For cryptocurrency enthusiasts, this week’s blockbuster US stock market listing for Coinbase is the modern equivalent of the Netscape debut that thrust the internet in to the mainstream of finance a quarter of a century ago.

The initial public offering of the web browser — then a Silicon Valley start-up — came well before Microsoft bundled Internet Explorer into its best-selling PC software. It was the moment to get in on the ground floor of a life-changing technology.

Still, the 1995 launch left some fund managers scratching their heads: how do you value this company? Is it really a game-changer?

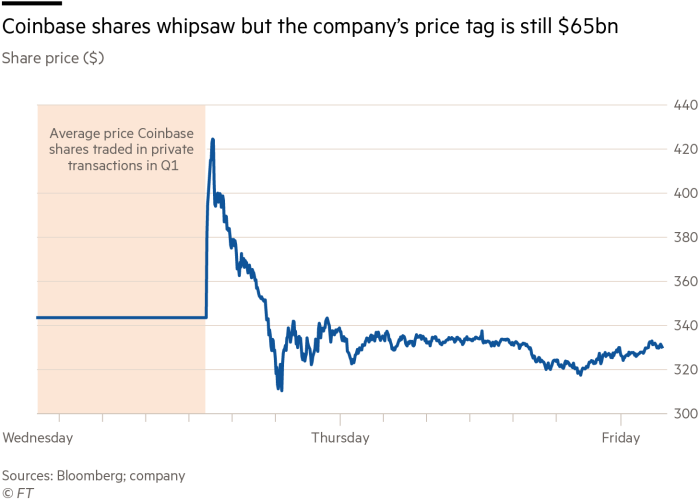

A similar conversation is taking place across Wall Street today after more than 120m Coinbase shares — worth $43bn — changed hands on Wednesday and Thursday, pushing its valuation to $65bn, just below that of Intercontinental Exchange, the owner of the New York Stock Exchange.

The public-market launch of the company, which holds digital assets for 56m retail customers and operates the largest digital coin exchange in the US, was the latest in a long line of examples of how bitcoin and other digital assets are moving from the fringes to the main stage.

The Netscape IPO “was the moment it was printed on the public psyche: ‘What is the internet? What is the web?’,” said Tom Jessop, the president of Fidelity Digital Assets. “This transaction is probably that significant.”

Several asset managers have filed plans to launch bitcoin exchange traded funds with the Securities and Exchange Commission. A handful of companies, including Tesla and payments group Square, have bought bitcoin to hold on their balance sheets. And this week hedge fund Brevan Howard moved to invest up to 1.5 per cent of its main fund in cryptocurrencies, according to a person briefed on the matter.

Goldman Sachs, which advised Coinbase on its flotation, is restarting a crypto derivatives trading desk as institutional money managers warm to the market. Goldman’s chief executive told investors this week that he wanted to “look for ways to expand our capabilities” in crypto.

Sceptics note that cryptocurrencies have yet to achieve widespread adoption in payments and other core areas of the financial system. Jay Powell, chair of the Federal Reserve, on Wednesday called cryptocurrencies “vehicles for speculation”, reflecting a view that is still prevalent among policymakers around the world.

Cryptocurrencies have also drawn the ire of prosecutors and regulators, concerned over money laundering and risks to the investing public given their high volatility, as well as alarm over the environmental damage caused by bitcoin mining. In 2018, Bank for International Settlements head Agustín Carstens said “cryptocurrencies are, in a nutshell, a bubble, a Ponzi scheme and an environmental disaster”.

Though the Coinbase debut marks a critical juncture for crypto markets, the company had to put some of its more ambitious plans on hold. A sale of tokens, a type of digital asset that would have formed a class of Coinbase stock, was ultimately cancelled after the company struggled to find a large enough pool of brokers licensed to trade them, according to people involved in the process.

The Coinbase listing, which raised at least $3.4bn for shareholders who sold at the opening trade on Wednesday, does not guarantee a solid trajectory for the exchange or for cryptocurrencies. The rally in bitcoin prices has helped drive investor interest in the digital currency, and a reversal could prove damaging to its prospects. Already, the surge in retail trading that captivated Wall Street and the investing public in January and February has begun to fade.

Bitcoin and other assets have appeared to be on the verge of mainstream adoption before; in one high-profile setback in 2019, the derivatives exchange Cboe pulled the plug on bitcoin futures due to a lack of investor interest.

Still, more crypto listings are in the pipeline. Bakkt, the Intercontinental Exchange-backed provider of crypto wallets, is going public through a merger with a shell company. The chief executive of Kraken, a Coinbase rival, has also laid out his ambitions to go public. Shares in the company have recently changed hands at prices that would give it an implied valuation of $10bn to $15bn, according to people briefed on the trades.

Coinbase has already shown it is profitable, recording net income of at least $730m from about $1.8bn in revenue during the first quarter. That suggests that, compared to the fees that established brokers and exchanges can earn from processing much larger volumes of stocks trades, this is a lucrative business.

Coinbase’s regulatory filings, including quarterly and annual reports and investor presentations, will now offer a peek into the business in a way not seen by the public before.

“It’s now a phenomenon traditional institutions cannot ignore,” Jessop said, noting the company’s large user base. “Clearly that’s an attractive pool of revenue.”

For the wider cryptocurrency ecosystem, the Coinbase listing “legitimises the industry in a new way”, said Stephen Wink, a partner at law firm Latham & Watkins, which advised banks on the transaction. “Folks understand that the SEC process for becoming a public company is a rigorous one, and that gives some comfort that what they’re doing is on solid ground. That lends real credence to do all this.”

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2NiZDQ2ZDk1LTY4NjYtNGMzMi1iN2FmLTUxYjE3NzJlMzg4ZNIBAA?oc=5

2021-04-16 20:00:03Z

52781512049405

Tidak ada komentar:

Posting Komentar