting interest cuts by the end of the year, following the collapse of Silicon Valley Bank.

The CME FedWatch Tool, which tracks investor expectations for the trajectory of rates, suggests that the Federal Reserve could raise its benchmark rate by a quarter-point, or 25 basis points, to 4.75%-5.00%, at its meeting next week.

But by December, the markest suggest rates will have fallen back to around 4%-4.25%, or half a point lower than current levels.

There has been a “Titanic repricing” in expectations for US interest rate moves this year, say ING.

In the US, markets now see only a 50% chance of a 25bp hike in March, and fully price in 67bp of cuts by year-end.

Jim Reid, strategist at Deutsche Bank, says yesterday’s dramatic session was “up there with some of the wilder days I can remember”.

I always thought that with inflation where it was, that central banks would keep hiking until they broke something, which was especially likely with the yield curve so inverted. Now they have broken something, is that enough for a pause?

Much will depend on whether markets and contagion risk can calm quickly enough. If the FOMC meeting was today I strongly suspect they wouldn’t hike but a week is a long time in these markets.

Global financial stocks have lost $465bn in market value in two days as investors cut exposure to lenders from New York to Japan in the wake of Silicon Valley Bank’s collapse, Bloomberg has calculated.

They explain:

Losses widened today, with the MSCI Asia Pacific Financials Index dropping as much as 2.7% to the lowest since Nov. 29. Mitsubishi UFJ Financial Group Inc. slid as much as 8.3% in Japan, while South Korea’s Hana Financial Group Inc. fell 4.7% and Australia’s ANZ Group Holdings Ltd. lost 2.8%.

There are concerns that financial firms could see an impact from their investments in bonds and other instruments on the SVB-induced worry. Treasury yields plunged Monday amid expectations the Federal Reserve will hold off raising rates due to turmoil in the banking system.

Volatility is likely to remain the name of the game in the markets today, say ING.

US stock futures point at a marginally positive open this morning, but markets are constantly monitoring incoming news on the health of other financial institutions, in particular US regional banks.

SVB Financial Group and two top executives have been sued by shareholders over the collapse of Silicon Valley Bank, as global stocks continued to suffer on Tuesday despite assurances from US president Joe Biden.

The bank’s shareholders accuse SVB Financial Group chief executive Greg Becker and chief financial officer Daniel Beck of concealing how rising interest rates would leave its Silicon Valley Bank unit “particularly susceptible” to a bank run.

The proposed class action was filed on Monday in the federal court in San Jose, California.

It appeared to be the first of many likely lawsuits over the demise of Silicon Valley Bank (SVB), which US regulators seized on 10 March after a surge of deposit withdrawals.

Good morning.

The collapse of Silicon Valley Bank is gripping the financial markets, as global bank shares slide despite reassurances from President Joe Biden on Monday.

There have been fresh losses in Asia-Pacific stock markets today, as bank stocks continues to fall.

Japan’s Topix Banks index is on track for its worst day since March 2020, early in the pandemic, currently down 7.4%. Mitsubishi UFJ Financial Group is down 8.66%, with Mizuho Financial Group losing 7.1%

This has pulled Japan’s Topix index down by 2.7%.

Elsewhere, Hong Kong’s Hang Seng index has dropped by 2.35%.

South Korea’s KOSPI index has lost 2.4%, with its Hana Financial Group down almost 4%. Australia’s S&P/ASX is down 1.4%.

Stephen Innes, managing partner at SPI Asset Management, says:

The collapse of Silicon Valley Bank on Friday has brought on the highest volatile market conditions of 2023 so far.

Shares in a number of America’s regional banks closed sharply lower on Monday night, hours after president Joe Biden tried to reassure depositors and investors, saying:

Americans can rest assured that our banking system is safe.

Your deposits are safe.

On Sunday night, the Federal Reserve and Treasury boosted lenders’ access to quick cash, and guaranteed deposits at Signature Bank (which was closed down on Sunday night) and Silicon Valley Bank.

But other regional banks still came under pressure, with San Francisco-based First Republic losing 62% and Arizona-headquartered Western Alliance Bank off 47%.

On Monday, there were heavy falls on European stock markets, with the UK’s FTSE 100 index sheddding 200 points, or 2.58%, to end at 7548 points, the lowest since the start of January.

Markets are expected to open calmer today, though….

Silicon Valley Bank’s collapse last week was the largest bank failure in over a decade.

It came after SVB made a $1.8bn loss on a sale of securities, due to the drop in prices of government bond and mortgage-backed securities as interest rates have risen. That left it struggling to meet withdrawal requests from customers.

Expectations of further sharp rises in borrowing costs are being reassessed too, with central banks likely to be warier of breaking another part of the financial system.

Yesterday was “a wild session on Wall Street as the failure of Silicon Valley Bank revealed the unintended consequence of the Fed’s tightening cycle”, says IG analyst Tony Sycamore:

As noted in recent months and in wider financial circles, the Fed has historically continued tightening until something breaks.

While the Fed’s move to backstop uninsured deposits will likely prevent further banking runs, a potential banking crisis threat trumps high inflation any day of the week.

Reflecting this, the rates market experienced the most significant 2-day fall in U.S. treasury yields since the 1987 crash (yields are now at 4% from 5.08% last week). After being 70% priced for a 50bp rate hike last week, there is now just 12bps priced for next week’s FOMC meeting.

The agenda

7am GMT: UK unemployment report

8am GMT: European finance ministers hold an ECOFIN conference

10.15am GMT: MPs hold hearing on “Prepayment meters: warrants and forced installations”

12.30pm: US CPI inflation report for February

https://news.google.com/rss/articles/CBMihgFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21hci8xNC9nbG9iYWwtbWFya2V0cy1zaWxpY29uLXZhbGxleS1iYW5rLWNvbGxhcHNlLWJhbmtpbmctc2hhcmVzLWJvai1lY2ItYnVzaW5lc3MtbGl2ZdIBhgFodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21hci8xNC9nbG9iYWwtbWFya2V0cy1zaWxpY29uLXZhbGxleS1iYW5rLWNvbGxhcHNlLWJhbmtpbmctc2hhcmVzLWJvai1lY2ItYnVzaW5lc3MtbGl2ZQ?oc=5

2023-03-14 10:20:10Z

1792546704

Tidak ada komentar:

Posting Komentar