Howard Davies has apologised for the uncertainty created by recent events but insisted that “My intention is to continue to lead the board”.

Speaking to reporters this morning, Davies says NatWest’s board met yesterday and agreed to the terms of reference for an independent review into the handling of Nigel Farage’s accounts at Coutts.

This review will examine the way in which information about that issue has been handled within the bank. The terms of reference of that review will be released today and the finding will be released “in due course”, says Davies.

He adds:

“My intention is to continue to lead the board and ensure that the bank remains sound and stable and able to support our 19 million customers”.

In April, Davies said he planned to step down as NatWest’s chair by July 2024.

Earlier this week, Farage called for all NatWest’s board to go, after it released a statement backing Rose, hours before her resignation.

Filters BETA

2023 has been a pretty profitable year for the banks, although there are now signs that the windfall from higher interest rates is fading…

Matt Britzman, equity analyst at Hargreaves Lansdown, says NatWest has had a “week to forget” as the row over Nigel Farage’s account closure saw it lose CEO Alison Rose and Coutts chief Peter Flavel.

He adds that the drop in NatWest’s net interest margin in the last quarter, and the lower guidance on this metric for the year (see earlier) is a disappointment.

Britzman says:

“It’s been a week to forget at NatWest as it’s had to lose two of its top execs because of the Nigel Farage account closure debacle.

Today’s results probably don’t do the group any favours either, despite a slight beat on the bottom line. We know markets are laser-focused on net interest margin and at 3.13% for the second quarter that was below expectations, leading to a miss on net interest income.

But perhaps more importantly, full-year guidance has been dragged lower reflecting the ongoing deposit shift to accounts that offer better rates as consumers do all they can to make cash savings go further. NatWest should be a little more robust than peers in this regard, owing to the fact more of its deposits are held by small and medium-sized businesses which tend to keep more cash current accounts that are more profitable for banks.

The UK borrower continues to look robust and this was one area of strength in today’s results. NatWest increased its expectations of future loan defaults by £223m over the half, though a lower-than-expected number for the second quarter reflects default levels that remain low across the portfolio. As we saw with Barclays, a new buyback will go some way to easing investor sentiment, but with NatWest much more reliant on interest income, the downgrade to margin guidance will be disappointing for many.”

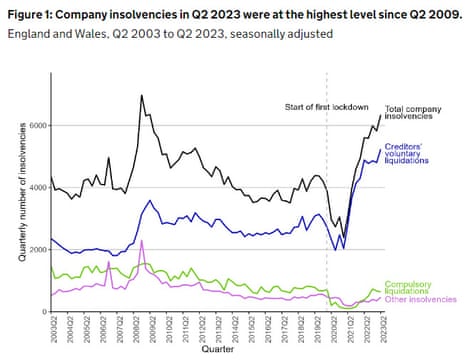

More businesses in England and Wales collapsed in the second quarter of the year than in any three month period since 2009, according to the latest figures from the Insolvency Service.

The government agency said the number of company insolvencies in the three months to the end of June was 9% higher than the previous quarter and 13% higher than the same period last year.

Company insolvencies reached 6,342 in the quarter, comprising 5,240 creditors’ voluntary liquidations (CVLs), 637 compulsory liquidations, 409 administrations and 56 company voluntary arrangements (CVAs).

In total, in the first half of 2023, there were almost 13,000 corporate failures, the agency said.

Business groups have blamed high inflation, rising rents and the cost of living crisis affecting customers for the increase in the number of firms going to the wall.

In the last year the construction industry registered the largest number of insolvencies, closely followed by wholesale and retail trade and hotels and restaurants. Manufacturing made up 8% of cases.

Sam Fenwick, a partner at the law firm Wedlake Bell said:

“More and more businesses are struggling to make ends meet due to increased overheads and their customers having less money to spend.

He added:

“Directors are increasingly throwing in the towel, particularly in smaller businesses.”

The latest growth data from the eurozone paints a mixed picture this morning.

The good news is that France’s gross domestic product grew by 0.5% in the April-June quarter, faster than expected, after 0.1% growth in Q1.

Spain’s economy grew 0.4%, slightly slower than the 0.5% recorded in Q1.

But Germany’s economy stagnated, with no increase in GDP in the last quarter, after it fell into recession over the winter.

Politicians on the right of the political spectrum aren’t the only ones to fall victim to ‘debanking’, it seems.

According to the BBC, anti-Brexit campaigner Gina Miller was told a bank account for her political party would close without explanation.

The BBC reports:

Monzo initially refused to tell Ms Miller why her “True and Fair” party account would be closed in September.

After the BBC contacted the bank about the case, it said it did not allow political party accounts and had made a mistake in allowing it to be opened.

Monzo said it recognised the experience would have been “frustrating for the customer and we’re sorry for that”.

More here.

It’s not exactly the same as Nigel Farage’s situation, as the ex-Ukip leader saw his personal account closed. But it will put more focus on the issue.

Away from NatWest, the high court has dismissed a legal challenge by five Conservative-led councils against the expansion of London’s ultra-low emission zone (Ulez).

Our transport correspondent Gwyn Topham explains:

The zone, which the mayor of London, Sadiq Khan, has said is a vital move to tackle toxic air, is due to be extended throughout the whole of Greater London at the end of August, making owners of the most polluting cars pay to drive.

The outer London boroughs of Bexley, Bromley, Harrow and Hillingdon, along with Surrey county council, launched legal action in February. At the high court earlier this month, barristers argued that Khan had failed to adequately consult, overstepped his powers, and had provided a flawed £110m scrappage scheme.

Our Politics Live blog has all the reaction to th decision:

NatWest will make a fresh £190m payout to its largest shareholder, the UK government, after Downing Street had an influence in the resignation of Alison Rose as the bank’s chief executive amid a row over Nigel Farage’s accounts.

The crisis-hit group said it was planning to pay dividends worth £500m to its investors after another strong quarter in which pre-tax profits rose by a higher than expected 27% to £1.8bn in the three months to June. That was compared with £1.4bn a year earlier, as the bank benefited from rising interest rates that allowed it to charge borrowers more for loans and mortgages.

The shareholder payout will benefit the UK government, which still holds a 38.5% stake in the lender after its £45bn state bailout during the 2008 financial crisis. NatWest also announced a £500m share buyback on Friday morning but that will only benefit investors whose shares are traded on the public stock market, meaning it will not affect the taxpayer’s stake.

It comes during a chaotic week for NatWest Group after the departure of Rose and the ousting of the boss of its private bank Coutts, which triggered a scandal after closing Farage’s bank accounts earlier this year.

Their departures followed interventions by the chancellor and the prime minister this week, who made it clear they wanted change at the top of the bank.

While indiscretion may have led to her departure, the latest results from NatWest suggest former CEO Alison Rose was making “a decent fist of her day job”, says Russ Mould, investment director at AJ Bell.

Moult says:

“After years of struggle following its forced nationalisation during the 2007/8 financial crisis, Rose had probably got the bank as close to normality as any of her predecessors and there will be real frustration that NatWestis back in crisis mode, undoing much of that good work.

This is not an unblemished update. The trimming of guidance on the company’s net interest margin hints at the problems for banks, under big political and regulatory pressure, of charging more to borrowers without offering more to savers too, particularly with mounting competition in the savings market.

And, while earnings beat expectations, this reflected several one-off items and did not reveal too much about the underlying performance of the bank.

The scandal over confidentiality and the way it has played out is a reminder to other investors that the Government remains a major shareholder and, as such, has real influence on the way the bank is run. This is not a reminder the market is likely to receive positively.

While bad debts remain under control for now, the pressures on UK households are acute and this remains an issue which could flare-up for NatWest and the other banks.

NatWest’s share are ralling this morning, recovering some of their losses from earlier this week.

They’re up 1.75% at 244p, after the bank beat profit forecasts and announced a £500m share buyback this morning.

NatWest has appointed law firm Travers Smith to independently probe its handling of the Farage affair, our City editor Anna Isaac explains.

This review will have three aims: to check how Farage’s accounts at private bank Coutts were closed; why they were shut down; and how such a controversial set of statements about his political views and actions were compiled.

It will also look at how the bank communicated with him about his accounts at the bank and their closure.

The investigation is also set to examine the “timing and content” of updates about Farage’s accounts from Coutts to Natwest group level - suggesting this could include memos or briefings from former chief executive Peter Flavel to ex-group boss Dame Alison Rose.

One of its more sensitive tasks will be to put a spotlight on the circumstances and nature of any leaks to the press, and what confidential information may have been passed from the banking group to the media, including the BBC.

Beyond the handling of Farage’s accounts, the probe will also look at all accounts closed at Coutts over the past 24 months. It will follow a similar approach as with the Farage-specific investigation: looking at questions of how and why accounts were shut, and what was said to all other customers whose accounts were shut down.

Howard Davies ended his call with journalists about this morning’s results by insisting that this morning’s results are “positive” (Natwest posted a rise in profits to £3.6bn for the first half of the year).

People will want to look at its ‘net interest margin’, after NatWest cut its guidance on this profitability measure this morning (see earlier post), Davies predicts.

But, he says, “the bank is in a good financial condition”, insisting:

We have not seen deposit outflows or customer outflows on any scale which concerns us.

And the NatWest chair insists that business continues as normal.

Davies signs off by saying that Natwest is open for business for its customers, explaining:

I want to end where I began by reassuring our customers, and our shareholders, that the business of this bank is continuing as normal and will do because it’s crucial from the British economy point of view and for the 19 million customers we serve, that they know that, in spite of all this, we are open for business and ready to serve them.

https://news.google.com/rss/articles/CBMidWh0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvanVsLzI4L25hdHdlc3QtcHJvZml0cy1mYXJhZ2UtYmFuay1hY2NvdW50LWhvd2FyZC1kYXZpZXMtYnVzaW5lc3MtbGl2ZdIBdWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvanVsLzI4L25hdHdlc3QtcHJvZml0cy1mYXJhZ2UtYmFuay1hY2NvdW50LWhvd2FyZC1kYXZpZXMtYnVzaW5lc3MtbGl2ZQ?oc=5

2023-07-28 10:18:45Z

2246872094

Tidak ada komentar:

Posting Komentar