The extension of the stamp duty holiday put a "spring in the step" of home movers in March, according to the UK's biggest mortgage lender.

The Halifax, part of Lloyds Banking Group, said there was "something of a resurgence" in the UK housing market in March.

Extensions to stamp duty holidays in England, Northern Ireland and Wales were key to the rise in activity.

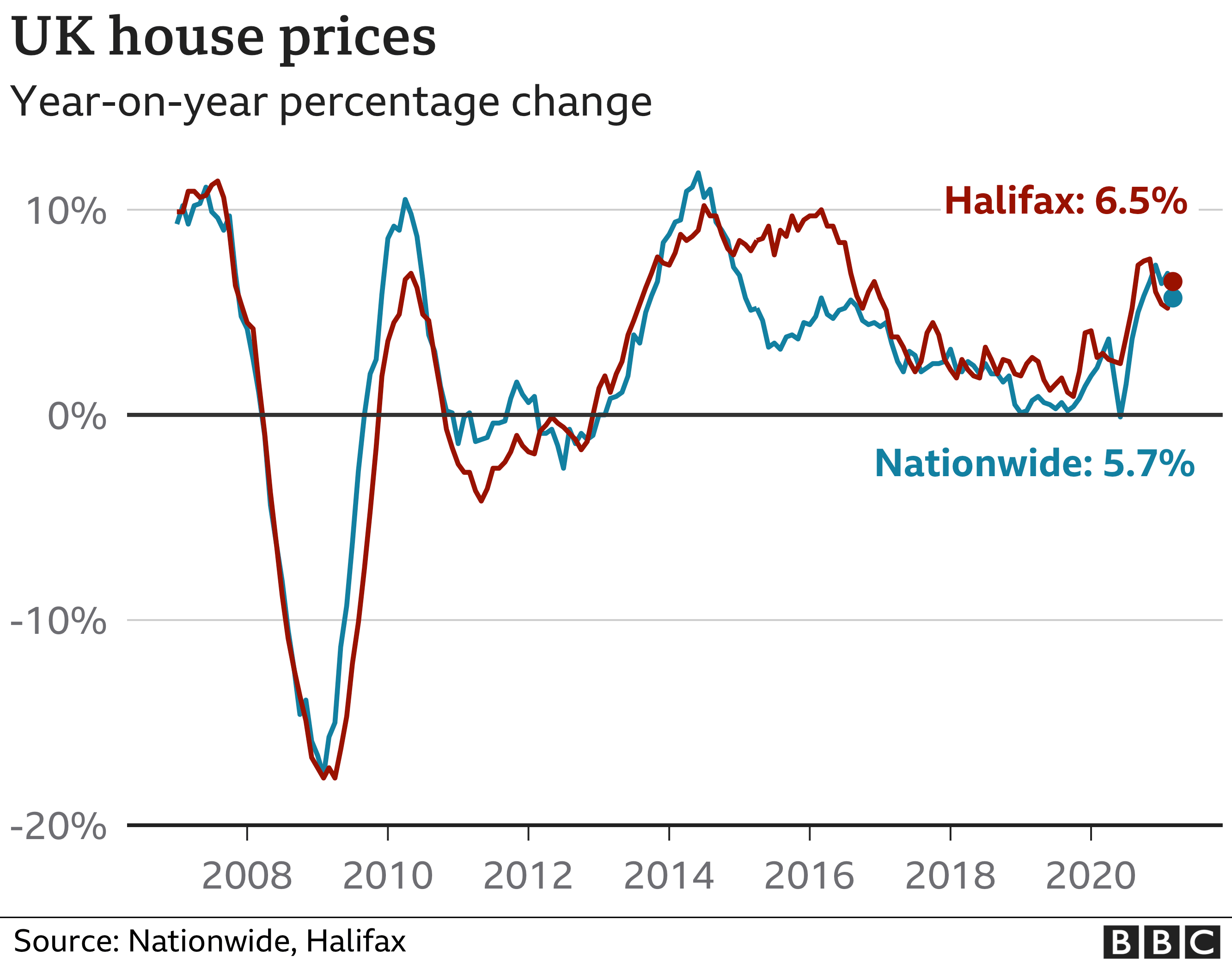

As a result, the average house price was 6.5% higher than a year ago.

It meant the typical home was valued at £254,606 in March.

Although rising house prices will be welcomed by some, it will frustrate those wanting to buy a home for the first time - particularly if Covid uncertainty has affected their income and ability to borrow through a mortgage.

There was some support announced in the Budget as a government guarantee means first-time buyers should get a wider choice of mortgages that require a deposit of just 5% of the loan.

The economic fallout of the pandemic could affect longer-term pricing of property, according to Russell Galley, managing director at the Halifax.

"With the economy yet to feel the full effect of its biggest recession in more than 300 years, we remain cautious about the longer-term outlook," he said.

"Given current levels of uncertainty and the potential for higher unemployment, we still expect house price growth to slow somewhat by the end of this year."

Defying expectations

The Halifax said that UK house prices rose by 1.1% in March compared with February, according to figures based on the lender's own mortgage data.

That meant they had risen in cash terms by £15,430 over the last year - a 12 months dominated by Covid, with various lockdowns and other restrictions.

"Casting our minds back 12 months, few could have predicted quite how well the housing market would ride out the impact of the pandemic so far, let alone post growth of more than £1,000 per month on average," Mr Galley said.

Anna Clare Harper, chief executive of asset manager SPI Capital, suggested that lockdowns and rising living standards had encouraged existing owners to buy bigger properties.

However, she said inequality among generations and incomes meant many would need to rent instead, which could increase demand in that sector.

The UK housing market is judged by average prices, but there are a host of local markets in which schools, housing development and regional employment that can affect property values.

https://news.google.com/__i/rss/rd/articles/CBMiKmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9idXNpbmVzcy01NjY4NzQ0N9IBLmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9hbXAvYnVzaW5lc3MtNTY2ODc0NDc?oc=5

2021-04-09 08:23:57Z

CBMiKmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9idXNpbmVzcy01NjY4NzQ0N9IBLmh0dHBzOi8vd3d3LmJiYy5jb20vbmV3cy9hbXAvYnVzaW5lc3MtNTY2ODc0NDc

Tidak ada komentar:

Posting Komentar