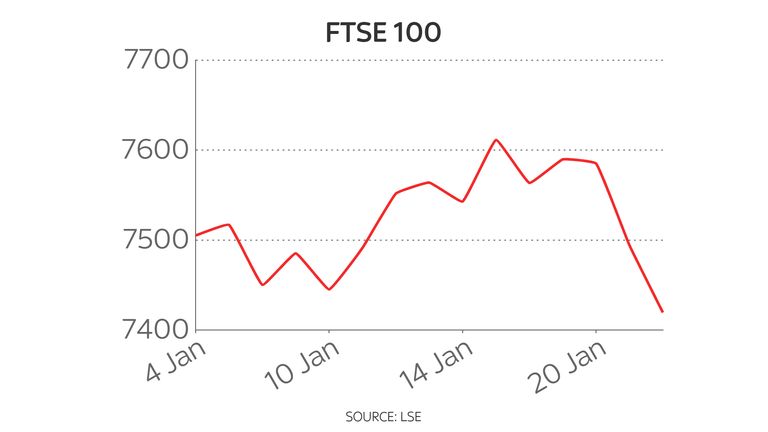

The FTSE 100 has seen £53bn wiped off its value amid a global markets sell-off as tensions between Russia and Ukraine add to a cocktail of investor worries.

Trading screens in London, New York, Paris and Milan turned red while wholesale gas prices also rose sharply and Bitcoin plunged.

London's leading share index fell by 2.6%, or just under 197 points, to 7297 - leaving it below its level at the end of 2021 after giving up gains enjoyed during a brisk start to this year.

It was the FTSE 100's biggest one-day fall since November, when fears about the impact of the Omicron variant were taking hold.

The market volatility builds on heavy sell-offs that saw the US Nasdaq index come under particular pressure last week and endure its worst week of trading since March 2020.

That was largely down to fears of overinflated tech firm values and an accelerated pace of interest rate rises ahead as the Federal Reserve prepares to meet in the face of surging inflation.

The start of the new trading week saw a sell-off in Europe gather pace - building on losses on Friday linked to the US rate and tech rout.

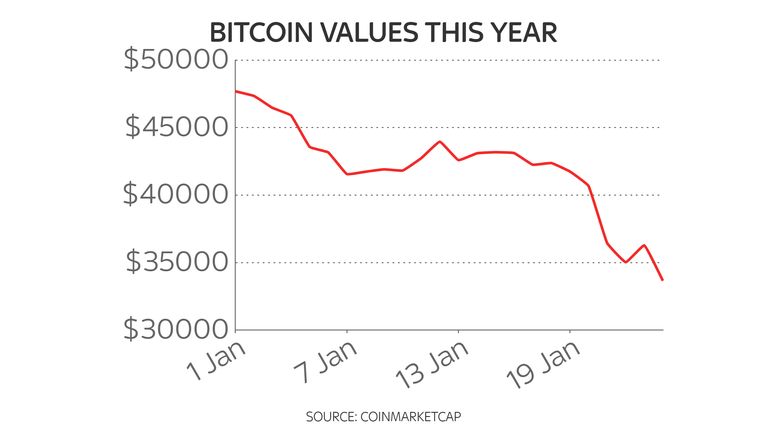

The flight from risk also saw Bitcoin fall to below $33,000 for the first time since July last year - less than half the $69,000 all-time high reached last November.

The pound came under pressure too and was a cent down on the dollar at just above $1.34 as the so-called safe haven US currency found support.

The FTSE 100's fall, led by mining and housebuilding stocks, built on the losses of 1.2% witnessed on Friday while the domestically-focused FTSE 250 was down by 3.6%.

Airlines were hard hit too amid the global tensions, despite the announcement of a further easing of travel testing requirements for UK arrivals - with British Airways owner International Airlines Group losing 6.5%.

Percentage falls in France, Germany and Italy on Monday were even sharper than in London, with stock indices down by around 4%.

Trading in New York also saw further falls to add to last week's sell-off - with the tech-heavy Nasdaq again seeing the worst of the pressure as it dived nearly 5% and the broader-based S&P 500 lost around 4%.

Market analysts pointed to a growing influence from the Russia-Ukraine tensions.

It was evident in wholesale gas prices, which rose across Europe on Monday amid no sign that the stand-off was closer to a diplomatic solution.

NATO revealed it was bolstering its air and sea forces in the region while the UK joined the US in pulling out some of their embassy staff from Kyiv.

The UK wholesale gas contract for next day delivery was as much as 20% up on Monday - though at 228p per therm, it remains well down on the unprecedented highs above 400p witnessed last year.

Those additional costs are, without government intervention, tipped to raise the energy price cap by 50% for UK households from April.

Bjarne Schieldrop, commodities analyst at SEB, told Sky's Ian King Live that Europe was already paying a heavy price for the spat with Russia over Ukraine, as Moscow holds the key to wholesale costs through its 40% share of gas supply to the EU.

Asked whether Russia had been deliberately withholding supplies as a bargaining chip, he said of plunging gas pipeline volumes: "[The] increasing assumption these days is that this is sort of gaming from the Russian side with respect to Ukraine."

Meanwhile in the UK, the wider energy network is showing signs of strain often seen in the winter - with National Grid issuing a notice asking electricity suppliers to bump up capacity to make sure the system has enough spare "margin" in place, which was quickly withdrawn as the market responded.

It is the spectre of inflation that has harmed market sentiment - particularly in the US where the central bank's crisis era of support is being wound down.

All the major US indices have been tumbling from record highs this year as the pace of price increases threaten to dampen both consumer and corporate demand.

AJ Bell's investment director, Russ Mould, wrote: "The Federal Reserve is meeting on Wednesday amid expectations of a first interest rate hike in March and more increases to come this year than had previously been pencilled in.

"This has been signalled by a rise in bond yields. The hardening of monetary policy has negative implications for the valuations of tech stocks and they have seen big slumps in recent weeks.

"Perhaps Apple, Microsoft and Tesla can come to the rescue with some knockout numbers when they report this week. On the other hand, a series of disappointing updates from these technology titans would only undermine sentiment further.

"The shifting market landscape is further complicated by the increasingly noisy sabre rattling by Russia on the Ukrainian border.

"Escalation to a full armed conflict is likely to prompt market volatility and potentially a further surge in energy prices - only adding to the current inflationary pressures."

https://news.google.com/__i/rss/rd/articles/CBMidGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L3N0b2Nrcy1hbmQtYml0Y29pbi10YWtlLWZyZXNoLWhpdHMtYXMtY29ja3RhaWwtb2Ytd29ycmllcy1jb21iaW5lLXRvLWhpdC1tYXJrZXRzLTEyNTI0MjM40gF4aHR0cHM6Ly9uZXdzLnNreS5jb20vc3RvcnkvYW1wL3N0b2Nrcy1hbmQtYml0Y29pbi10YWtlLWZyZXNoLWhpdHMtYXMtY29ja3RhaWwtb2Ytd29ycmllcy1jb21iaW5lLXRvLWhpdC1tYXJrZXRzLTEyNTI0MjM4?oc=5

2022-01-24 17:37:30Z

1202897808

Tidak ada komentar:

Posting Komentar