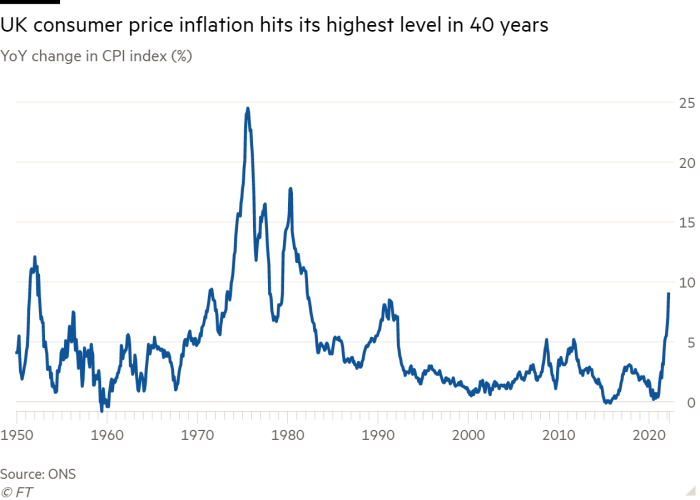

Chancellor Rishi Sunak on Wednesday night warned that “the next few months will be tough”, after UK inflation hit 9 per cent in April, its highest level in over 40 years and more than any other G7 economy.

Consumer price inflation is almost double the rate the Bank of England expected only six months ago; Andrew Bailey, BoE governor, had claimed the problem would be “temporary”.

With economic activity slowing sharply during the first quarter of the year, the UK economy is suffering its worst bout of stagflation — weak growth alongside high inflation — since the second oil shock of the 1970s.

The chancellor, speaking at a CBI dinner, said: “There is no measure any government could take, no law we could pass, that can make these global forces disappear overnight.”

Sunak promised he would cut business taxes in his autumn Budget to encourage investment, although a pre-announced rise in corporation tax from 19p to 25p is still scheduled to go ahead next April.

The chancellor has also warned recently that he would put a windfall tax on the profits of oil and gas companies unless they ramped up investment plans.

Sunak, who is preparing a summer emergency package aimed at poor households to alleviate soaring gas and electricity bills, has left “on the table” the possibility of the levy to help pay for the measure.

The CPI figure rose from 7 per cent in March to 9 per cent in April, putting it among the highest of any advanced economy in the world.

It is expected to rise further in the autumn to more than 10 per cent.

The Office for National Statistics said the 54 per cent increase in Britain’s energy price cap in April caused almost three-quarters of the rise in the inflation rate that month, but prices were also climbing rapidly in almost all categories of expenditure and in goods leaving factories.

Grant Fitzner, ONS chief economist, said the rise in raw material prices was adding to pressure on manufacturers to pass on their higher costs. “This was driven by increases for food products, transport equipment and metals, machinery and equipment,” he said.

With inflation far in excess of the Bank of England’s 2 per cent target and the price of services up 4.7 per cent on a year earlier, widespread evidence that inflation is becoming more persistent will increase pressure on the central bank to raise interest rates further to cool the economy.

Kitty Ussher, chief economist at the Institute of Directors, said business leaders were saying the weak economy was now “their number one negative issue” and was making them “more reluctant to invest, storing up problems for the economy in future”.

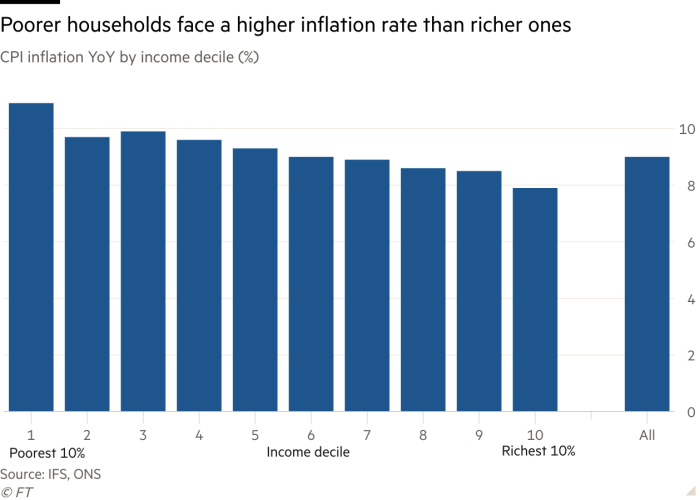

Using the ONS figures on Wednesday, the Institute for Fiscal Studies showed that the 54 per cent rise in energy prices resulted in a much higher inflation rate for poorer households than richer ones because they spent a higher proportion of their incomes on gas and electricity.

Heidi Karjalainen, economist at the IFS, estimated that inflation for the poorest 10 per cent of Britain’s households was running at 10.9 per cent in April, compared with 7.9 per cent among the richest 10 per cent. With state benefits rising only 3.1 per cent in April, it meant “big real-terms cuts to the living standards”, said Karjalainen.

The Bank of England this week sought to deflect blame for the lack of control of inflation. Andrew Bailey, BoE governor, blamed global shocks for rising prices and said there was “not a lot we can do about it”.

Yael Selfin, chief UK economist at KPMG, said: “The key risk facing policymakers is if today’s high pace of inflation becomes embedded in pay negotiations, which will put additional pressure on prices to rise.”

Retail price inflation, using a discredited measure that still underpins the cost of index-linked government debt, rose to 11.1 per cent in April, also a 40-year high.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzUzOTk5Mjg3LWZiNzUtNGRhMi04ODNjLWJhZTE3ODIzNTRiOdIBAA?oc=5

2022-05-18 18:44:18Z

1432290186

Tidak ada komentar:

Posting Komentar