- UK central bank is seen keeping its policy rate intact at 5.25%.

- Bank of England is seen reducing its rates by 75 bps this year.

- GBP/USD should maintain its recent familiar range in the wake of the event.

The Bank of England (BoE) is set to hold its policy rate flat for a sixth meeting in a row on Thursday amid persistent disinflationary pressure in the UK and investors’ repricing of interest rate reductions earlier than anticipated.

Bank of England could lean toward dovish hold

It's anticipated that the Bank of England will maintain the benchmark interest rate at 5.25% after its policy meeting on Thursday at 11:00 GMT. Alongside the policy rate announcement, the bank will release the Monetary Policy Minutes and the Monetary Policy Report, followed by a press conference held by Governor Andrew Bailey.

Although initially anticipated to trail behind the Federal Reserve (Fed) and the European Central Bank (ECB) in initiating their easing measures, the Bank of England (BoE) now appears poised to begin reducing interest rates sooner than expected due to mounting disinflationary pressures.

Furthermore, investors widely anticipate a cut in the Bank of England's interest rates, potentially occurring in August or September, with around a 70% chance of a subsequent decrease in December.

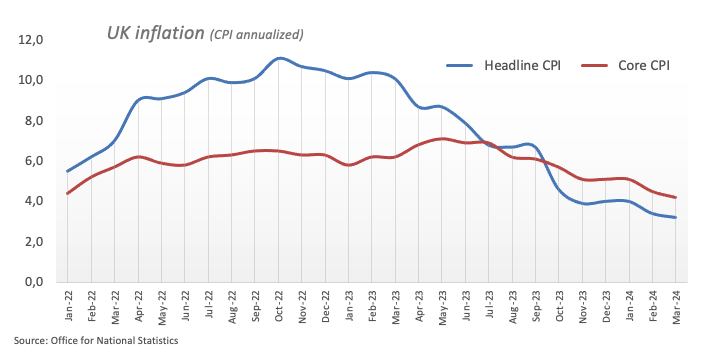

In March, disinflationary trends in the UK accelerated, with the headline Consumer Price Index (CPI) increasing by 3.2% (down from 3.4%) and the core CPI, which excludes food and energy costs, rising by 4.2% (down from 4.5%).

Indeed, the most recent inflation data from the UK seems to challenge the Bank of England's narrative of "higher for longer." Regarding the upcoming event, it is widely expected that the central bank will keep rates unchanged, with the possibility of extending its cautious approach.

During a recent event held by the Institute of International Finance, Governor Andrew Bailey stated that the upcoming inflation figures are anticipated to demonstrate a significant decrease, while he also hinted at some loosening of the labour market.

Back to inflation, the latest BoE’s Decision Maker Panel survey (DMP) conducted between March 8 and 22 showed that one-year ahead CPI inflation expectations decreased to 3.2%, dropping from 3.3% in February. Similarly, three-year-ahead CPI inflation expectations declined to 2.7% over the three months leading to March. Expected year-ahead wage growth, measured on a three-month moving average, also decreased to 4.9%. Consequently, firms anticipate a 1.5 percentage point decrease in their wage growth over the next 12 months based on three-month averages.

At the BoE’s March 21 gathering, Governor Andrew Bailey remarked that it was justifiable for financial markets to anticipate interest rate reductions, expressing optimism regarding the trajectory of inflation. Bailey also indicated that it was reasonable for markets to anticipate two or three rate cuts this year. While refraining from explicitly endorsing the market curve, he acknowledged: "I'm not going to endorse the market curve, but I think that it's reasonable that markets are taking that view, given the way inflation has performed."

Ahead of the BoE gathering, analysts at TD Securities argued: “The BoE will likely stand pat at its May meeting, as wage and inflation data is a bit too sticky to warrant a cut just yet. We see a repeat in language and another 8-1 vote, though the risks are marginally skewed to another dovish dissenter joining Dhingra. We also do not look for any major changes to the projections, though the Year 2 inflation forecast could be lower.”

In the same vein, strategists at Danske Bank noted: “We expect the Bank of England (BoE) to keep the bank rate unchanged at 5.25% on May 9, which is in line with consensus and current market pricing. Overall, we expect the MPC to soften its communication, priming the markets for an imminent start to a cutting cycle. We expect the first 25 bps cut in June.”

How will the BoE interest rate decision impact GBP/USD?

Despite inflation continuing to trend lower in March, the central bank is unlikely to change its tone to a more relaxed one and hence give a more solid signal towards the potential timing of the interest rate reduction. While surprises have been practically ruled out, the British Pound is seen maintaining its current familiar range for the time being.

Under such circumstances, GBP/USD needs to convincingly clear the critical 200-day Simple Moving Average (SMA) at 1.2545 to allow for the continuation of the ongoing recovery, which started around yearly lows in the 1.2300 neighbourhood recorded on April 22. FXStreet Senior Analyst Pablo Piovano suggests:, "Further gains may lead Cable to revisit the May peak of 1.2634 (May 3), an area that appears to be reinforced by the provisional 100-day SMA at 1.2640. Further up comes the 2024 top of 1.2893 (March 8). Surpassing this level could propel GBP/USD towards the psychological milestone of 1.3000 in the first instance.”

On the flip side, Pablo highlights that "the resurgence of the selling bias could prompt some corrective moves in the short-term horizon. That said, an immediate contention aligns at the 2024 bottom of 1.2299 (April 22). The breach of this region exposes further weakness, although the next support is not expected to emerge until the October 2023 low of 1.2037 (October 4).

Economic Indicator

BoE's Governor Bailey speech

Andrew Bailey is the Bank of England's Governor. He took office on March 16th, 2020, at the end of Mark Carney's term. Bailey was serving as the Chief Executive of the Financial Conduct Authority before being designated. This British central banker was also the Deputy Governor of the Bank of England from April 2013 to July 2016 and the Chief Cashier of the Bank of England from January 2004 until April 2011.

Read more.Next release: Thu May 09, 2024 11:30

Frequency: Irregular

Consensus: -

Previous: -

Source: Bank of England

UK gilt yields FAQs

UK Gilt Yields measure the annual return an investor can expect from holding UK government bonds, or Gilts. Like other bonds, Gilts pay interest to holders at regular intervals, the ‘coupon’, followed by the full value of the bond at maturity. The coupon is fixed but the Yield varies as it takes into account changes in the bond's price. For example, a Gilt worth 100 Pounds Sterling might have a coupon of 5.0%. If the Gilt's price were to fall to 98 Pounds, the coupon would still be 5.0%, but the Gilt Yield would rise to 5.102% to reflect the decline in price.

Many factors influence Gilt yields, but the main ones are interest rates, the strength of the British economy, the liquidity of the bond market and the value of the Pound Sterling. Rising inflation will generally weaken Gilt prices and lead to higher Gilt yields because Gilts are long-term investments susceptible to inflation, which erodes their value. Higher interest rates impact existing Gilt yields because newly-issued Gilts will carry a higher, more attractive coupon. Liquidity can be a risk when there is a lack of buyers or sellers due to panic or preference for riskier assets.

Probably the most important factor influencing the level of Gilt yields is interest rates. These are set by the Bank of England (BoE) to ensure price stability. Higher interest rates will raise yields and lower the price of Gilts because new Gilts issued will bear a higher, more attractive coupon, reducing demand for older Gilts, which will see a corresponding decline in price.

Inflation is a key factor affecting Gilt yields as it impacts the value of the principal received by the holder at the end of the term, as well as the relative value of the repayments. Higher inflation deteriorates the value of Gilts over time, reflected in a higher yield (lower price). The opposite is true of lower inflation. In rare cases of deflation, a Gilt may rise in price – represented by a negative yield.

Foreign holders of Gilts are exposed to exchange-rate risk since Gilts are denominated in Pound Sterling. If the currency strengthens investors will realize a higher return and vice versa if it weakens. In addition, Gilt yields are highly correlated to the Pound Sterling. This is because yields are a reflection of interest rates and interest rate expectations, a key driver of Pound Sterling. Higher interest rates, raise the coupon on newly-issued Gilts, attracting more global investors. Since they are priced in Pounds, this increases demand for Pound Sterling.

https://news.google.com/rss/articles/CBMieWh0dHBzOi8vd3d3LmZ4c3RyZWV0LmNvbS9uZXdzL2JvZS1zZXQtdG8tbGVhdmUtaW50ZXJlc3QtcmF0ZXMtdW5jaGFuZ2VkLWFtaWQtaW5jcmVhc2luZy1leHBlY3RhdGlvbnMtb2YtY3V0cy0yMDI0MDUwOTA2MDDSAX1odHRwczovL3d3dy5meHN0cmVldC5jb20vYW1wL25ld3MvYm9lLXNldC10by1sZWF2ZS1pbnRlcmVzdC1yYXRlcy11bmNoYW5nZWQtYW1pZC1pbmNyZWFzaW5nLWV4cGVjdGF0aW9ucy1vZi1jdXRzLTIwMjQwNTA5MDYwMA?oc=5

2024-05-09 09:15:00Z

CBMieWh0dHBzOi8vd3d3LmZ4c3RyZWV0LmNvbS9uZXdzL2JvZS1zZXQtdG8tbGVhdmUtaW50ZXJlc3QtcmF0ZXMtdW5jaGFuZ2VkLWFtaWQtaW5jcmVhc2luZy1leHBlY3RhdGlvbnMtb2YtY3V0cy0yMDI0MDUwOTA2MDDSAX1odHRwczovL3d3dy5meHN0cmVldC5jb20vYW1wL25ld3MvYm9lLXNldC10by1sZWF2ZS1pbnRlcmVzdC1yYXRlcy11bmNoYW5nZWQtYW1pZC1pbmNyZWFzaW5nLWV4cGVjdGF0aW9ucy1vZi1jdXRzLTIwMjQwNTA5MDYwMA

Tidak ada komentar:

Posting Komentar