China's economy stumbled in the second quarter, official data shows, just as the country's top leaders gathered for a key meeting to address its sluggish growth.

It grew 4.7% in the three months to June, falling short of expectations after a stronger start in the first three months of 2024. The government's annual growth target is around 5%.

"China’s economy hit the brakes in the June quarter," said Heron Lim at Moody's Analytics, adding that analysts are hoping for solutions from the meeting under way in Beijing, also called the Third Plenum.

The world's second-largest economy is facing a prolonged property crisis, steep local government debt, weak consumption and high unemployment.

Past outcomes of the Plenum have changed the course of history in China - in 1978, then leader Deng Xiaoping began opening China's markets to the world, and in 2013 President Xi Jinping hinted at loosening the controversial one-child policy.

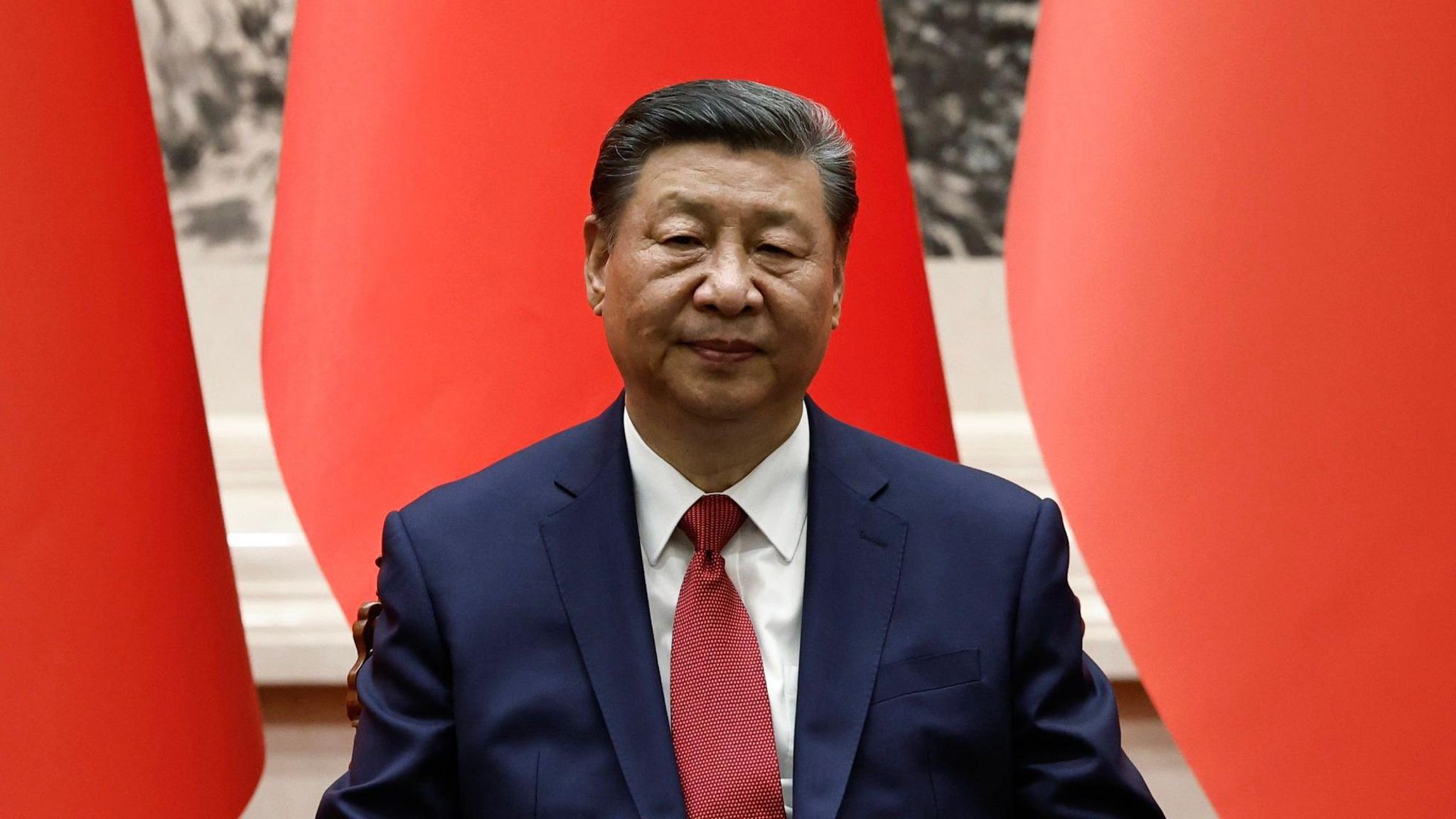

And so there are expectations of this year's Plenum, where Mr Xi is presiding over a closed-door gathering of 370-plus high-ranking Chinese Communist Party members.

The rhetoric on state-controlled media has certainly been encouraging.

An editorial in The Global Times said a "wide range of reform-focused polices" are "high on the agenda" and would usher in a "new chapter". Xinhua referred to "comprehensive" and "unprecedented" reforms. The editorial in the People's Daily was headlined on a "new era of reform and opening up", invoking the very phrase Deng coined in 1978.

Observers, however, are unsure of how much room there is for bold ideas or debate in the Party under Mr Xi's heavily-centralised leadership. Some see the meeting as a mere rubber-stamping exercise for decisions that have already been made.

Economists are also sceptical the meeting will deliver a quick fix.

It has "little impact on near-term growth," says Qian Wang, Asia Pacific chief economist at Vanguard, because its focus will be on longer-term and more significant reforms to "unleash the long-term growth potential".

Still, analysts will be watching for announcements that signal the Party's economic priorities.

Separate data on Monday showed that prices for new homes in June fell at the fastest pace in nine years.

This is more evidence of the crisis that has engulfed China's property sector and led to the demise of giants such as Evergrande. The fear is that it could spread to other parts of the economy.

"There are more than 4,000 banks in China and over 90% are smaller, regional banks which are highly exposed to the housing market and local government debt," says Shanghai-based economist Dan Wang.

She believes Party leaders will "push for consolidation of small banks".

Another issue is falling prices - a symptom of weak demand.

Producer prices continued to drop in the last month, while consumer prices rose by a mere 0.2%, the slowest pace in three months.

Meanwhile, retail sales in June grew by just 2%, which is below expectations and a sign that consumers are still cautious about spending and uncertain of the future.

"A major concern is the loss of household, business, and investor confidence in the government’s ability to navigate the perilous economic environment," said Eswar Prasad, former head of the International Monetary Fund's China division.

Still, questions remain about Beijing's willingness to deliver the sort of solution that would satisfy observers and the markets.

"The government is reluctant to turn to short-term stimulus plans such as cash transfer to families," Dan Wang said. "Instead, we expect them to stress once again on bolstering supply chains and high tech."

That is in line with Beijing's bets on high-tech industries such as renewable energy, artificial intelligence and chip-making, and exports to revive the economy. Last month, China reported a record trade surplus - $99bn (£76.4bn) - as exports soared and imports struggled.

But even that bet faces challenging odds. Major trading partners such as the European Union and the United States have imposed tariffs and other barriers on goods made in China, from electric vehicles to advanced chips.

Related Topics

https://news.google.com/rss/articles/CBMiMGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NsNHk2bWV4Z3o4b9IBNGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NsNHk2bWV4Z3o4by5hbXA?oc=5

2024-07-15 06:33:15Z

CBMiMGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NsNHk2bWV4Z3o4b9IBNGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NsNHk2bWV4Z3o4by5hbXA

Tidak ada komentar:

Posting Komentar