Shares in London have risen sharply on the first day of trading in 2021 amid optimism stemming from the rollout of the second coronavirus vaccine.

The FTSE 100 index of larger companies rose 3% in early trading, while the more UK-focused FTSE 250 rose 1.5%.

The main market was led by a surge from Ladbrokes owner Entain, which jumped 26% after a bid from rival MGM Resorts.

The pound also gained against the dollar, rising to $1.37 for the first time since May 2018.

"The FTSE 100 has begun the new trading year on the front foot," said Susannah Streeter, senior investment and markets analyst at stockbroker Hargreaves Lansdown.

The gains came amid a backdrop of "optimism for global growth as vaccine roll outs gather pace," she said.

Dialysis patient Brian Pinker, 82, became the first person to receive the Oxford-AstraZeneca Covid-19 vaccine at 7:30 GMT at Oxford's Churchill Hospital.

More than half a million doses of the vaccine are ready for use in the UK on Monday.

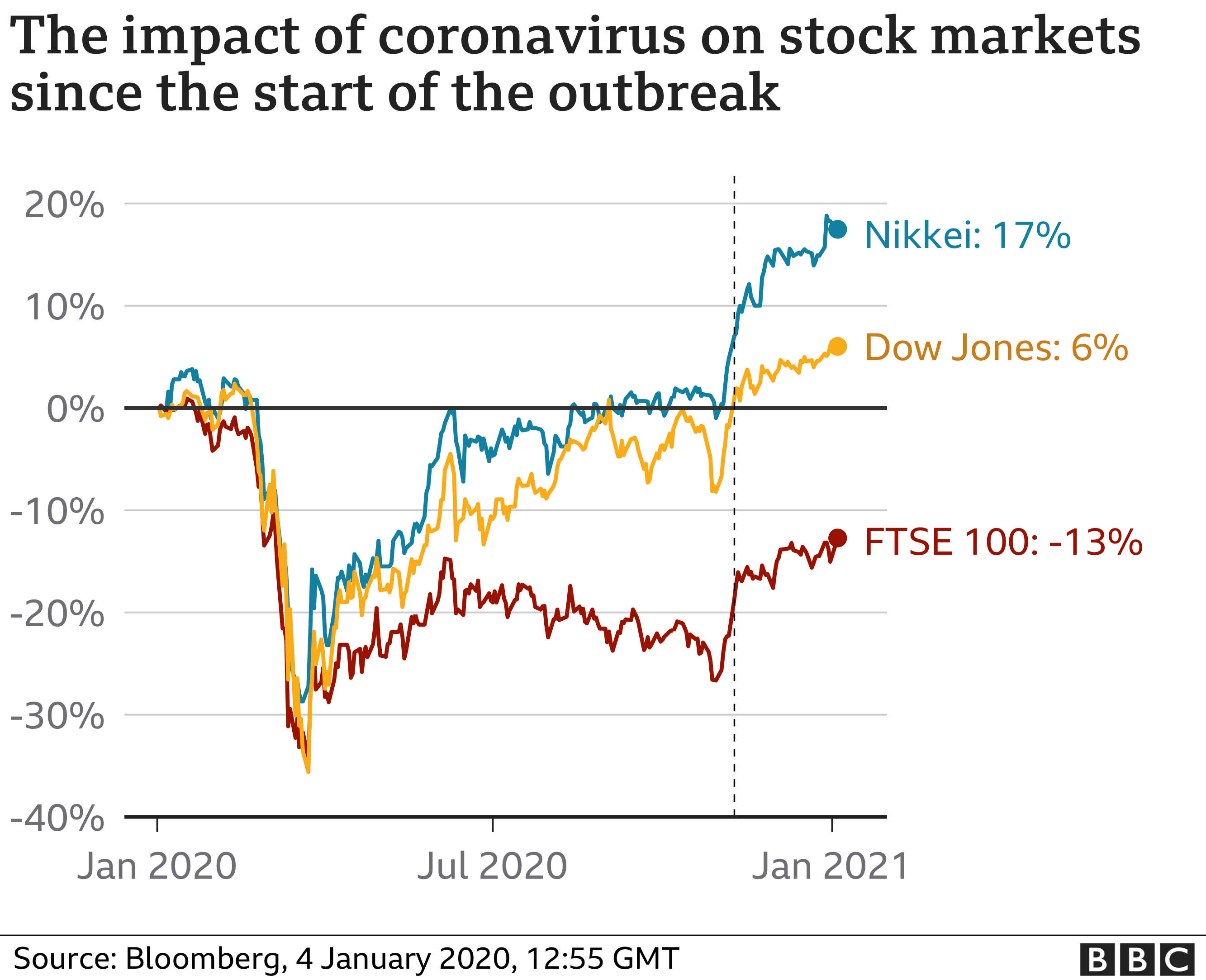

In 2020, the FTSE 100 lagged other major stock indexes around the world.

While the US's Nasdaq and Japan's Nikkei 225 finished the year higher than they started, the FTSE 100 is yet to regain the heights it reached of more than 7,600 last January.

While most Britons may not directly invest in the stock markets by buying shares from a stockbroker, many pensions are invested in stock markets around the world.

For instance, more than nine million people are enrolled in Nest, the private pension scheme set up by the government.

Not all shares have fared well. Banks and homebuilders have had a bad day amid concern over the UK economy and whether further lockdowns could harm household finances.

Hope and relief are the flavours of the start of 2021 trading: hope that the rollout of the Oxford/AstraZeneca vaccine will bring forward the end of restrictions, and relief that there is - as yet - no sign of visible disruption from the new trading arrangements with the EU.

But while London stocks comfortably outpaced their European rivals, there are a couple of caveats.

First, it will be a while before we know the impact of the new trading rules.

A survey of manufacturers found a surge in activity in factories in December as they rushed to fill and ship orders ahead of the changes; it may be some weeks before the business gets back to normal.

And second, the economy has a long way to go. The FTSE 100, in contrast to its Wall Street counterpart, is more than 10% below the level it was a year ago, while the UK economy is likely to have finished 2020 at least 10% smaller.

In addition, the potential for more school closures and lockdowns means that not only is the economy inevitably in the second dip of recession - but recovery is further off.

With figures from the Bank of England suggesting households are sitting, on average, on more money, that recovery could be emphatic - but only once restrictions are lifted; the spectre of uncertainty continues to hover.

Betting company Entain was the biggest share riser by far in London on Monday following the $11bn (£8.1bn) takeover offer from MGM Resorts.

Entain has said the approach undervalues the company, leading to speculation that MGM will come back with a higher offer.

The move is the latest attempt by a casino operator to move into the online gambling business.

In addition to Ladbrokes, UK-based Entain also owns a number of online sports betting and gambling brands, including Bwin, Partypoker, Coral, Eurobet, Gala and Foxy Bingo.

It had recently rebuffed an earlier $10bn all-cash approach from MGM, the newspaper said.

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTU1NTI5NjMw0gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYW1wL2J1c2luZXNzLTU1NTI5NjMw?oc=5

2021-01-04 13:22:00Z

52781285005862

Tidak ada komentar:

Posting Komentar