Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have continued to recover from their slide last year, with prices rising on an annual basis for the first time in over a year last month.

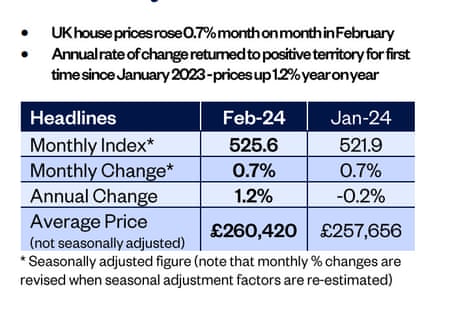

Lender Nationwide has reported that UK house prices were 1.2% higher than a year ago in February, having jumped by 0.7% during the month – the same monthly rise as in January.

This lifted the average price to £260,420, up from £257,656 in January, Nationwide reports.

Nationwides’s data is based on mortgages approved by the lender, and doesn’t capture cash buyers. It does suggest that the drop in mortgage rates following the surge last year is helping to bring buyers back to the market.

Robert Gardner, Nationwide’s chief economist, says:

“The decline in borrowing costs around the turn of the year appears to have prompted an uptick in the housing market.

Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries.

Gardner adds that “the near-term prospects remain highly uncertain”, partly due to ongoing uncertainty about the future path of interest rates.

He says:

After falling sharply in late December, swap rates, which underpin fixed rate mortgage pricing, have drifted back up.

Nationwide reports that house prices are now around 3% below the all-time highs recorded in the summer of 2022, once seasonal effects are taking into account.

February’s rise in prices follows a 0.7% rise during January, according to Nationwide’s data, which left prices 0.2% lower than a year ago.

Yesterday, Bank of England data showed that new mortgage approvals rose in January to their highest level since October 2022, although new lending was still subdued in historic terms:

Zoopla has reported this week that activity in the housing market has picked up; they forecast sales will rise 10% this year.

Also coming up today

We round off the week with a flurry of economic data, including the latest eurozone inflation reading and Brazil’s growth report. Factory surveys from across the world are expected to confirm another drop in activity in the eurozone and the UK.

China’s manufacturing downturn has continued, with activity shrinking for a fifth straight month in February.

This puts more pressure on Beijing to deploy new stimulus measures to support its economy.

Stock markets in Japan, Australia and India have all hit record highs today, as the equities rally continues.

The agenda

9am GMT: Eurozone manufacturing PMI for January

9.30am GMT: UK manufacturing PMI for January

10am GMT: Eurozone flash inflation reading for February

10am GMT: Eurozone unemployment report for January

Noon GMT: Brazil’s GDP report for Q4 2023

2pm GMT: Bank of England’s chief economist Huw Pill: gives a speech at the Cardiff University Business School

3pm GMT: US manufacturing PMI for January

3pm GMT: University of Michigan’s index of US consumer confidence

Filters BETA

In the City, shares in broadcaster ITV have surged 14% after it announced the sale of its stake in the BritBox streaming service.

BBC Studios, ITV’s joint partner in the venture, is buying the 50% stake for £255m.

ITV says it is focusing on its advertiser-funded streaming service, ITVX; it plans to return the cash from the sale of its Britbox stake to investors through a share buyback.

Carolyn McCall, ITV’s CEO says:

“The sale of 50% of BritBox International means ITV is focused on its core strategic goals of continuing to build on ITVX’s success and growing ITV Studios.

I would like to thank the BritBox International team for making the company such a success and particularly CEO Reemah Sakaan for her leadership, drive and vision.”

News of the sale has sent ITV’s shares surging to the top of the leaderboard on the FTSE 250 index of medium-sized stocks.

BritBox was launched by the BBC and ITV in 2019, as a rival to streaming services such as Netflix, Amazon Video, and Sky’s Now TV. It offers a range of classic UK shows, from Downton Abbey and Love Island to Grange Hill and Captain Pugwash.

February’s pick-up in house prices bolsters the view that the correction in property values seen in late 2022 and part of last year has ended, says Martin Beck, chief economic advisor to the EY ITEM Club forecasting group.

Beck explains:

An improving economic outlook has helped. Falling inflation and still-strong pay growth mean real wages are rising again, unemployment is very low, consumer sentiment has picked up and quoted mortgage rates are up to 150 basis points lower than the peaks of summer 2023.

“These factors contributed to mortgage approvals in January increasing to a 15-month high [the Bank of England reported yesterday], while surveys of buyer and seller activity have also picked up.

Very high inward migration, along with a continued under-supply of new houses, are also supporting property values.

Karen Noye, mortgage expert at Quilter, points out that some lenders – including Nationwide – have recently been raising their mortgage rates.

They’ve been tracking the increase in borrowing costs in the market, she explains:

“The latest Nationwide house price index shows the housing market continued its positive start to the year in February, with annual house price growth up 1.2%, the first sign of positive annual growth since January 2023, while on a monthly basis prices rose 0.7%.

“Lower mortgage rates at the start of the year appear to have spurred some buyers back to the market which has buoyed prices, but more recently we have seen a further uptick in rates as swap rates have risen so this could be relatively short lived. Just last week, lenders including Nationwide, NatWest, Santander and HSBC all made the decision to increase their rates.

Hopes that the UK property market has “turned a corner” are creating momentum and lifting prices, says Jonathan Hopper, CEO of Garrington Property Finders:

“It’s a bounceback, not a blip. Nationwide’s data shows house prices have risen in four out of the past five months, and the upward momentum is now so strong that prices have climbed 1.2% compared to this time last year.

“Crucially the market has also become more free-flowing. For sale signs are starting to sprout from homes across the country, and estate agents report a steady uptick in interest from both buyers and sellers.

“Two things are driving this resurgence in activity – mortgages have become more affordable and there’s a widespread sense that house prices have definitively turned a corner.

Tom Bill, head of UK residential research at Knight Frank, predicts average house prices will rise by 3% this year, as interest rates are cut.

Following this morning’s Nationwide house price data, Bill says:

“Buyers feel confident that the only way for the base rate is down, which has seen demand and house prices pick up in recent months. However, the upwards pressure on mortgage rates in recent weeks shows sellers the importance of getting the asking price right.

Banks are keen to lend and should eventually lower rates this year as inflation comes under control, which we believe will sustain positive annual growth in 2024 and see UK house prices increase by 3%.”

Jeremy Leaf, north London estate agent, reports that the housing market is still ‘price sensitive’ – meaning over-priced houses will struggle to sell:

“In our offices, more valuations, listings and viewings combined with fewer fall-throughs than this time last year are feeding through to agreed sales, mortgage approvals and exchanges.

“However, while Nationwide reports another rise in prices, the market does remain price sensitive. Only competitively-priced properties are attracting attention. Sellers must price realistically or offers won’t be forthcoming and market improvement may not be sustained.”

These charts from Nationwide show how annual house price inflation has pulled out of its slide last year, leaving prices 3% below the all-time highs:

A pick-up in borrowing costs could “restrain” the recovery in house prices, Nationwide adds.

Chief economist Robert Gardner says:

“Borrowing costs remain well below the highs recorded last summer but, if the recent upward trend is sustained, it threatens to restrain the pace of any housing market recovery.

“While the squeeze on household budgets is easing, with wage growth now outstripping inflation by a healthy margin, it will take time to make up for the ground lost over the past few years, especially given consumer confidence remains fragile.”

The money markets have dialled back their expectations of interest rate cuts this year, which is why borrowing costs have been inching higher.

At the end of 2023, the City expected as many as six interest rate cuts in 2024, bringing Bank of England base rate down to 3.75%, from 5.25%. Now, though, fewer than three quarter-point rate cuts are expected.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have continued to recover from their slide last year, with prices rising on an annual basis for the first time in over a year last month.

Lender Nationwide has reported that UK house prices were 1.2% higher than a year ago in February, having jumped by 0.7% during the month – the same monthly rise as in January.

This lifted the average price to £260,420, up from £257,656 in January, Nationwide reports.

Nationwides’s data is based on mortgages approved by the lender, and doesn’t capture cash buyers. It does suggest that the drop in mortgage rates following the surge last year is helping to bring buyers back to the market.

Robert Gardner, Nationwide’s chief economist, says:

“The decline in borrowing costs around the turn of the year appears to have prompted an uptick in the housing market.

Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries.

Gardner adds that “the near-term prospects remain highly uncertain”, partly due to ongoing uncertainty about the future path of interest rates.

He says:

After falling sharply in late December, swap rates, which underpin fixed rate mortgage pricing, have drifted back up.

Nationwide reports that house prices are now around 3% below the all-time highs recorded in the summer of 2022, once seasonal effects are taking into account.

February’s rise in prices follows a 0.7% rise during January, according to Nationwide’s data, which left prices 0.2% lower than a year ago.

Yesterday, Bank of England data showed that new mortgage approvals rose in January to their highest level since October 2022, although new lending was still subdued in historic terms:

Zoopla has reported this week that activity in the housing market has picked up; they forecast sales will rise 10% this year.

Also coming up today

We round off the week with a flurry of economic data, including the latest eurozone inflation reading and Brazil’s growth report. Factory surveys from across the world are expected to confirm another drop in activity in the eurozone and the UK.

China’s manufacturing downturn has continued, with activity shrinking for a fifth straight month in February.

This puts more pressure on Beijing to deploy new stimulus measures to support its economy.

Stock markets in Japan, Australia and India have all hit record highs today, as the equities rally continues.

The agenda

9am GMT: Eurozone manufacturing PMI for January

9.30am GMT: UK manufacturing PMI for January

10am GMT: Eurozone flash inflation reading for February

10am GMT: Eurozone unemployment report for January

Noon GMT: Brazil’s GDP report for Q4 2023

2pm GMT: Bank of England’s chief economist Huw Pill: gives a speech at the Cardiff University Business School

3pm GMT: US manufacturing PMI for January

3pm GMT: University of Michigan’s index of US consumer confidence

https://news.google.com/rss/articles/CBMihQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L21hci8wMS91ay1ob3VzZS1wcmljZXMtcmlzZS1ib3Jyb3dpbmctY29zdHMtZmFsbC1mYWN0b3JpZXMtc3RvY2stbWFya2V0cy1idXNpbmVzcy1saXZl0gGFAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvbWFyLzAxL3VrLWhvdXNlLXByaWNlcy1yaXNlLWJvcnJvd2luZy1jb3N0cy1mYWxsLWZhY3Rvcmllcy1zdG9jay1tYXJrZXRzLWJ1c2luZXNzLWxpdmU?oc=5

2024-03-01 07:15:00Z

CBMihQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L21hci8wMS91ay1ob3VzZS1wcmljZXMtcmlzZS1ib3Jyb3dpbmctY29zdHMtZmFsbC1mYWN0b3JpZXMtc3RvY2stbWFya2V0cy1idXNpbmVzcy1saXZl0gGFAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvbWFyLzAxL3VrLWhvdXNlLXByaWNlcy1yaXNlLWJvcnJvd2luZy1jb3N0cy1mYWxsLWZhY3Rvcmllcy1zdG9jay1tYXJrZXRzLWJ1c2luZXNzLWxpdmU

Tidak ada komentar:

Posting Komentar