Thames Water is in a race to find extra cash after its investors said they would not give the struggling water giant extra cash unless bills rise.

The UK's largest water firm has been pushing for the regulator Ofwat to agree to a substantial increase in water bills over the next five years.

Sources close to Ofwat say it plans to "stick to its guns" and won't raise bills to address shareholder problems.

Fears emerged last year that Thames could collapse due to its huge debts.

Regardless of what happens, water supplies will continue as normal.

Thames Water drew up a turnaround plan last summer which asked for a 40% rise in bills over the next five years. But it is now understood shareholders want to see even higher bill rises as a condition of injecting more money.

Investors were due to pump in almost £4bn into the business over the next two years, but have withheld the first payment - due at the end of March - saying its turnaround plan is "uninvestible".

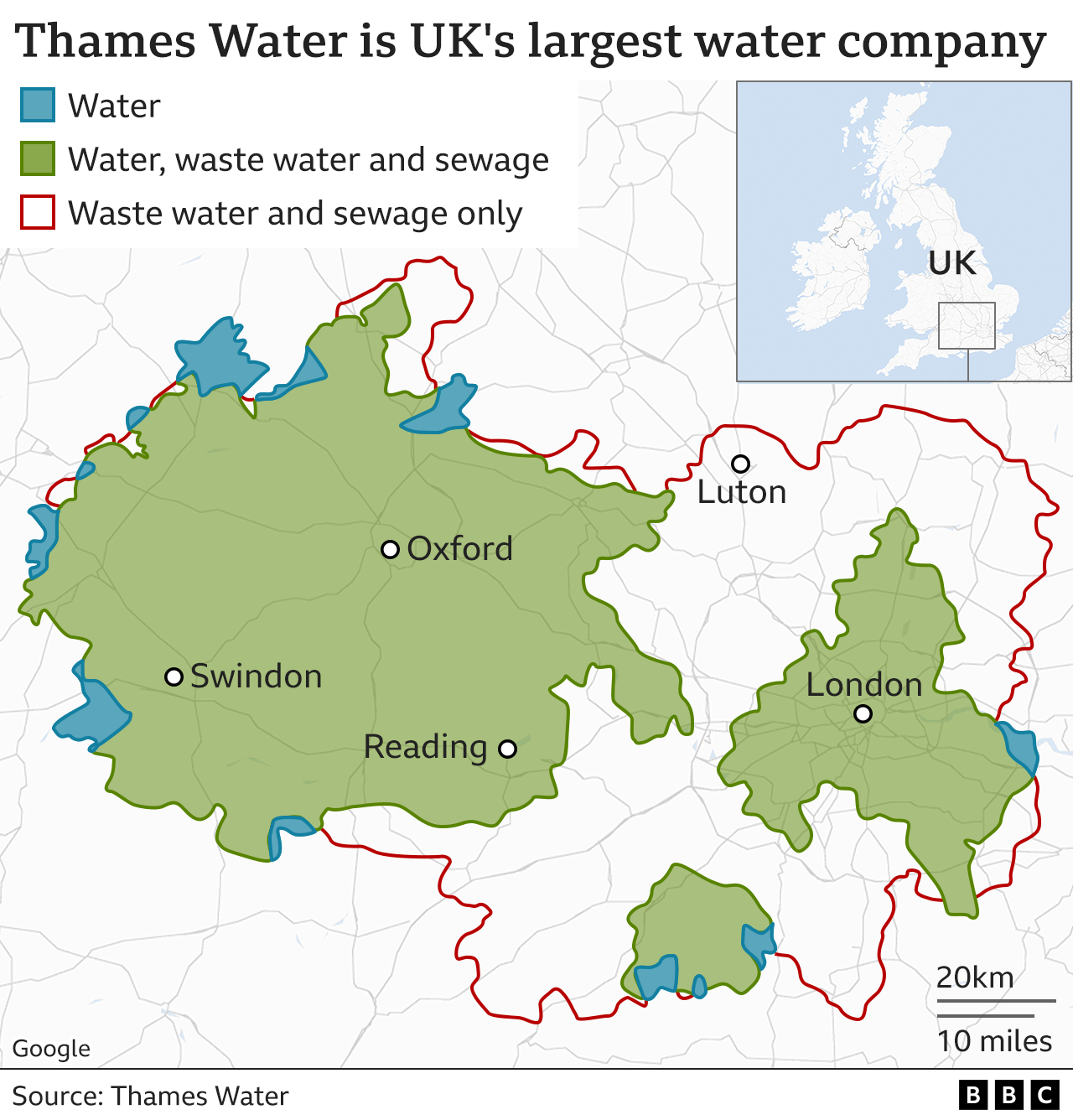

The government has previously said it is ready to take over Thames Water, which is the UK's largest water company, in the event that it collapses. It serves 15 million households, mostly across London and parts of southern England.

The regulator insists that even without the additional capital, the Thames Water operating company will not need to be nationalised immediately as it is still generating enough money to keep it going day-to-day for up to 18 months.

However, at some point Thames will need to raise new money to finance the huge programme of investment that is needed and if the current shareholders - which include domestic and foreign pension funds as well as wealth funds from China and Abu Dhabi - won't inject cash, then Thames will need to find new ones.

Sources close to the current owners say that unless Thames can pay a return - few people will find it an attractive investment.

However, it is not unusual for investors to try to put pressure on the regulator, which is in the process of deciding how much water companies will be able to charge customers from 2025 to 2030.

Chris Weston, chief executive of Thames Water, told the BBC he wanted to "reassure our customers that the business continue to operate as usual".

He said the company was "a long way" from nationalisation "at the moment".

Mr Weston later said that Thames Water was planning to come up with a plan that is acceptable to investors - who want higher returns - and Ofwat - which said it had to be "fair to bill payers".

"It is a balancing act," Mr Weston said.

Ofwat wants the company to clean up its act when it comes to the environment, and improve customer service.

The regulator has also knocked back Thames Water requests for lighter touch regulation.

Chancellor Jeremy Hunt said the shareholder move "should not have an impact on the services received by customers" and that the company was still solvent.

But he added that "there are parts of the country where the service has not been up to scratch, including in my own constituency".

But Labour said it was the government which had "weakened regulation allowing water companies to get massively in debt while the sewerage system crumbled and illegal sewage dumping hit record levels".

The GMB union said investors were trying to "blackmail" customers and Ofwat so bills can "rocket".

Thames Water is heavily indebted, with a large proportion of its £14.7bn debt pile having been run up when it was owned by Macquarie, an Australian infrastructure bank.

Interest payments on its debt have also sharply increased.

Macquarie has said that it invested billions of pounds in upgrading Thames's water and sewage infrastructure while it owned the company.

But critics argue that it took billions of pounds out of the company in loans and dividends - which is a share of a business's profits that is paid to shareholders.

Along with many UK water firms, Thames Water has been in the spotlight for pumping sewage into rivers.

Between 2020 and the end of last year, it discharged at least 72 billion litres of sewage into the Thames.

Ofwat said safeguards were in place to ensure that services to customers were protected "regardless of issues faced by shareholders of Thames Water".

"The company must now pursue all options to seek further equity for the business to turn around the performance of the company for customers. "We also need to see companies deliver the performance that customers expect and that they are run in a way that meets customers' expectations," it added.

Related Topics

https://news.google.com/rss/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTY4NjgyMTk40gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjg2ODIxOTguYW1w?oc=5

2024-03-28 10:18:57Z

CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTY4NjgyMTk40gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjg2ODIxOTguYW1w

Tidak ada komentar:

Posting Komentar