Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK wage growth has strengthened, giving the Bank of England another headache as it tries to cool inflation without crashing the economy.

But while earning are growing, they are still not keeping pace with inflation.

Regular pay (excluding bonuses) rose by 7.2% per year in the February-April quarter, new figures from the Office for National Statistics show, up from 6.6% in November-January.

That is the fastest growth rate for basic pay on record, if you exclude the Covid-19 pandemic which distorted wage data.

Wages were boosted by the 9.7% rise in the minimum wage in April.

Total pay, including bonuses, grew by 6.5% per year in the three months to April.

The Bank is due to set interest rates next week, on Thursday 22 June, and looks certain to hike borrowing costs for the 13th time in a row.

Yael Selfin, chief economist at KPMG UK, says the UK’s “Continued strength in pay growth” will warrant higher interest rates”.

Selfin adds:

“The pickup in regular pay growth is the latest sign that inflation is driving up pay demands, which in turn is making inflation stickier. With negative productivity growth, these figures are well above the levels consistent with the 2% target.

“As higher interest rates feed through to the economy, we still expect the labour market to loosen. But even in that scenario, pay growth may continue to be inflationary as the moderation in prices will drive up real wages and strengthen workers’ purchasing power.

“If there was still any doubt about the direction of monetary policy, these data should solidify another interest rate increase from the Bank of England next week, and probably more in the coming months.”

However, in real terms earnings still fell, as UK inflation was clocked at 8.7% in April

Average regular pay growth for the private sector was 7.6%, again the largest growth rate seen outside of the pandemic period.

Public sector pay growth was weaker, growing by 5.6%, the fastest growth rate since August to October 2003 (when it rose by 5.7%).

The finance and business services sector saw the largest regular growth rate at 9.2%, followed by the manufacturing sector at 7.0%.

That’s the fastest rise in manufacturing pay since comparable records began in 2001.

More details to follow….

Also coming up today

Having won a confidence vote last week, the CBI’s new director-general will face MPs today in a one-off evidence session.

Rain Newton-Smith will be questioned by the Business and Trade Committee this morning, at a hearing which will focus on “the group’s future role, and actions to clean it up”.

The hearing will also examine whether the CBI can still claim to speak for big businesses, as my colleague Anna Isaac explains:

Rain Newton-Smith, a former CBI chief economist who has rejoined as director general while it grapples with the fallout from a sexual misconduct scandal, is to take questions on the organisation’s failings and its future ambitions during an appearance before the business and trade committee.

The Guardian has revealed that more than a dozen women have claimed to have been victims of various forms of sexual misconduct by senior figures at the CBI. This included an account from a woman who alleged she was raped at a staff party on a boat on the Thames and another who claimed she was raped by colleagues when she worked at a CBI office overseas.

Down the corridor at Westminster, the Treasury committee will hold a pre-appointment hearing with economist Megan Greene, ahead of her appointment to the Bank of England’s monetary policy committee.

Greene is joining the Bank at a time when the mortgage market is in turmoil, so will probably be asked whether she supports further interest rate hikes to fight inflation.

Expectations of higher rates have forced several lenders to pull deals, or reprice them higher.

Financial investors are eager to see the latest US inflation data today, which will help determine whether the US central bank raises rates tomorrow, or holds borrowing costs.

The annual US CPI inflation rate is expected to have fallen to 4.1% from 4.9%, with a smaller dip in core inflation.

Michael Hewson, analyst at CMC Markets explains:

It is in core prices that we might see some nervousness for markets ahead of tomorrow’s CPI numbers. If we don’t see a slowdown in core prices, then that might introduce some nervousness that might prompt the Fed to hike again tomorrow instead of the pause that is currently being priced.

The agenda

7am BST: UK labour market report

10am BST: ZEW Institute survey of German and eurozone economic sentiment

10am: House of Commons Business and Trade Committee questions CBI chief Rain Newton-Smith

10.15am: Treasury Committee holds pre-appointment hearing with new Bank of England MPC appointee Megan Greene

1.30pm BST: US CBI inflation report for May

Filters BETA

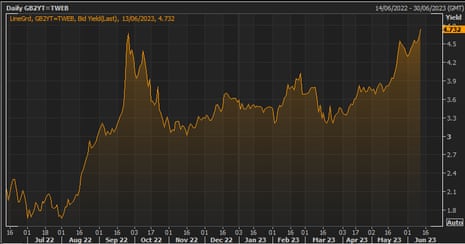

Expectations that UK interest rates will keep rising are driving up the British government’s short-term borrowing costs ABOVE levels seen in Liz Truss’s brief premiership.

That’s bad news for people who looking to take out a mortgage, or remortage, soon.

The yield, or interest rate, on UK two-year government bonds has hit 4.73% this morning, up from 4.62% last night, after this morning’s jobs report showed regular pay growing at the fastest rate on record.

That is slightly higher than the peak seen in the turmoil after last autumn’s mini-budget, when chancellor Kwasi Kwarteng’s plan for unfunded tax cuts spooked the markets.

These two-year gilts are used to price fixed-term mortgages, and the recent increase in yields has already been forcing lenders to reprice deals, or pull them off the markets.

There could be more pain ahead too, as the money markets expect Bank of England base rate to hit 5.5% by the end of this year, up from 4.5% today.

Longer-dated government bond yields have also risen today, but are below their panic levels last autumn.

The surge in bond yields last autumn was partly driven by forced selling by pension funds who had followed Liability Driven Investment strategies, and by a lack of confidence in the Truss-Kwarteng plan.

Neil Wilson of Markets.com says the current situation is different:

UK 2yr gilt yields jumped above 4.73% [today], the highest since September 28th when the mini-Budget was doing its wrecking ball job.

This time is different – LDI has unleveraged, and it’s not about the fiscal or political risk premium. It’s all about strong wage numbers driving expectations for the Bank of England to need to press hike button again and again.

We are now in wage-price spiral territory – private sector wage growth rose to 7.6% in the three months to April, whilst overall regular pay rose 7.2%. This only makes it harder for the BoE to cool inflation – a tougher stance is required but we know the dangers for the economy and notably the mortgage market if that happens.

On today’s jobs data, Minister for Employment Guy Opperman MP says:

“Our drive to get more people into work and grow the economy has seen inactivity fall for the fifth month in a row. Vacancies continue to drop, employment is up and the numbers on company payrolls are also up.

“We’re investing £3.5 billion to remove barriers to work - with extra support for people with health conditions, an expansion of free childcare and arming jobseekers with the skills they need through tailored training and extra work coach time.”

The money markets indicate that the Bank of England is certain to lift interest rates next Thursday…. and a bumper increase in borrowing costs is looking more likely.

Currently, a quarter-point increase in Bank rate to 4.75%, from 4.5%, is seen as a 70% chance.

And a half-point increase, taking Bank rate to 5%, is now seen as a 30% possibility, up from around 25% yesterday afternoon.

The markets now predict Bank rate will be above 5.5% at the end of this year, a whole percentage point higher than today.

Emma Mogford, fund manager at Premier Miton Monthly Income Fund, says today’s jobs market report suggests interest rates must stay higher for longer.

The labour market remains surprisingly tight with unemployment falling and wage inflation increasing.

While broadly good news for the UK economy, this is very challenging for the Bank of England. It may mean interest rates have to stay higher for longer to bring inflation back to normal levels.”

Reaction to this morning’s UK jobs report is flooding in.

Matthew Percival, the CBI’s Director for People and Skills policy, warns that the increase in long-term sickness (see earlier post) is concerning.

“While the number of people in work is rising and unfilled vacancies are slowly falling, the difficulties companies face when hiring is still a hard brake on growth.

Signs that stubbornly high inactivity is starting to fall are encouraging, but a new record high number of people unable to work because of long-term sickness is a real cause for concern.

“Business and government have identified getting people back into work as a top priority. A laser-like focus on delivering the promised expansions to childcare and occupational health services, and businesses increasing flexible working can quicken the pace of easing shortages.”

ING says another increase in UK interest rates next week now looks very likely, followed by another in the summer, given the strong wage growth (although still not matching inflation…)

ING say:

Faster-than-expected wage growth points to a rate hike in June and potentially August, and is a reminder that pay pressures are likely to ease only gradually.

That doesn’t necessarily suggest the Bank of England needs to raise rates as aggressively as markets expect, but it does imply that rate cuts are some way off.

Jake Finney, economist at PwC UK, says the labour market “remains tight” but there are signs that is is normalising, adding:

“The economic inactivity rate declined on the previous quarter to 21%, which was driven by falls to inactivity rates across all age groups. However, the number of workers inactive due to long-term sickness remains persistently elevated - reaching another record high this quarter.

“Declining inactivity saw both the employment and the unemployment rates increase on the previous quarter. As a result, the total number of employed workers has returned to pre-pandemic levels for the first time. This indicates that the labour market is gradually normalising.

Kitty Ussher, chief economist at the Institute of Directors, says firms are still struggling to hire workers:

“Today’s data shows that while the labour market has stabilised a little since the acute shortages of late 2021, it remains very tight by historical standards.

“It also confirms a structural shift: more people with home and caring responsibilities are working than before the pandemic, presumably because they can do so remotely, but those excluded from the labour market due to sickness is depressingly far higher.

The slight rise in unemployment in the latest data is due to more people starting to look for work, not increased layoffs.

And here’s Labour’s shadow chancellor, Rachel Reeves, responding to today’s labour market statistics, said:

“Our country has enormous potential. We should be leading in the industries of the future and creating good jobs across Britain, but the Tories continue to hold us back.

“Family finances are being squeezed to breaking point by a further fall in real wages, and record numbers of people are out of work due to long-term sickness.

“13 years of the Tories and all we have is a gaping hole where their plan for growth should be and a Tory mortgage penalty damaging family finances for years to come.“Labour will get people back into work, and with our mission to secure the highest sustained growth in the G7, create good jobs and productivity growth across every part of our country.”

Chancellor the Exchequer Jeremy Hunt has acknowledged that inflation is taking a bite out of earnings, saying:

“The number of people in work has reached a record high, and the IMF and OECD recently credited our major reforms at the Budget which will help even more back into work while growing the economy.

“But rising prices are continuing to eat into people’s pay checks – so we must stick to our plan to halve inflation this year to boost living standards.”

Hunt’s plan to tackle inflation has includes refusing larger pay increases for the public sector, to help doctors, nurses and teachers through the cost of living squeeze:

ONS director of economic statistics Darren Morgan says:

“With another rise in employment, the number of people in work overall has gone past its pre-pandemic level for the first time, setting a new record high, as have total hours worked. The biggest driver in recent jobs growth, meanwhile, is health and social care, followed by hospitality.

“While there has been another drop in the number of people neither working nor looking for work, which is now falling right across the age range, those outside the jobs market due to long-term sickness continues to rise, to a new record.

“In cash terms, basic pay is now growing at its fastest since current records began, apart from the period when the figures were distorted by the pandemic. However, even so, wage rises continue to lag behind inflation.”

The number of people out of the labour market because of long-term sickness increased to a record high, this morning’s UK unemployment report shows.

The rise in chronic illness in the UK in recent years has forced more people out of the labour market. As well as Covid-19, the rise in NHS waiting lists to record levels means 7.4 million people in England are waiting to start treatment.

Ben Harrison, Director of the Work Foundation at Lancaster University, says:

“With a record 2.55 million long-term sick, the UK is the worst performer in the G7 for workforce participation since the start of the pandemic. Yet nearly one in four people who are long-term sick want to work.

Mel Stride MP’s review of workforce participation therefore must recognise the importance of improving the quality of jobs on offer.

Emelia Quist, head of policy research at the Federation of Small Businesses, says current support to bring people with long-term sickness back into jobs isn’t working:

Despite this rise, the overall economic inactivity rate decreased by 0.4 percentage points on the quarter, to 21.0% in February to April.

Here’s Sky News’s Paul Kelso:

The number of vacancies at UK firms has dropped.

There were 1,051,000 vacancies in March to May 2023, down from 79,000 in December 2022 to February 2023.

That’s the 11th drop in a row, with 250,000 fewer vacancies than a year ago, today’s labour market report shows.

The ONA also estimates that firms kept hiring staff last month.

It estimates that UK payrolls rose by 23,000 in May, to 30.0 million, over a million more than before the pandemic.

Today’s labour market report shows the number of people in employment increased to a record high in the latest quarter.

There were increases in both the number of employees and self-employed workers, the Office for National Statistics reports, pushing up the employment total by 250,000 in February-April to 33,089m.

That has lifted the UK’s employment rate to 76%, up from 75.8% in November to January.

The unemployment rate was 3.8%, up from 3.7% in the previous quarter but down on the 3.9% reported last month.

The increase in unemployment in the last quarter was driven by people unemployed for up to 12 months, the ONS adds.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK wage growth has strengthened, giving the Bank of England another headache as it tries to cool inflation without crashing the economy.

But while earning are growing, they are still not keeping pace with inflation.

Regular pay (excluding bonuses) rose by 7.2% per year in the February-April quarter, new figures from the Office for National Statistics show, up from 6.6% in November-January.

That is the fastest growth rate for basic pay on record, if you exclude the Covid-19 pandemic which distorted wage data.

Wages were boosted by the 9.7% rise in the minimum wage in April.

Total pay, including bonuses, grew by 6.5% per year in the three months to April.

The Bank is due to set interest rates next week, on Thursday 22 June, and looks certain to hike borrowing costs for the 13th time in a row.

Yael Selfin, chief economist at KPMG UK, says the UK’s “Continued strength in pay growth” will warrant higher interest rates”.

Selfin adds:

“The pickup in regular pay growth is the latest sign that inflation is driving up pay demands, which in turn is making inflation stickier. With negative productivity growth, these figures are well above the levels consistent with the 2% target.

“As higher interest rates feed through to the economy, we still expect the labour market to loosen. But even in that scenario, pay growth may continue to be inflationary as the moderation in prices will drive up real wages and strengthen workers’ purchasing power.

“If there was still any doubt about the direction of monetary policy, these data should solidify another interest rate increase from the Bank of England next week, and probably more in the coming months.”

However, in real terms earnings still fell, as UK inflation was clocked at 8.7% in April

Average regular pay growth for the private sector was 7.6%, again the largest growth rate seen outside of the pandemic period.

Public sector pay growth was weaker, growing by 5.6%, the fastest growth rate since August to October 2003 (when it rose by 5.7%).

The finance and business services sector saw the largest regular growth rate at 9.2%, followed by the manufacturing sector at 7.0%.

That’s the fastest rise in manufacturing pay since comparable records began in 2001.

More details to follow….

Also coming up today

Having won a confidence vote last week, the CBI’s new director-general will face MPs today in a one-off evidence session.

Rain Newton-Smith will be questioned by the Business and Trade Committee this morning, at a hearing which will focus on “the group’s future role, and actions to clean it up”.

The hearing will also examine whether the CBI can still claim to speak for big businesses, as my colleague Anna Isaac explains:

Rain Newton-Smith, a former CBI chief economist who has rejoined as director general while it grapples with the fallout from a sexual misconduct scandal, is to take questions on the organisation’s failings and its future ambitions during an appearance before the business and trade committee.

The Guardian has revealed that more than a dozen women have claimed to have been victims of various forms of sexual misconduct by senior figures at the CBI. This included an account from a woman who alleged she was raped at a staff party on a boat on the Thames and another who claimed she was raped by colleagues when she worked at a CBI office overseas.

Down the corridor at Westminster, the Treasury committee will hold a pre-appointment hearing with economist Megan Greene, ahead of her appointment to the Bank of England’s monetary policy committee.

Greene is joining the Bank at a time when the mortgage market is in turmoil, so will probably be asked whether she supports further interest rate hikes to fight inflation.

Expectations of higher rates have forced several lenders to pull deals, or reprice them higher.

Financial investors are eager to see the latest US inflation data today, which will help determine whether the US central bank raises rates tomorrow, or holds borrowing costs.

The annual US CPI inflation rate is expected to have fallen to 4.1% from 4.9%, with a smaller dip in core inflation.

Michael Hewson, analyst at CMC Markets explains:

It is in core prices that we might see some nervousness for markets ahead of tomorrow’s CPI numbers. If we don’t see a slowdown in core prices, then that might introduce some nervousness that might prompt the Fed to hike again tomorrow instead of the pause that is currently being priced.

The agenda

7am BST: UK labour market report

10am BST: ZEW Institute survey of German and eurozone economic sentiment

10am: House of Commons Business and Trade Committee questions CBI chief Rain Newton-Smith

10.15am: Treasury Committee holds pre-appointment hearing with new Bank of England MPC appointee Megan Greene

1.30pm BST: US CBI inflation report for May

https://news.google.com/rss/articles/CBMimQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDIzL2p1bi8xMy91ay1wYXktZ3Jvd3RoLWhpZ2hlci1pbnRlcmVzdC1yYXRlcy11bmVtcGxveW1lbnQtdmFjYW5jaWVzLWNiaS1jaGllZi1tcHMtdXMtaW5mbGF0aW9uLWJ1c2luZXNzLWxpdmXSAZkBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyMy9qdW4vMTMvdWstcGF5LWdyb3d0aC1oaWdoZXItaW50ZXJlc3QtcmF0ZXMtdW5lbXBsb3ltZW50LXZhY2FuY2llcy1jYmktY2hpZWYtbXBzLXVzLWluZmxhdGlvbi1idXNpbmVzcy1saXZl?oc=5

2023-06-13 06:25:00Z

2110518542

Tidak ada komentar:

Posting Komentar