This article is part of the FT’s Runaway Markets series.

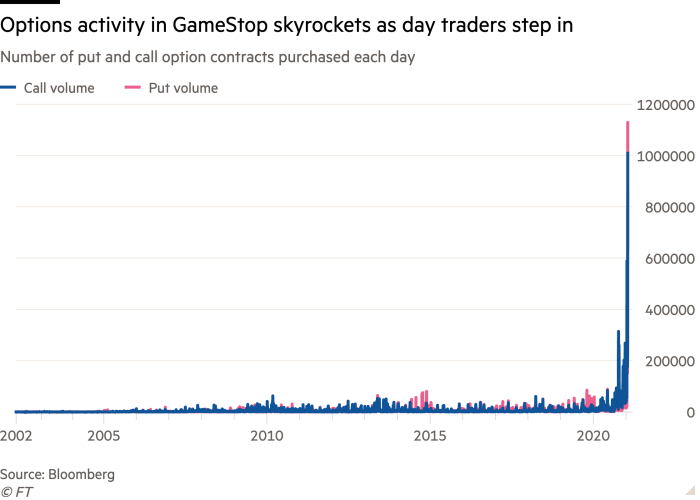

GameStop’s rocket-fuelled trading this month, which has taken the stock’s 2021 gains above 1,000 per cent, is a vivid example of how a new army of day traders have “weaponised” financial derivatives to their advantage.

During pre-market trading on Wednesday, the game retailer’s stock catapulted above $300 at one point, more than doubling from Tuesday’s closing level, having finished 2020 below $19 a share. It recently traded at $260.

One user with the moniker DeepFuckingValue on the popular Reddit forum WallStreetBets posted screenshots on Tuesday showing how he had turned about $50,000 worth of GameStop call options — which give the holder a right to buy a stock at a certain price, and function much like a leveraged bet — into nearly $23m this year.

Yet GameStop is only the most visible example of today’s options-fuelled stock market mania. While the increasing use of derivatives has been a hallmark of previous retail trading frenzies — such as the late 1990s dotcom boom — the current popularity is alarming even seasoned observers.

“What we’ve seen over the last few trading sessions borders on madness,” said Steve Sosnick, chief strategist at Interactive Brokers. “You could always get crazy things going on in individual stocks, but when you see it metastasising through a whole range of other stocks, that’s a sign of real froth.”

Options are particularly powerful trading tools, because they can be used to bet on and against financial securities, and can magnify returns and losses, which has made them wildly popular among the new generation of retail traders.

In return for a premium, calls give holders a right to buy a stock at an agreed “strike” price within a certain date. Puts give the right to sell at a certain price, and function as insurance against declines. But on internet forums there is mostly only appetite for calls to punt on stocks rising “to the moon”, as the common refrain goes.

More worryingly to some analysts, the more sophisticated traders also seem to be actively harnessing some of the unique characteristics of options, often denoted with Greek letters such as “delta” and “gamma” by Wall Street professionals, and using them to drive prices higher.

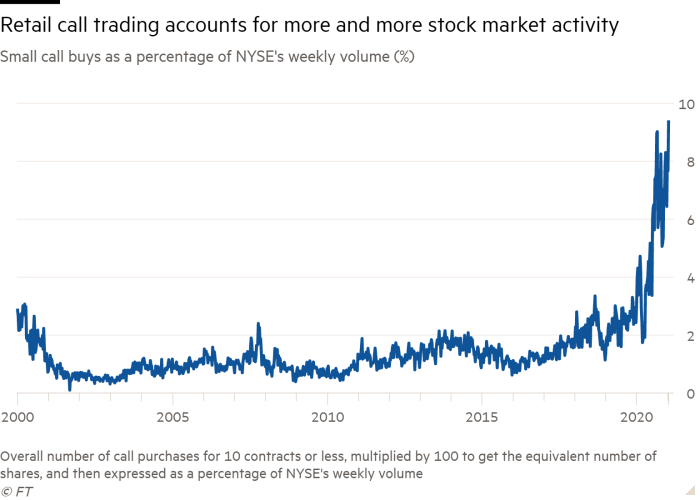

Options trading volumes have exploded over the past year, yet the upswing has been particularly powerful in small trades of 10 call contracts or less — typically the kind of trade size dominated by retail investors rather than big institutions.

The amount of money spent on premiums for call options trades of this size declined last autumn after a record-shattering summer frenzy, but is now back to near a record of $34.2bn on a rolling four-week basis, according to research by Jason Goepfert of Sundial Capital Research.

The reason why options can have an outsized impact on the underlying stock is because of their unique dynamics. The seller of an option, typically a bank or another big financial institution, is obliged to deliver the promised shares if call strike prices are triggered, or buying the shares in the case of puts. Dealers will therefore continually hedge themselves by buying — or selling — the underlying security.

This can trigger feedback loops, especially when stocks start moving towards the strike price and banks are forced to hedge their “gamma” exposure — as it is called in trader jargon. Gamma measures how much the price of an option accelerates when the price of the security it is based on changes.

Some analysts and investors say that many retail investors have learned that by banding together to blitz-purchase calls, they can help drive the price of the underlying stock up to the strike prices by compelling dealers to hedge their own exposure.

“Weaponised gamma is a perfectly reasonable way of describing it,” said Benn Eifert chief investment officer of QVR Advisors, a hedge fund. “You see a lot of snide comments that these are just dumb people. But there are clearly sophisticated, clever, thoughtful people doing this as well.”

Mr Sosnick agreed, and said the feedback loops could become particularly powerful when the gamma hedging of dealers was combined with small stocks that had a limited proportion of freely tradable shares and were subject to big short positions — such as GameStop.

“It’s like an ant colony. Each individual ant may not be able to move much, but if you have enough of them they can move a remarkable amount,” he said. “If enough people buy $40 calls on a $35 stock, the market-makers will have to hedge eventually . . . In the short term you can really make yourself right.”

The question is to what extent these dynamics are affecting not just some individual stocks, but the stock market as a whole. Analysts say that the retail frenzy has migrated from big names such as Apple, Google and Tesla that were popular last summer to more recondite corners of the equity market, where the impact is more powerful but more idiosyncratic.

Nonetheless, the overall marketwide impact of the option frenzy is likely to be “meaningful”, according to Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

“It’s not just the overall volume numbers — which are impressive in themselves — but it also has knock-on effects all over different parts of the market,” he said.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2FlMWVjZmY0LTkwMTktNGEyYS05N2VhLTU1YTNjZDE1YzM2YdIBAA?oc=5

2021-01-27 11:29:00Z

CAIiEPydRj0rDZLNmonZcJ7KmpoqFwgEKg8IACoHCAow-4fWBzD4z0gwwtp6

Tidak ada komentar:

Posting Komentar