Filters BETA

Q: Could the ECB consider skipping rate rises at certain meetings, and only make changes when you also release new forecasts (which would be every other meeting)?

Lagarde reiterates that the ECB still has ground to cover to reach its inflation target.

The governing council have not discussed a skip, and not begun thinking about it either, “because we have work to do”.

Q: Your new forecasts show you don’t expect to reach your 2% inflation target in the next three years – so is 3% the new 2%?

Lagarde says the ECB is in the middle of its fight against inflation, and insists it will get inflation down to the 2% target, (rather than shuffling the target up to make it more achievable).

Q: Were today’s decisions unanimous?

Christine Lagarde says there was “quite a harmonious discussion” at this month’s meeting, with some deep analysis of the eurozone labour market and the factors driving inflation.

“It was a very, very broad consensus,” she insists, to raise interest rates and to confirm that the ECB would stop reinvesting cash from maturing bonds bought through its asset purchase programme.

That’s not exactly confirmation that the decisions were unanimous, though….

Christine Lagarde explains that the ECB wants to get inflation down to its 2% target, and feel confident that it will stay there.

The ECB chief explains that the governing council need to be confident that core inflation is heading downwards

Q: How alarmed are you by the upward revisions to eurozone inflation in 2025 – will that mean that prevous expectations that terminal rate of interest (peak rates) of 3.75% will not be enough?

Lagarde says the ECB isn’t satisfied by the inflation outlook.

Lagarde isn’t tempted into commenting on the terminal rate.

It is something we will know when we get there, she says.

The ECB are now taking questions…

Q: Is the ECB close to pausing its monetary policy tightening, and what is your take on the US Federal Reserve holding interest rates last night?

Christine Lagarde says today’s decision, to raise interest rates, followed analysis of the latest economic data and new staff forecasts.

Lagarde says the ECB’s decisions are ‘data-dependent’, and insists that further increases in borrowing costs will be needed.

She says:

Are we done? Have we finished the journey? No, we’re not at the destination.

Do we still have ground to cover? Yes.

Unless there is a material change to the ECB’s forecasts, Lagarde adds, the central bank is very likely to raise interest rates again in July.

And on the Fed, Lagarde says she doesn’t know the difference between a ‘pause’ and a ‘skip’ (two terms banded around to describe last night’s no-change). But the ECB is not thinking about pausing.

“The outlook for economic growth and inflation remains highly uncertain”, Lagarde tells reporters in Frankfurt.

Downside risks includes the possibility of upward pressures to food and energy prices from Russia’s war against Ukraine, or the risk of a broader increase in geopolitical tensions that disrupt global trade.

There is also a risk that the tightening of monetary policy (higher interest rates) have a greater impact than expected, she says.

Weaker growth in the world economy would also dampen growth in the eurozone.

But… growth could be higher than thought, if rising confidence leads individuals and companies to spend more.

Digging into inflation, ECB chief Christine Lagarde says that past increases in energy costs are still driving up prices across the economy.

Pent-up demand following the reopening from pandemic restrictions are also pushing up inflation, especially in the services sector.

Wage pressures are becoming an ‘increasingly important source of inflation’, Lagarde says, citing recent increases in wages.

Lagarde also cites corporate profits as another source of inflation, saying:

Firms in some sectors have been able to keep profits relatively high, especially where demand has outstripped supply.

ECB president Christine Lagarde tells reporters in Frankfurt that the eurozone economy has “stagnated” in recent months.

GDP shrank by 0.1% in both Q4 2022 and Q1 2023 (creating a technical recession).

Economic growth is likely to remain weak in the short run, she warns, but strengthen in the course of the year as inflation comes down and supply disruption continues to ease.

Manufacturing continues to weaken, she says, partly due to lower global demand and tighter financial conditions in the eurozone, but the service sector remains resilient.

The jobs market remains resilient, though, Lagarde insists, with unemployment at record lows.

ECB president Christine Lagarde is giving a press conference now to explain today’s interest rate decisions.

Lagarde confirms that the three key ECB interest rates have been lifted by 25 basis points, and that the ECB has adjusted its inflation forecasts (higher) and growth forecasts (lower).

Lagarde also points out that the Governing Council’s past rate increases are being “transmitted forcefully to financing conditions” and are having an impact, gradually, across the economy.

She adds:

Borrowing costs have increased steeply and growth in loans is slowing. Tighter financing conditions are a key reason why inflation is projected to decline further towards target, as they are expected to increasingly dampen demand.

Lagarde also says the Governing Council will discontinue reinvestments under its asset purchase programme (created to stimulate the economy) from July.

You can read the statement here.

Today’s changes mean the ECB’s benchmark deposit rate is the highest level in 22 years:

Neil Shah, Director of Research at Edison Group, predicts eurozone interest rates could reach their peak this summer, following today’s increases.

He points out that the eurozone is technically in recession, after shrinking slightly in the final quarter of 2022 and the first three months of 2023. Higher borrowing costs will suppress the recovery.

Shah says:

“The ECB’s latest 25-point hike has the Eurozone approaching Lagarde’s aforementioned “cruising altitude.” With a further hike in July likely and a potential pause in September, the ECB’s terminal rate could be within reach over the summer months.

On top of that, the Eurozone’s economy has contracted over the past two quarters. As a priority, the ECB will want to avoid turning a technical recession into a real one.

Claus Vistesen, economist at Pantheon Macroeconomics, says the ECB’s new forecasts (see previous post) suggest the eurozone faces stagflation:

Carsten Brzeski, global head of macro at ING, points out that the ECB has now raised its deposit rate to 3.5%, from minus 0.5% a year ago.

Brzerski doesn’t see a pause in sight soon, saying:

Despite a recent softening, actual headline and core inflation remain too high and with expectations for inflation to return to target only in two years from now, there were clear arguments for the ECB to continue raising rates.

The fact that the ECB’s newest staff projections include an upward revision of both headline and core inflation across the entire time horizon must have strengthened the case for continued hiking.

Still, with the Federal Reserve’s hawkish pause and a eurozone economy not only turning out to be less resilient than anticipated but also facing a very subdued growth outlook, the ECB is increasingly taking the risk of worsening the economic outlook.

Also, historical evidence suggests that core inflation normally lags headline inflation while services inflation lags that of goods. These are two strong arguments for a further slowing of core inflation in the second half of the year.

The ECB also pledges to keep borrowing costs at ‘sufficiently restrictive’ levels to bring inflation down to target, saying:

The Governing Council’s future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary.

The European Central Bank has lifted its inflation forecasts, but trimmed its growth forecasts.

Its staff now expect headline inflation to average 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025 – all 0.1 percentage point higher than previously.

The ECB says that core inflation (stripping out food and energy costs) is forecast to be more persistent than previously thought:

Indicators of underlying price pressures remain strong, although some show tentative signs of softening. Staff have revised up their projections for inflation excluding energy and food, especially for this year and next year, owing to past upward surprises and the implications of the robust labour market for the speed of disinflation.

Core inflation is now expected to reach 5.1% in 2023, before it declines to 3.0% in 2024 and 2.3% in 2025.

Staff have slightly lowered their economic growth projections for this year and next year. They now expect the economy to grow by 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025.

Newsflash: The European Central Bank has voted to lift borrowing costs across the eurozone.

The ECB’s governing council has voted to raise the three key ECB interest rates by 25 basis points, or a quarter of one percent.

Announcing the move, it says:

Inflation has been coming down but is projected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner.

Eurozone inflation was recorded at 6.1% in the year to May, down from 7.0% in April, so three times higher than its target.

Today’s changes mean that the interest rate on ECB’s main refinancing operations will rise to 4%.

The marginal lending facility (used by commercial banks to borrow from the ECB) rises to 4.25%, while the deposit facility rate (paid on commercial bank deposits left at the ECB) rises to 3.5%.

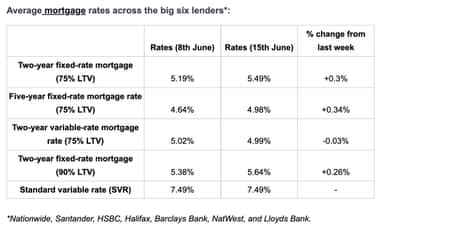

Mortgage rates are continuing to climb.

New data from USwitch, the price-comparison website, shows that the average two-year fixed-rate mortgage, at a loan-to-value ratio of 75%, from the major lenders has risen to 5.49% today, from 5.19% last week.

That follows the increase in UK government short-term borrowing this week, when the yield (or interest rate) on two-year gilts hit a 15-year high. Those yields are used to price fixed-rate mortages.

Moneyfacts data shows that the average rate on a two-year fixed mortage is 5.92% today, up from 5.86% on Tuesday.

Five-year fixed rate mortgage rates are 5.56% on average today, Moneyfacts reports, up from 5.51% two days ago.

The number of mortgage deals available has risen, by 62, to 5,080, they add.

https://news.google.com/rss/articles/CBMiemh0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjMvanVuLzE1L2ludGVyZXN0LXJhdGVzLXRvLXJlbWFpbi1oaWdoLWNhcm5leS1lY2ItZmVkLW1vcnRnYWdlcy1idXNpbmVzcy1saXZl0gF6aHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyMy9qdW4vMTUvaW50ZXJlc3QtcmF0ZXMtdG8tcmVtYWluLWhpZ2gtY2FybmV5LWVjYi1mZWQtbW9ydGdhZ2VzLWJ1c2luZXNzLWxpdmU?oc=5

2023-06-15 12:22:27Z

2112904194

Tidak ada komentar:

Posting Komentar