Bank of England governor Andrew Bailey said he was “optimistic that things are moving in the right direction” – likely a hint that a rate cut is getting closer.

Bailey said the committee voted to wait and see after a majority agreed they needed to see more evidence that inflationary pressures will remain subdued.

In a statement, after the Bank left interest rates on hold today, Bailey says:

“We’ve had encouraging news on inflation and we think it will fall close to our 2% target in the next couple of months.

“We need to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that things are moving in the right direction.”

Filters BETA

BoE governor Andrew Bailey says there’s been an absence of data surprises recently – a sign that we are returning to more normal economic times.

Despite geopoliticial risks, Bailey says global supply chains have held up, energy prices have moderated.

Bailey also doesn’t sound too concerned about recent higher-than-expected wage and services inflation data. Such data has been “well within” normal volatility levels.

The Bank of England is briefing reporters now at its headquarters in London.

Governor Andrew Bailey is explaining that “the big global shocks” that drove up inflation have faded.

UK inflation has now fallen close to 3%, he says, and is expected to be close to the Bank’s 2% target in the coming months. “That’s encouraging”, Bailey says.

But, the Bank isn’t yet confident enough to start cutting interest rates, and will consider upcoming economic data as it weighs up whether to ease policy.

Boom! Britain’s blue-chip share index has climbed to yet-another record high.

The FTSE 100 index jumped to 8394 points, up 50 points or almost 0.5%

Investors are cheered by the prospect that the Bank of England appears to be on track to start cutting interest rates this summer.

The FTSE 100 has hit a series of highs in the last couple of weeks, and is now up over 8% so far this year.

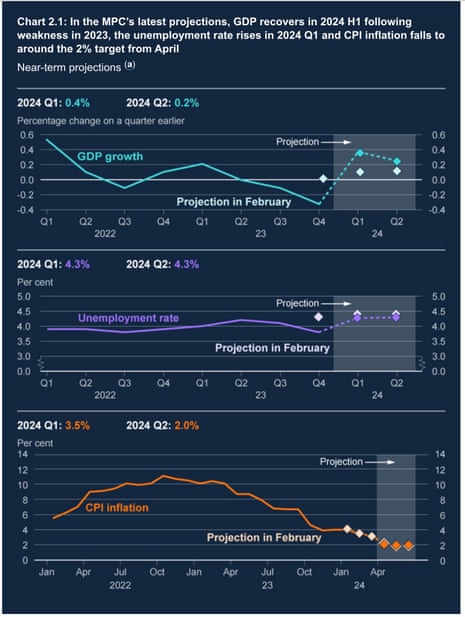

Here’s a handy chart from the Bank’s latest Monetary Policy Reports, showing how it has revised up its growth forecasts a little, while still expecting unemployment to rise and inflation to fall:

Bank of England governor Andrew Bailey said he was “optimistic that things are moving in the right direction” – likely a hint that a rate cut is getting closer.

Bailey said the committee voted to wait and see after a majority agreed they needed to see more evidence that inflationary pressures will remain subdued.

In a statement, after the Bank left interest rates on hold today, Bailey says:

“We’ve had encouraging news on inflation and we think it will fall close to our 2% target in the next couple of months.

“We need to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that things are moving in the right direction.”

The minutes of this week’s meeting show that Bank policymakers were far from united about the situation.

Even among the seven MPC members who voted to hold rates, there was “a range of views” about the risks to the inflation outlook.

There was also “a range of views about the extent of the evidence that was likely to be needed to warrant a change in Bank Rate” – which indicates that some are closer to voting for a cut than others.

As covered at noon, deputy governor Sir Dave Ramsden has seen enough – choosing to join the MPC’s most dovish member, Swati Dhingra, in voting for a rate cut.

The Bank of England still expects inflation to pick up towards the end of this year, but not by as much as it did three months ago.

It says today:

CPI inflation is expected to return to close to the 2% target in the near term, but to increase slightly in the second half of this year, to around 2½%, owing to the unwinding of energy-related base effects.

There continue to be upside risks to the near-term inflation outlook from geopolitical factors, although developments in the Middle East have had a limited impact on oil prices so far.

Back in February, the Bank predicted that inflation would rise to around 2.75% by the end of 2024, so this is a welcome downward move.

The Bank of England also predicts that the UK economy returned to growth in the first quarter of this year, after shrinking in the third and fourth quarters of 2023.

The MPC says:

Following modest weakness last year, UK GDP is expected to have risen by 0.4% in 2024 Q1 and to grow by 0.2% in Q2. Despite picking up during the forecast period, demand growth is expected to remain weaker than potential supply growth throughout most of that period.

A margin of economic slack is projected to emerge during 2024 and 2025 and to remain thereafter, in part reflecting the continued restrictive stance of monetary policy.

We’ll learn at 7am tomorrow if they’re right, when the official GDP report for the first quarter of the year is released.

Newsflash: the Bank of England has left UK interest rates on hold at 5.25% for the sixth time in a row.

As widely expected, the BoE resisted pressure to cut rates, even though UK inflation has slowed to 3.2% (in March).

But the decision is not unanimous. The nine members of the Monetary Policy Committee were split, with seven voting to hold rates and two voting to cut to 5%.

The Bank says:

The Chair invited the Committee to vote on the proposition that Bank Rate should be maintained at 5.25%.

Seven members (Andrew Bailey, Sarah Breeden, Ben Broadbent, Megan Greene, Jonathan Haskel, Catherine L Mann and Huw Pill) voted in favour of the proposition. Two members (Swati Dhingra and Dave Ramsden) voted against the proposition, preferring to reduce Bank Rate by 0.25 percentage points, to 5%.

https://news.google.com/rss/articles/CBMihwFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L21heS8wOS9iYW5rLW9mLWVuZ2xhbmQtZXhwZWN0ZWQtaW50ZXJlc3QtcmF0ZXMtb24taG9sZC1jdXQtaW5mbGF0aW9uLXdhZ2VzLWJ1c2luZXNzLWxpdmXSAYcBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyNC9tYXkvMDkvYmFuay1vZi1lbmdsYW5kLWV4cGVjdGVkLWludGVyZXN0LXJhdGVzLW9uLWhvbGQtY3V0LWluZmxhdGlvbi13YWdlcy1idXNpbmVzcy1saXZl?oc=5

2024-05-09 11:18:56Z

CBMihwFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L21heS8wOS9iYW5rLW9mLWVuZ2xhbmQtZXhwZWN0ZWQtaW50ZXJlc3QtcmF0ZXMtb24taG9sZC1jdXQtaW5mbGF0aW9uLXdhZ2VzLWJ1c2luZXNzLWxpdmXSAYcBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyNC9tYXkvMDkvYmFuay1vZi1lbmdsYW5kLWV4cGVjdGVkLWludGVyZXN0LXJhdGVzLW9uLWhvbGQtY3V0LWluZmxhdGlvbi13YWdlcy1idXNpbmVzcy1saXZl

Tidak ada komentar:

Posting Komentar