Hidden among thick bushland in the outer suburbs of southern Sydney sits an expansive facility housing a technological breakthrough.

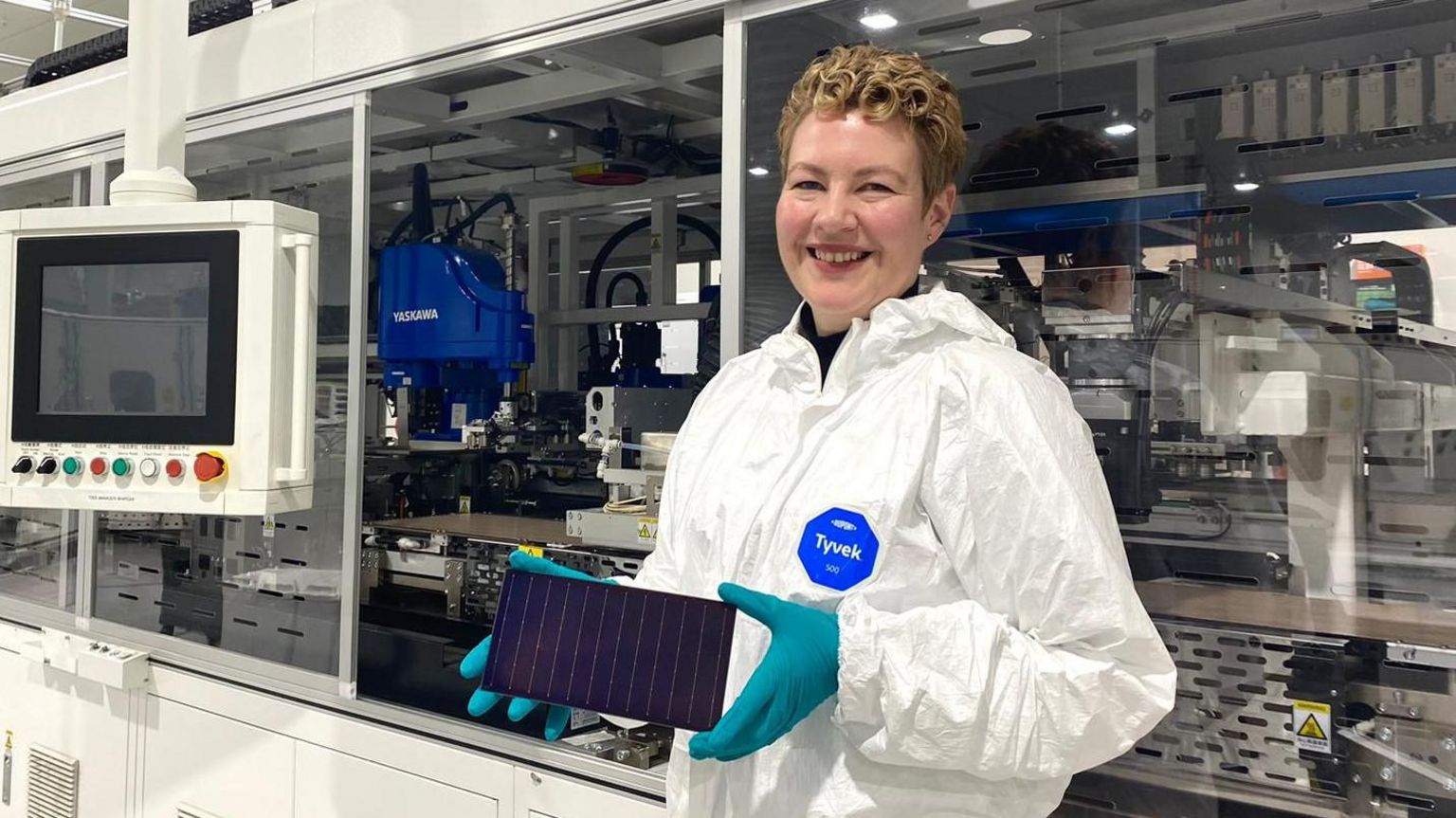

It’s here that Australian company SunDrive Solar makes its “special sauce”: a new - top secret - formula that it says has solved “a very high value problem”.

Its big innovation? Finding a way to replace the silver used in solar cells with copper, which was previously thought impossible.

“Silver is expensive, scarce and environmentally disastrous, and it limits how much solar can be rolled out around the world,” explains chief commercial officer Maia Schweizer.

“Copper is also highly in demand, but it's 1,000 times more abundant, and 100 times lower cost.”

The start-up is one of the beneficiaries of the government’s Future Made in Australia plan - a suite of policies that aim to turn the country into a “renewable energy superpower” by investing in homegrown green industries.

But some experts question whether the $A22.7bn ($15bn; £11.8bn) package, which comprises tax incentives, loans, and kick-starter grants - is enough to meet those lofty ambitions.

And climate scientists say that if Australia wants to be a major player in the net zero transition, it needs to stop peddling fossil fuels.

Australia’s economy has long been powered by its natural resources, such as coal, gas and iron ore.

But its critical minerals - many of which underpin crucial low emissions technologies - are exported raw, and refined abroad, predominantly by China.

It’s a dig-and-ship model of trade that has earned Australia a reputation as the world’s quarry, and seen it lose out on a significant chunk of change further up the supply chain.

Lithium - which is used in the batteries that store renewable energy and power electric vehicles - is one example.

Despite being responsible for more than half of the world’s supply, Australia captures just 0.5% of the global $57bn lithium battery market, according to the country’s national science agency.

The Future Made in Australia policy - which was formally announced in April - seeks to change that, by offering tax breaks and loans to companies seeking to process critical minerals at home.

Doing so, the government argues, is a national security priority, as countries examine their trade dependence on Beijing, and look to insulate themselves against supply chain shocks.

“This is not old-fashioned protectionism or isolationism – it is the new competition,” Prime Minister Anthony Albanese said, when announcing the plan.

“We need to aim high, be bold, and build big, to match the size of the opportunity in front of us.”

Queensland-based Alpha HPA is one of the companies the government has tapped to execute its vision.

Like SunDrive, it views itself as a disruptor, due to its ability to create ultra-high purity aluminium products - used in things like semiconductors and iPhones - with a lower carbon footprint than overseas competitors.

Thanks to a A$400m federal loan, it is building one of the world’s largest alumina refineries near the coastal city of Gladstone, which it says will create hundreds of local jobs.

It’s a huge source of pride, given that there is still scepticism over whether Australia can make things, after decades of outsourcing its manufacturing to China, Alpha HPA’s chief operating officer Rob Williamson says.

“Anybody that puts forward the case that we don't have people in this country to do [this work] is just not trying," he adds.

SunDrive is on a similar journey.

Without government support, Ms Schweizer says, the company might have moved offshore.

Instead, it's looking to transform one of the country’s oldest coal power stations into a massive solar panel manufacturing hub.

Currently, one in three Australian households have solar panels, the highest rate in the world, and yet only 1% are made locally - with China responsible for more than 80% of global production.

“Every single mineral that you need to make a solar panel, we've got one of the top three reserves in the world,” Ms Schweizer explains.

“Now there's the possibility of the end-to-end value chain coming onshore in Australia for the first time, which is super, super exciting.”

The Made in Australia pledge has won the support of the country’s biggest renewable energy industry trade bodies, who say the investments could be “game changing”.

“It’s a big opportunity for us to be an exporter of climate solutions to the world instead of climate problems,” John Grimes, who heads the Smart Energy Council, says.

But some climate experts warn it is being “severely undermined” by the government’s recent decision to champion gas until 2050 and beyond despite global calls to rapidly phase out fossil fuels.

“We’re sending a really mixed message to investors,” says Polly Hemming, the director of the Australia Institute’s climate and energy programme.

“This government has continued to approve new gas and coal projects - it's flown to Japan, India, Korea, and Vietnam to secure long-term markets for gas and coal.

“If we really wanted to be a green energy superpower, we wouldn’t be relentlessly pursuing customers for our fossil fuels,” she says.

One of the nation’s leading climate scientists agrees.

“There is a very deep contradiction at the heart of the two policies,” says Prof Bill Hare, chief executive of Climate Analytics and author of numerous UN climate change reports.

“The Future Made in Australia [plan] is playing second fiddle to the government’s gas strategy.”

To understand how, Ms Hemming says you need to “follow the money”.

According to an analysis from her thinktank, last year alone, state and federal governments spent A$14.5bn subsidising fossil fuel use across Australia, and that sum is only expected to balloon, according to budget estimates.

By contrast, she says the A$13.7bn set aside to process critical minerals and incubate Australia’s nascent green hydrogen industry “isn’t real money”.

That’s because it will take the form of tax breaks over the course of a decade, which can only be cashed in on production starting from 2027 – a model which policymakers say will ensure taxpayers' money is not wasted.

But all the green hydrogen projects - many of which are being led by the nation’s largest mining and energy companies - are yet to be built. And the incentives could be scrapped before they get off the ground if there’s a change in government.

“It’s like me having a healthy eating and junk food policy running at the same time in my home and telling my kids, ‘You can have $10 a week now if you keep eating junk food'," says Ms Hemming.

"Or, 'I'll give you $2 in 2027 if you switch to broccoli’. What do you think they are going to prioritise?"

Some energy experts have also cast doubt over the business rationale behind green hydrogen - given the industry is still in its infancy and riddled with unknowns.

Others worry it could divert investment away from the renewable power sources that have already proven their worth, resulting in delayed climate action.

But Mr Grimes says that green hydrogen will play an essential role in “stripping emissions” out of Australia’s carbon-intensive mining sector - as companies look for cheap green sources of fuel to continue powering their operations.

And bigger picture, he argues that the government’s new green investments should be assessed as “a milestone first step” rather than an end point.

“The government knows that if it doesn’t pivot beyond its exports of coal, gas and iron ore soon, Australia risks becoming the Kodak economy of the future: a big deal one day and completely irrelevant the next.”

Australia isn’t the only country looking to position itself as the engine room of the new green economy.

Dozens of nations are putting forward ambitious proposals, such as the European Union’s Green Deal or America’s gargantuan Inflation Reduction Act.

Globally, policymakers have already invested over A$2tn in clean energy initiatives since 2020, according to the International Energy Agency.

But Australia has some compelling natural advantages, such as enviable wind and solar capabilities, stores of critical minerals and rare earths, and a strong mining infrastructure network that can be repurposed.

If used correctly, all the experts the BBC spoke with agreed it has every chance of securing its place as a critical green trading partner among allies.

Getting there though, they say, will require even greater investment - particularly in research and development, which is currently at 30-year lows.

And they’ve warned that the government can’t afford to drag its feet - a point which Mr Albanese himself has addressed head on.

“We have to get cracking. We have unlimited potential, but we do not have unlimited time.

“If we don’t seize this moment, it will pass. If we don’t take this chance, we won’t get another. If we don’t act to shape the future, the future will shape us.”

https://news.google.com/rss/articles/CBMiMGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NwMDB2eWw2bDZtb9IBNGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NwMDB2eWw2bDZtby5hbXA?oc=5

2024-06-04 23:10:23Z

CBMiMGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NwMDB2eWw2bDZtb9IBNGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2FydGljbGVzL2NwMDB2eWw2bDZtby5hbXA

Tidak ada komentar:

Posting Komentar