European equities fell on Monday in volatile trading, rebounding from session lows as Russia eased some fears of an imminent attack on Ukraine.

The regional Stoxx Europe 600 index fell as much as 2.9 per cent, before recovering slightly to trade 1.7 per cent lower. Germany’s Xetra Dax fell 2.3 per cent with sharper falls for bourses in Sweden, Austria and Greece.

Monday’s moves came after Jake Sullivan, US national security adviser, said on Sunday that an attack by Russia against Ukraine could begin “any day now”, including “this coming week before the end of the Olympics”.

However, Russian foreign minister Sergei Lavrov told President Vladimir Putin in a televised meeting on Monday that diplomatic engagement with the west should continue. Stocks recovered from their lows after his remarks.

“There’s always a chance,” Lavrov said, when asked by Putin whether there was any likelihood that an agreement with the west could be reached in the flurry of negotiations between Moscow and western capitals aimed at defusing tensions on the border with Ukraine.

Wall Street’s S&P 500 share index, which closed almost 2 per cent lower on Friday after the White House issued its first warning of an “immediate threat” of invasion, opened 0.1 per cent lower. The technology-focused Nasdaq Composite fell 0.2 per cent.

The Vix, a measure of expected volatility in the US stock market, traded at an elevated level of 29.4, suggesting the possibility of further market swings in coming weeks.

Western nations are continuing to withdraw diplomatic and military personnel from Ukraine, and airlines have cancelled flights to the country. The moves have jolted investors who were focused on US monetary policy and viewed geopolitical tensions as less of a risk.

“The market has been wrongfooted,” said Altaf Kassam, head of investment strategy for Europe, the Middle East and Africa at State Street Global Advisors. “People expected a de-escalation and it feels like things are rolling in the other direction.”

The potential effect of sanctions, he added, would “add to inflationary pressures as well as people’s perceptions of inflation”. Consumer price increases in the eurozone hit a record high last month, largely driven by energy costs. Inflation is running at a 40-year high in the US as the Federal Reserve prepares to raise interest rates from pandemic-era lows.

With global supply chains snarled up from Covid-19, all major commodity markets are in a “state of severe depletion”, said Jeff Currie, head of commodities research at Goldman Sachs. “Such depleted systems are highly vulnerable to even the smallest shocks, even [with just] a few days of disruption.”

German chancellor Olaf Scholz travelled to Kyiv on Monday before heading for Moscow on Tuesday. The German leader was expected to urge Putin to de-escalate the situation on the Ukraine border.

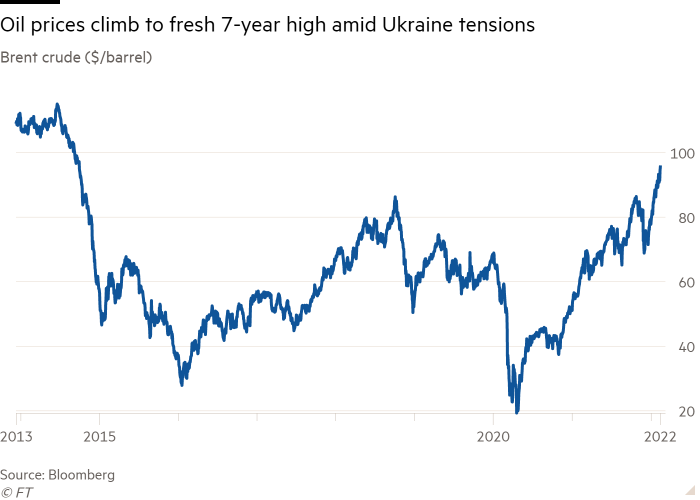

In a sign of how heightened geopolitical tensions are spreading to financial markets, European natural gas contracts for next-month delivery jumped 10 per cent on Monday to €83.41 per megawatt hour. International oil benchmark Brent crude rose as high as $96.16 a barrel, the highest level in more than seven years, before losing 0.7 per cent to $93.77.

“If western claims of [a] Russian invasion of Ukraine turned out to be unsubstantiated [or] Russia withdrew its troops from its western borders, oil prices will come crashing,” said Tamas Varga at PVM Oil Associates, a broker. “For the time being all eyes are on Ukraine and on the $100-a-barrel level.”

Top-rated European government bonds rallied on Monday as traders sought shelter in the lower-risk assets, pushing yields lower. Germany’s benchmark 10-year Bund yield declined 0.05 percentage points to just under 0.24 per cent. The equivalent UK gilt yield fell 0.02 percentage points to 1.52 per cent. America’s 10-year Treasury yield, however, rose 0.03 percentage points to 1.98 per cent — partially reversing a sharp fall on Friday.

In contrast, Russian and Ukrainian government bonds tumbled to their lowest levels of 2022.

Ukraine’s dollar bond maturing in 2032 dropped more than 10 per cent in price to 77 cents on the dollar. Russian dollar-denominated bonds were down roughly 2 per cent, with the yield on a bond maturing in 2047 rising 0.15 percentage points to 4.93 per cent.

In Asia, Hong Kong’s benchmark Hang Seng fell 1.4 per cent, while Japan’s Topix and South Korea’s Kospi both closed 1.6 per cent lower.

Additional reporting by Tommy Stubbington and Polina Ivanova

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50Lzg4ZmNhOTk2LTY0NDctNDY0YS1iMjVkLTlmYjc2YTRmYzQyZtIBAA?oc=5

2022-02-14 14:14:48Z

1290197942

Tidak ada komentar:

Posting Komentar