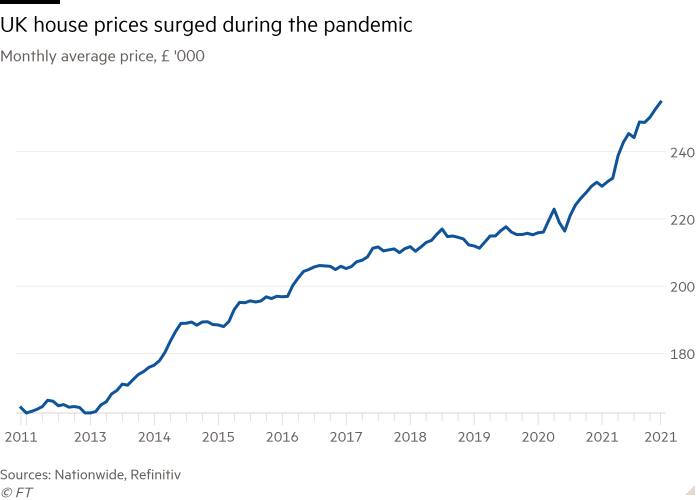

UK house prices grew at the fastest pace in 15 years in 2021, reaching a record high as low interest rates and a pandemic-induced race for more space boosted demand and housing stock remained low.

Prices rose at an annual rate of 10.4 per cent in December, making the calendar year performance the strongest since 2006, according to data from the Nationwide Building Society published on Thursday.

The average increase from early 2020, before the pandemic, was 16 per cent. This is in sharp contrast with the unprecedented hit to broader economic activity in the UK.

“Despite maintaining a blistering pace for most of the year, and in the face of the Omicron variant, price growth still managed a sprint finish,” said Jonathan Hopper, chief executive of Garrington Property Finders.

The price of a typical UK home rose to a record high of £254,822, up £23,902 over the year, the largest rise recorded in a single year in cash terms since Nationwide began collecting the data in 1991.

“Demand has remained strong in recent months, despite the end of the stamp duty holiday at the end of September,” said Robert Gardner, Nationwide’s chief economist. “At the same time, the stock of homes on the market has remained extremely low throughout the year, which has contributed to the robust pace of price growth.”

In December, instructions have been especially sparse, as the surge in Covid-19 cases prompted many would-be sellers to hold off on listing their home, further boosting prices, according to Hopper.

Despite the Bank of England increasing interest rates in December, “the cost of borrowing remained mercifully low while the price of everything else took off”, said Lucy Pendleton, property expert at independent estate agents James Pendleton.

House prices grew at a double-digit pace despite London recording a weaker annual growth of 4.2 per cent in the three months to December, one-third or less the rate of Wales, Northern Ireland and the South East, reflecting increased demand for bigger houses in less crowded places following the rise of homeworking.

However, Gardner predicted that the housing market “will slow next year”, because the stamp duty holiday encouraged many to bring forward their house purchase in order to avoid additional tax. Higher interest rates and a weaker labour market as a result of the Omicron coronavirus variant could also reinforce the slowdown.

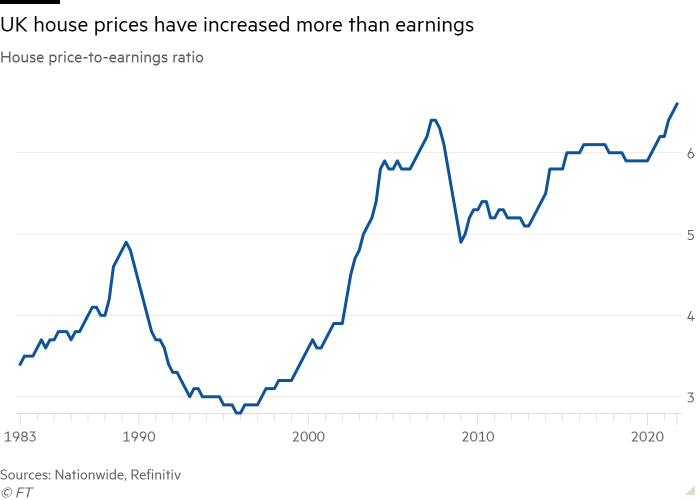

Moreover, house price growth has outpaced income growth during the pandemic, resulting in the price-to-earnings ratio rising to the highest level since records began in 1983, Nationwide data showed.

Nationwide calculated that in London the average deposit is now £88,000, corresponding to 183 per cent of the average annual gross income in the capital, strongly up from a decade ago.

As a result, “another year of double-digit price rises seems unlikely”, said Hopper.

However, the housing market could surprise expectations in 2022 as it did this year, Gardner said.

“The market still has significant momentum and shifts in housing preferences as a result of the pandemic could continue to support activity and price growth,” he noted. “Indeed, the Omicron variant could serve to reinforce the shift in preferences in the near term.”

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2ZjMzNiMTA5LTBkN2EtNDI2ZC1hYzY0LWQwMWEwZmI4OWYxMtIBAA?oc=5

2021-12-30 08:40:17Z

1204435717

Tidak ada komentar:

Posting Komentar