China’s economic activity contracted sharply in April as a wave of lockdowns across the country posed the most significant challenge to its growth prospects since Covid-19 emerged more than two years ago.

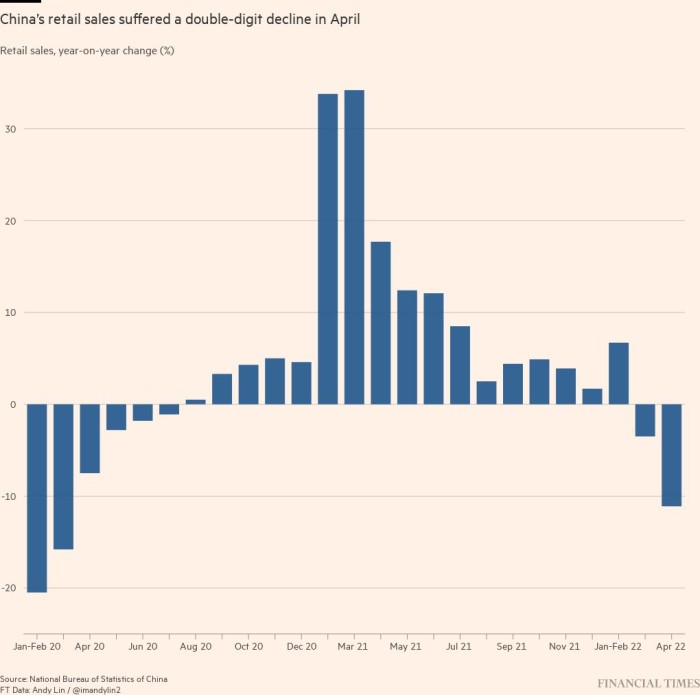

Retail sales, the country’s main gauge of consumer activity, slumped 11.1 per cent year on year, compared with forecasts of a 6.6 per cent fall by economists polled by Bloomberg. Retail sales dropped in March, down 3.5 per cent year on year.

Industrial production, which underpinned China’s rapid economic recovery from the initial Covid shock in early 2020 and was expected to rise slightly despite the recent restrictions, dropped 2.9 per cent.

The data are the most striking sign of the rising economic toll from China’s approach to coronavirus, which it has sought to quash through city-wide lockdowns, mass testing and quarantine centres. The elimination of infections is a priority for President Xi Jinping, who has reaffirmed his commitment to the strategy this year ahead of his bid for a third term in power.

The zero-Covid approach had largely contained the virus over the past two years but authorities have escalated their measures dramatically in 2022 following an outbreak of the highly infectious Omicron variant. The restrictions have mainly centred on Shanghai, which was locked down in late March.

“The activity in April was weaker than expected, [and] the declines were led by retail sales, which is understandable in the context of there being lockdowns,” said Carlos Casanova, a senior economist for Asia at UBP. He expects retail sales to contract even further in May.

Dozens of cities and hundreds of millions of people across China have been placed under full or partial lockdowns as part of a policy that is expected to have deep ramifications for global supply chains.

China’s economy was already under pressure from a liquidity crisis across its highly leveraged real estate developers and a wider property slowdown as home sales collapsed.

Over the weekend, the government effectively cut mortgage base rates for new lending to first-time buyers from 4.6 per cent to 4.4 per cent, the latest in a series of easing measures intended to support one of the country’s most important economic drivers.

Zhiwei Zhang, chief economist at Pinpoint Asset Management, noted that the government was under pressure to launch new stimulus measures and that the mortgage rate cut was “one step in that direction”. But he added that “the effectiveness of these policies depends on how the government will ‘fine-tune’ the zero-tolerance policy against the Omicron crisis”.

European stocks opened lower after Asia markets reversed early gains. The Stoxx 600 share index fell 0.8 per cent and the FTSE 100 was down 0.7 per cent. The CSI 300 of Shanghai- and Shenzhen-listed stocks closed down 0.8 per cent. Hong Kong’s Hang Seng index had a volatile day of trading, rising as much as 1.1 per cent before dropping 0.4 per cent and recovering to end the day 0.3 per cent higher.

Last week, authorities said citizens would not be able to leave the country for “non-essential” reasons and introduced more severe measures in Shanghai almost seven weeks after a city-wide lockdown was introduced. A city official said on Monday that authorities aimed to broadly reopen Shanghai from June 1.

China’s gross domestic product rose 4.8 per cent year on year in the first quarter. The government has targeted growth of 5.5 per cent for the year, its lowest official target in three decades. Economists have already slashed growth forecasts for the second quarter.

Analysts at Australian bank ANZ maintained a 5 per cent growth target for 2022 on the basis that stimulus would “offset the loss of economic activity in the past two months”. But they were “pessimistic about China’s medium-term outlook” given expectations that supportive measures will be unwound next year.

“The impact of Shanghai’s lockdown is far-reaching,” they wrote. “Economic and technological linkage with the rest of the world is at risk.”

The surveyed unemployment rate was 6.1 per cent in April, its highest level since February 2020.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzQxZjgwYmFkLTBlY2EtNDQ1YS1hN2ZiLTkyMjI2MjYxMTMxMdIBAA?oc=5

2022-05-16 08:41:11Z

1419434803

Tidak ada komentar:

Posting Komentar