Government borrowing in September was lower than most economists had expected but remains high, figures show.

Borrowing - the difference between spending and tax income - was £14.3bn last month.

This was £1.6bn less than a year earlier, but the sixth highest borrowing in September since monthly records began in 1993.

The figures come ahead of the Autumn Statement in November, but tax cuts to ease pressure on families are unlikely.

Economists had predicted government borrowing to be £18.3bn last month while the Office for Budget Responsibility had forecast the level to be £20.5bn.

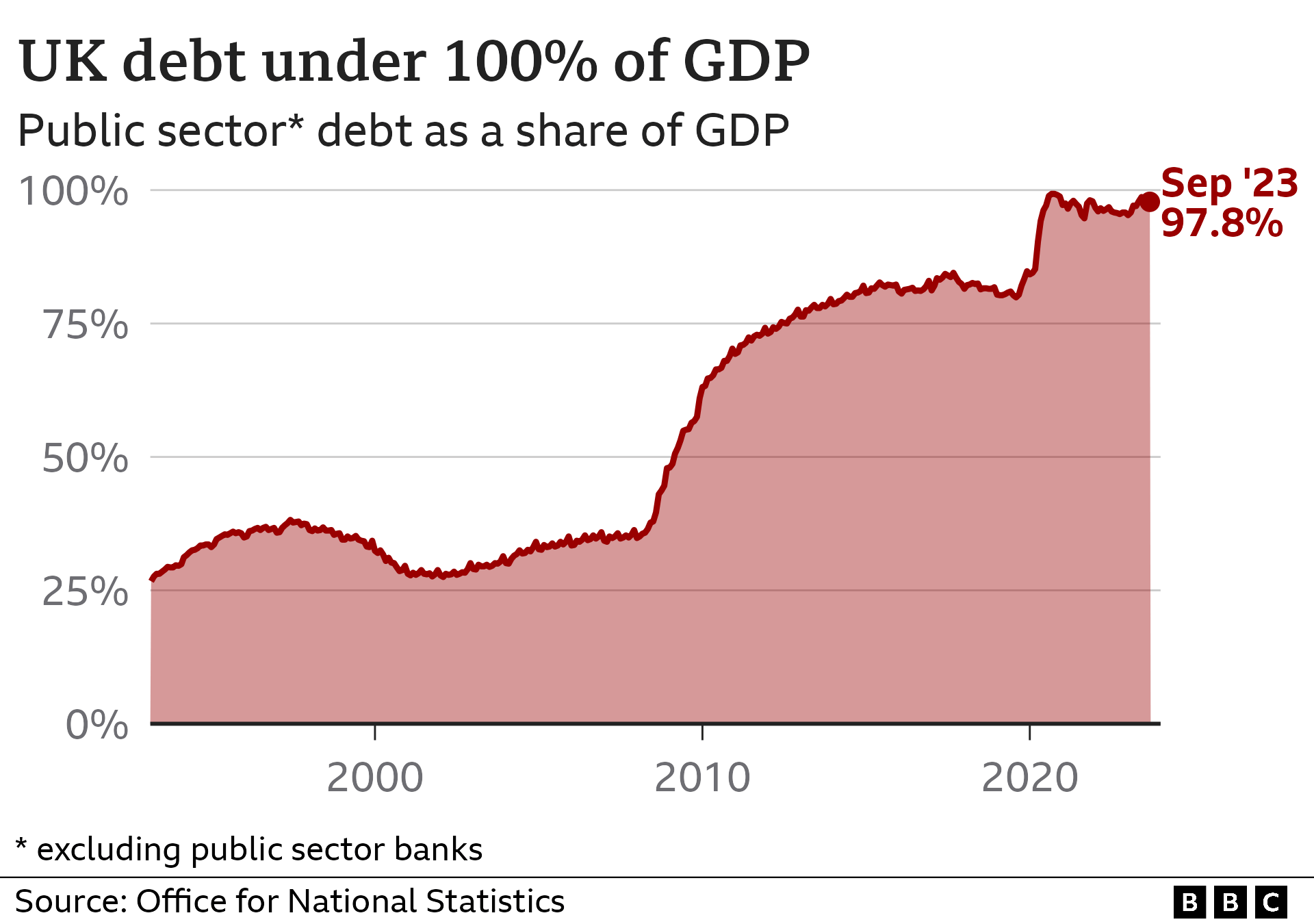

Government debt was nearly £2.6 trillion in September, more than 2% higher than last year, according to the Office for National Statistics (ONS).

The government's debt is usually linked to inflation or interest rates, meaning it has had to pay more overall in interest on its debt in recent times.

Divya Sridhar, economist at PwC, said public spending in the UK was "particularly susceptible" to inflation "because a significant proportion of UK government debt is index-linked, meaning interest payments go up with inflation".

With inflation falling from its peak last year, some repayments on debt have come down.

"We continue to be optimistic that the government will meet its target to halve inflation by the end of this year. There are considerable gains to be made from a public finances perspective if this target is met," said Ms Sridhar.

However, responding to the latest borrowing figures, Chancellor Jeremy Hunt said the government's spending on debt interest was twice the level it was last year and was "clearly not sustainable".

But he said the government "had to borrow during the pandemic to protect lives and livelihoods" and blamed Russia's invasion of Ukraine for having "pushed up inflation and interest rates".

Last week Mr Hunt said that higher interest rates were likely to cost the UK an extra £20bn to £30bn per year.

He has all but ruled out near-term tax cuts, saying the government needs to prioritise bringing down inflation.

But the chancellor is also under pressure from some Conservative MPs to announce plans to lower taxes before the next general election, which will be held at the latest in January 2025.

Alison Ring, director of public sector and taxation at the Institute of Chartered Accountants in England and Wales, said Friday's borrowing figures concluded a "mixed set of results for the first half of the 2023-24 financial year".

She said the scrapping of HS2's northern leg was "likely to result in a relatively small reduction in spending in the second half of the financial year, with the government continuing to search for other savings to offset higher than anticipated spending on debt interest and inflationary pressures on costs".

This week the Institute for Fiscal Studies said the UK economy was in a "horrible fiscal bind" with no room to cut taxes or increase public spending amid mounting political pressure on Mr Hunt to do so.

Mr Hunt on Friday said that the UK needed to "get debt falling and reduce public sector waste so that those delivering public services can get back to what they do best; teaching our children, keeping us safe, and treating us when we're sick".

Since the Conservatives came to power in 2010, local government funding has been heavily cut, there have been large real-term cuts in education funding, and there are gaps in NHS funding.

Related Topics

https://news.google.com/rss/articles/CBMiKmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9idXNpbmVzcy02NzE2NjkxM9IBLmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9idXNpbmVzcy02NzE2NjkxMy5hbXA?oc=5

2023-10-20 06:58:39Z

2544142442

Tidak ada komentar:

Posting Komentar