UK economic activity contracted at its fastest pace in almost two years in October, suggesting the country has fallen into a recession during a period of political uncertainty and high energy and borrowing costs.

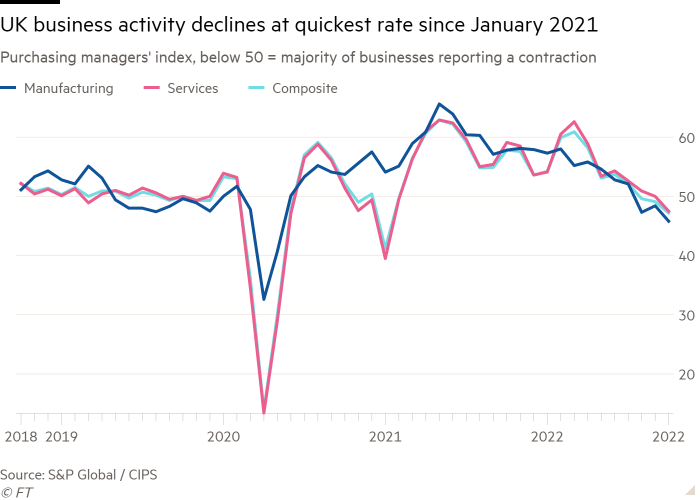

The S&P Global/Cips flash UK composite output index, a measure of activity in the private sector, dropped to a 21-month low of 47.1 in October from 49.1 in September.

October’s was the third consecutive reading under 50, which indicates a majority of businesses reporting a contraction in activity, and was below the 48.1 forecast by economists polled by Reuters.

The gloomy outlook comes amid domestic political uncertainty, with Rishi Sunak on course to become prime minister after Liz Truss resigned last week.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said October’s flash PMI data showed “the pace of economic decline gathering momentum” after recent political and financial market upheaval.

The economy “therefore looks certain to fall in the fourth quarter after a likely third-quarter contraction, meaning the UK is in recession”, he added.

The latest official data showed that economic output fell 0.3 per cent in the three months to August compared with the previous quarter.

Eurozone PMIs also fell one point to 47.1 in October, suggesting recessionary pressures are widespread across Europe.

The UK survey, based on responses collected between October 12 and 20, also showed that new orders had decreased at the sharpest pace since January 2021, with panellists attributing it to the worsening economic outlook. Manufacturers reported a particularly steep fall in new work, with export sales falling at the fastest pace in almost two-and-a-half years.

Business confidence also collapsed, sliding to a level rarely seen in 25 years of survey history, with escalating political uncertainty and rising interest rates among the most commonly cited reasons for the downbeat sentiment.

Companies reported that they were still hiring but at the slowest pace for 20 months. The fall in sentiment suggested businesses would “move decisively to reduce employment this winter”, said Samuel Tombs, economist at the consultancy Pantheon Macroeconomics.

Williamson said that although price pressures had eased because of the economic downturn, the weak pound and high energy costs meant input cost inflation remained higher than at any time in the survey’s pre-pandemic history, said Williamson.

Ashley Webb, economist at the consultancy Capital Economics, said that while the latest PMIs provided further evidence that the economy was heading into recession, with domestic inflationary pressures remaining strong the Bank of England would have “little choice” but to continue raising interest rates.

Markets expect the BoE’s Monetary Policy Committee to raise rates by between 75 and 100 basis points when it meets next week.

The manufacturing sector remained in a downturn for the third consecutive month, while the services sector reported the first contraction in 20 months.

John Glen, Cips chief economist, said that “concerns over rising energy and food bills affected consumer appetite for pubs and restaurants and demand was scaled back”.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50Lzc3YTAzZTg5LTEzYzUtNGQwNS1hZDcxLTcyYTE4YmQwNWQ3Y9IBAA?oc=5

2022-10-24 10:26:03Z

1618642309

Tidak ada komentar:

Posting Komentar