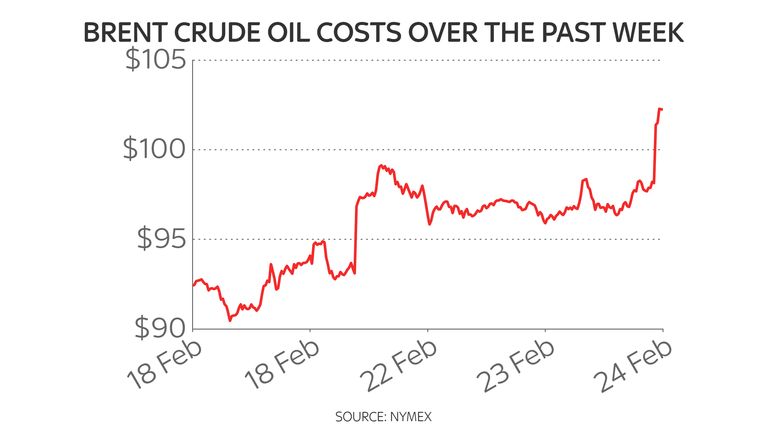

The heightened invasion of Ukraine by Russia has sparked a rush for safe haven assets and sent the cost of Brent crude oil above $100 a barrel for the first time since September 2014.

Fears of a wider conflict, additional sanctions and higher inflation arising from president Putin's order to attack prompted a rush of activity on global markets, first felt in Asia where stock markets were widely down by 3%.

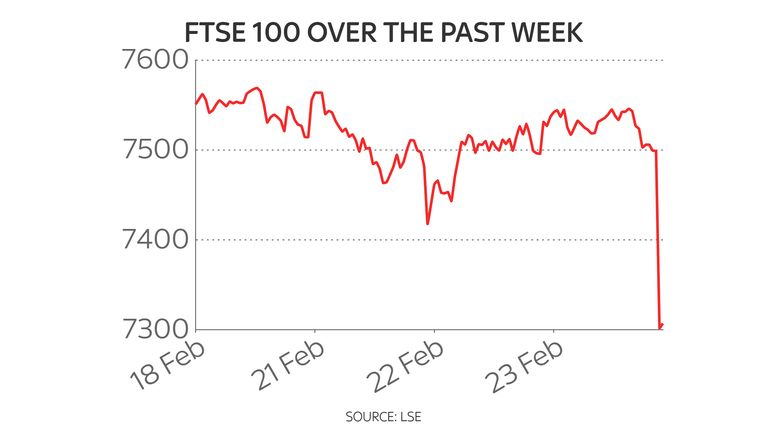

Germany's DAX and the CAC in Paris were 3.5% lower at the open, while the commodity-heavy FTSE 100 in London started the day 2.6% down - partly shielded from the worst as the price of oil, gas and things such as metals shoot up.

Follow the latest updates on the Russian attack on Ukraine here

Financial services and stocks linked to consumer spending, such as retailers, felt some of the worst pain on London's blue chip index initially, with only Shell and precious metal mining firm Fresnillo seeing gains.

Evraz, another miner, was the biggest faller - down by 18% - as it has major operations in Russia.

Russia's own stock market took a hammering, with values on both main indexes slumping by around 30% when a suspension on trading in Moscow was temporarily lifted.

A collapse in the value of the rouble versus the US dollar - to a record low - meant the dollar-linked RTS index had lost more than 34%.

Brent crude, the international oil benchmark, rose by more than $4 a barrel on reports of the first explosions in Ukraine.

It continued to climb to almost $103 as the extent of the invasion became clearer, signalling additional price pressures for a global economy already battling a COVID-linked surge in inflation.

UK natural gas contracts for March delivery were also 20% higher.

Ipek Ozkardeskaya, senior analyst at Swissquote, said markets had clearly entered "panic" mode.

"In commodities, the European natural gas futures are already up 10%... US (WTI) crude jumped past the $98 mark.

"Gold flirts with the $1950 per ounce and the bulls are already to target a further advance toward the $2000 threshold.

"Corn futures are up more than 4%, wheat futures are up more than 5%, as Russia is the world's largest grain wheat exporter.

"Oat futures, soybean futures, silver, platinum, palladium, all move higher this morning expect for sugar, cotton, orange juice and live cattle."

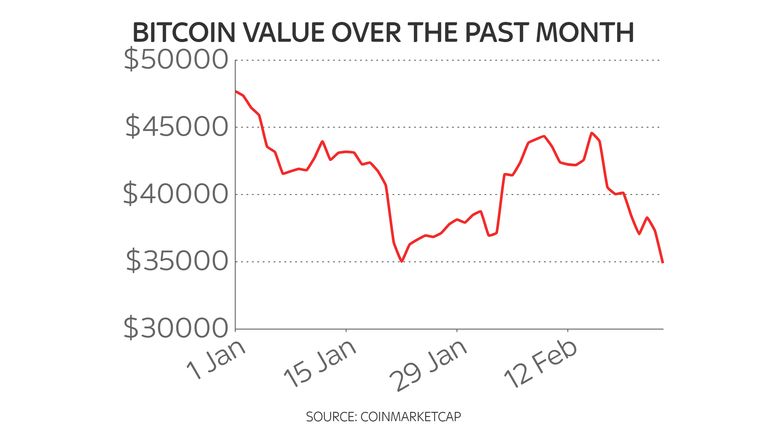

Cryptocurrency was battered too - with Bitcoin's sensitivity evident through a 6% slide to $35,000.

Chris Weston, head of research at foreign exchange brokerage Pepperstone, said of the latest developments: "The market was always trying to judge if (Russia) would stop at Donbas, and it looks pretty clear that they are moving toward Kyiv, which was always one of the worst case scenarios.

"There are no buyers here for risk, and there are a lot of sellers out there, so this market is getting hit very hard."

https://news.google.com/__i/rss/rd/articles/CBMieGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L29pbC1zbWFzaGVzLXRocm91Z2gtMTAwLWJhcnJpZXItaW4tc2FmZS1oYXZlbi1ydXNoLWFzLXB1dGluLXB1bGxzLXRyaWdnZXItb24tdWtyYWluZS0xMjU1MDA0MNIBfGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L2FtcC9vaWwtc21hc2hlcy10aHJvdWdoLTEwMC1iYXJyaWVyLWluLXNhZmUtaGF2ZW4tcnVzaC1hcy1wdXRpbi1wdWxscy10cmlnZ2VyLW9uLXVrcmFpbmUtMTI1NTAwNDA?oc=5

2022-02-24 08:15:00Z

1281799890

Tidak ada komentar:

Posting Komentar