The government has restated it is considering "all options" to keep Liberty Steel's UK plants and jobs afloat, including nationalisation.

On Sunday, the government rejected a request for £170m in financial support for the firm.

But that is due to concerns about the "very opaque" structure of its owner GFG, a minister said.

Business Secretary Kwasi Kwarteng said the government could not put money into a "black box".

Mr Kwarteng told the BBC's Today programme that Liberty Steel was "an important national asset" but that the structure of its owner - Gupta Family Group (GFG) - was "very opaque" and "not helpful".

"We are custodians of taxpayer's money... and we feel that if we gave the (£170m) money, there was no guarantee that the money would stay in the UK, and would protect British jobs," he said.

Liberty Steel's founder, Sanjeev Gupta, is trying to refinance GFG after its key financial backer Greensill Capital filed for insolvency earlier this month.

Mr Kwarteng said he wanted to see Mr Gupta's plans "work through" before the government took any further action.

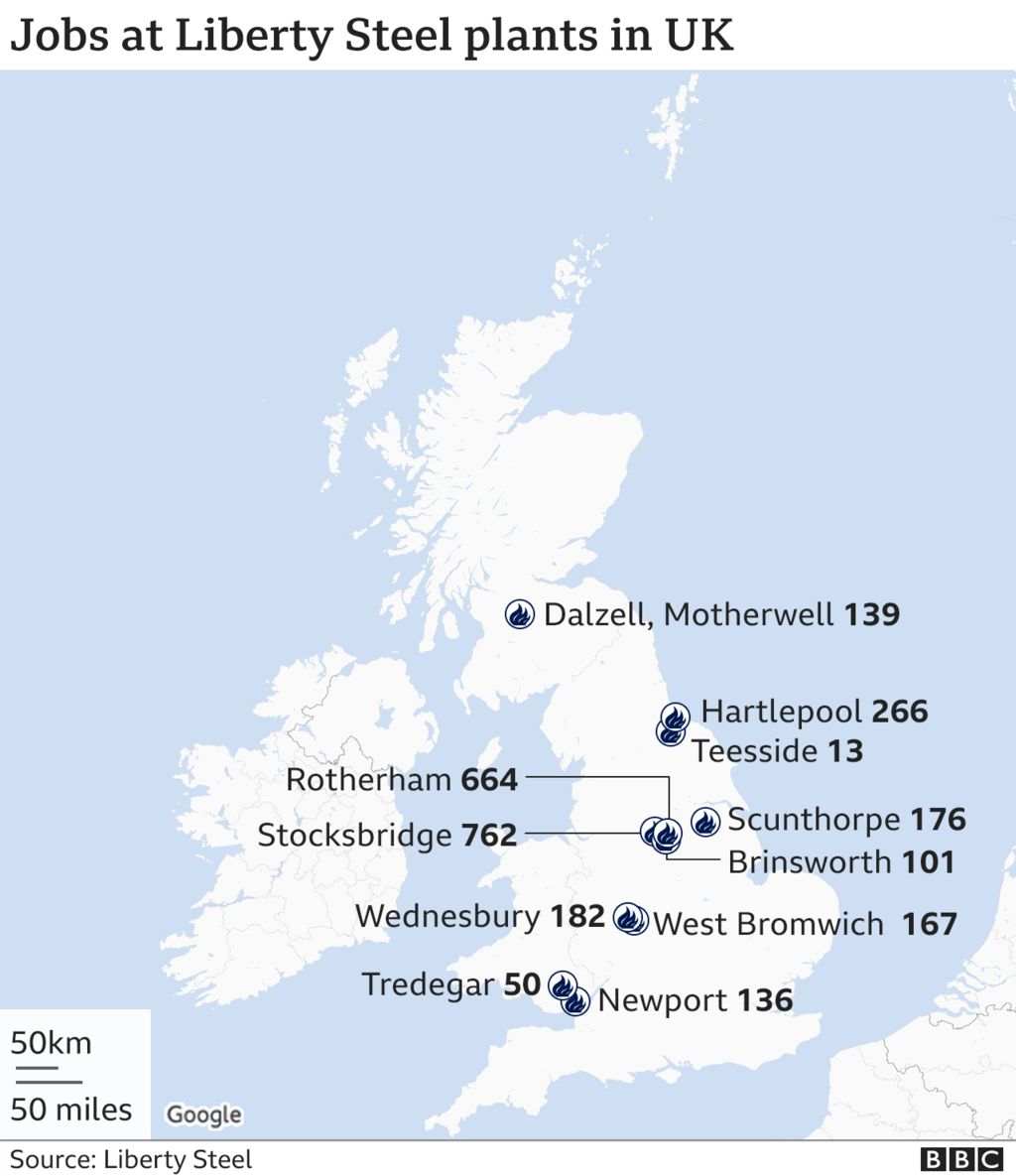

There are about 3,000 staff directly employed at Liberty's UK sites, which include Rotherham, Motherwell and Newport, and a further 2,000 jobs at GFG Alliance in the UK.

The £170m request was made for working capital for Liberty Steel plants.

Mr Gupta's empire employs 35,000 people worldwide.

GFG Alliance said most of its businesses around the world "are performing well and generating positive cash flow, supported by the operational improvements we've made and strong steel, aluminium and iron ore markets."

"We are taking prudent steps across our global portfolio to manage resources while we try to negotiate a formal standstill agreement with Greensill's administrators and refinance the businesses.

"In the UK, GFG Alliance has invested significantly to rescue steel and aluminium plants saving thousands of jobs in industrial communities across the United Kingdom, that would have otherwise been lost."

The GFG spokesperson added that Liberty Steel had been hit by the coronavirus crisis due to a drop in demand for aerospace products compounded by energy prices.

The company plans to restart steelmaking in the UK around the 6 April.

Green plans

Mr Kwarteng said "all options are on the table" to keep Liberty Steel jobs and plants going, including nationalisation.

"We think that the steel industry has a future in the UK," he said.

The UK's industrial decarbonisation strategy means the government wants to see "clean steel" produced, he said.

"Electric arc furnace-produced steel of the kind that Liberty makes - we think that has a future in the UK," Mr Kwarteng said.

He said that while the future of the steel market is "uncertain", the government's "net zero" carbon plan "has changed the dynamics in terms of the government's relationship to parts of the economy."

Alasdair McDiarmid, operations director at the Community union, said options open to the government included directly supporting the business, facilitating a takeover as happened with British Steel, or nationalisation.

He said it was "far from clear how a nationalisation of Liberty Steel would work or what the costs of that would be to the taxpayer".

"Liberty Steel is a very complicated organisation with lots of different entities, all loaded with millions if not billions of debt, and mortgaged to the hilt with many different creditors having a call on different parts of the business.

"It seems to us that the first option to look at would be whether the business can be supported as is, because that would be likely to be the least disruptive, and probably the least costly to the taxpayer," Mr McDiarmid added.

Steel industry analyst Kathryn Ringwald Wildman said GFG had "found a difficult patch" in their finances after the Greensill collapse which meant they were no longer able to service their debts.

Both companies were now in "a very precarious position" she said, with GFG finding it "quite difficult" to find alternative sources of funding due to how much debt it has, the complexity of its structure, and the future of the steel market.

"All three of the major steel companies in the UK are hoping to secure government funding for the medium to long-term development of the industry," she said.

"It is extremely difficult for the company at the moment even though they have been a model of steel-making in the industry."

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU2NTc1Mjk30gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYW1wL2J1c2luZXNzLTU2NTc1Mjk3?oc=5

2021-03-30 11:55:36Z

52781466394794

Tidak ada komentar:

Posting Komentar