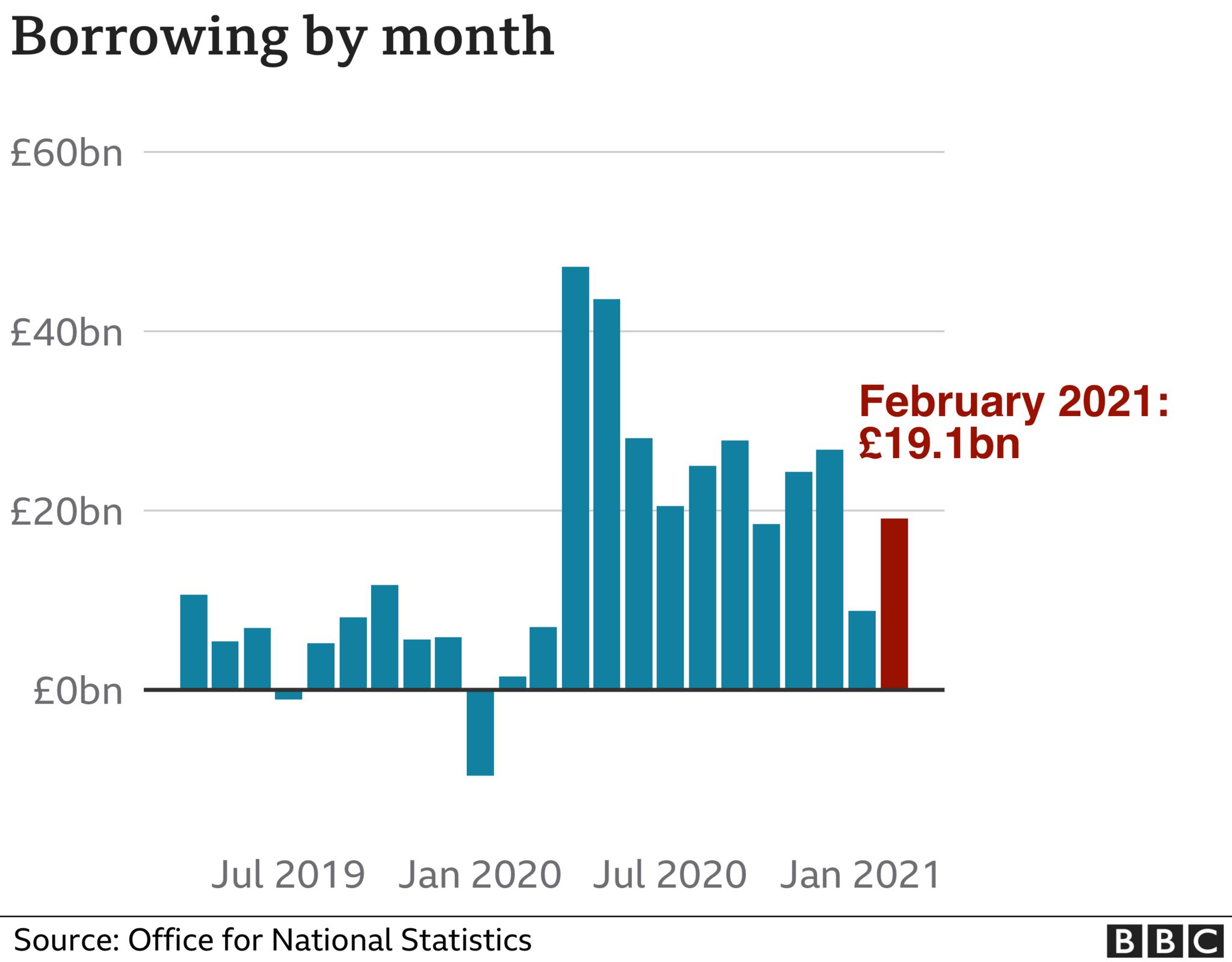

The government borrowed £19.1bn last month, the highest figure for February since records began in 1993, reflecting the cost of pandemic support measures.

The Office for National Statistics (ONS) said borrowing was £17.6bn higher compared with February last year.

The Chancellor, Rishi Sunak, said: "Coronavirus has caused one of the largest economic shocks this country has ever faced."

Loans and furlough payments have taken a heavy toll on government finances.

The latest ONS figures showed the government spent £3.9bn last month on job support measures alone.

They also showed a fall in tax income, notably from lower VAT, business rates and fuel duty, although they also showed money coming in from self-employed tax payments rose by £0.9bn from last year.

Borrowing for the year so far reached £278.8bn, a record for that period.

Total public sector debt has risen to £2.13 trillion, according to the ONS.

The ONS said: "Although the impact of the pandemic on the public finances is becoming clearer, its effects are not fully captured in this release, meaning that estimates of accrued tax receipts and borrowing are subject to greater than usual uncertainty."

Ruth Gregory, senior UK economist at Capital Economics, acknowledged the dire state of the UK's finances but said the government's increased spending was the only sensible course at this time.

"Today's figures are pretty terrible but it is important to take in to account the economy as well. The chancellor is doing the right thing in continuing to support the economy," she told the BBC's Today programme.

"His action in the Budget to extend many of the existing schemes means the rug will not pulled out from under the feet of households and businesses.

"If we can limit the damage to the economy now, when the crisis ends it means the country will be stronger amore able to cope with that debt."

Separately, the government said it would receive £1.1bn from selling part of its stake in NatWest Group.

The sale, which will complete on 23 March, will cut the size of the government's stake in the bank from almost 62% to 59.8%.

Ultimately, if it's consistently spending much more than it has in the past, the state has to raise more money in taxes. But the key word there is "ultimately". There is no urgency to repaying the government's debt. More urgent are the debts of small businesses and poorer households.

Ordinary households rightly fear getting into too much debt because if interest rates rise, lenders can close in and deploy lawyers and bailiffs with all the attendant unpleasantness.

But it is profoundly wrong and misleading to infer that it's like that for governments who issue their own sovereign currency.

Unlike households, governments controlling their own currency can borrow without limit money that they have freshly created.

They therefore can't go bankrupt. Because almost all of the money borrowed by the government in this financial year (by issuing gilts) will be owed to another public sector body, the Bank of England, it's nothing like a household borrowing from a bank.

And in fact, as the government tacitly acknowledged in its recent Budget, it makes sense in the midst of an economic contraction for the government to spend more, not less - not least because other parts of the economy (households and businesses) aren't spending anything like what they normally would.

Without the additional government spending the economic contraction would, without a shadow of a doubt, be worse.

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU2NDUzODY50gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYW1wL2J1c2luZXNzLTU2NDUzODY5?oc=5

2021-03-19 09:18:01Z

52781444573636

Tidak ada komentar:

Posting Komentar