Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Andrew Bailey, the governor of the Bank of England, has appealed to businesses to avoid price rises but expressed confidence that the rises in the cost of living would slow sharply in the early summer.

Speaking on BBC radio 4’s Today programme, he admitted that inflation had not yet eased, after it unexpectedly rose to 10.4% in February. The Bank raised interest rates to 4.25% yesterday.

Companies should set prices in a way that do not embed inflation at current levels because it could hurt people and would mean higher interest rates, he said.

If all prices try to beat inflation then we will get domestic inflation that will start repeating itself. Higher inflation really benefits nobody and particularly hurts the least well-off in society.

Rising inflation hits the least well-off hardest because they spend a bigger proportion of their income on food and energy.

Bailey said he hasn’t seen evidence of profiteering by companies, but other policymakers are worried that after the pandemic and Brexit, businesses face less European competition, which makes the UK more inflation-prone.

Last year, Bailey called on workers not to ask for big pay rises, sparking a backlash from unions. As wage growth has evaporated, he’s now asking firms to stop raising prices further.

His comments came as government figures released on Thursday showed that the average council tax in the UK will exceed £2,000 for the first time next month.

As local authorities struggle under growing financial pressures, it emerged that the average bill for band D properties will go up by £99 to £2,065 for 2023-24.

In towns and cities areas outside London bills rise by 5.1% to an average of £2,059, while rural parts of the country will see an increase of 5% to just below £2,140.

The Agenda

8.15am GMT: France S&P Global PMIs flash for March

8.30am GMT: Germany S&P Global PMIs flash for March

9am GMT: Eurozone S&P Global PMIs flash for March

9.30am GMT: UK S&P/CIPS Global PMIs flash for March

12.30pm GMT: US Durable goods orders for February

1.45p GMT: US S&P Global PMIs flash for March

4pm GMT: Bank of England policymaker Catherine Mann speaks

Filters BETA

Stock markets are in the red again, with the FTSE 100 index down 67 points, or 0.9%, at 7,431.

Germany’s Dax has lost 133 points, or 0.9%, to 15,076 while France’s CAC fell 65 points, or 0.9% to 7,072 and Italy’s FTSE MiB has tumbled 309 points to 26,173, a 1.2% drop.

Crude oil prices have also fallen, with Brent crude, the global benchmark, down 0.4% at $75.59 a barrel.

The pound is trading 0.3% lower against the dollar at $1.2250 but has edged up 0.1% versus the euro to €1.1353.

Bailey went on to say that the economic picture has brightened considerably.

The prospects for the economy in terms of growth are now better, considerably better, and it is reasonable to say that there’s a pretty strong likelihood that we will avoid a recession this year.

But we’ve still got to put in place the conditions for much stronger growth in the economy and sustainable growth in the economy.

We’ve got to build a new engine of growth in this country to grow the economy.

Michael Hewson, chief market analyst at CMC Markets UK, tweeted:

Here are more comments from Bank of England governor Andrew Bailey, speaking on BBC radio 4’s Today programme.

We’ve got to get inflation down. Inflation is too high at the moment. Now we think that it will fall sharply really from the early summer throughout the rest of the year. And we’re pretty confident about that.

But it hasn’t come down yet and we had some news earlier this week which was a bit higher than we expected it to be, there were probably some temporary factors in there. But there was a message in there that we’ve not got to the point where we’re getting the sharp fall that we expect. We weren’t expecting it immediately but we’ve got to see that happen. That’s my message, that’s what lies behind the [rate] increase [on Thursday].

Inflation “is way too high at the moment and we’ve got to get it back to the 2% target.”

I believe there are powerful forces that will bring it down because unless something really bad happens over the rest of this year, we’re going to see a reversal of what we saw last year in terms of energy prices.

In an appeal to businesses, he said:

I would say to people who are setting prices: Please understand if we get inflation embedded interest rates will have to go up further.

When companies set prices I understand that they have to reflect the costs that they face. But what I would say please is that when we are setting prices in the economy and people are looking forwards we do expect inflation to come down sharply this year and I would just say please bear that in mind.

Former Guardian journalist Tom Clark, a fellow of the Joseph Rowntree Foundation and a contributing editor to Prospect, tweeted:

Victoria Scholar, head of investment at interactive investor, has looked at consumer confidence and the wider economy.

Sentiment improved to a one-year high but remains gloomy by historic standards. The personal finance measure however remains low as inflation erodes take home pay and cost-of-living pressures persist.

Economic data, though still weak, has started to show incipient signs of improvement in the UK with house prices, retail sales, confidence and PMI figures picking up off the lows as the mini-budget chaos fades into the rear-view mirror and the Bank of England approaches the end of the rate hiking cycle. Inflation however remains a sticking point, having unexpectedly picked up again in February, going against recent months of improvement since October’s peak.

The jump in retail sales came as consumer confidence improved slightly. GfK’s consumer confidence index rose by two points to -36 in March.

Joe Staton, client strategy director at GfK, said:

A small improvement in the overall index score this month masks continuing concerns among consumers about their personal financial situation. This measure best reflects the financial pulse of the nation and it remains weak, with the figure for the coming year down three to -21 and an unchanged score for the past 12 months of -26.

Forecasts that headline inflation will fall this year have proved premature, given Wednesday’s announcement of an unexpected increase. Wages are not keeping up with rising prices and the cost-of-living crisis remains a stark reality for most.

The recent budget will bring relief to some sections of the population, but for now many people are simply looking to survive day-by-day. Just having enough money to live right and pay the bills remains the number one concern for consumers across the UK.

Nicholas Hyett, investment analyst at the investment service Wealth Club, said:

The UK is finding its shopping habit hard to kick it would seem. Retail sales volumes have come in stronger than expected for the second month this year despite the cost of living squeeze.

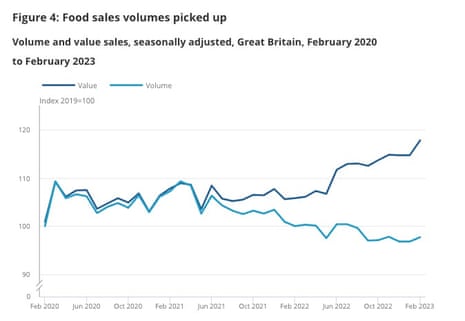

But beneath that headline, there’s clear evidence that shoppers are being careful with their money. Growth in non-food sales was driven by discounters and second hand shops, while the rise in food volumes is attributed to people choosing to eat in and avoid pricey meals out. Shoppers may be more willing to spend, but only when there’s a bargain to be had.

Longer term, sales volumes remain lower than they were this time last year. With the Bank of England expecting the UK economy to hold up better than previously expected, that provides room for several months more sales growth. Whether shoppers find the confidence to return to the mid-market space though remains to be seen.

Aled Patchett, head of retail and consumer goods at Lloyds Bank, is more upbeat:

A rise in sales for February suggests that consumer confidence is heading in the right direction after a difficult few months. While inflation remains higher than hoped, retailers will be buoyed to see consumers spending on little luxuries and celebrations.

Those in the industry will be hopeful that warmer temperatures and a fall in gas prices will be the spark needed to free up disposable income amongst consumers and leads to a longer period of growth.

Despite a surprise uptick in inflation earlier this week, we still expect levels to wane later in the year. Retailers will be hoping it’s the shot in the arm consumers need to loosen their grip on purse strings.

Ashley Webb, UK economist at Capital Economics, said it’s too soon to conclude February’s rebound in retail sales will be sustained.

At face value, these data further add to the view that the recent resilience in activity is still holding up. But when households’ finances are under pressure, it is possible that any improvement in retail sales will be just be met by a softening in non-retail spending (such as restaurants).

And although the worst of the falls in real household incomes are in the past, the full drag on activity from higher interest rates has yet to be felt. As such, the coming months may still be a struggle for retailers as the economy tips into recession.

Retail sales in the UK were much stronger than expected last month, as people turned to discount stores and cut back on eating out and takeaways because of cost-of-living pressures.

Retail sales volumes increased by 1.2% in February from the month before, compared with January’s 0.9% rise (revised higher from 0.5%) and analyst expectations of a 0.2% gain. It was the biggest monthly rise since October. The figures were released by the Office for National Statistics.

However, sales were down 0.3% in the three months to February when compared with the previous three months.

The ONS director of economic statistics, Darren Morgan, said:

Retail grew sharply in February with sales returning to their pre-pandemic level.

However, the broader picture remains more subdued, with retail sales showing little real growth, particularly over the last eighteen months with price rises hitting consumer spending power.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Andrew Bailey, the governor of the Bank of England, has appealed to businesses to avoid price rises but expressed confidence that the rises in the cost of living would slow sharply in the early summer.

Speaking on BBC radio 4’s Today programme, he admitted that inflation had not yet eased, after it unexpectedly rose to 10.4% in February. The Bank raised interest rates to 4.25% yesterday.

Companies should set prices in a way that do not embed inflation at current levels because it could hurt people and would mean higher interest rates, he said.

If all prices try to beat inflation then we will get domestic inflation that will start repeating itself. Higher inflation really benefits nobody and particularly hurts the least well-off in society.

Rising inflation hits the least well-off hardest because they spend a bigger proportion of their income on food and energy.

Bailey said he hasn’t seen evidence of profiteering by companies, but other policymakers are worried that after the pandemic and Brexit, businesses face less European competition, which makes the UK more inflation-prone.

Last year, Bailey called on workers not to ask for big pay rises, sparking a backlash from unions. As wage growth has evaporated, he’s now asking firms to stop raising prices further.

His comments came as government figures released on Thursday showed that the average council tax in the UK will exceed £2,000 for the first time next month.

As local authorities struggle under growing financial pressures, it emerged that the average bill for band D properties will go up by £99 to £2,065 for 2023-24.

In towns and cities areas outside London bills rise by 5.1% to an average of £2,059, while rural parts of the country will see an increase of 5% to just below £2,140.

The Agenda

8.15am GMT: France S&P Global PMIs flash for March

8.30am GMT: Germany S&P Global PMIs flash for March

9am GMT: Eurozone S&P Global PMIs flash for March

9.30am GMT: UK S&P/CIPS Global PMIs flash for March

12.30pm GMT: US Durable goods orders for February

1.45p GMT: US S&P Global PMIs flash for March

4pm GMT: Bank of England policymaker Catherine Mann speaks

https://news.google.com/rss/articles/CBMingFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21hci8yNC9iYW5rLW9mLWVuZ2xhbmQtY2hpZWYtd2FybnMtZnVydGhlci1yYXRlLWhpa2VzLWZpcm1zLXJhaXNlLXByaWNlcy1jb3VuY2lsLXRheC1yZXRhaWwtc2FsZXMtYnVzaW5lc3MtbGl2ZdIBngFodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL21hci8yNC9iYW5rLW9mLWVuZ2xhbmQtY2hpZWYtd2FybnMtZnVydGhlci1yYXRlLWhpa2VzLWZpcm1zLXJhaXNlLXByaWNlcy1jb3VuY2lsLXRheC1yZXRhaWwtc2FsZXMtYnVzaW5lc3MtbGl2ZQ?oc=5

2023-03-24 07:39:00Z

1852383049

Tidak ada komentar:

Posting Komentar