Stock markets are plunging and Brent crude oil costs are nearing $100 a barrel as the crisis over Ukraine deteriorates.

Brent, the international benchmark, was trading just shy of $99 - its highest level since 2014 - and market experts said there would be an inevitable spike in the event of a full invasion of Ukraine by Russia.

The price climbed by more than 3.5% as jitters grew when tanks and armoured personnel carriers were seen on the outskirts of Donetsk, the capital of one of two breakaway regions of eastern Ukraine that Russia said it had now recognised as republics.

US and European sanctions are to follow president Putin's declaration - raising the stakes.

He could potentially respond by disrupting supplies of Russian oil and gas to Europe, threatening to add to an energy-led inflation spiral on the continent.

Market commentators said the coming hours would determine the direction for energy costs.

They warned that any move towards military conflict would tip oil and gas prices up sharply because of Russia's hold over European supplies.

UK contracts for next-day natural gas delivery were up by more than 7% on Tuesday but, at 183p-per-therm, the cost was well down on levels above 400p seen last year.

Contracts for future delivery saw a larger spike.

Europe currently relies on Russia for more than 40% of its natural gas - with costs already reeling from weak stocks and supply disruption that have pushed UK energy bills to record levels, with the promise of worse to come in April and beyond already.

Stock markets in Asia were the first to react to the uncertainty created by Russia's strategic move on Ukraine.

The Hang Seng in Hong Kong was down by almost 3% while Japan's Nikkei shed 2%.

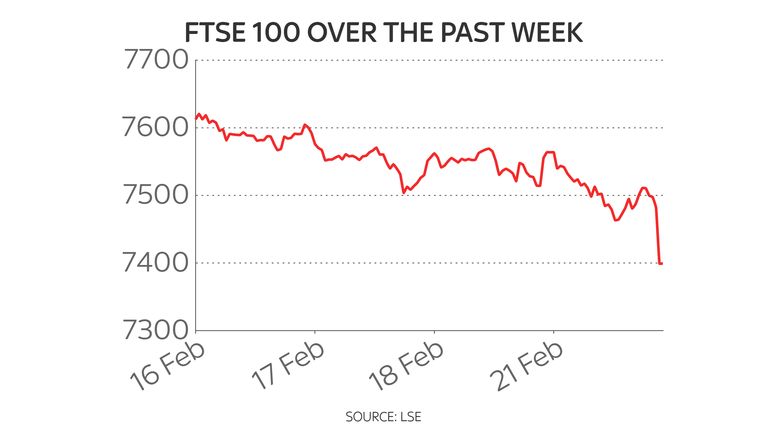

In London, the FTSE 100 opened 1.5% down led by banking and travel-related stocks. The DAX in Frankfurt was 2.5% off in early trading.

US futures showed the S&P 500 on course to open 2.4% lower as the implications of the Russian action evolved.

The tech-focused Nasdaq was seen opening almost 4% off.

Russia's rouble-linked stock market, the MOEX, was 7% down - building on sharp losses witnessed on Monday.

Ipek Ozkardeskaya, senior analyst at Swissquote, wrote: "The latest turn of events narrows the chances of a Russian pullback, and the window for diplomacy is almost shut.

"The US ordered new sanctions on Russia and the new Russian-backed republics; Europeans pledged to respond as well. This is the worst escalation since the Cold War."

She added: "The risk off mode will likely stay on for the coming hours, but at this point it's hard to predict what's next.

"Any positive news could reverse the bearish action and lead to sudden jumps in risk asset prices, yet a further escalation of tensions, which now became the base case scenario, should further enhance gains in energy, safe haven assets and gold."

https://news.google.com/__i/rss/rd/articles/CBMia2h0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L29pbC1tYXJjaGVzLXRvd2FyZHMtMTAwLWEtYmFycmVsLWFzLW1hcmtldHMtd2F0Y2gtdWtyYWluZS1jcmlzaXMtZGVlcGVuLTEyNTQ4NDQ50gFvaHR0cHM6Ly9uZXdzLnNreS5jb20vc3RvcnkvYW1wL29pbC1tYXJjaGVzLXRvd2FyZHMtMTAwLWEtYmFycmVsLWFzLW1hcmtldHMtd2F0Y2gtdWtyYWluZS1jcmlzaXMtZGVlcGVuLTEyNTQ4NDQ5?oc=5

2022-02-22 09:00:00Z

1281799890

Tidak ada komentar:

Posting Komentar