Jay Powell declared the Federal Reserve “must keep at it until the job is done” as he used a speech at Jackson Hole to deliver his most hawkish message to date on the US central bank’s determination to tame soaring inflation by raising interest rates.

In a hotly anticipated address at the first in-person gathering of global central bankers since the beginning of the coronavirus pandemic, the Fed chair said reducing inflation would probably result in “a sustained period of below-trend growth” and predicted there would “very likely be some softening of labour market conditions”.

“These are the unfortunate costs of reducing inflation,” Powell said as he predicted “some pain” for households and businesses, adding: “But a failure to restore price stability would mean far greater pain.”

The remarks were intended to dispel doubts over the Fed’s resolve to continue squeezing the US economy to root out inflation after it embarked on the most aggressive tightening of monetary policy since 1981.

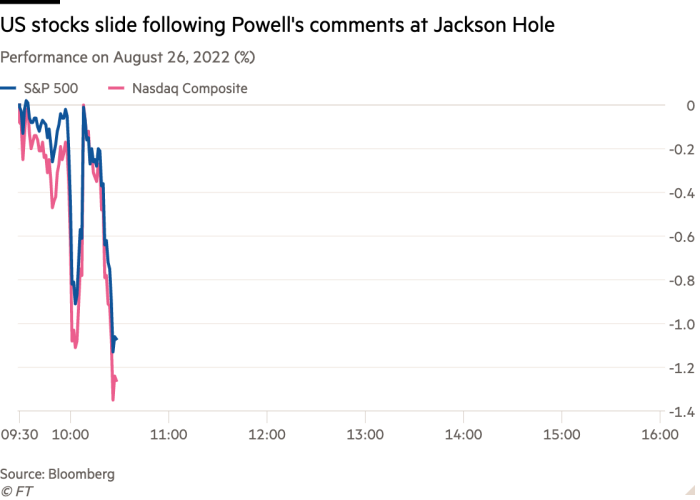

The US stock market weakened after Powell spoke, with the benchmark S&P 500 index down 1.7 per cent and the tech-heavy Nasdaq Composite falling 2 per cent.

Yields on US government debt climbed. On the policy-sensitive two-year Treasury note, the yield increased 0.05 percentage points to 3.42 per cent. The yield on the 10-year note — which moves with growth and inflation expectations — rose a smaller 0.02 percentage points to 3.04 per cent. Yields rise when a bond’s price falls.

“We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored,” Powell said.

Powell’s speech stood in sharp contrast to the message he delivered at last year’s symposium, when he predicted that surging consumer prices were a “transitory” phenomenon stemming from supply chain-related issues. It has since become clear that inflation is demand-driven and therefore likely to persist for longer.

The Fed chair harked back to the lessons of the 1970s, when the US central bank presided over a period of turmoil after it made several policy blunders and failed to rein in inflation. That forced Paul Volcker, who became Fed chair in August 1979, to choke the economy and cause more pain than would have been necessary if officials had acted more quickly.

“The historical record cautions strongly against prematurely loosening policy,” said Powell as he explained that interest rates would need to stay at a level that restrains growth “for some time”.

The main lesson of that period was that “central banks can and should take responsibility for delivering low and stable inflation,” he said, reiterating the Fed’s “unconditional” commitment to tackling price growth.

He also highlighted the risk posed by inflation remaining too high for too long, setting off a chain reaction whereby people come to expect further price increases.

“The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched,” Powell warned.

Financial markets had rallied in recent weeks amid expectations the Fed might ease up its efforts to damp demand as incoming economic data deteriorated further and concerns grew over the risks of being too heavy-handed.

Last month the central bank delivered its second consecutive 0.75 percentage point rate rise, bringing the federal funds rate to a new target range of 2.25 per cent to 2.50 per cent.

Fed officials are debating whether a third increase of the same magnitude will be necessary at its meeting in September, or if they should opt for a half-point rise instead.

The comments from Powell prompted traders to shift wagers on how high policymakers will ultimately raise interest rates. Futures markets on Friday implied that the Fed would lift the federal funds rate as high as 3.83 per cent by next March.

Futures markets also suggested that traders accept that the central bank could keep that rate higher for longer. It marked a noticeable deviation, given investors had been reluctant to bet that the Fed would have the commitment to keep interest rates high in the face of a slowing economy.

Powell said at some point it would be appropriate to slow the pace of interest rate increases. But he dismissed recent data showing a slight easing of inflation as insufficient, adding: “A single month’s improvement falls far short of what the committee will need to see before we are confident that inflation is moving down.”

Most officials maintain they can bring inflation under control without causing a painful recession. That runs counter to the consensus view among Wall Street economists, who predict at least a mild recession some time in the next year.

Economists also expect the US’s unemployment rate to rise beyond the 4.1 per cent broadly anticipated by FOMC members and regional bank presidents in June. The unemployment rate, the current bright spot in the US economy, hovers at a multi-decade low of 3.5 per cent.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2YyYTZkOWFjLTI0ZGUtNGUxMC04ZmQ2LTkyNGU4YTQ1YjA0N9IBAA?oc=5

2022-08-26 14:00:17Z

1530774120

Tidak ada komentar:

Posting Komentar