Traders are preparing for a jolt of volatility in the Turkish lira after president Recep Tayyip Erdogan sacked the country’s central bank chief, who was regarded as a key force in pulling the lira from historic lows last year.

The removal of Naci Agbal, announced in the early hours of Saturday, shocked many local and foreign investors who had applauded the official’s decisions to move Turkey towards a more orthodox monetary policy.

“Unwinding what was briefly appropriate macro policy is going to be painful”, said Edward Al-Hussainy, a senior rates and currencies analyst at Columbia Threadneedle, adding that it would hit the appeal of Turkish assets.

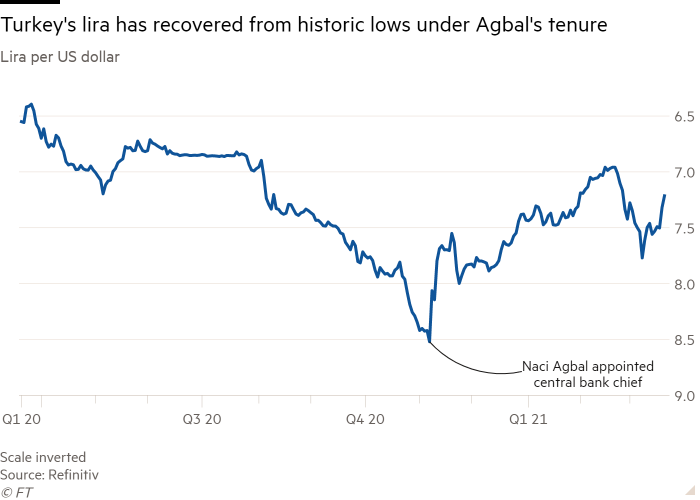

The appointment of Agbal in November, which was part of a broader economic leadership shake-up, helped spark a sharp rally in the lira after the currency had plummeted to a historic low. The lira was at one point the best performing emerging-market currency of 2021 and has recovered almost a fifth from the trough of around 8.58 to the US dollar struck on November 6.

The lira had gained last Thursday after Agbal increased interest rates by 2 percentage points, double what economists expected and adding to a 6.75 percentage point increase he oversaw last year.

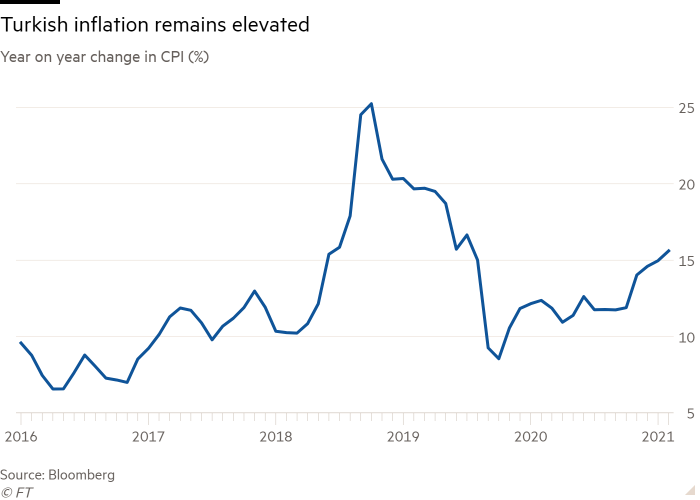

Investors had long called for tighter monetary policy in Turkey to tame inflation that is running at more than 15 per cent and to quell strong outflows from foreign investors.

Ehsan Khoman, head of emerging markets research at MUFG Bank in Dubai said the Agbal’s leadership and the central bank’s prudent measures had played a “pivotal role” in restoring confidence in the lira and Turkish assets.

Traders and analysts are now concerned that Erdogan’s decision to install Sahap Kavcioglu to the role could rapidly erode the gains made during Agbal’s short tenure. Kavcioglu is a little-known professor of banking and a former lawmaker from the ruling Justice and Development party.

The new central bank head wrote in his column at the Islamist newspaper Yeni Safak last month that “interest rate increases will indirectly lead to an increase in inflation” — a view that runs counter to most modern macroeconomic theories and is also espoused by Erdogan, a vocal opponent of high rates.

Robin Brooks, chief economist at think-tank the Institute of International Finance, said Turkey was now at risk of “large” investor outflows that would place pressure on the lira.

Goldman Sachs warned on Sunday that it sees “significant risks of a near-term discontinuous move weaker in the lira”. The investment bank said local lenders had been quoting retail clients to buy the lira at the TL7.7 to TL7.8 to the dollar level, far weaker than Friday’s closing level of around TL7.22.

Currency trading begins in Asia around 10pm GMT.

“Big surprises tend to have market consequences and I think we can expect fairly aggressive falls in the lira at the open and the coming days,” Paul McNamara, an investment director at GAM, added.

Kavcioglu said in a statement on Sunday that the central bank “will continue to use the monetary policy tools effectively in line with its main objective of achieving a permanent fall in inflation”.

The sudden change in Turkey’s monetary policy leadership comes during a fraught moment for emerging markets, which have been under pressure as borrowing costs in the US and other developing markets have climbed higher. Last week, Russia and Brazil both joined Turkey in increasing interest rates as they sought to keep a lid on inflation.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzZiZTNlZmQxLWE4ZTktNDdhOC1hYmFjLTk2NmRiMmQzY2Y5M9IBAA?oc=5

2021-03-21 13:42:12Z

52781447527984

Tidak ada komentar:

Posting Komentar