US regulators are to review extraordinary rallies in the shares of struggling gaming retailer Gamestop, part-driven by users of a forum on Reddit, as concerns grow over a surge in retail investor activism.

The Securities and Exchange Commission said it was working with other watchdogs to "assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants".

The action reflects widespread worries over the functioning of financial markets, with the trading activity by amateur members of the public - known as retail investors - spreading globally including to the UK.

It all started with Gamestop. It is a US gaming retailer that has been closing stores at pace in recent years because of weak sales.

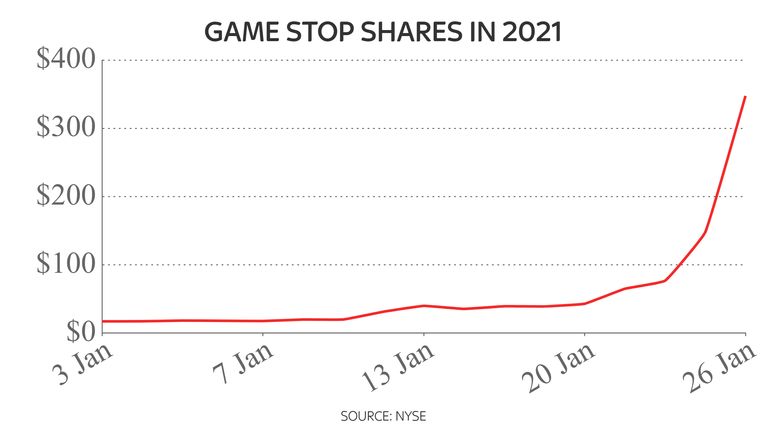

But its shares were up by 1,744% in the year to date - with a market value above $20bn - at the close of trading on Wednesday night.

The staggering leap represents a victory for retail investors over hedge fund short-sellers, those betting the share price will fall, leaving them nursing heavy losses.

Millions of ordinary people have taken advantage of zero-commission trading platforms during the coronavirus crisis - often using social media forums to discuss opportunities.

By piling into a stock in a co-ordinated way, they have created value for themselves against market norms.

The value surge has not been restricted to Gamestop but the risks of such activity became apparent last night.

Gamestop shares, and those of other firms including BlackBerry and AMC Entertainment, fell by more than 20% in extended trading when it emerged that Reddit had temporarily closed the Wallstreetbets chat room.

Discussion within it is widely seen by market analysts as the catalyst for the activist movement.

Wallstreetbets alone is understood to have more than four million members.

The market behaviour has prompted widespread calls for scrutiny of trading fuelled by anonymous social media posts. Reddit said it had not been contacted by any authorities in relation to users' behaviour.

Some heavily-shorted UK stocks, including Cineworld, have also showed signs of retail activist-style gains.

A spokesperson for the UK regulator, the Financial Conduct Authority (FCA), told Sky News: "The FCA is aware of the situation and continues to closely monitor trading in UK markets.

"UK investors should take care when trading shares in highly volatile market conditions that they fully understand the risks they are taking. This applies to UK investors trading both US and UK stocks.

"Firms and individuals should also ensure they are familiar with, and abiding by, all regulations including the market abuse and short selling regimes in the jurisdiction they are trading in."

Users of London-based investor platform Trading212 complained via its Twitter account on Thursday that they had been blocked from buying Gamestop shares, with a screen grab suggesting their positions could only be closed "in the interest of mitigating risk."

One customer responded: "This is unacceptable, you are not asked to take the role of a financial advisor. You will remember this day as the day you went down."

In a sign of the rush for trading accounts among members of the public, Trading212 announced: "Due to the unprecedented demand, we have temporarily stopped onboarding new clients. Once we process the existing queue, we will be open for new registrations."

Wider US market falls in recent days have been blamed on hedge funds selling positions to pay for losses shorting Gamestop.

Wednesday's session saw the main indexes on Wall St lose more than 2% and futures indicate further turbulence ahead.

Even the new US treasury secretary, Janet Yellen, said she was "monitoring the situation" while a state regulator has called for Gamestop shares to be suspended for 30 days to allow a cooling off period.

Technology investor Chamath Palihapitiya told Sky's sister channel CNBC: "We are moving to a world where ordinary folk have the same access as professionals and can come to the same conclusion or maybe the opposite.

"The solution is more transparency on the institutional side, not less access for retail."

In Gamestop's case, it has been shuttering stores for years in a tough retail landscape and market analysts have likened the stock interest - driven purely by retail investors - to a pyramid scheme.

Nasdaq chief Adena Friedman said: "If we see a significant rise in the chatter on social media ... and we also match that up against unusual trading activity, we will potentially halt that stock to allow ourselves to investigate the situation."

https://news.google.com/__i/rss/rd/articles/CBMiZ2h0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L3JlZGRpdC1mb3J1bXMtcm9sZS1pbi1nYW1lc3RvcC1zaGFyZXMtZnJlbnp5LWZhY2VzLXJlZ3VsYXRvcnktcHJvYmUtMTIyMDEwODjSAWtodHRwczovL25ld3Muc2t5LmNvbS9zdG9yeS9hbXAvcmVkZGl0LWZvcnVtcy1yb2xlLWluLWdhbWVzdG9wLXNoYXJlcy1mcmVuenktZmFjZXMtcmVndWxhdG9yeS1wcm9iZS0xMjIwMTA4OA?oc=5

2021-01-28 12:22:30Z

52781330174217

Tidak ada komentar:

Posting Komentar